Trends

India TWS shipments increase 168% YoY in Q2 2022

India’s TWS (True Wireless earbuds) shipments delivered a strong quarter with 168% YoY growth and 62% QoQ growth in Q2 2022, according to the latest research from Counterpoint’s IoT Service. The increased penetration of the low-price band (₹1,000-₹2,000 or $25-$50), multiple discount offers and growing popularity due to convenience of use led to this huge jump in market demand.

Commenting on the overall market, Senior Research Analyst Anshika Jain said, “India’s TWS market continues to show phenomenal growth due to the reasons like availability of low-priced new TWS devices, better features and functionalities like ANC, innovative designs, and low-latency mode for gaming. The market is expected to grow 47% in 2022 as new brands continue to arrive even as existing ones expand their channel presence. Besides, consumer demand is expected to rise during the festive period as people are also seeing TWS devices as a good option for gifting purposes.”

On local production, Jain added, “The share of domestic manufacturing stood at 16%, the highest ever. With boAt, Noise, Mivi and pTron ramping up their local manufacturing capabilities, these brands together accounted for 98% of the domestic shipment volume in Q2 2022. ‘Made in India’ has been taking the spotlight since the beginning of this year. But more brands started focusing on local manufacturing during this quarter. Gizmore and new entrant SWOTT also offered locally produced devices in Q2 2022. Further, we expect to see ‘Make in India’ devices from Truke and Portronics as they focus on localizing their manufacturing to maintain price competitiveness.”

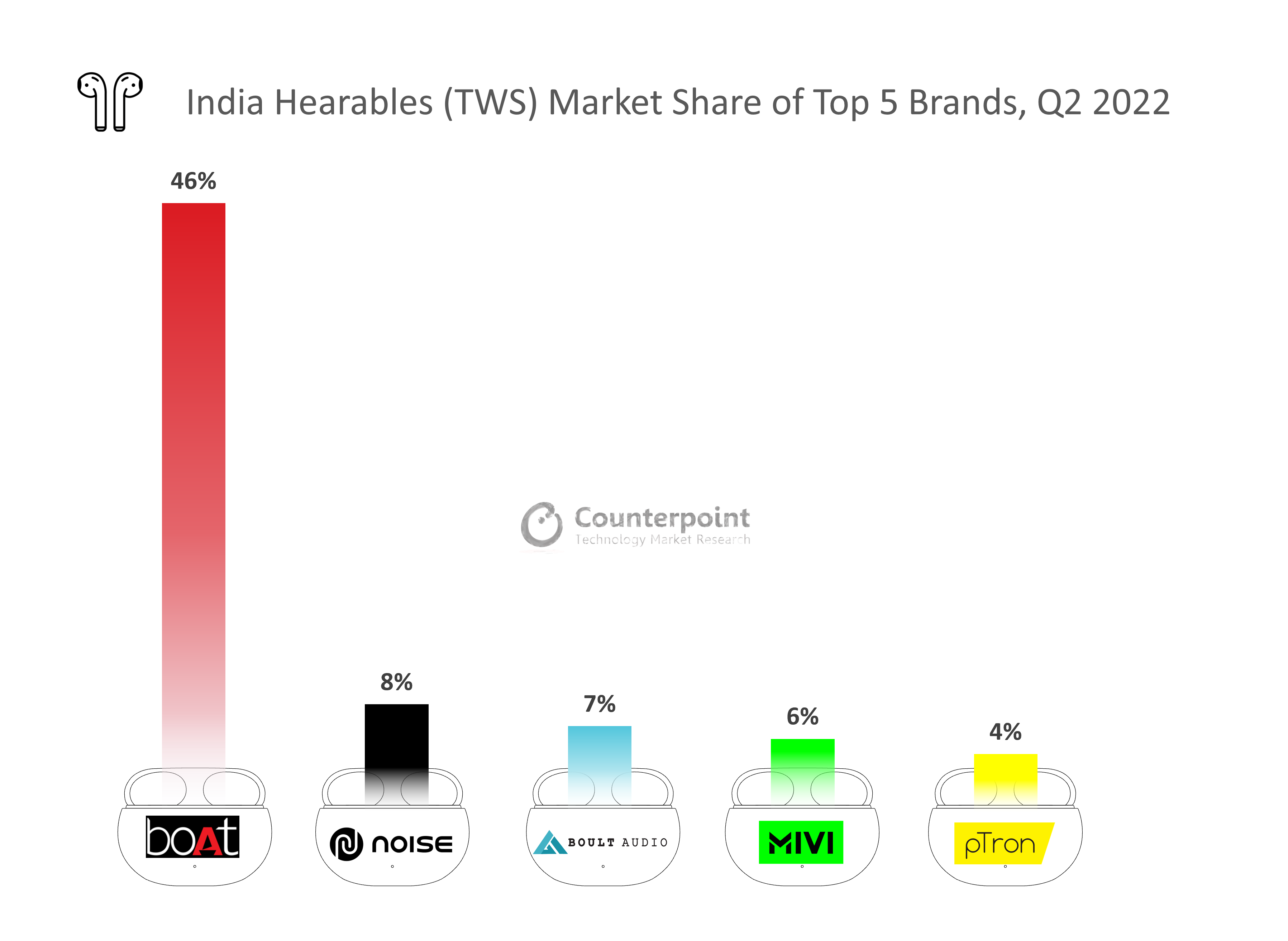

Talking about the dominance of Indian brands, Associate Research Director Liz Lee said, “During Q2 2022, homegrown brands captured the top five brands rankings for the first time. These brands together took over 70% share and were quite aggressive in their marketing strategies, introducing new advanced alternatives at affordable prices along with discount schemes through various sales events. Besides, there has been a growing emphasis on roping in brand ambassadors to capture customer mind share. The top position was taken by boAt, followed by Noise and Boult Audio. Mivi entered the top five list for the very first time due to its focus on R&D and designing better quality products under the ‘Make in India’ scheme.”

Market summary for Q2 2022

- boAt maintained its leadership with 236% YoY growth in Q2 2022. The substantial demand was driven by its new low-priced alternatives and big sales events like Amazon’s summer and mega music fest sales. The Airdopes 131 remained the bestseller model, contributing a 15% share to the overall TWS market shipments.

- Noise maintained its second position for the third consecutive quarter with 190% YoY growth driven by its locally produced TWS earbuds. The brand again refreshed its low-priced VS series with the launch of the Noise Buds VS104 in Q2 2022. The Noise Buds VS102 was the brand’s most popular model, entering the top 10 models list for the quarter.

- Boult Audio again took the third spot and reached a record high volume with 233% YoY During the quarter, it offered multiple new launches in the low-price segments (₹1,000-₹2,000 or $25-$50). The brand also participated in Amazon sales events to drive volumes. The Boult Audio Airbass X Pods grabbed a spot in the top 10 bestseller list, contributing 33% of the brand’s volume.

- Mivi made it to the top five brand ranking for the very first time with more than 2X QoQ The Duopods F30 and Duopods M20 were its most popular devices.

- PTron took the fifth spot with a 4% The brand actively participated in multiple sales events on different e-commerce platforms and offered two new launches at an entry-level price band (less than ₹1,000 or $13). The PTron Bassbuds Duo was its bestseller model, making it to the top 10 model rankings.

Other emerging brands in Q2 2022

- OPPO saw 171% YoY growth driven by its frequent new launches. The brand launched the Enco buds Air 2 Pro in Q2 2022 in the mid-price segment. It was the second most popular model after the Enco Buds in the brand’s TWS offerings.

- OnePlus maintained its position in the top 10 list. It released a new model Buds Pro in the mid-price segment in Q2 2022. The model is the least-priced TWS device in the brand’s portfolio.

- Samsung took the first position in the premium segment driven by the popularity of its Galaxy Buds 2 and Galaxy Buds Pro models. The brand also offered discounts during Amazon’s summer sale.

- Truke registered 75% YoY growth in Q2 2022. The brand offered two new alternatives at low price points with ENC technology. The Buds F1 model attained a record of selling 10,000 units on its launch day on Flipkart

CT Bureau

You must be logged in to post a comment Login