Industry

Remaining steady through turbulence

Near-term turbulence aside, Indian SaaS remains in its early stages and has proven that it is building world-leading companies across categories.

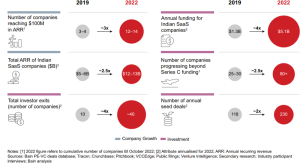

The Indian Software-as-a-Service (SaaS) ecosystem continues to gather momentum despite prevailing market headwinds and has become a global leader behind only the US in scale and maturity. Whether measured in total annual recurring revenue (ARR) of $12 billion–$13 billion in 2022, up four times over the past 5 years; or investment (~$5 billion in 2022, up six times), Indian SaaS progress is irrefutable and its future trajectory promising. This momentum is driven by a mutually reinforcing flywheel of SaaS companies and investors, with a proliferation of new SaaS companies with proven growth models, supported by investors who are allocating increased capital to Indian SaaS across stages.

Indian SaaS companies are being founded in record numbers and are proving they have a right to win in the global market. Of the 1,600 Indian SaaS companies that have now been funded over the past five years, around 14 of them exceed $100 million in ARR (vs. around 5 in 2020) and are reaching this growth milestone as quickly as their US counterparts. Indian SaaS companies win using a variety of approaches, including product leadership, attractive pricing, and service quality—and emerge as globally best-in-class across numerous categories. While software buyer sentiment has softened in the second half of 2022, Indian SaaS companies play in categories that benefit from long-term, secular-demand tailwinds.

The Indian SaaS ecosystem has come a long way over the past three years

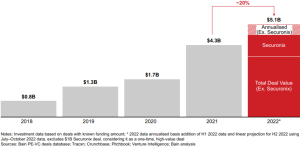

Encouraged by this growth, investment in Indian SaaS reached an all-time high of ~$5 billion in 2022, bolstered by a record $1 billion investment in Securonix. However, 2022 has been a game of two halves. While 2021’s funding momentum carried over into a record first quarter, there has been a subsequent 40% year-on-year decline in investment across quarters two through four as global sentiment has softened. Behind this has been a decline in large deals as investor sentiment meets with scaled Indian SaaS companies that previously raised capital, benefit from supportive eco- nomics, and choose to stay out of the capital markets for now.

Despite this market slowdown, proven revenue growth combined with attractive margins has made SaaS a comparative bulwark for investors, with Indian SaaS venture capital (VC) investment up 10% over quarters one through three in 2022—while overall VC investments are down ~22% vs. 2021. Investors in Indian SaaS benefit from an opportunity to back a wide array of companies across sub-categories and have a clear path to realisation, with ~40 SaaS exits in 2022 (almost doubling year-on-year) across a variety of modes. As a result, more than 70% of investors expect to increase their investment in Indian SaaS going forward.

Growth remains at the top of the agenda for Indian SaaS companies, with new market entry enabled by effective enterprise go-to-market (GTM), a key priority. Selling into scaled SaaS markets such as the US (close to $150 billion in SaaS spending) is a strategic imperative, and today just around 20% of revenues for Indian SaaS companies are generated from India. Going global necessitates effective enterprise GTM playbooks that Indian SaaS companies are increasingly refining. However, Indian SaaS companies are also being confronted with a new economic reality that emphasises efficiency, and cost and liquidity management now need to be part of any management team’s toolkit.

Near-term turbulence aside, Indian SaaS remains in its early stages and has proven that it is building world-leading companies across categories. We expect that over the next 5 years, Indian SaaS companies will collectively reach ~$35 billion in ARR and capture ~8% of the global SaaS market.

Indian SaaS investment overview

2022 was another record year for Indian SaaS investments, with investments reaching ~$5.1 billion in 2022, up ~20% vs. in 2021.

- Growth has primarily been driven by increased interest in earlier-stage deals; there are more seed deals happening (+65% vs. 2021) that are larger ($1.7 million vs. $1.3 million average in 2021), while the number of Series A investments have nearly doubled (+90% vs. 2021) as a greater supply of companies meets more early-stage capital across existing and new investors.

- Later-stage deals have become smaller (~$75 million average vs. ~$100 million in 2021) as some of the largest Indian SaaS companies choose not to raise in prevailing market conditions.

Investment growth was primarily driven by a record $2.2 billion in investment in the first quarter of 2022 (~55% of the total year-to-date, excluding Securonix); from the second quarter onwards, there has been a substantial decline (-40%) in investments vs. 2021 as global investor sentiment has softened.

Indian SaaS has seen a large increase in the breadth of investible companies, with funding con- centration reduced in recent years. The top 15 deals for Indian SaaS accounted for just ~50% of deal value in 2022, down from 60% to 70% in prior years and below the ~70% observed in Indian tech.

In an environment of softening investor sentiment, SaaS has emerged as a comparative bulwark for India-focused venture investors given proven revenue growth and attractive operating economics, becoming among the fastest-growing venture investment sectors and accounting for ~17% of total investments in the first 3 quarters of 2022, up from ~12% in the first three quarters of 2021.

Indian SaaS is beginning to provide realised returns to investors, and the number of exits almost doubled in 2022, reaching ~40 exits across a variety of modes, including large-scale secondary transactions, strategic acquisitions, and public market exits/initial public offerings (IPOs).

Public markets offer a meaningful path to exit, and many Indian SaaS companies are already ‘IPO Ready’ based on their scale; however, deteriorating market conditions have led to muted IPO activity throughout 2022.

Key SaaS themes

Indian investors continue to back a range of companies across horizontal business, horizontal infrastructure, and vertical SaaS. When we look at investments in these sectors, excluding the Securonix deal:

- Horizontal business: Largest investment category (nearly 70% of 2022 investments), driven by large end-markets (more than $140 billion for top-5 horizontal categories) and numerous proof-points of >$100 million ARR companies (~70% of top-20 Indian SaaS companies are horizontal business).

- Horizontal infrastructure: Around 15% of 2022 investments, with numerous global leaders emerging out of India in DevTools in particular (e.g., Postman, BrowserStack) given India’s extensive developer base (~10% of global total) and rapid, product-led growth.

- Vertical: Around 15% of 2022 investments, with smaller end-markets (~$30 billion) compared to horizontal business. Vertical SaaS is typically high-retention, with India’s notable healthcare and wellness and logistics companies seeing rapid growth.

The number of SaaS companies being funded in India has doubled compared to five years ago

An increasingly mature Indian SaaS ecosystem provides investors with an opportunity to back companies across a variety of sub-sectors within horizontal and vertical SaaS:

- Indian SaaS companies often bring a unique approach to these sub-sectors (e.g., mobile-first solutions in MarTech and underserved geographies/verticals/employment models in human capital management).

- While select categories are comparatively mature, there are clear white-space opportunities for existing and new Indian SaaS companies (e.g., pricing management, workflow automation, identity and access management).

Indian SaaS investors consistently back companies in larger and more mature sub-sectors such as Customer Relationship Management & Sales and Enterprise Resource Planning. An increased diversity of companies has enabled Indian SaaS investors to begin developing sub-sector specialisation for the first time (e.g., Nexus in DevTools).

The outlook for Indian SaaS investment remains broadly positive over the next 12 months, with ~90% expecting to increase or maintain their capital allocation to SaaS driven by strong business economics, path to scale, and successful exit trends.

Investors count dev tools, CRM, and logistics tech among the most exciting sub-sectors, while portfolio priorities are product market fit and GTM for early-stage companies, and talent management/acquisition and overseas GTM for late-stage companies.

Focus areas for Indian SaaS companies

Bain’s experience shows that focus areas for Indian SaaS companies vary by scale but centre on several key themes:

- Smaller companies (less than 1,000 FTEs) are primarily focused on entry into new markets, managing downturns, and talent acquisition and retention as they look to scale.

- Larger companies (more than 1,000 FTEs) additionally focus on enhancing their GTM model and are maintaining a long-term view towards IPO readiness.

Global markets are a key step for Indian SaaS companies looking to achieve substantial scale (more than $100 million ARR). Developing a clear overseas market growth playbook is a strategic imperative for most companies that involves:

- Market opportunity: India remains a comparatively smaller market opportunity (~$2–3 billion) when compared to the US (~$150 billion). The majority of Indian SaaS companies looking to achieve meaningful scale build an overseas focus, with the US alone comprising ~50% of top-20 Indian SaaS company revenues.

- Growth model: The US SaaS market is highly competitive, and Indian companies that succeed do so through a combination of product excellence, competitive pricing, and a focus on distinct/underserved market segments combined with a clear GTM playbook.

Indian SaaS investments increased by ~20% in 2022 vs 2021, boosted by a record ~$1 billion investment in Securonix

Downturn management is becoming increasingly critical for Indian SaaS companies. Cost and liquidity management are essential toolkits for management teams, while downturns are an opportunity for well-capitalised companies to “play offense” and engage in tactical mergers and acquisitions.

Building winning talent models is critical to maintain growth and a competitive edge.

- High demand and long-term attrition: Talent demand from Indian SaaS companies is increasing rapidly (more than 80% headcount growth over 2020–2022), and Indian SaaS companies compete for talent from similar sources.

- Winning talent models: Talent outperformers have more than 10 percentage points lower annual attrition. Building winning talent strategies involves focusing on key interventions across priority areas for employees, namely culture and values, compensation and benefits, and leadership engagement.

Numerous Indian SaaS companies are at an IPO-ready scale (more than $100 million ARR). Going forward, as capital markets recover, going public will require a well-defined pre- and post-IPO strategy, a compelling equity story, thoughtful timing, and technical readiness.

Complete report, https://www.communicationstoday.co.in/india-saas-report-2022-bain-comapany

You must be logged in to post a comment Login