CT Stories

India secures its burgeoning submarine cables industry

India is an attractive gateway location due to its location, geopolitical situation, and saturation in parts of Asia. Due to rapid infrastructure and surging cloud growth, India is becoming a growing epicenter for internet traffic between Europe, the Middle East, and Africa. In line with this, the Indian Finance Minister’s concession was music to the ears. In the interim Union Budget 2024, announced by the Finance Minister on February 1, 2024 customs duty exemption was granted to vessels engaged in laying submarine cables, that lapses on March 31, 2024, was extended up to September 30, 2024. Telecom companies depend heavily on submarine cables for the high-speed transfer of data around the globe.

India’s strategic and geographic position in the Indian Ocean region has made it a critical player in the development of submarine cable infrastructure. The country is connected to the world (Asia, Middle East, Europe & Africa) through multiple submarine cable systems, such as the Southeast Asia-Middle East-Western Europe (SEA-ME-WE) cable system, the Bay of Bengal Gateway (BBG) cable system, and the India-Middle East-Western Europe (IMEWE) cable system, etc.

2024 is set to see a number of highly anticipated submarine cable systems worldwide go live this year. The submarine cable systems market estimated at USD 18.28 billion in 2023, at a CAGR of 12.3 percent is expected to be USD 33.29 billion in 2028.

Submarine cable systems carry over 99 percent of intercontinental communication traffic, making them the invisible enabler of global connectivity. Growing investment in high-speed internet infrastructure is driving the growth of the submarine optical fiber cable market. The continuous increase in the generation and transfer of vast amounts of data worldwide is one of the primary drivers of the market.

The high installation and maintenance costs are expected to challenge the market’s growth. Furthermore, the growing investment in satellite communications is another major factor challenging growth, as cables only have an advantage over short paths, especially if traffic is heavy. However, satellites become economically more attractive as distance increases and density decreases. Additionally, having a satellite communication link is much faster, as with the other wireless deployments, than deploying submarine cables, which is another significant advantage of satellite communications over submarine optical fiber cables.

In the Indian region, part of four new cable systems – 2Africa, IAX, IEX, and PEACE – are all planned to go live in 2024. Taken together with their existing cable projects, these new systems will create an interconnected backbone for international data traffic, bolstering these transport routes between Asia and the rest of the world for years to come.

2Africa is expected to be operational in 2024, with the PEARLS branch – which extends the system to Oman, the UAE, Qatar, Bahrain, Kuwait, Iraq, Pakistan, India, and Saudi Arabia – planned for service in 2025. Airtel is part of this where it has a wide-ranging partnership with Meta, covering subsea cable systems to bring 2Africa Pearls to its landing station in Mumbai. The telco planned to partner with Meta and Saudi Telecom in the venture of 2Africa Pearls extending to India.

While the India Asia Xpress (IAX) cable, expected to be ready for service later this year, and the India Europe Xpress (IEX) system, which will be ready next year. IAX will stretch from Mumbai, India, to the Maldives, and onwards to Singapore, with additional branches extending to Thailand and Sri Lanka. IEX, meanwhile, will travel westwards from Mumbai, through the Red Sea and the Mediterranean Sea, before landing at its final destination in Savona, Italy. Reliance Jio is partners with IAX and IEX.

Occupying a crucial junction for international data traffic, linking Southeast Asia to Europe, India is a major data hub in its own right. Both APAC and Europe are already highly developed when it comes to submarine cable infrastructure, but the sheer scale of the data growth expected over the coming decade is making the further development of these state-of-the-art cables highly attractive. IAX and IEX will play a major role in meeting that need, offering customers alternatives on some of the most popular data routes in the world.

In addition, a number of new international submarine cables are in pipeline for rollout, including MIST, and TEAS, etc.

MIST, aka the Myanmar/Malaysia India Singapore Transit cable system, has a total length of 8,100km and connects Singapore, Malaysia, Myanmar, Thailand, and Mumbai and Chennai in India. It is being constructed by NEC Corporation. Once fully deployed, the cable is expected to reach 11,000km and have the capacity for future expansion.

TEAS, Trans Europe Asia System is a trans-regional network that seamlessly links two new diverse connections across the Arabian Peninsula that are designed to support the future needs of key data centers, linking India, the Middle East and Europe.

NEC Corporation India (NEC India) together with NEC Corporation in January 2024 has successfully completed its optical submarine cable system in Southern India connecting Kochi and the Lakshadweep Islands. Spanning approximately 1,870 kilometres the order was awarded with a project by BSNL.

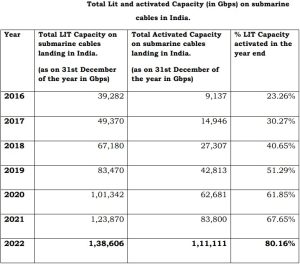

Currently, there are 17 international subsea cables (Seacom and MENA are considered separate cables) landing in 14 distinct cable landing stations in 5 cities across India, in Mumbai, Chennai, Cochin, Tuticorin and Trivandrum, and the lit capacity and the activated capacity on these 17 international subsea cables were 138.606Tbps and 111.111Tbps respectively.

There are also domestic submarine cables such as the Chennai-Andaman and Nicobar Island Cable (CANI) connecting Port Blair along with seven other Islands of Andaman & Nicobar, and the Kochi-Lakshadweep Island (KLI) cable system for a direct communication link through a dedicated submarine optical fiber cable between Kochi and 11 islands of Lakshadweep.

In a move to ease the rules for setting up submarine (undersea) cable landing stations (CLS) in India, the TRAI has made recommendations on the licensing framework and regulatory mechanism for submarine cables landing in India within existing UL-ILD/standalone ILD license, visit, https://trai.gov.in/sites/default/files/Recommendation_19062023.pdf

The protection of subsea infrastructure is a growing concern. Recent disruptions either through sabotage, espionage, manipulation, or sheer accident highlight the issue and require legislative and physical protection in the Indian Ocean region.

Currently, India has 17 submarine cables landing from different parts of the world. However, India currently lacks jurisdictional, legislative, and physical protection measures for these expensive and vulnerable underwater assets. India needs to create Submarine Cable Protection Zone within India’s Exclusive Economic Zone, that is consistent with the international maritime laws, provided under UNCLOS.

A solid legislative framework would enable India to use its maritime law enforcement within these zones, as well as jurisdictional capacities for the arrest and prosecution of wrongdoers. In terms of physical protection, the repair of damaged cables is an expensive and skilled task. The rather difficult task of monitoring and protecting submarine assets in the Indian Ocean Region not only requires technical expertise but also a policy framework to ensure physical safeguards are backed up by legislation.

Interesting times ahead!

You must be logged in to post a comment Login