5G Features

The 5G inevitability

2019 was a pivotal year for 5G, as operators and enterprises worldwide began to stake their claim in the technology, and consumers started to realise the benefits of the latest mobile generation.

Operators. Service providers are increasingly seeking ways to grow revenue and cut costs in a low-growth environment, which is made more complicated by the demanding requirements of 5G services (i.e., high speed, low latency and ultra-reliability). Operators, therefore, need to evolve their networks (using innovations such as virtual RAN, edge networking, and network automation) to meet the demands of the 5G era. They will also need to diversify their revenue streams (into areas such as pay TV, media/entertainment, advertising and IoT) to seek growth beyond core telecom services.

Enterprises. While speed gains are a well-recognized benefit of 5G, other improvements (e.g., network slicing, edge computing and low-latency services) are not widely appreciated, with many companies believing that 4G remains good enough. Most of the key benefits for enterprises would not come until standalone 5G is deployed. The challenge, therefore, is to lay the foundations now and start the conversations about what problems 5G can solve in the future. As this is a highly competitive area, given the presence of Amazon, Microsoft, Google, and other cloud companies, speed-to-market is an important factor.

Consumers. Awareness and knowledge of 5G are both rising as hype makes way for reality. However, there is wide variation across the globe in terms of intentions to upgrade to 5G and the willingness to pay more for it. In general, consumers in South Korea, China, and the Middle East tend to be the most willing to upgrade to 5G, while those in the US, Europe, and Japan seem satisfied using 4G for the time being. 5G is still in its infancy though; as more tangible use cases are deployed, more consumers will appreciate the benefits of 5G.

4G rules, but 5G is ramping up

In 2019, 4G became the dominant mobile technology across the world with over 4 billion connections, accounting for 52 percent of total connections (excluding licensed cellular IoT). 4G connections will continue to grow for the next few years, peaking at just under 60 percent of global connections by 2023.

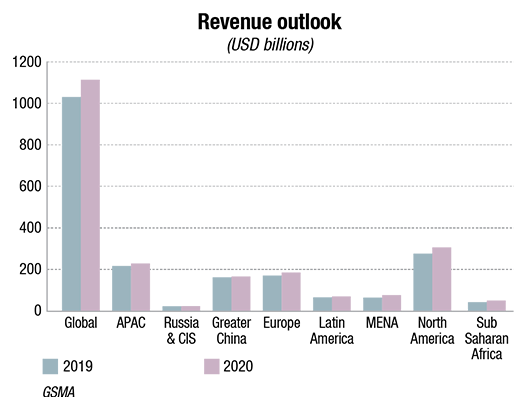

Meanwhile, 5G is gaining pace– it is now live in 24 markets; numerous 5G smartphones have been launched; and 5G awareness and the intention to upgrade among consumers are both on the rise. By 2025, 5G will account for 20 percent of global connections, with take-up particularly strong across developed Asia, North America and Europe. To support this generational shift and further drive consumer engagement, operators are expected to invest around USD 1.1 trillion worldwide between 2020 and 2025 in mobile CapEx, roughly 80 percent of which will be in 5G networks.

Indian scenario

Indian scenario

As the government finalizes the framework for 5G technology and plans to begin trials, and conjectures are made by various analysts on which telcos will bid, the TSDSI has ensured that its Radio Interface Technology Proposal fulfils all qualifying criteria for the IMT-2020 technical performance requirements. The Indian telecom standards body has made strides toward its goal of getting the IMT status for its local 5G standard, TSDSI-RIT, in the recently concluded meeting of ITU-R WP5D held in Geneva.

This technology is critical to the rapid deployment of IMT-2020 in rural and remote, sparsely populated areas. It has the potential to make a significant impact in various countries that are confronted with challenges of providing broadband wireless coverage in rural, sparsely populated, and security-wise vulnerable areas. More countries have joined in supporting TSDSI’s standard as it addresses their regional needs from a 5G standpoint.

This technology is critical to the rapid deployment of IMT-2020 in rural and remote, sparsely populated areas. It has the potential to make a significant impact in various countries that are confronted with challenges of providing broadband wireless coverage in rural, sparsely populated, and security-wise vulnerable areas. More countries have joined in supporting TSDSI’s standard as it addresses their regional needs from a 5G standpoint.

TSDSI has successfully introduced an indigenously developed 5G candidate standard, based on 3GPP technology, at the International Telecommunications Union (ITU) in 2019 for IMT 2020 ratification. The TSDSI-RIT incorporates India-specific technology enhancements that can enable longer coverage for meeting the LMLC requirements. The TSDSI-RIT, geared mainly to address the LMLC requirements, exploits a new transmit waveform that increases cell range, developed by research institutions in India (IIT Hyderabad, CEWiT and IIT Madras), and supported by several Indian companies. It enables low-cost rural coverage. It has additional features, which enable higher spectrum efficiency and improved latency. TSDSI-RIT is a key enabler for 5G-based rural broadband usage scenario in India and similarly placed geographies.

This enhancement will ensure nearly all of India’s villages can be covered from towers located at gram panchayats, whereas nearly a third of such villages would be out of coverage otherwise. The larger coverage by the proposed technology would mean that base stations established at the gram panchayats (using the optical connectivity provided by BharatNet) can cover all the neighboring villages.

Adoption of TSDSI’s 5G standard in India by the government will enable India to leapfrog in the 5G space, with key innovations introduced by Indian entities accepted as part of global wireless standards for the first time.

Cavli Wireless has joined hands with Maker Village, the Indian IoT and hardware innovation hub, to launch India’s first 5G network test lab in the third quarter of 2020. The lab will enable IoT OEMs and ODMs to test their prototypes in real-world settings to fast track the product-development processes. The lab will enable 5G technology’s transformation of cellular technologies as NB IoT and LTE-M into mass adoption. The test network will be available with 5G SA and NSA modes (supporting sub-6Ghz bands), alongside the LTE NB-IoT and CAT-M for LPWAN side of the IoT. In addition, Cavli will provide test network users with C200-Series 5G IoT cellular modules/modems and the C1X, C3X, C4X series cellular IoT modules and modems, which will be released later this year.

Reliance Jio has developed its own 5G technology as it looks to reduce dependence on foreign vendors and bring cost-related advantages. Jio has designed its own hardware for the 5G technology, which could be made in India once 5G trials are successful along with the IoT gear. The telco has sought DoT approval to conduct 5G trials based on its own technology. Rancore Technologies, earlier a subsidiary of RIL, was merged with Jio and the acquisition of Radisys further builds upon its 5G and IoT technology capability. These acquisitions accelerated Jio’s in-house development capabilities around open-sourtce technologies and NFV adoption, paving way for the development of IoT platform and applications. The operator’s IMS (IP multimedia subsystem) solution (vIMS) for VoLTE and VoWiFi already offers 4G voice service.

Bharti Airtel has taken the initiative to build a 5G-ready network that continues to serve the growing demand for high-speed data services in the country. The telco has collaborated with Cisco to launch this 100G IP and optical integrated network that collapses multiple legacy domains to build a flatter, simpler, and automated 5G-ready IP network for enhanced customer experiences. It integrates Cisco IP and optical solutions along with segment routing to more easily extend services in rural communities while significantly improving network availability and creating cost efficiencies. The simple, flexible, and self-healing architecture is built with an agile, programmable, and software-defined platform to deliver exponential mobile-internet growth. The open standards architecture with automation brings in efficiencies for new and legacy infrastructure, eliminating manual touchpoints in a brownfield environment.

In 2020, 5G-compatible devices are entering the volume market, scaling up 5G adoption globally. In India too, smartphone brands have scooped up the opportunity to become the early players in the new technology. While TechArc expects to see 15–18 premium smartphone models (excluding variants) to be introduced in India this year, IDC observes that due to the affordability factor, companies will come up with both 4G and 5G variants in 2020, while full-fledged sales of 5G phones will pick up only in 2021. It is expected that Indian mobile phone manufacturers, popular more for basic models, are likely to be left further behind as the market moves to 5G.

Xiaomi, Vivo’s sub-brand iQoo, and Oppo’s sub-brand Realme have all moved in tandem to unveil their 5G smartphones. While Xiaomi, which has been the top handset vendor in India for more than two years, has showcased its recently unveiled 5G-enabled MiMix Alpha smartphone at several of its physical stores in the country, the other two companies have moved to launch new phones. Vivo launched the iQoo 3 series, priced Rs 36,990 to Rs 44,990 and Realme launched the X50 Pro 5G priced at Rs 37,999, which goes as high as Rs 44,999 for variants with additional storage and memory.

Outlook

In India, the road to 5G services isn’t clear yet.

5G opens up new possibilities for a multitude of life transforming applications from 3D video to immersive media, autonomous vehicles and the enablement of smart cities, and is also the key to unlock other technologies like AI, robotics, and IoT.

Operators have huge areas of concern. Spectrum availability, technological issues as extensive fiberization, antennae upgradation, virtualization of the core, and 5G network slicing, sophisticated cloud and analytics capabilities, and transformed support systems pose major challenges. And above all, arranging funds for the heavy investment required. Demand will build up progressively and adoption will take off as economies of scale build up in the market. A lot depends on the viability of used cases, devices, and the ecosystem.

In order to commercially move forward, operators must establish the financial justification for introducing 5G at this juncture.

5G devices ecosystem

A flurry of device launches (all originally timed to coincide with MWC 2020) meant a big leap in the number of announced 5G devices in February and early March. In January 2020, the number of announced 5G devices exceeded 200 for the first time; by early March over 250 devices had been announced. By mid-March 2020, GSA had identified sixteen announced form factors (phones, head-mounted displays, hotspots, indoor CPE, outdoor CPE, laptops/notebooks, modules, snap-on dongles/adapters, industrial-grade CPE/routers/gateways, drones, robots, tablets, TVs, a switch, modems, and a vending machine). Eighty-one vendors had announced available or forthcoming 5G devices – 253 devices (including regional variants and phones that can be upgraded using a separate adapter, but excluding prototypes, not expected to be commercialized, and operator-branded devices that are essentially rebadged versions of other phones), including at least 67 that are commercially available; eighty-seven phones, (up 25 from end January), at least 40 of which are now commercially available (up from 35 at end January), including three phones that are upgraded to offer 5G using an adapter; seventy-six CPE devices (indoor and outdoor, including two Verizon-spec-compliant devices not meeting 3GPP 5G standards), at least 13 of which are now believed to be commercially available; 43 modules, 17 hotspots (including regional variants) at least nine of which are now commercially available; and five laptops (notebooks). Announcements have also been made for five industrial-grade CPE/routers/gateways, which include three robots, three televisions, three tablets, three USB terminals/dongles/modems, two snap-on dongles/adapters, and two drones. Also, two head-mounted displays, including one switch and one vending machine.

Availability of spectrum band support of 5G devices

Availability of spectrum band support of 5G devices

Availability of information about spectrum support is improving as a greater number become commercially available. Just over two-thirds (68.0%) of all announced 5G devices are identified as supporting sub-6 GHz spectrum bands, and just under one-third (30.8%) are understood to support mmWave spectrum. Just under 25 percent of all announced devices are known to support both mmWave and sub-6 GHz spectrum bands. Only 17 of the commercially available devices (25.4% of them) are known to support services operating in mmWave spectrum, but 83.6 percent of the commercially available devices are known to support sub-6 GHz spectrum. The bands known to be most supported by announced 5G devices are n78, n41, n79, and n77.

The device ecosystem is expected to continue to grow quickly, and for more data to become available about announced devices as they reach the market. Based on vendors’ statements, GSA expects more than 50 additional announced devices to become commercially available before the end of June 2020.

Comparison to 4G LTE

In February 2015, 5 years after LTE was launched, GSA was tracking 2218 devices, of which 1045 were smartphones (including frequency/carrier variants). 978 new devices were added to the GSA GAMBoD database in the previous 12 months. At the predicted rate of growth, 5G devices will reach the 2000 mark during the summer of 2021, some 2 years earlier than 4G. Clearly 5G is recognised as a disrupting technology by the mobile ecosystem and mobile operators are gaining in confidence regarding the potential of 5G to change the industrial, business, public, and consumer landscapes.

Capitalising on the 5G opportunity

5G will drive future innovation and economic growth, delivering greater societal benefit than any previous mobile generation and allowing new digital services and business models to thrive. Many countries have already launched 5G, but widespread commercial 5G services are expected in the post-2020 period, which will mark the start of the 5G era. 5G is developing in parallel with rapid advancements in both AI and IoT; the combination of these technologies will have a large positive impact, spawning innovations for consumers and enterprises defined by highly contextualised, on-demand and personalised experiences. To propel 5G into commercial use, governments and regulators must play their part and implement policies that encourage advanced technologies to be applied across all economic sectors.

Ensuring consumer trust

Erosion of trust in digital services was a major concern in 2019, which saw record levels of data breaches and disinformation campaigns, as well as startling revelations about the monetisation of consumers’ personal information by internet companies. Governments are implementing new or revised rules to ensure their citizens are protected when they engage with digital technologies. Rules for the protection, management and processing of consumers’ personal data vary greatly by sector, technology and country. This includes organisations’ ability to transfer data within and between countries. For data privacy laws to be successful, they must provide effective protection for individuals while allowing organisations the freedom to operate, innovate and comply in a way that makes sense for their businesses and secures positive outcomes for society.

Rapid progress in digital technologies is not a guarantee. Operators in every country face obligations and constraints that slow down investment in mobile networks. To advance the mobile ecosystem and the digital economy overall, governments should strive, as much as possible, to lighten the regulatory load on the industry. When the business environment for mobile operators is less costly and more flexible, the performance and reach of mobile service expands, the pace of innovation increases and users’ confidence in the digital ecosystem is strengthened.

You must be logged in to post a comment Login