5G Features

Reimagining Industry Futures

Enterprise participation in 5G investment has seen a rapid uptick, energy and consumer companies are leading the way, with manufacturing organizations lagging behind other industries, says an EY study.

Enterprises’ 5G and IoT strategies are increasingly oriented toward growth. Among organizational priorities, IoT’s contribution to revenue growth is now on par with the operational efficiency benefits it offers. And 5G-IoT use cases such as virtual reality (VR), augmented reality (AR) and remote working now score ahead of others – such as infrastructure control – as focus areas for applications.

Sustainability and broader environmental, social and governance (ESG) goals are very much at the heart of enterprises’ relationship with technology. Emerging technologies can play a critical role in reducing the organization’s carbon emissions, and most enterprise will prioritize vendors who can articulate the environmental impact of new technologies.

Looking ahead, organizations cite capabilities and credentials around sustainability as the number one attribute they will be seeking in their suppliers in the future, ranking ahead of competitive pricing or end-to-end solution capabilities. Businesses also expect to leverage their ecosystem positions to explore circular business models with other organizations.

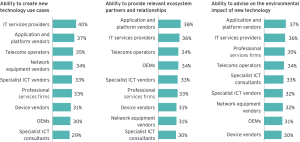

Enterprise perceptions of supplier competencies

Response to survey conducted by EY to the question posed to all

Which types of ICT supplier are viewed as the most capable of providing the following competencies by your organization?

From technology deployments and partnerships to security, execution challenges are mounting. Successful activation of 5G requires businesses to make new choices in how they purchase it and whom they purchase it from, which generates uncertainties. Although the wide range of 5G purchasing models on offer brings new procurement options and service benefits, uncertainty over deployment scenarios and timings now ranks second as an internal 5G challenge at a time when return on investment (ROI) anxieties are rising. Execution challenges also extend into organizations’ ecosystem strategies, with more businesses than ever finding multi-sided partnerships difficult to execute in practice, and limited resources for collaboration also presenting more problems than before. Finally, security concerns remain firmly on the corporate radar: Cyber risks lead this year’s external challenges associated with 5G.

Knowledge gaps undermine efforts to exploit 5G alongside other technologies, such as edge computing. Knowledge gaps continue to pose problems: While businesses are keen to explore 5G’s relationship to other emerging technologies, many do not think that they understand the ideal points of intersection between them. Poor understanding of 5G’s relationship with other technologies tops the list of internal challenges organizations face this year, while four in 10 cite exploring these relationships further as a top priority. Meanwhile, three in four organizations believe they need a better understanding of edge computing use cases. These findings highlight that knowledge gaps have different origins and dimensions, suggesting more than a quick fix is needed.

These are the main conclusions that Tom Loozen, global telecommunications leader at EY, draws from the consultancy’s latest annual study of enterprise perceptions surrounding 5G and IoT.

The “EY Reimagining Industry Futures Study 2023” is based on an online survey of 1,325 enterprises worldwide. Conducted in November 2022, the survey suggests that many industry verticals are still furtively weighing up their 5G investment options, despite the technology being on their radar for five or six years.

Enterprises have mixed views on supplier competencies – but rank IT services providers and application vendors ahead of the rest Enterprises’ perspectives on which types of ICT suppliers are most capable of providing various competencies are instructive. There are no dominant leaders when it comes to the perceived ability of different suppliers to create use cases, provide ecosystem relationships or advise on the environmental impact of new technology.

That said, respondents tend to favor IT services providers and application providers above others. There is more variation in sentiment between industries. For example, specialist technology vendors score top for environmental advice among energy companies and rank second as use case creators among consumer industry respondents. Encouragingly for telcos, government respondents see them as best placed to provide relevant ecosystem partners and relationships.

Next steps for 5G service providers

EY has identified four key actions that 5G providers could take to help enterprises realize their ambitions

Given its promise of being the “G for enterprise,” enterprise adoption of 5G has fallen below expectations.

One major barrier to 5G adoption, finds the survey, is complexity of integration with existing technologies. But EY takes it one step further. Telco management has not shown enough digital ambition when it comes to serving the enterprise market by allowing the technology integration challenge to largely go unaddressed.

While organizations’ views on specific supplier competencies are fairly evenly spread, their perceptions of overall expertise in technology and advisory capabilities are both more clear-cut and also broadly consistent year-on-year. Telcos rank first as perceived IoT experts, meanwhile, they continue to lag as digital transformation experts, with only one in five respondents selecting them as their most trusted supplier.

You must be logged in to post a comment Login