Data Centers

Waiting with bated breath

The data center industry continues to see massive investment, albeit riddled with challenges.

2023 has yet to see large acquisition deals in the data center industry.

2022 saw USD 48 billion worth of data center deals transacted, including the closure of the USD 15-billion CyrusOne acquisition announced in 2021. 2021 saw a flurry of 10- and 11-figure deals, those broke records for the industry. 2020 was a then-record-breaking year for M&A in the industry, with more than USD 31 billion spent across more than 110 deals, doubling the figures of 2019.

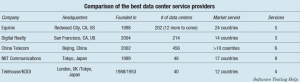

While multi-billion-dollar acquisition deals are common occurrences in the world of technology, such giant buyouts are relatively rare in the field of data centers.

“Hyperscale operators continue to aggressively expand their operations, while both enterprise and consumer-oriented cloud markets keep on growing rapidly. This is driving an ever-increasing need for data center capacity,” John Dinsdale, a chief analyst at Synergy Research Group, had said in the wake of the CoreSite/CyrusOne deals in 2021.

“The level of data center investment required is too much for even the biggest data center operators, causing an influx of new money from external investors. In quick succession, ownership of four of the top six US data center operators has changed hands, while the two biggest names in the industry – Equinix and Digital Realty – are increasingly turning to joint ventures to help fund their growth. Over the last 18 months, there has been a very notable shift in buyers with private equity investors becoming a lot more active than data center operators,” Dinsdale added.

With greater innovation and industry transformation, particularly in 5G and the metaverse, the data center owners and operators in 2023 are seeking infrastructure solutions partners that are able to advise them on the best practices and technologies to help them meet their net-zero goals.

While the commitments toward net-zero carbon emissions from most operators in India are encouraging, there are still many challenges on the path ahead. Similar to data center operators, the end customers of data centers may also have net-zero commitments. These customers may demand requirements in terms of MEP equipment, sourcing of raw materials, etc., based on their net-zero commitments. Such requirements can directly impact the CapEx and operating costs for operators.

India, for instance, has ~1.5 GW of new supply in the pipeline, and the landbank with operators can potentially add another 3 GW of supply. While India is focused on increasing renewable energy generation, the capacity addition may not keep pace with data center deployments, thereby delaying the net-zero targets. In the face of increasing data demands and the environmental impact of technology, data center operators are prioritizing sustainability to ensure that their data centers are green and carbon-neutral.

Data centers are continuing to experience increased regulation and third-party oversight as the world continues to grapple with the industry’s rising energy and water consumption against the backdrop of ongoing climate change.

Increased regulation leads to important innovations. The process may not always be easy or linear, but it can be navigated with the help of expert data center partners and innovative solutions that can anticipate the changes while meeting the always-increasing requirements of data center applications.

It is happening in some places already. Dublin, Ireland, and Singapore have taken steps to control data center energy use, and data center water consumption – especially in areas prone to drought – is likely to trigger similar scrutiny.

Prefabricated, modular data center designs will be a part of their future data center strategy, concludes a recent Omdia survey. A continuing shift in the same direction among hyperscalers is being observed as they seek the speed and efficiencies standardization delivers.

This is a newer concept for the world’s leading cloud providers, and they are turning to colocation providers – who have been standardizing for years – to make it happen. Specifically, those cloud providers are outsourcing their new builds to colos to leverage their in-market expertise, proven repeatability, and speed of deployment. In short order, standardization – ranging from modular components, such as power and cooling modules and skids, to full-fledged prefabricated facilities – will become the default approach, not just for the enterprise but also for hyperscale and the edge of the network.

Increased reliance on batteries for longer load support with minimal generator capacity, increasing rack densities, and creating thermal profiles that require liquid cooling and thereby addition of direct-to-chip cooling to new Open Core Protocol (OCP) and Open19 standards are accelerating trends.

An industry grappling with higher costs, and a slowing global economy, sets the stage for a challenging landscape for delivering new data center capacity. After several years of powerful growth, the digital infrastructure sector faces a challenging environment for building new data centers at internet speed. Key markets are facing power constraints, and new deployment timelines may be slowed by supply chain issues and community resistance. On the demand side, enterprise IT shops will likely face budget constraints, while the hyperscale sector must absorb the massive amount of capacity leased in 2022.

The hype about generative AI became reality in 2023. For the data center sector, this means more demand for specialized high-performance computing (HPC) platforms. The large cloud providers will be the key players here, but forward-leaning enterprises may want to use these tools to unlock business value in proprietary datasets that may not be cloud candidates.

That creates opportunities for high-density colocation, offerings optimized around new processors and software frameworks for generative AI. Larger colo and wholesale data center providers may accelerate plans to create high-density zones in their facility.

Community resistance to data center development is a growing challenge in some of the most important data center markets, as they devour vital community resources like water and electricity. Extreme heat and drought are raising the bar for fast-growing cloud computing platforms and data center developers.

In many regions, data centers are now using air-cooled chillers that recirculate water in a closed loop, drastically reducing their water use. But in other regions, they continue to rely on evaporative cooling systems that are highly efficient but require lots of water.

According to the US Department of Energy, the water-usage effectiveness (WUE) of an average data center, using evaporative cooling systems, is 1.8 L per kWh. That type of data center can consume 3–5 million gallons of water per day – similar to the capacity used by a city of 30,000–50,000 people. The industry will continue to take steps to self-monitor and moderate – including an increasing preference for environmentally-friendly thermal designs – but this year will see increases in regulatory oversight.

We have reached a tipping point. The existing data center ecosystem has an upper limit when it comes to the amount and density of infrastructure it can cool, with average data center physically unable to cool racks with a density greater than 20 kW. Conventional air cooling ceases to be an economical or effective solution when rack densities are higher than 20–25 kW. This was not perceived as an especially pressing issue even a couple of years ago, when the industry sat comfortably in the 10–19 kW range.

More heat means more power consumed to cool server racks, more carbon emissions, more wear and tear on hardware, and fewer opportunities for enterprises to capitalize on the power of AI/HPC. Customers are already consuming AI/HPC resources on a regular basis to solve the most pressing and immediate problems. AI/HPC in the enterprise space has become normalized, accepted, and expected. Moving forward, a new breed of facility that is capable of accommodating the hardware powering this revolution is needed.

When rack densities grow to the point we are starting to see in dedicated AI/HPC facilities, air ceases to be a viable medium for cooling those servers. Liquids, on the other hand, can absorb a lot of heat very quickly and carry it away, making water or dielectric cooling fluid much more effective than air as a cooling agent. Cooling a server using a dielectric cooling fluid is 1500 times more efficient than traditional HVAC cooling. The data center industry is waking up to the fact that immersion cooling is no longer a niche solution, but rather the enabler that will make AI/HPC accessible to a rapidly expanding user market; that is where collocated HPC or HPC-as-a-service comes into play.

With the generative AI industry alone predicted to reach USD 103.74 billion by 2030, at a CAGR of 33.7 percent from 2023 to 2030, a shift toward higher-density digital infrastructure is imminent. The chips that are being released right now — the ones that will support the transition of generative AI, advanced GPU processing, and all the other technologies are producing twice as much heat as the previous generation. There is little to suggest the leap to the generation after that will be any less exponential.

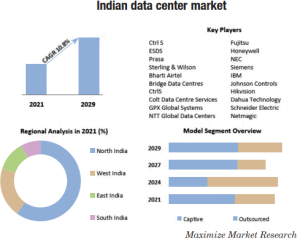

Indian scenario

India’s data center industry doubled to 722 MW in 2022 from 350 MW in 2019, registering a robust CAGR of 27 percent. In 2022, the industry saw an all-time high absorption of 160 MW, which is 32 percent higher than the previous year. Mumbai leads the absorption pie, accounting for a 43-percent share, with a substantial hyperscale precommitment being delivered in Delhi NCR.

India has been and will be the preferred market for data center providers. The rising demand for on-demand video, mobile gaming, and online content will be a stronger force for data center procurement in the country.

This growth shows no signs of slowing down, thanks to the high pace of India’s digital transformation, migration of IT infrastructure to third-party providers, and growing usage of data from new and existing channels. Hyperscalers’ public cloud services have been scaling up their requirements and are expected to grow further.

With a strong precommitment pipeline, it is expected to result in 678 MW being added over the next three years, taking the industry’s capacity to 1400 MW by end-2025. This will create demand for 9.1 million sq. ft. of real estate space, which will need an investment of USD 4.8 billion, some from global investors or alliances to fund the additions, in both data center infrastructure and data center sector real estate, according to a JLL report. The highest capacity addition is expected in Mumbai, including Navi Mumbai, requiring 4.7 million sq. ft. of real estate, followed by Chennai at 2.3 million sq. ft. and Delhi NCR at 1 million sq. ft.

Strong data localisation policies of the government encouraged setting up of a robust data center ecosystem in India as they mandated processing of data generated in the country within its boundaries. Initiatives, such as Digital India, Make in India, Atmanirbhar Bharat, and the Digital Personal Data Protection Bill 2022 are providing the requisite impetus.

It is not just India that is seeing huge sums of money going into data centers. One good example is NTT Ltd. Following the Jakarta 3 Data Center (JKT3) in Indonesia, completed in April 2022, and the Cyberjaya 6Data Center (CBJ6) in Malaysia, scheduled for completion around the middle of 2023, the company has announced an investment of USD 90 million for the development of its newest and largest data center in Thailand.

Despite cloud-based alternatives to on-site servers becoming more popular, the various large companies across the world are continuing to build data centers and the growth momentum is expected to continue.

You must be logged in to post a comment Login