CT Stories

Cabling, the most overlooked aspect of the network

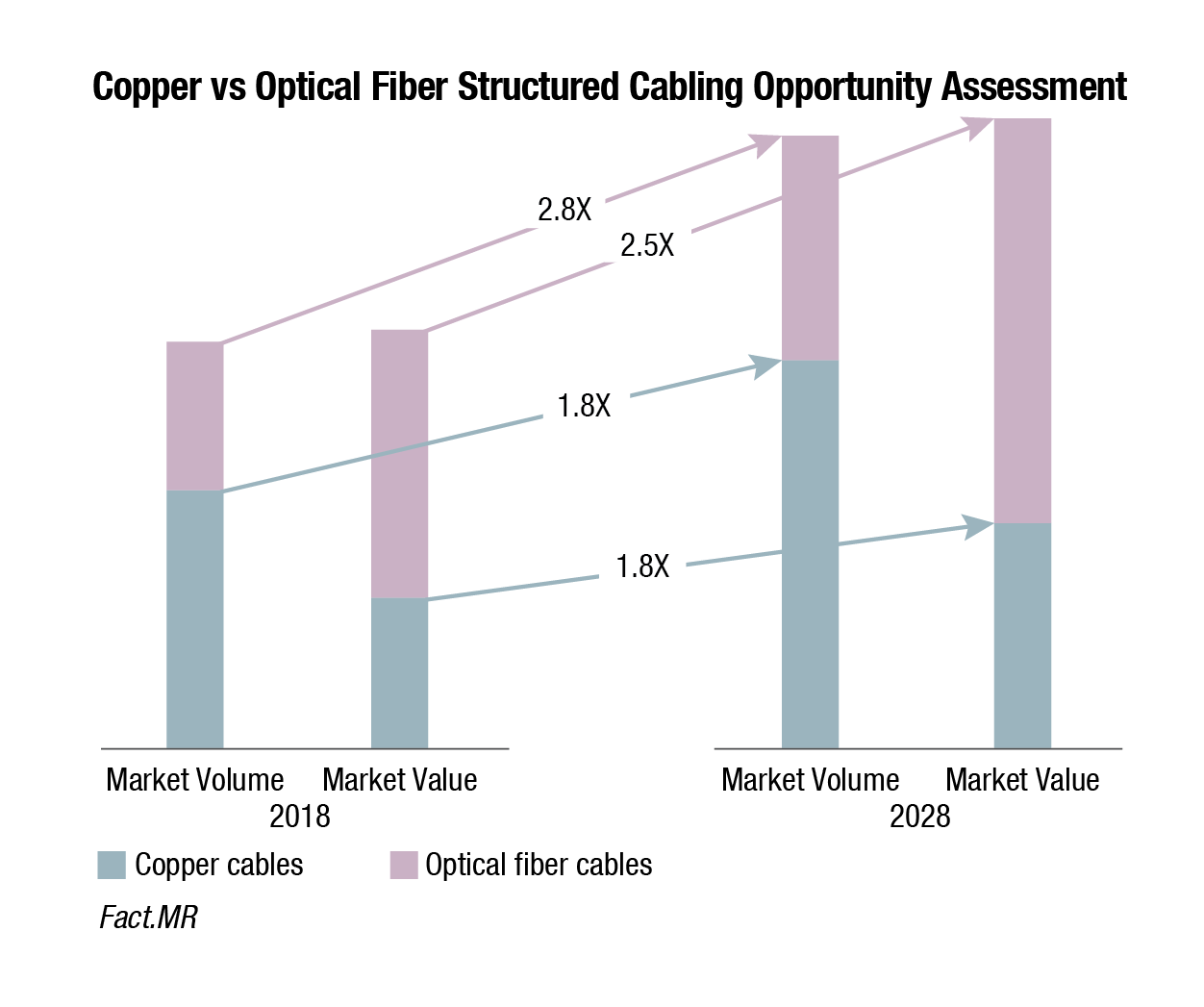

The global structured cabling market, estimated at USD 17.28 billion in 2019 is poised to record a CAGR of 8 percent through 2028. North America remains the leading market, driven by proliferation of data center project. 5G technology is expected to pave lucrative growth opportunities, upheld by increasing palpability of the technology’s trails and deployments worldwide.

The market is driven by the increasing demand for FTTx. In addition, the increasing investment in construction of data centers is anticipated to further boost the growth of the structured cabling market.

Higher bandwidth, high-speed, and lower installation cost are amongst the key benefits network architectures like fiber-to-the-x (FTTx), fiber-to-the-node (FTTN), fiber-to-the-curb (FTTC), fiber-to-the-premises (FTTP), and fiber-to-the-home (FTTH) extend to their users. FTTH networks provide high-speed service using fiber optic cables instead of copper, telephone, or cable wires. The fiber optical technology also uses light instead of electricity for transferring IP packets, thereby providing significantly higher bandwidth. Moreover, FTTH service providers are also investing heavily in the building of FTTH architecture. The emergence of high-speed FTTH network service will drive the demand for fiber optics and fiber optic cables, thereby propelling the growth of the structured cabling

market.

Major vendors

Belden operates the businesses under various segments such as broadcast solutions, enterprise solutions, industrial solutions, and network solutions. The company offers cables and connectivity products for broadcast applications, end-to-end copper and fiber network systems to include cable, assemblies, input/output (I/O) connectors, industrial cables, and IP and networking cables.

Furukawa Electric operates the business under six segments, which include communication solutions, energy infrastructure, automotive products and batteries, electronics component material, functional products, and service and developments. The company offers telecommunication system products, FTTx products and construction tools, optical component and fiber, and wiring materials.

Nexans has business operations under various segments, namely, building and territories; high voltage and products; telecom and data; industry and solutions; and others. The company offers LANmark copper and fiber optic structured cabling solutions, LANactive FTTO and industrial solutions (switches and cabling), LANsense automated infrastructure management, and essential standard LAN cabling components.

Prysmian Group operates the business under four segments, which include energy projects, energy products, oil and gas, and telecom. The company offers structured cabling products and accessories for construction and infrastructure projects in sectors like power and control, multimedia, and railways.

Schneider Electric operates the businesses under the following segments: medium voltage, low voltage, secure power, and industrial automation. The company offers cat6 UTP faceplate, cat6 UTP keystone, Cat6 UTP patch panel, Cat6A UTP solid cable, Cat6A FTP patch cord, Cat6 UTP solid cable, Cat6 UTP cable, Cat6 SFTP patch cords, Cat6 UTP solid cable, Cat5e shielded keystone jack, Cat5e STP patch panel, Cat5e UTP solid cable, Cat5e UTP patch cords, Cat5e SFTP patch cords, Cat6 shielded keystone jack, and Cat6 UTP patch cord segments.

Cat5 versus Cat5e versus Cat6

Network and cabling professionals are likely to come across different Ethernet cabling standards over the course of their career. These range from legacy installs of Cat3 and Cat5e – to the modern ultra-high-performance data center Cat8 standard. Yet, for most access-layer installs, Cat6 and Cat6A are the two most common standards to choose from. This cabling will be responsible for connecting end-devices like PCs, laptops, Wi-Fi access points and a plethora of Internet of Things (IoT) devices.

For most of the past few decades, new Ethernet installations have been dominated by Cat5, Cat5e, and Cat6 cabling. Cat5 saw its stock rise in the mid-to-late 90s, Cat5e had its heyday in the 2000s, and Cat6 has been a popular choice for the last ten years or so. But the recently introduced standard, Cat6a is causing many telecom specialists to factor in the value of futureproofing their upcoming projects.

Cat5 was first introduced in the mid-90s and grew in popularity toward the late 90s. It is rated for a maximum frequency of 100 MHz and top speeds of 100 Mbps. While it is still commonly used for local area networks, it is too slow for most other applications and is now on its way to obsolescence.

Cat5e was introduced around 2000 and, as its name suggests, served as an enhanced version of Cat5. It offered the same bandwidth (100 MHz) but was designed to reduce crosstalk and handle speeds up to 1000 Mbps, making it the first Cat standard capable of supporting the dream of Gigabit Ethernet.

Cat6 was introduced in the early 2000s but started becoming popular around 2008. Today, it is considered the minimum standard for new installations, and is backward compatible with Cat5, Cat5e, and even Cat3. It offers a bandwidth of 250 MHz and supports speeds up to 10 Gbps and can come in a shielded option.

Cat6a: The new standard? It is early days still for Cat6a, but it is growing in popularity in sectors like healthcare and education. The benefit that the best copper cable, Cat6a has over Cat6 is speed. A Cat6 cable can run 10/100/1000BASE-T Ethernet at speeds up to 1000 Mbps and a maximum length of 100 meters. The same is also true for 2.5GBASE-T and 5GBASE-T running at 2.5 and 5 Gbps, respectively. However, when moving up to the newer 10GBASE-T standard that operates at speeds of 10 Gbps, Cat6 cabling is only supported up to a maximum distance of 37 to 55 meters, depending on the levels of alien crosstalk in the installation environment.

Cat6a: The new standard? It is early days still for Cat6a, but it is growing in popularity in sectors like healthcare and education. The benefit that the best copper cable, Cat6a has over Cat6 is speed. A Cat6 cable can run 10/100/1000BASE-T Ethernet at speeds up to 1000 Mbps and a maximum length of 100 meters. The same is also true for 2.5GBASE-T and 5GBASE-T running at 2.5 and 5 Gbps, respectively. However, when moving up to the newer 10GBASE-T standard that operates at speeds of 10 Gbps, Cat6 cabling is only supported up to a maximum distance of 37 to 55 meters, depending on the levels of alien crosstalk in the installation environment.

The main difference between Cat6a cable and Cat6 is the diameter. Cat6a essentially has more copper, thus increasing its capability. Cat7, which is not widely available yet, will be even thicker, filled with more copper to support even more distance and speed. At some point, there will be physical issues with using copper.

In addition to the speed/distance benefits, Cat6A is defined for frequencies up to 500 MHz and improved noise-cancelling properties. Both translate into improved Ethernet performance with fewer chances of external interference.

Another benefit of Cat6A that is growing in importance is that it can handle higher levels of power over Ethernet (PoE) output without any performance degradation. Endpoints such as Wi-Fi access points, surveillance cameras, intelligent lighting, and monitoring/automation sensors are growing increasingly power hungry. The latest 802.3bt PoE specifications support 60W (Type 3) to 100W (Type 4) of output per cable run. That is as much as three times the maximum wattage specified in the 802.3at (PoE+) standard.

Even though 802.3bt utilizes all four pairs of wires as opposed to two, more power output translates into more heat on the wire. When cables get hot, they become susceptible to what is known as insertion loss. Transmitting added power to end-devices also causes an increased chance of DC-resistance unbalance. Both problems are more likely to occur when running Cat6 cabling as opposed to Cat6A. Cat6A conductors are thicker – which can help dissipate the heat.

Additionally, DC-resistance unbalance is less likely to occur in high-quality Cat6A cabling due to the likelihood that the cabling conductor diameter will not vary as much compared to lower-cost Cat6 alternatives. Ultimately, the only way to verify that cabling runs adhere to 802.3bt standards is to perform cable-certification tests using a testing tool.

Additionally, DC-resistance unbalance is less likely to occur in high-quality Cat6A cabling due to the likelihood that the cabling conductor diameter will not vary as much compared to lower-cost Cat6 alternatives. Ultimately, the only way to verify that cabling runs adhere to 802.3bt standards is to perform cable-certification tests using a testing tool.

No doubt, Cat6A has certain issues that need to be kept in mind. The cables are heavier and thicker compared to Cat6. Thus, extra care must be taken to ensure that overhead racks and conduit can handle the added size and load. Also, while running a significant number of 802.3bt devices over Cat6A, it must be kept in mind that the cables are less flexible and more challenging to terminate, especially in tight spots. And thus, it takes more time to have technicians properly terminate the cabling. And, of course, Cat6A costs more than Cat6. It may be more prudent to have a combination of Cat6 and Cat6A cabling, depending on where it has to be installed.

Cabling is the infrastructure that supports business operations today, and it will only continue to be more important. One thing is clear about the future of cabling – bandwidth requirements will only continue to go up. While some think cables will go away with wireless, they forget that those wireless units (access points) still need to be wired. So, while the cabling needs and designs will change, the importance of cabling will continue to grow.

You must be logged in to post a comment Login