5G Features

Telcos are defining their role in the wider ecosystem

The telecom service providers will need to abandon their walled-garden mindset, and make giant strides toward cross-sector convergence, spearheading digital transformation across industries.

5G is no longer a journey reserved for the privileged. It has rolled out in 2497 cities globally across 92 countries serving more than 1.2 billion people.

5G is more than a new generation of technologies; it denotes a new era in which connectivity will become increasingly fluid and flexible. 5G networks will adapt to applications and performance will be tailored precisely to the needs of the user.

Service providers are coping with a volume and velocity of challenges they have not previously seen. Will my multi-vendor system work? Can my network functions perform in the cloud? Does edge deliver on its promised value? Is my new network secure? Will my processes and network scale to meet new demands?

For all the progress made, 5G remains in its infancy with plenty of roadway ahead. Less than 35 percent of service providers have deployed any flavor of 5G. Less than 5 percent have deployed on a true 5G core network. 5G is harder, more expansive, and has more riding on it – literally and figuratively – than any previous-generation network. It is no surprise then that even with today’s macro-economic headwinds, more than USD 175 billion will be spent globally on infrastructure between 2023 and 2025 to support everything these deployments comprise – from cloud and core to private wireless networks, Open RAN, and beyond. Investments will be made to counter inflationary and energy pressures with heightened focus on solutions and technologies to improve productivity, capital efficiency, and power management. The 5G opportunity is not solely left to traditional players. It is attracting investment and competition from tech leaders outside of telecom, leading to a much larger field of vendors.

Diverse vendors

The disaggregated 5G core and cloudification of the network have opened the door to the first real opportunity for vendor diversification in the heart of the network. Now, vendors can choose to deploy only a piece of the core network. This has potential cost benefits for service providers, who have more choices and, therefore, more financial leverage as hardware becomes commoditized.

Meanwhile, hyperscalers with expertise in IT, cloud, virtualization, and scale are heavily engaged and bring capabilities that have not yet been in the service provider mainstream. The enthusiasm around Open RAN is bringing the multi-vendor, plug-and-play model to the radio network as well. In space, the non-terrestrial networks are getting a boost from 5G NTN connectivity standards, and a host of LEO satellite providers are in play. This growing coral vendors is great news for the industry, and service providers are working with multiple providers to move quickly and take advantage of existing capabilities. They recognize that they cannot be experts in everything, especially vertical markets, such as automotive or private networks. Where they lack expertise, or for functions outside primary domains, they are outsourcing to managed services companies. This diverse set of players does bring new challenges – security, standards interpretation, and feature parity, among them.

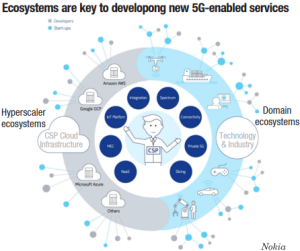

Telcos and ecosystem

The telcos are on a generational shift from presenting a solution and being in front of the customer to understanding that they are actually part of an ecosystem. They are focusing beyond connectivity toward collaboration across the telecom value chain and cross-sector, leading to the creation of new business models and innovation. India is making giant strides toward cross-sector convergence, spearheading digital transformation across industries. They are teaming up with developers, systems integrators, hyperscalers, and over time maybe even other telcos. Only by working together can these variously skilled parties enable the full value of 5G to be realized.

The 5G ecosystem is a constellation of mutually beneficial relationships aimed at addressing a specific business objective. And the enterprise is where the biggest 5G opportunities lie – opportunities that will amount to USD 4.5 trillion by 2030.

An ecosystem approach to the enterprise 5G opportunity is vital, because business goals like digital transformation and intelligent automation require complex solutions that exceed the capabilities of any one supplier. To move up the value chain, telcos need to enable innovation to occur elsewhere. Then they need to recognize when that innovation has value, and bring their commercial capabilities to bear to ensure that the value is maximized.

Some of the most successful ecosystems of the digital era are those created by hyperscalers and SaaS giants like Amazon and Salesforce. Both have built global platforms (AWS and AppExchange, respectively), where developers can access resources, experiment, build, and commercialize the results – with a portion of any revenue going to the ecosystem orchestrator.

Telcos can, and should play in these hyperscaler-led ecosystems and can do so in a number of ways. The most basic model is by monetizing network APIs – providing 5G network functions as a service in the hyperscalers’ public clouds and charging developers either for bulk utilization or per API call.

While the returns from simply providing open APIs will be minimal, the plug-and-play aspect of the model is something telcos should aim for. The way to extract more value from it is to join forces with the developers who make use of the APIs, and help them bring their solutions to market.

5G is a new technology for enterprises, so the telcos can help them understand the technology and how it can be used to address their business needs. They do not need an ecosystem of 50 partners to do that – they can do it with a handful. It may not, however, be the same handful of partners for every business need. The needs of manufacturing companies are very different from those of healthcare providers, and organizations in those sectors will look for relevant vertical experience in the suppliers they engage.

Whichever approach they take, telcos will need to abandon their walled-garden mindset and make it easy for as many developers as possible to work with them. They will need to open up, because the size of an ecosystem to a large extent determines its impact.

The other critical mindset shift will be from one of ownership and control to one based on loose partnerships and a fail-fast culture. With more workloads moving to the hyperscalers, telcos will need to focus on what they can offer that is unique – whether that is connectivity expertise, local points of presence, mobile security, or other capabilities.

Defining the 5G ecosystem

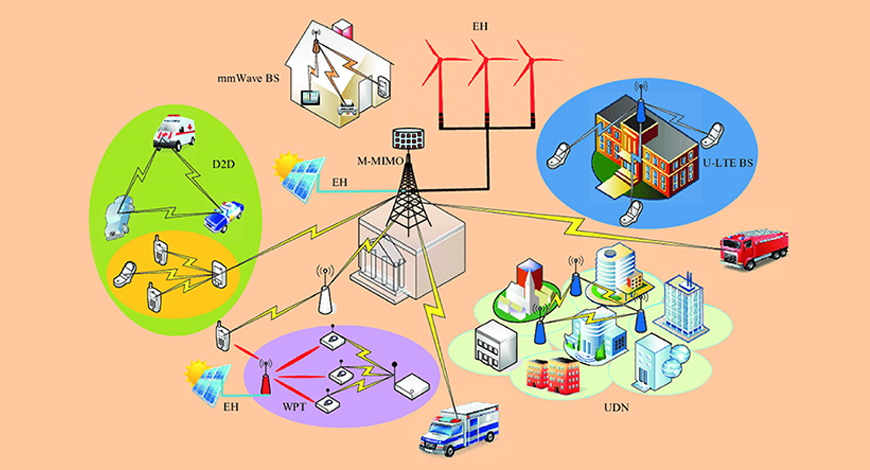

Given the scale of the global efforts involved in developing the concepts, the technologies, the infrastructure, and the use cases, when all pooled together, make up the phenomenon, the 5G ecosystem, the intricate web of relationships which connects all the players involved.

In its own analysis of 5G, the World Economic Forum (WEF) has offered a very useful and coherent explanation of this 5G ecosystem, setting out what it calls the 5G Ecosystem Cycle. According to the WEF’s model, the various parts that make up 5G fit together something like this:

Spectrum. The WEF refers to radio spectrum as the oil of the 5G ecosystem, the fuel which powers the machine. Radio spectrum is not quite a finite resource as it can be reused, but there is a finite capacity as to how much of it can be used at once, with only the bandwidths sitting in the 3-kHz to 300-GHz frequency range currently being suitable for communications.

Infrastructure. Mobile infrastructure is what makes radio spectrum available for use in wireless communications and data services. Infrastructure includes the network – base stations, mobile backhaul, edge clouds, and core networks.

Devices. Devices are an essential cog in the mobile machine, providing the interface via which end users can enjoy the benefits of mobile connectivity. To date, one type of device above all others – the mobile phone – has dominated the mobile landscape, and phone manufacturers and vendors have, therefore, been key players in the ecosystem. But one of the most significant changes anticipated with 5G is that it will open the door to new use cases for mobile, meaning a much broader range of devices will be built, ready to connect. From industrial machines to home appliances, vehicles to medical equipment, OEMs from across a huge swathe of verticals will suddenly find themselves with a stake in the 5G ecosystem. And just as network operators are leaning on network tech specialists to build out their 5G assets, so device OEMs will rely on chipset manufacturers to provide the essential technology that will allow their devices to connect.

Roadmap to 5G revenue

Each 3GPP release delivers new features that enable or enhance support for new revenue-generating applications and services. This roadmap highlights the key contributions of current and planned 3GPP releases for a set of promising new 5G revenue streams. After a release is finalized, equipment typically becomes available within 18-24 months. Initial network deployments begin 6-12 months after equipment availability and may continue for several years.

Spirent Communications

The service segment of the 5G ecosystem cannot be undermined, the commercial relationships which link customers to network capabilities. Network carriers and virtual operators will continue to hold a key stake in 5G services, particularly in the consumer segment, where buying airtime off a mobile company is likely to remain the standard commercial model. But as use cases for mobile diversify, so will the market for 5G services. From ISPs delivering mobile broadband to software specialists building advanced mobile-first applications, from systems integrators helping businesses migrate their connectivity to wireless to cybersecurity specialists, helping enterprises protect vast new IoT deployments, 5G will likely create brand new opportunities for brand new mobile services.

Security sits in the center of the 5G ecosystem cycle, which the WEF argues will be a critical consideration for consumers, enterprises, and public bodies in deciding whether to switch to 5G (and, therefore, in making all the investment by all the various stakeholders worthwhile). Elsewhere, the WEF also outlines various potential security concerns around 5G which stakeholders must overcome – the increased vulnerabilities that come with increased dependence on networks as more and more devices connect, the corresponding multiplication in target points for cybercriminals and other hostile forces, the huge hike in complexity in data and privacy protection as we move from the World Wide Web to multiple interconnected webs of networked services (sometimes referred to as the Internet of Everything). Some of these security concerns have already become high-profile news, such as the geopolitical wrangle over Huawei’s involvement in infrastructure build-out and its alleged relationship with the Chinese government.

Other issues rest on the fact that 5G will continue to operate alongside, and indeed on the same networks as, previous generations of mobile technology, in some regions stretching back all the way to 2G. In the context of contemporary cyber threats, several signaling protocols used for 2G, 3G, and 4G have security flaws, which could undermine 5G signaling security through proximity. How to work backwards and resolve the signaling security shortcomings of 30 years of mobile technology in time for 5G remains a major challenge.

The technology leaders, namely, the network technology vendors – the hardware and software companies; the network operators with each country with its set of service providers; and the chipset manufacturers comprise the balance ecosystem.

Driven by the rapid pace of technology innovation, the need to fill skill gaps, and the disaggregated 5G network, a hesitancy to embrace outsiders has turned into a true desire to team for success – increasingly, this is not a choice but a reality.

The intersecting trends of an expanding set of vendors and the need for neutral, collaboration environments are stimulating the creation of ecosystems. A growing realization that validation costs will surge without tighter ecosystem coordination is adding even more urgency to this push.

Roadmap to 5G revenue

Spirent Communications

You must be logged in to post a comment Login