Headlines of the Day

Telecom-Expect steady quarter in Q4FY23

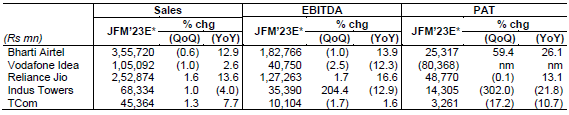

Q4FY23E estimates suggest a deceleration in mobile revenue growth QoQ across telcos due to two less days during the quarter, and absence of tariff hikes, according to ICICI Securities research. Subscriber (sub) base for Bharti and RJio is likely to expand while that for VIL will most likely continue to shrink. We expect mobile revenue for Bharti and RJio to rise 0.8% and 1.8% QoQ respectively in Q4FY23E. RJio has grabbed higher incremental revenue probably as it gains subs as Bharti has increased its base plan price to Rs155 (from Rs99). We expect VIL’s revenue to dip 1% QoQ. EBITDA margin expansion is likely to be limited, or decline, due to rise in network operating cost owing to 5G deployment (which means higher loading charges and more power consumption). We expect Indus Towers’ performance to be aided by rise in tenancy net adds and higher 5G loading; its EBITDA is likely to benefit from the absence of any provision for doubtful debts related to VIL receivables. Tata Communications may report steady revenue growth (+2.3% QoQ) in its data business on easing supply-chain issues and stable segmental margins QoQ. Key things to watch will be capex, FCF generation and net debt levels. We expect Bharti to likely call for the second tranche of payment from its rights issue.

- ARPU growth lower QoQ due to two days less in Q4FY23E. The quarter will likely bear the impact of SIM consolidation and churn induced by Bharti’s select rise in tariffs. Bharti may report sub rise of 2mn (+0.6% QoQ) while VIL’s sub base may fall by 4mn (-1.7%). RJio’s net sub add will likely be 6mn (+1.4%). We estimate ARPU growth to be flattish to +1% QoQ as Q4FY23E had two less days. Bharti’s ARPU may dip 0.2% QoQ to Rs193; RJio may grow 0.5% QoQ to Rs179 driven by growth in FBB subs and enterprise business. VIL’s ARPU may be up 1.0% at Rs136.

- Bharti’s consolidated EBITDA estimated to decline 1% QoQ (+14% YoY) to Rs183bn. We expect Bharti’s India revenue to rise 0.9% QoQ (+11.4% YoY) to Rs254bn led by the mobile segment (+0.8% QoQ / +10.7% YoY). India EBITDA is estimated to be up 0.7% QoQ (+16.1% YoY) to Rs133bn. Bharti Africa’s USD revenue may fall 4% QoQ and EBITDA -5.1% QoQ to US$1,296mn and US$624mn respectively. Decline in Africa is due to seasonality and blended dip of 2.5% QoQ in Africa currencies vs the USD. Consolidated revenue could decline 0.6% QoQ to Rs356bn while EBITDA may be down 1% to Rs183bn. Net profit is seen at Rs25bn – benefiting from higher profit from JV (Indus Towers).

- VIL’s EBITDA may slide 2.5% QoQ to Rs41bn. We expect VIL’s revenue to shrink 1% QoQ to Rs105bn due to sub losses while its ARPU may grow on rise in penetration of unlimited plans. We expect EBITDA to decline 2.5% QoQ and net loss to be at Rs80bn for VIL (nil tax rebate).

- JioPlatforms’ EBITDA likely to rise 1.7% QoQ. (Note: We have shifted our estimates to JioPlatforms from earlier Reliance Jio Infocomm). JioPlatforms’ Q4FY23E revenue is estimated to rise 1.6% QoQ to Rs251bn benefiting from sub adds. EBITDA may grow 1.7% QoQ to Rs127bn. Net profit is likely to be flattish QoQ at Rs49bn on higher depreciation and amortisation cost.

- Indus’ tenancies to rise by 1,500. Rental per tenant is likely to increase by 1.0% QoQ to Rs41,218 partly driven by higher loading revenue on 5G rollout. Rental revenue may rise 0.8% QoQ (down 11.3% YoY on higher base with one-off gains) to Rs42bn. We expect EBITDA to increase 3x QoQ (down 12.9% YoY) to Rs35bn on a low base as we assume nil provisioning for doubtful debt related to VIL receivables in Q4FY23E. We expect net profit to shrink 21.8% YoY to Rs14.3bn. Note: YoY is not strictly comparable as base has one-off gains.

- Expect TCom’s data business EBITDA to grow 1.5% QoQ to Rs9.6bn. We expect voice revenue to dip 5% QoQ and EBITDA margin to be at 10% (vs 17% in Q3FY23). We estimate data revenue to rise 2.3% QoQ (+11.3% YoY) on the back of benefit from rise in execution on easing supply-chain issues. EBITDA margin is likely to contract 20bps QoQ to 26.2%. Data segment EBITDA may rise 1.5% QoQ (-0.5% YoY on high base) to Rs9.6bn. Consolidated EBITDA may dip 1.7% QoQ due to decline in voice EBITDA. We estimate net profit at Rs3.3bn (down 17% QoQ) due to higher effective tax rate.

Quarterly summary

CT Bureau

You must be logged in to post a comment Login