Trends

Mexico smartphone shipments plunge 21% YoY in Q4 2022

Going through one of its toughest years, Mexico’s smartphone market saw its shipments fall 21% YoY in Q4 2022, according to the latest data from Counterpoint Research’s Market Monitor service. The total addressable market (TAM) too decreased by 7% YoY.

Commenting on the market dynamics, Principal Analyst Tina Lu said, “Mexico is the second biggest smartphone market in the Latin American region. With its low import taxes and no entry barriers, Mexico is also the favorite market for many OEMs to launch their Latin America operations. But it still has its caveats, like the operators that dominate the channel, especially Telcel.”

Lu added, “High inflation combined with political turmoil has led consumers to delay their smartphone purchases. On the other hand, many sales channels were still carrying high inventory in Q4. All this led to a sudden drop in shipments. The market is not expected to return to growth in H1 2023 due to continued economic turbulence and H1 2022 shipments being high. It is more likely to remain flat and grow 1-2% in the best case.”

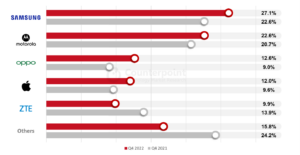

Commenting on the performance of OEMs in the market, Vice President of Research Peter Richardson said, “The shipment drop has also led to increasing brand concentration. In Q4 2021, the top five players represented 78.7% of the total shipments, while in Q4 2022, the top five, with slightly different players, represented 84.2% of the total shipments. Bigger players with stronger brand recognition managed to keep shipping, while the smaller brands felt the impact of a falling market more strongly.”

Market Summary

- Most OEMs’ volume decreased YoY but increased in share as the overall market declined.

- Samsung’s volume decreased YoY but increased in share, maintaining the brand’s top position in the market. Samsung’s share increased thanks to its larger portfolio and volume in the entry-level price segment.

- Motorola, which has led the rankings from time to time, finished second as its shipments contracted following efforts to decrease inventory.

- OPPO, which was relaunched in Mexico less than three years ago, was the only brand to manage a marginal YoY growth in shipments.

- However, OPPO’s success in the country is very dependent on Telcel. It is slowly opening to other carriers.

- Apple managed to sustain its shipments YoY. Keeping the iPhone 11 alive in the region has driven its volume and share.

- ZTE’s volume dropped significantly, impacted by increased competition from leading brands.

- Xiaomi’s high inventory that it had been carrying since Q2 2022 pushed it out of the top five in Q4 2022.

CT Bureau

You must be logged in to post a comment Login