5G Features

Lighting up with 5G

5G has made its way around the globe over the last several years, but its journey is far from over. 2023 is expected to close at 1.9 billion 5G connections.

The fifth generation of wireless cellular networks, 5G, marked another year of astonishing growth. Global 5G wireless connections, after adding 455 million connections, increased by 76 percent from 2021 to 2022, reaching up to 1.05 billion, are poised to touch a mark of 5.9 billion by the end of 2027.

The Asia-Pacific region has been leading the 5G race, with South Korea and China being the first countries to launch commercial 5G services in 2019. According to a report by the Global System for Mobile Communications Association (GSMA), the Asia-Pacific region will have the largest number of 5G users by 2025. It will account for almost two-thirds of the global 5G network.

In China, the three major operators recently revealed that by the end of March 2023, the number of 5G package users on the entire network exceeded 1.2 billion. Among them, the number of China Mobile 5G package users hit 689.235 million, China Telecom users is 283.21 million, and China Unicom 5G package users hit 223.81 million. There are another 8.7 million 5G users that use China Radio and Television, the fourth largest operator in China.

South Korea, by the end of 2022, had over 28 million 5G users. The country’s three major carriers – SK Telecom, KT, and LG Uplus – have expanded their 5G networks to cover most major cities.

Japan launched its 5G services in March 2020, with NTT Docomo, SoftBank, and KDDI being the major carriers. The country has been slow to adopt 5G, with the tech facing several issues with the rollout. By 2022, it had over 53 million users. There are reports that Japan will have over 100 million users by the end of this year.

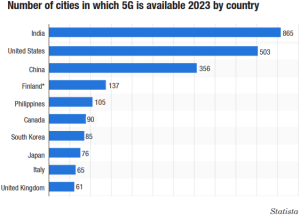

India has two service providers that have launched 5G services. Bharti Airtel’s 5G service by March 2023 is available in 500 cities and the telco is adding 30 to 40 cities every single day. The telco is adding 30 to 40 cities every single day, and by September 2023 expects to expand our 5G footprint to all of urban India.Reliance Jio had by March 2023 launched its True 5G services in 365 cities. Jio is on track to cover all cities by December 2023. The other two telcos, Vodafone Idea and BSNL have yet to order the equipment.

North America is expected to have the second-largest number of 5G users by 2025, according to the GSMA. It will account for around 20 percent of global 5G users. As of 2022, there are about 150 million 5G users in North America. Verizon, T-Mobile and AT&T are the major carriers.

Canada has been slow to adopt 5G, with limited coverage in most major cities. It has over 3 million 5G subscribers now, with the major carriers being Bell, Rogers, and Telus.

Europe. Several EU nations, including the UK, Germany, and Spain, have launched 5G services, with the rollout accelerating in 2020. According to the GSMA, Europe is expected to have the third-largest number of 5G users by 2025. As of 2021, there are over 25 million 5G subscribers in Europe, but this figure in April 2023 is over 80 million.

The United Kingdom launched its 5G services in May 2019, with EE being the first carrier to offer the service. Other major carriers, including Vodafone and O2, followed suit later in the year. As of February 2022, the UK had over 3 million 5G subscribers. Germany launched its 5G services in mid-2019, with Deutsche Telekom, Vodafone, and Telefonica being the major carriers. The country has been slow to adopt 5G, with limited coverage in most major cities. As of February 2022, Germany had over 5 million 5G subscribers.

The Middle-East and Africa region is also starting to see 5G deployments, with countries, such as the UAE and Saudi Arabia launching commercial 5G services in 2019. According to the GSMA, the region is expected to have over 70 million 5G connections by 2025. The United Arab Emirates launched its 5G services in 2019, with Etisalat and Du being the major carriers. Saudi Arabia also launched its 5G services in 2019, with Saudi Telecom Company and Mobily being the major carriers. In Africa, nations like South Africa, Botswana, Seychelles, Zimbabwe, Madagascar, Lesotho, and Egypt all have 5G service.

Latin America. 5G is still in the early stages of adoption in Latin America, with several countries, including Brazil and Mexico launching pilot projects in 2020. According to the GSMA, the region is expected to have over 60 million 5G connections by 2025. As of 2022, the number of 5G subscribers in Latin America was relatively small.

Brazil launched its 5G services in July 2021, with Claro being the first carrier to offer the service. Other major carriers, including Vivo and TIM, followed suit later in the year.

Mexico launched its 5G services in late 2020, with Telcel and AT&T being the major carriers. As of September 2022.

Opening up in emerging markets

Moving ahead, growth will come from key markets within APAC and LATAM, such as Brazil and India. Many of the new 5G markets scheduled to launch networks in 2023 are in developing regions across Africa – including Ethiopia and Ghana – and Asia. Today, 5G adoption in the sub-Saharan region sits below 1 percent but will reach over 4 percent by 2025 and 16 percent in 2030, largely thanks to a concerted effort from the industry and government organizations to provide connectivity to citizens.

“Until now, 5G adoption has been driven by relatively mature markets and consumer use cases like enhanced mobile broadband, but that is changing. We are now entering a second wave for 5G that will see the technology engage a diverse set of new markets and audiences,” says Peter Jarich, Head of GSMA Intelligence. “The extension to new use cases and markets will challenge the mobile ecosystem to prove that 5G truly is flexible enough to meet these diverse demands in a way that is both inclusive and innovative.”

The rise of 5G FWA

As of January 2023, more than 90 fixed broadband service providers (the vast majority of which are mobile operators) had launched commercial 5G-based fixed wireless services across over 48 countries. This means around 40 percent of 5G commercial mobile launches worldwide currently include an FWA offering.

With T-Mobile, USA expecting to have eight million FWA subscribers, Verizon is targeting five million by 2025, and RJio announcing ambitions to connect as many as 100 million homes across India to its 5G FWA network, the number of FWA users looks likely to grow substantially over the next few years.

While the majority of current 5G FWA deployments focus on the 3.5–3.8GHz bands, several operators around the world are already using 5G mmWave spectrum as a capacity and performance booster to complement coverage provided by lower bands.

Only 7 percent of 5G launches have been in 5G mmWave spectrum so far, but this looks set to change given 27 percent of spectrum allocations and 35 percent of trials are already using 5G mmWave bands. Furthermore, in 2023 alone, the industry will see ten more countries assigned 5G mmWave spectrum for use – a significant increase from the 22 countries that have been assigned it to date. Spain received the first European 5G mmWave spectrum allocation this year, resulting in Telefónica, Ericsson, and Qualcomm launching their first commercial 5G mmWave networks at MWC Barcelona 2023.

Enterprise IoT driving growth

The figures from GSMA Intelligence also suggest that, for operators, the enterprise market will be the main driver of 5G revenue growth over the next decade. Revenues from business customers already represent around 30 percent of total revenues on average for major operators, with further potential as enterprise digitization scales. Edge computing and IoT technology presents further opportunities for 5G, with 12 percent of operators having already launched private wireless solutions – a figure that will grow with a wider range of expected IoT deployments in 2023.

Another major development for the enterprise will be the commercial availability of 5G Advanced in 2025. Focusing on uplink technology, 5G Advanced will improve speed, coverage, mobility, and power efficiency – and support a new wave of business opportunities. GSMA’s Network Transformation survey showed half of the operators expect to support 5G Advanced commercial networks within two years of its launch. While this is likely optimistic, it presents the ecosystem with a clear opportunity to execute on.

5G spectrum dynamics

The realization of 5G use cases rests on the timely allocation of spectrum to operators and industry verticals. Spectrum for 5G ranges across different bands that can be grouped into three – low-band (below 1GHz), mid-band (between 1GHz and 6GHz) and high-band or millimeter wave (above 24GHz).

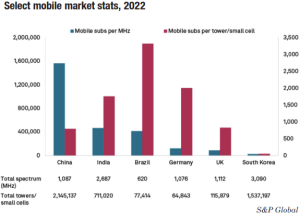

Low-band and mid-band spectrums are adjacent to existing spectrum allocations of 4G and earlier technologies, which makes them easy to be repurposed for 5G. Mid-band, specifically 3.5GHz to 3.7GHz, has emerged as the most popular spectrum for 5G, with at least 180 operators using it for their commercial 5G network.

Due to their adjacency to existing spectrum for earlier mobile technologies, low-band and mid-band spectrum 5G best serves enhanced mobile broadband, or eMBB use cases. Ultra-reliable low-latency communications, or URLLC, and massive machine-type communications, or mMTC use cases are better served by millimeter wave 5G due to the high-capacity characteristics of higher frequencies.

As most 5G networks worldwide are based on mid-band spectrum, eMBB use cases are currently the most popular offerings of many operators. But to an average consumer, eMBB 5G is indistinguishable from the current 4G. In fact, some demonstrations of 4G LTE-A breach 1 Gbps speed – almost as fast as current 5G speeds. For some, 5G is just faster 4G, and these consumers do not see the need to jump to the new technology when 4G can already serve their needs.

Operators wanting to offer URLLC and mMTC use cases face several hurdles. Spectrum availability is at the top of the list, with regulators in many markets not yet releasing millimeter-wave spectrum. While the US has been the most prominent advocate of millimeter-wave, or mmWave, most of Europe and Asia-Pacific are sticking to mid-band spectrum. Second, the lack of demand for consumer eMBB 5G has caused some operators hold back on their 5G investments, which makes the expansion to URLLC and mMTC use cases even a harder business case to defend. Lastly, the use of mmWave spectrum requires building dense networks, which ultimately drives up cost for operators.

These headwinds might explain why several auctions for mmWave spectrum received little interest from operators in several markets, such as Brazil, Chile, Cyprus, Hong Kong, Poland, and Russia. While South Korea successfully auctioned 28 GHz in June 2018, operators waited until December 2020 before turning on their mmWave 5G due to concerns with the cost of power. China, despite multiple announcements of interest, has not even allocated mmWave spectrum to operators.

At the moment, 5G is in a somewhat quiet period in terms of new services and applications. The industry is stuck on the rhetoric of private networks, the metaverse, and a myriad of low-latency applications as it waits for the widespread arrival of stand-alone 5G.

The spectrum pipeline in the US looks bleak, especially since the US Senate failed to renew the FCC’s auction authority.

In the US, T-Mobile is in a superior position with 5G. It has both a plethora of mid-band spectrum, and has deployed a stand-alone network. Mid-band spectrum (1GHz to 6GHz) has emerged as a critical and globally harmonized component of 5G networks as it offers optimal speed and coverage needed for more advanced wireless capabilities. However, T-Mobile does not have an ecosystem behind it, namely, devices, thanks to the fact that the world’s operators have been slow to move to stand-alone 5G.

As of March 2023, there are no bands in the spectrum pipeline in the US. And, T-Mobile, which built its 5G network leadership largely on the 2.5 GHz spectrum it got with Sprint, is still waiting to get the 2.5 GHz spectrum it won in last summer’s 2.5GHz auction.

T-Mobile won over 90 percent of the licenses in that auction, but FCC Chairwoman Jessica Rosenworcel has said that the agency cannot issue 2.5GHz band licenses until Congress reauthorizes the FCC auction authority.

Analysts at New Street Research (NSR) have their doubts about the FCC’s legal analysis in saying it cannot issue the licenses at the present time, but they do not think T-Mobile will be able to get a court to force the FCC to issue the licenses prior to the auction authority being re-established, which may not be until the back half of this year.

The 2.5GHz (n41) band, CBRS (n48) band, 3.7–3.98 C-band and 3.45–3.55GHz bands have been allocated in the US. But the identification, allocation, and repurposing of the spectrum is a multiyear process and the lack of spectrum in the pipeline is of critical concern.

It is a difficult endeavor, given that many networks will rely on challenging new deployments, such as edge compute and virtualized RAN, and more expensive capital expenditure requirements.

While non-stand-alone 5G has enabled carriers to get to the market quicker, this deployment is supposed to be temporary. However, the number of carriers planning to deploy stand-alone 5G services has dropped, from 21 percent in 2021 to 18 percent in 2022, finds an S&P Global survey. And the operators that have deployed a stand-alone network, as T-Mobile in the US, do not have an ecosystem behind it, namely devices, thanks to the fact that the world’s operators have been slow to move to the stand-alone 5G.

You must be logged in to post a comment Login