OFC

OFC –The Stage Is Set For Next 10 Years

With demand for fiber expected to grow at a rapid pace as faster 4G/5G networks are rolled out and new age technologies such as IoT, augmented reality, virtual reality, cloud computing etc. become common place, the OFC industry is on a roll.

The industry has seen some key transformational trends. New business models are emerging, as communication service providers transform to digital service providers. This is accompanied by shifts from proprietary to open network systems and wireless to wireline CapEx shift. New players are coming up.

The industry has seen some key transformational trends. New business models are emerging, as communication service providers transform to digital service providers. This is accompanied by shifts from proprietary to open network systems and wireless to wireline CapEx shift. New players are coming up.

The Indian defence forces are in a network building phase with the Army, Navy, Air Force, and Border Security Force, all building intrusion-proof networks. These are large-scale and extremely mission-critical infrastructure investments.

OTTs are building their own data centres and sub-sea cable networks. According to Cisco, while the world has 259 hyperscale data centers, another 225 are expected to be built by 2020, accounting for 47 percent of total installed servers and 53 percent of data-centre traffic by 2020.

Ubiquitous, high speed and low latency networks will require deep fiberization and high densification. The number of network end points will surge due to increasing FTTx penetration, 5G (10-20x small cells per macro cells) and IoT (up to 10 devices per person). All this will require significant network creation with deep fiberisation and high densification.

The upcoming 5G technology will be an exponential shift from the previous generations. It will support a multitude of new applications, requiring higher peak and user data rates, reduced latency, enhanced indoor coverage, and better leveraging of existing infrastructure through greater energy and spectral efficiency. These goals will primarily be met by taking fiber deeper into the network supported by the combined use of more spectrum, higher spectral efficiency and densification of cells. The 5G network increases the front-haul bandwidth requirements due to the introduction of massive multiple input multiple output (MIMO), tighter intersite radio resource coordination, and wider spectrum allocations. Horizontal networks will have an increased need for high fibre-count cables to support the increased density of the antennas, while vertical networks will require hybrid cables, containing both copper for the power and fiber for the signal.

5G CapEx from US is expected to start coming this year, followed by that from Japan and South Korea next year. Bulk of deployment including China will come in 2020. 5G will help fiber move from backhaul to dominant role in fiber, paving the way for an era of deep fiberization.

At the same time, the fiber-to-the-x (FTTx) market globally is set to grow significantly.

Market dynamics

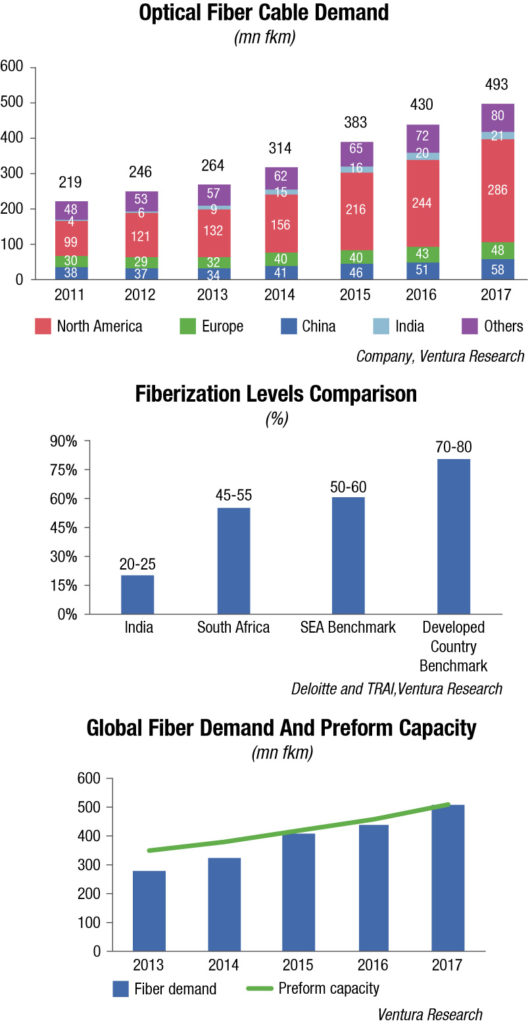

The global demand for fiber has increased from 219 mn fkm in 2011 to 493 mn fkm in 2017, representing a CAGR of 14.5 percent. China is the largest fiber consumer, with a demand of 99 mnfkm in 2011 which increased to 286 mnfkm in 2017, representing a CAGR of 19.3 percent. With strong focus laid on FTTx in this region, the demand for fiber will continue to remain robust. The rest of the regions grew at an average CAGR of 7-9 percent. However, with fiberization given priority in Europe, we expect this region to see maximum traction after India and China. Europe and China combined, currently contribute around 41 percent of revenues. Visibility of global fiber growth is expected to peak by FY2025.

Out of the above, India’s demand for fiber, which was only 4 mnfkm in 2011 increased to 21 mnfkm in 2017, reflecting the highest CAGR of 31.8 percent as compared to other regions. India’s current fiber network is vastly underserviced and represents a huge latent opportunity. Its fiberization levels stand at around 20-25 percent which is significantly low in comparison with developed countries where fiberization is around 70-80 percent. TRAI dictat of minimum 60 percent fiberization by FY22 augurs well for near term growth.

With technological advancement now picking up pace in India, fiberization levels will have to increase significantly to meet increased data demands. Also, as the telcos move from 3G to 4G to 5G, the higher bandwidth requirement can only be met through fiber. Globally, as the technology progressed, the global OFC consumption increased multifold.

Every new generation G of technology adds demand for fiber deployment. From 2G to 3G, global optical-fiber-cable consumption increased 1.9x. From 3G to 4G, consumption jumped 3x, till 2017. Fiber deployment for 4G should be completed by 2019-20. 5G should stoke the next wave of deployment, as networks become denser and their latency drops. A potential 2.5-5x jump in demand over 4G may be expected. The wave of fiber deployment will last a good 10 years, asserts Sterlite Technologies. Ongoing demand-supply mismatches should persist for at least another 1-2 years.

The recent Draft National Digital Communications Policy has set the stage for achieving full digital inclusion by declaring fiber as a critical public utility.

You must be logged in to post a comment Login