Trends

‘Made in India’ smartphone shipments declined 3% YoY in 2022

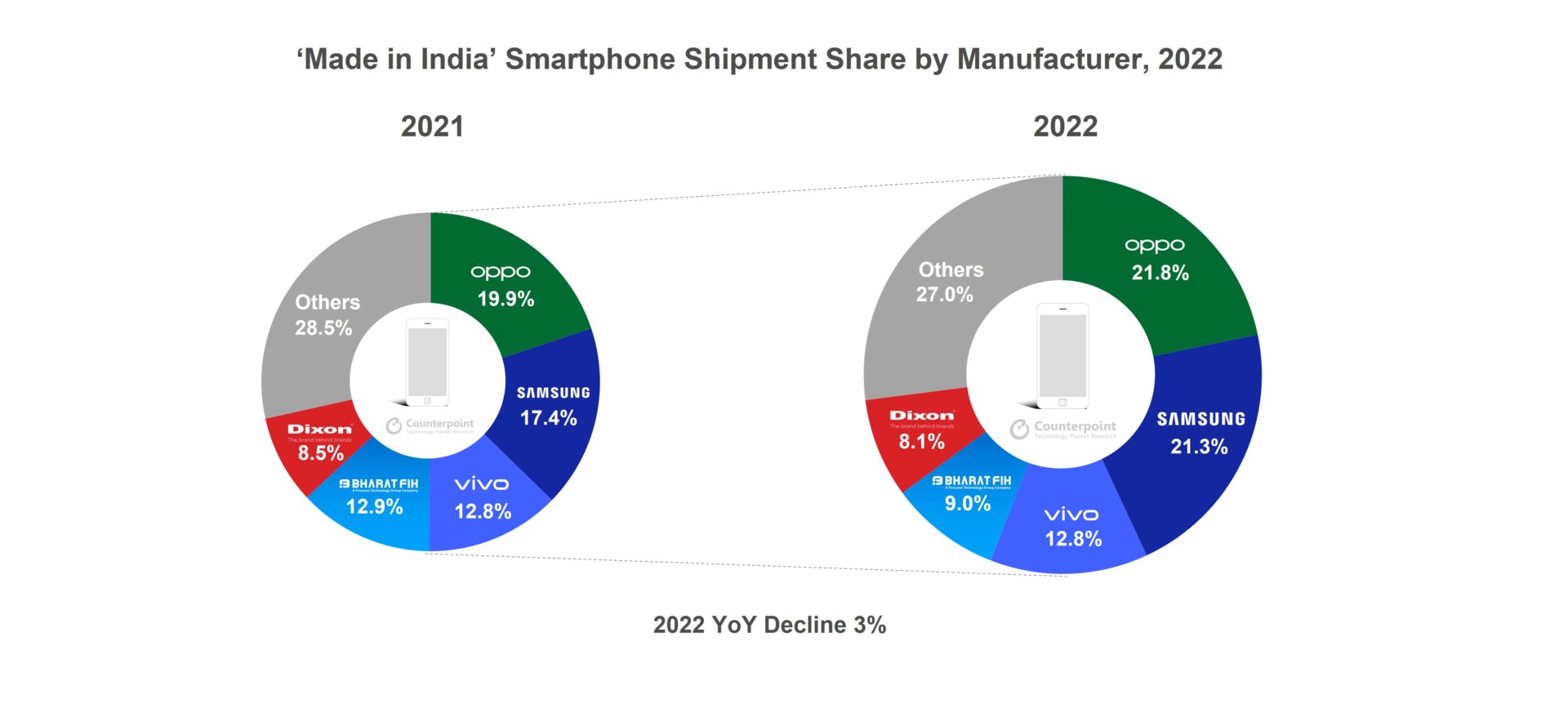

‘Made in India’ smartphone shipments declined 3% YoY in 2022 (January-December) , according to the latest research from Counterpoint’s Made in India service. The major factor behind this decline was the softening of consumer demand due to macroeconomic headwinds, especially in the second half of the year. The shipments fell 19% YoY in the last quarter due to local demand decline, particularly in the entry-tier and mid-tier segments. However, in terms of value, ‘Made in India’ smartphone shipments registered 34% YoY growth, riding on the local trend of increasing premiumization coupled with the increasing exports of premium smartphones, especially from Apple. ‘Made in India’ shipments from Apple grew 65% YoY by volume and 162% YoY by value, taking the brand’s value share to 25% in 2022, up from 12% in 2021.

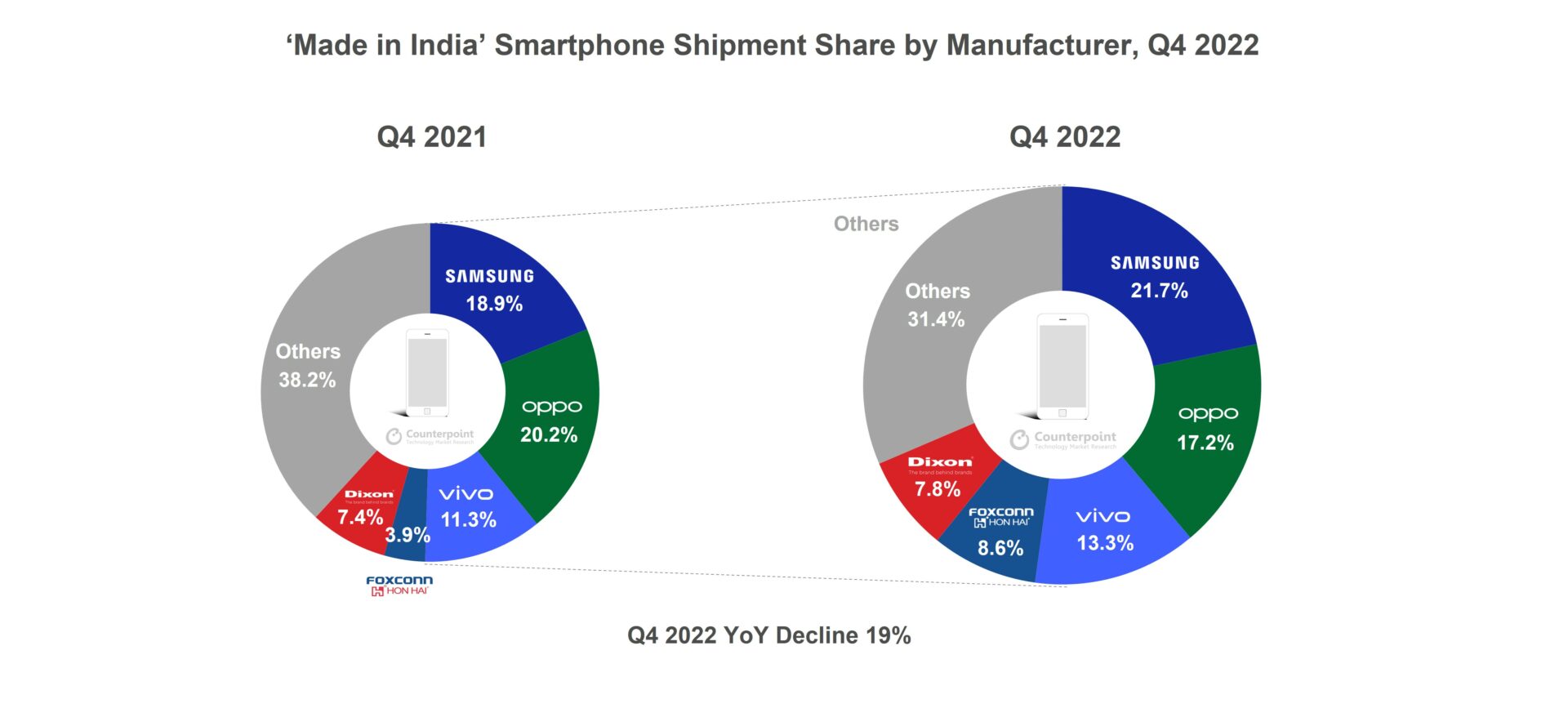

Commenting on the local manufacturing ecosystem and Q4 2022 dynamics, Senior Research Analyst Prachir Singh said, “The high inventory, which has impacted the overall supply of smartphones, is now being felt at the manufacturing level. However, the premiumization trend is benefitting some of the manufacturers. Apple’s EMS (electronics manufacturing services) partners Foxconn Hon Hai and Wistron were the fastest growing manufacturers among the top 10 in Q4 2022. The growth was also fuelled by increasing exports from Apple. In terms of overall exports, a volume growth of 37% YoY was witnessed. Further, the contribution of exports in the total ‘Made in India’ smartphone shipments reached the highest ever in 2022 both in volume (20%) and value terms (30%). In Q4 2022, Samsung emerged as the top smartphone manufacturer, ahead of OPPO whose manufacturing shipments declined 31% YoY due to inventory issues in the entry-tier segment. Samsung’s manufacturing shipments declined only 7% YoY due to its stable export volume. Among the EMS players, Foxconn Hon Hai led the manufacturing shipments in Q4 2022, followed by Dixon. Dixon remained the top Indian EMS player in Q4 2022 as well. In the feature phone segment, Lava led the ‘Made in India’ shipments with almost 29% share.”

Singh added, “The contract manufacturing landscape is expanding with multiple EMS players increasing their output. The PLI scheme is one of the major factors driving this trend. Bharat FIH remained the top EMS player for smartphone manufacturing in 2022, followed by Dixon. Bharat FIH has been a key player in developing the overall smartphone manufacturing ecosystem as well as local talent, especially with the women workforce. Dixon, which is also increasing its footprint in smartphone manufacturing, was the leading Indian EMS in 2022. Padget, with the Motorola portfolio, emerged as one of the fastest growing EMS players in 2022, registering 70% YoY growth in terms of manufacturing shipments. Apple’s EMS partners Foxconn Hon Hai, Wistron and Pegatron were among the top 10 EMS players in India in 2022 in terms of volume. In terms of value, Foxconn Hon Hai and Wistron led the EMS landscape. Both of these manufacturers also received the PLI incentive in the recent disbursements. Among OEMs, OPPO led the ‘Made in India’ smartphone shipments in 2022 with a 22% share, followed by Samsung.”

On the overall 2022 performance and Indian government initiatives, Research Director Tarun Pathak said, “Overall, 2022 has been a good year in terms of manufacturing and localization in India. The increasing exports from Apple, Samsung and other OEMs drove the locally manufactured shipments in 2022 and somewhat offset the impact of the local demand decline. The recent disbursement of PLI incentives from the government as well as other initiatives, both at the central and state levels, has boosted the overall local manufacturing. We are now seeing multiple companies investing in India and expanding their manufacturing base. Also, the component and semiconductor ecosystem is witnessing investment growth due to the government’s continuous efforts. However, the government should focus on developing the overall ecosystem and play on India’s strengths like high local demand, developing local talent and improving overall infrastructure. We believe that the government will leverage India’s geopolitical strengths and focus on building favourable export and trade policies to make India a preferred destination for electronics manufacturing.”

Going forward, we may see the country reaping benefits of the PLI scheme thanks to increasing exports from Apple and Samsung. The government will focus on leveraging geopolitics and improving local infrastructure to attract more investment.

CT Bureau

You must be logged in to post a comment Login