CT Stories

5G investment cycle tapering off and another one not on the horizon

2023 was without a doubt the year that India made a lot of headlines with a 5G rollout that was impressive both in speed and scale. Both Reliance Jio and Bharti Airtel have spent heavily on CapEx for 5G network rollouts and achieved impressive early coverage and healthy subscriber adoption.

Jio has made a cumulative investment of ₹4.99 lakh crore to build its entire digital ecosystem. Mukesh Ambani, chairman, RIL, had announced in the 2022 AGM that the 5G investment would be ₹2 lakh crore. The FY24 capital spend is expected at ₹60,000 crore and CapEx about ₹42,163 crore, which may lower to about ₹30,000 crore in FY25. “We are the only company with the capacity to smoothly transition our entire customer base to 5G, with minimal additional CapEx,” Mukesh Ambani had said in the 2023 AGM.

Bharti Airtel’s CapEx is expected to come down in FY25 as the telco has completed a vast part of the 5G rollout as well as made planned investments to improve its market share in rural areas, in FY2024. The CapEx intensity is expected to come down to ₹15,000–16,000 crore in FY25 from the estimated ₹30,000–33000 crore in FY24, a fall of near 46 percent. It was ₹28,500 crore in FY23. Gopal Vittal, Chief Executive Officer, Bharti Airtel and South Asia, had said during the October–December quarter earnings call that most telcos globally operate between 15 and 20 percent CapEx to revenue ratio and there is no reason for Airtel not to operate at that level in the future. Sunil Mittal, in the company’s annual report, had said that the telco has invested over USD 50 billion (₹4.15 lakh crore) to build its network in India. Its 5G CapEx is relatively low, as it depends on non-standalone technology.

The combined 5G capital expenditure of the two telcos is estimated to have tapered from 37 percent of revenue in FY23 to 35 percent in FY24.

Vodafone Idea’s CapEx continues to be muted. The telco is yet to roll out its 5G services. The CapEx spend for the nine months (April 2023–December 2023) was ₹1300 crore in FY24, down from ₹2800 crore in FY23. The CapEx being incurred is toward just the necessary investment, to take care of any capacity bottlenecks, or in some places where equipment is at the end of life and needs to be replaced.

The Cellular Operators Association of India (COAI), in a bid to provide relief to the telcos, has released a white paper, which has renewed the call for a fair share compensation mechanism, where the top four or five data consuming apps are made to pay the telecom companies for providing infrastructure. Telcos across the world have been demanding contributions from large traffic generator apps mainly Netflix, WhatsApp, Instagram, X, etc., to support the cost of network infrastructure.

The white paper petitions that from FY12 to FY23 the telcos have undertaken CapEx of ₹6.93 lakh crore. This had to be undertaken solely by the companies to meet the exponential growth in demand for data. It argues that this data consumption is only likely to grow with even more bandwidth-heavy apps and services being rolled out with 5G and 6G.

Telcos have spent an additional ₹10,000 crore in CapEx since March 2022 to enhance network infrastructure needed to support traffic from four–five OTT service providers. The telecom industry CapEx rose 15 percent to ₹53,661 crore in March 2022, up from ₹46,532 crore in March 2021 to accommodate the then traffic from telcos. However, from 2022 onwards the infrastructure spends saw a steeper growth in the CapEx figures, going up to ₹73,922 crore in March 2023.

Global scenario

The telcos worldwide too are scaling back their investments in 5G. According to a recent report from Dell’Oro Group:

- Global carrier revenues are expected to increase at a 1 percent CAGR over the next 3 years.

- Market conditions are expected to remain challenging in 2024. Worldwide telecom CapEx is now projected to decline at a mid-single-digit rate in 2024 and at a negative 2 to 3 percent CAGR by 2026.

- The mix between wireless and wireline remains largely unchanged, reflecting challenging times still ahead for wireless. Wireless related CapEx is on track to decline at a double-digit rate in the US in 2024.

5G era capital intensity ratios peaked in 2022 and are on track to approach 15 percent by 2026, down from 18 percent in 2022.

Vodafone, America Móvil, Comcast, and AT&T collectively account for around 15 percent of global telecom industry CapEx.

In its fiscal year ending March 2024, Vodafone reallocated its CapEx to regions with better ROCE. As part of its digital transformation, Vodafone used data analytics with machine learning and AI to help optimize CapEx allocation.

Out of a planned USD 24bn CapEx budget from 2022 to 2024, in 2022 América Móvil spent USD 7.9bn. In the Q4 23 earnings call, CEO Daniel Hajj Aboumrad offered an update that the company was reducing total CapEx to USD 7 billion in 2024 from USD 8.6 billion it spent in 2023.

Looking back at the last 5 years, Comcast’s capital expenditure peaked in December 2023 at USD 12.379 billion. He elaborated that the company will still invest in every country in Latin America and in Europe, expanding its fiber deployments and launching 5G in some countries where it does not yet exist.

AT&T annual CapEx is in the USD 24bn vicinity, it was USD 23.6bn in 2023. In 2024, the telco’s capital investment is planned in the USD 21–22 billion range. Capital investment includes capital expenditure and cash paid for vendor financing.

“Our peak capital spend is behind us, and we are now at a business-as-usual run rate for CapEx, which we expect will continue into 2024,” said Verizon CFO Anthony Skiadas on the carrier’s second-quarter earnings call in July.

The reasons for the reduction in revenue he elaborated are several: Higher interest rates have affected telco customers’ buying patterns. And telcos continue to digest their heavy investments related to the massive 5G rollout of 2021 and 2022. Further, the much-hyped 5G revolution has failed to open the floodgates of revenue telcos were hoping for.

It is too soon to tell how long until carriers ramp up their spending, but their guidance indicates the slowdown will persist through 2024.

Much depends on how technologies related to 5G, such as network slicing, will actually materialize in services. Generative Artificial Intelligence could also spur sales, but telcos have been a bit slow in taking some opportunities in that space. Surely, it will take a few more quarters to determine any real shift in telcos’ financial direction.

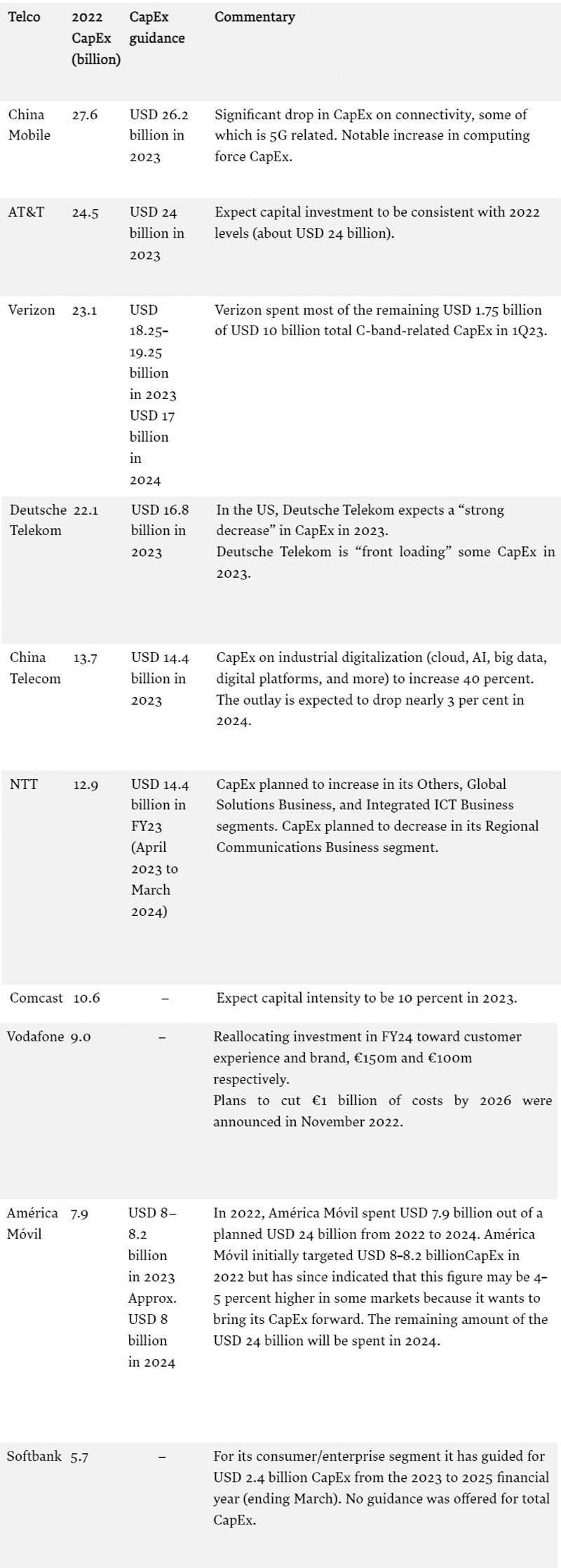

CapEx guidance from selected telcos

(June 2023)

Of the 10 operators reviewed by Omdia, in table above, three indicated CapEx would increase in 2023, four that it would fall, and three did not provide guidance on total CapEx. These 10 operators collectively account for around 47 percent of industry CapEx. There is a long tail of smaller operators that comprise the balance.

One trend observed in 2023 is that some operators are bringing forward their CapEx to capitalize on business opportunities or improve efficiencies, and this will contribute to slower CapEx growth in 2024. Despite the weak guidance of certain companies, such as Deutsche Telecom and Verizon, overall, Omdia forecasts that global telco CapEx will grow 1 percent in 2023, despite the backdrop of ongoing telco revenue decline. This represents a slight acceleration from 0.5 percent CapEx growth in 2022 when many operators rationalized budgets due to the impact of inflation.

Within the overall CapEx budget, some categories have healthier prospects than others. Segment categories are civil infrastructure, access network, transport, core, cloud infrastructure, IT and software, devices, and CPE. Growth expected in fixed access network CapEx is to be driven by passive optical networking (PON), and in IT and software to be driven by 5G automation and customer experience. Conversely, mobile radio access network CapEx is predicted to decrease.

Impact on vendors

Telco spending on network infrastructure is dropping in line with reduced revenues. And there is no sign of imminent relief.

Cisco has lowered its revenue outlook in the wake of reduction in CapEx by telcos and cable operators. Previously projected at USD 53.8-55 billion, Cisco now anticipates its revenue for the fiscal year 2024 to range between USD 51.5-52.5 billion. During a conference call, Charles Robbins acknowledged the ongoing challenges, stating, “We continue to see weak demand with our telco and cable service provider customers.” Its two large customers, MTN Consulting recently said telecoms CapEx for 2023 will be around USD 300-310 billion as compared with USD 328 billion recorded in 2022. Altice USA said its CapEx will be USD 1.6-1.7 billion in 2024 as compared with USD 1.7 billion in 2023. Altice USA said Q4 2023 capital intensity was 12.8 percent (7.9 percent excluding FTTH and new builds) and improved by decline of 45.6 percent. The capital intensity of Altice USA in 2023 was 18.5 percent (10.5 percent excluding FTTH and new builds) and improved by decline of 10.9 percent.

A well-publicized profit warning by telco test and measurement supplier Spirent on October 4, 2023 cited a telecommunications market that is “extremely challenged at this time, with Spirent’s largest customers delaying their expenditure and technology investments.” Similarly, in its quarterly report in August, VIAVI cited a “slowdown in overall service provider spend” and reported a quarterly net revenue decline of 21.4 percent year-over-year.

The situation is very similar in India. After strong growth since the fourth quarter of 2022, sales at Ericsson and Nokia hit a roadblock with Reliance Jio and Bharti Airtel focusing on 5G monetization and cutting CapEx spends, having virtually completed their pan-India rollouts. “A reduction in CapEx investments in India was expected in the beginning of 2024, but occurred earlier than anticipated,” Ericsson CEO Borje Ekholm had said in its earnings statement in January 2024.

Nokia and Ericsson had seen a sharp upsurge in India sales numbers from the fourth quarter of 2022 and first quarter of 2023, respectively, shortly after Airtel and Jio had started rolling out 5G networks nationally from October 2022.

Nokia’s India net sales jumped 129 percent on-year to 568 million euros in the fourth quarter of 2022. Ericsson’s net sales from the Southeast Asia, India, and Oceania market area, in turn, jumped 138 percent on-year to SEK 13.91 billion in the first quarter of 2023.

Nevertheless, despite the sharp sequential fall in India, net sales in Q4 2023, both Nokia and Ericsson have reported strong on-year sales growth from their mobile networks businesses in India, driven by 5G contract wins in India a year earlier. Both Nokia and Ericsson are the principal 5G gear suppliers to Jio and Airtel.

Outlook

To sum up, with the possible exception of China and South Korea, 5G has been an unmitigated failure for carriers, network equipment companies, and subscribers. There have not been any significant performance advantages over 4G. And, in India the telcos are offering 5G services at 4G rates!

You must be logged in to post a comment Login