Headlines of the Day

Vi Rs 18,000 crore FPO to boost coverage but meaningful market share gain tough

The Rs 18,000-crore follow-on public offer should improve Vodafone Idea’s near-term fortunes and help arrest some subscriber losses, but clawing back meaningful market share gains from larger peers may still prove to be tough, according to a report by Kotak Institutional Equities on Monday.

Terming the FPO as a step in the right direction although much delayed, Kotak Institutional Equities in a note said the capital raise should help it bridge the network coverage gap, and improve competitiveness versus peers to some extent. Further, with a sharp reduction in VIL’s bank debt, the operator should be able to secure further funding from banks.

“While the fund-raise should improve Vi’s near-term fortunes, we don’t expect Vi to gain any meaningful market share from peers and remain concerned about potential large equity dilution (on the conversion of Government dues). Potentially, the government could own an 80% plus stake in Vi on a fully diluted basis in the worst case, which would limit any meaningful upside for Vi’s minority investors,” the report said.

Utilising the FPO proceeds for boosting 4G coverage will help arrest market share losses in the near term, but wresting back the market share from larger peers would remain ‘a tall ask’.

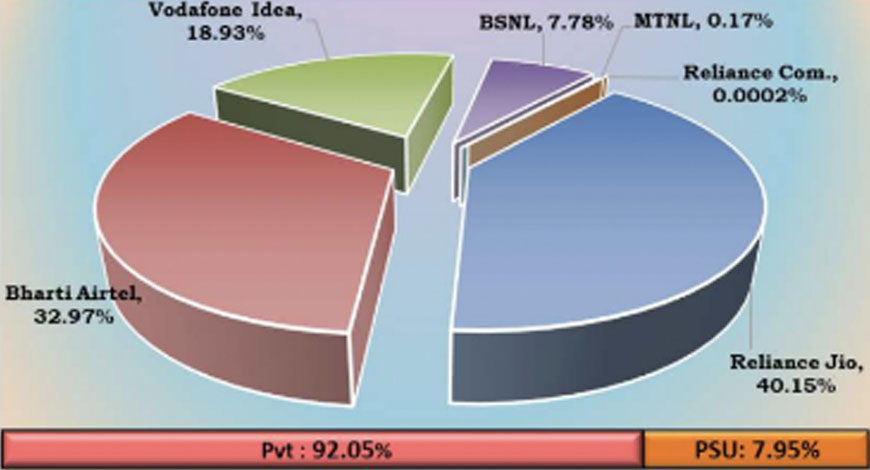

VIL lost about 19% market share since the merger due to its inadequate network spends, it observed.

“While we expect Vi to bridge the network coverage gap on 4G and arrest some of the market share losses. However, the gap in 5G coverage (versus larger peers) would still remain significant,” it said.

Explaining this, it said that VIL’s peers should benefit more from any potential tariff hike and can outspend the telco on customer acquisition, which, in turn would prevent any meaningful market share gains from Bharti and Reliance Jio.

While there could be an extension of the moratorium (on the dues owed to the Centre), a partial waiver (relief on AGR dues) and further relief, a total write off on Government dues in its entirety for a specific company may be ‘difficult’.

Kotak expects VIL to convert a large part of the Government dues into equity over time, which could potentially lead to large equity dilution for VIL’s non-Government investors.

“In the worst case (100 per cent of Government dues converted to equity at Rs 10/share), Government could end up with about 81% stake, with existing promoters stake diluted to about 9% (versus 49% currently and 38% post fund-raise) and non-promoters’ stake diluted to about 9% (from 16% currently and about 36% post fund-raise),” it stated.

BofA Securities

BofA Securities, in its note, emphasised that the potential capital raise does not change its fundamental view on VIL, and reiterated `underperform’ rating.

The potential transaction (if consummated), has implication on other telco companies, however, it said citing potential upsides for tower infrastructure firm Indus on account of site roll outs.

BofA Securities said that VIL was constantly losing subscribers every quarter in the last 12-24 months, leading to market share gains for competitors Bharti Airtel and Jio.

“Going ahead, assuming VIL raises intended capital, we see VIL’s network coverage to potentially improve. This could likely lead to VIL losing none to few users and hence incremental market share gain for competitors slowing,” it said.

Bharti has been a bigger beneficiary in the past of mid-to-high-end users of VIL churning out, it observed.

“However, Bharti and Jio are likely to gain share, given their investments in 5G and better competitive positioning in the 5G market. We also see upside risks to Bharti/Jio capex (although marginally) if they decide to respond to VIL’s improving positioning,” BofA said. PTI

You must be logged in to post a comment Login