Headlines of the Day

Cashflow, deleveraging & emerging opportunities, ICICI Securities

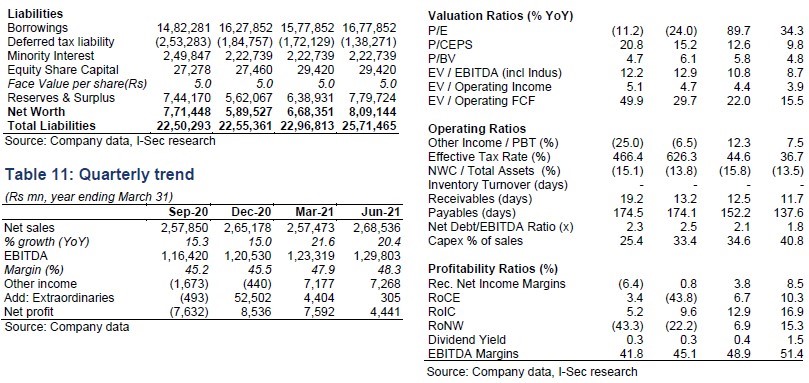

This note is aimed at reviewing top down industry opportunities and implications for each operator. Though industry consumer spend has reached pre-Reliance Jio (RJio) run-rate, ARPU is still 15% lower. It is without factoring SIM consolidation, inflation and multi-fold rise in data usage which implies large upside to industry ARPU, and hence, the revenue. RJio’s AGR market share may peak in FY23; Bharti should progressively narrow gap vs RJio in future. Bharti EBITDA is expected to grow stronger, and generate FCFE of >200bn FY24 onwards which should help reduce net debt significantly. Further, Bharti’s emerging opportunities are under-appreciated – FTTH, enterprise (including data center), payments bank and digital services. We increase Bharti’s EBITDA estimate by 3.5% for FY23E / 6.6% for FY24E. Also, increase our target price to Rs861 (from Rs712) on valuation rollover to FY24, but cut EV/EBITDA multiple to 10x (from 11x). Maintain BUY.

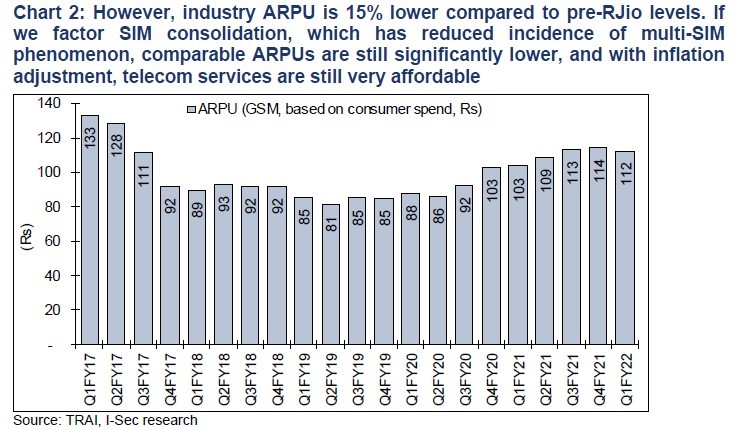

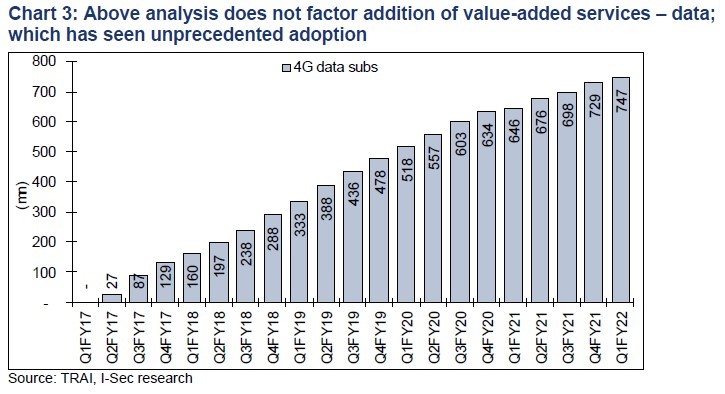

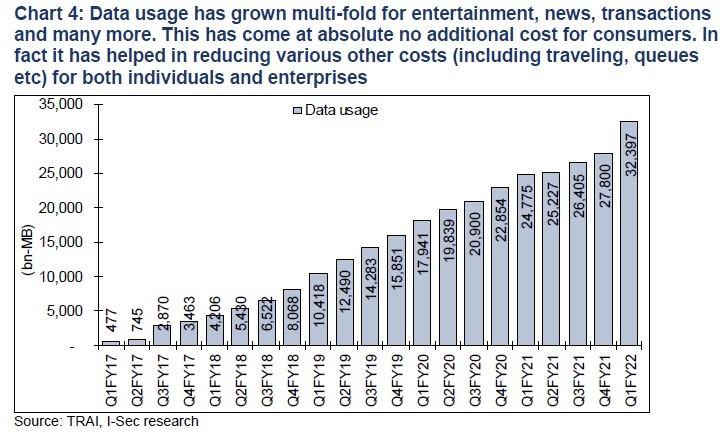

- AGR based telecom industry to grow at CAGR of 11.6% over FY21-25E. Indian mobile consumer spend has increased 41% from bottom of Q2FY19 from 1) price increase (without factoring Nov’21 price increase); and 2) adoption of 4G services. It has almost reached the run rate of pre-RJio launch of Rs400bn per quarter. However, ARPU (based on consumer spend) is still 15% below pre-RJio launch. Further, RJio has negatively impacted total subs due to SIM consolidation on bundled packs, and inflation adjustment for four years. The above analysis also does not factor addition of new service – data which has seen unprecedented adoption, and data usage has grown multi-fold. Thus, the ARPU still has significant headroom for growth from consumer surplus perspective. Nonetheless, the deciding factor is competitive intensity and insatiable market share ambition among telecom services providers.

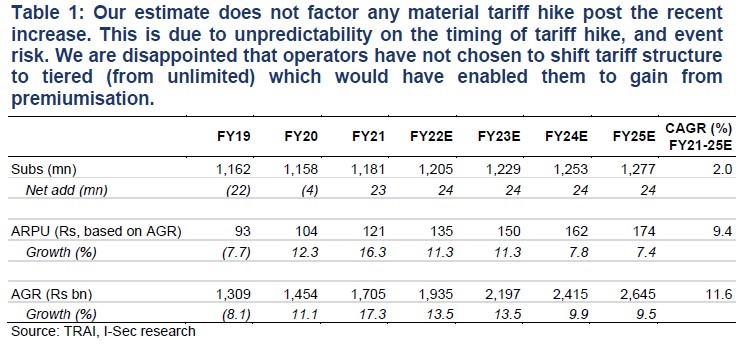

We estimate industry AGR to grow at CAGR of 11.6% over FY21-25E (11% CAGR over FY22-25E). The estimate does not factor any material tariff hike post the recent increase. It also does not have any large premiumisation benefits pending change in tariff structure which are upside risks.

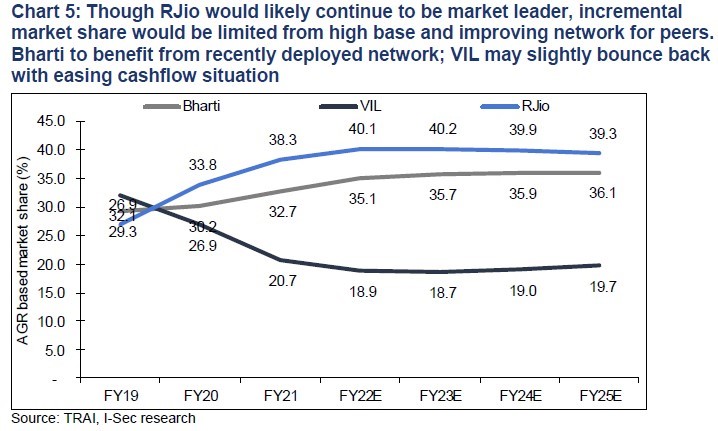

- Bharti to narrow market share gap vs RJio would likely remain the undisputed market leader with strong 4G subs base, and rising addressable market with affordable smartphone including JioPhone Next. However, we have assumed its market share to peak in FY23. We estimate its market share to slightly dip FY24 onwards with Bharti continuing to grab higher incremental AGR. Bharti would likely benefit from SIM consolidation, and significant improvement in network (particularly in B’ and C’ circles). We see AGR market share for Bharti at 36.1% in FY25E (32.7% in FY21); RJio AGR market share at 39.3% (38.3% in FY21). The underlying assumption is VIL will incur capex, and win back some market share but VIL AGR market share is expected to remain below 20% in foreseeable future.

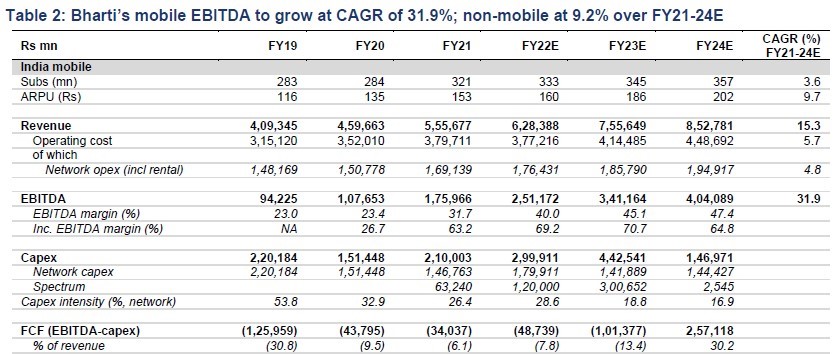

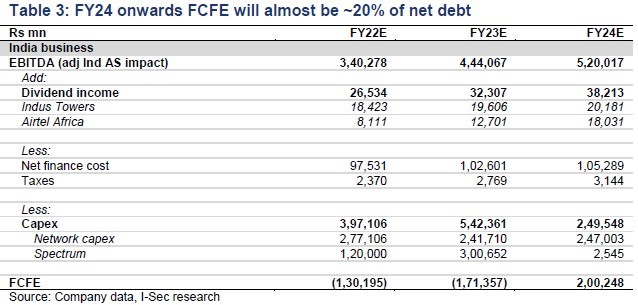

- Bharti to generate strong FCFE; deleveraging to begin FY24E onwards. Bharti’s mobile revenue to grow at CAGR of 15.3% to Rs853bn over FY21-24E. This is driven by 9.7% CAGR in ARPU to Rs202. Notably, Bharti’s management has ambition to achieve Rs200 ARPU in FY23, while we conservatively estimate it to reach in FY24. This would drive mobile cash EBITDA (adjusted for Ind AS impact) growth at 31.9% CAGR to Rs404bn in FY24E. Our capex estimate for Bharti includes 5G spectrum investment of Rs300bn. Network capex investment will be stable as 5G rollout will be gradual. 4G investment will be entirely diverted to 5G in the future. Non-mobile EBITDA CAGR of 9.2% is conservative on strong traction in FTTH subs, and rising demand for network servies by enterprise. Our analysis shows underlying FCFE at Rs200bn for Bharti which will be used to reduce net debt. Our FCFE does not take benefit of moratorium in finance cost.

We estimate Bharti India’s net debt to peak with 5G spectrum auction in FY23E. FY24E onwards, Bharti is likely to generate FCFE of >Rs200bn which will reduce net debt by 20% each year. The only risk to FCFE is the possibility of buying 700MHz spectrum which may take away 18 months of FCFE.

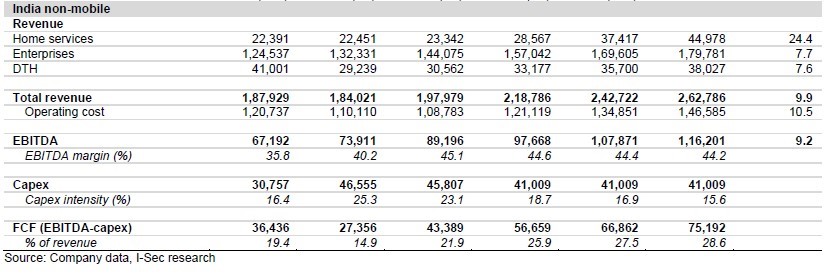

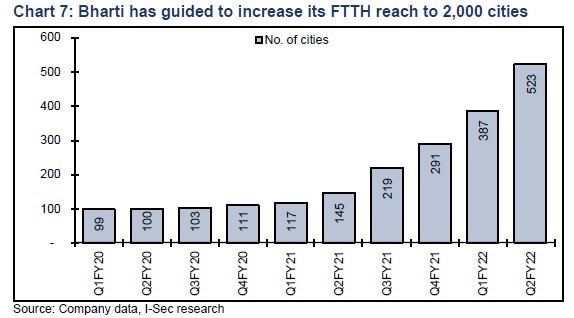

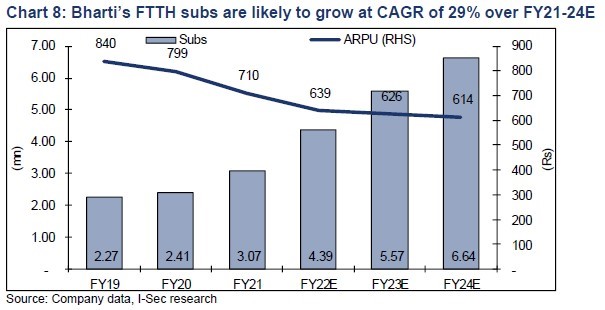

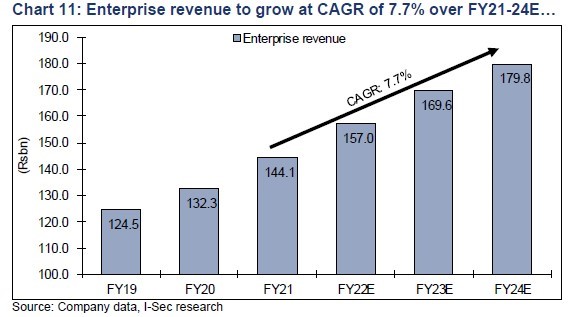

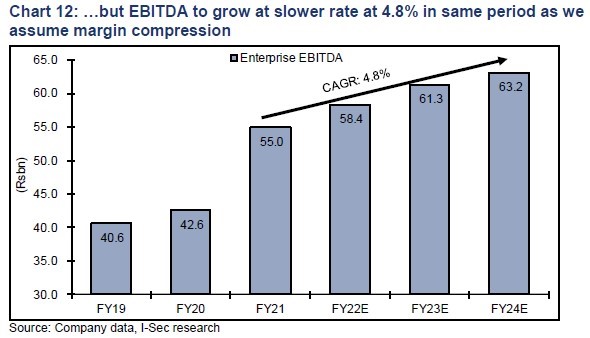

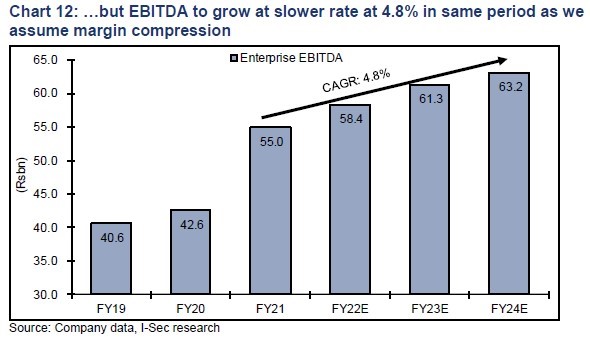

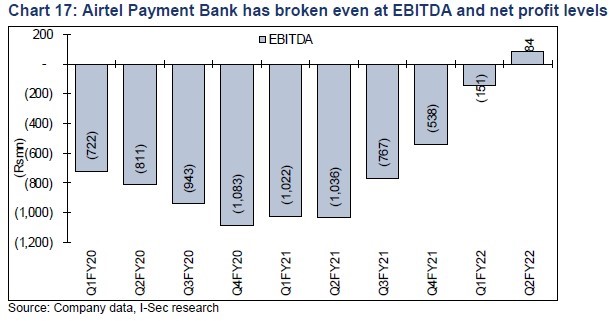

- Bharti has strong presence in emerging opportunities in adjacent businesses. Bharti has strong presence in FTTH, enterprise including data centre and payment bank which are under-appreciated. 1) FTTH has seen unprecedented adoption; Bharti is expanding reach to 2,000 cities (from 100 in FY20) which should increase the addressable market. It is growing through LCO partnership which not only reduces investments but also fastens go-to market. FTTH services revenue to grow at CAGR 24.4% to Rs45bn over FY21-24E; EBITDA CAGR at 25.5% to Rs27bn in same period. 2) Enterprise revenue is likely to boost from network transformation investment by enterprises and 5G will only add to growth in the segment. We see a significant upside risk to our revenue growth estimate of 7.7% CAGR for enterprise revenue (FY21-24E). 3) Bharti has guided >3x increase in data centre capacity to 400MW over the next five years; and 4) Airtel Payments Bank’s performance has been strong and it has broken even at EBITDA and net profit levels.

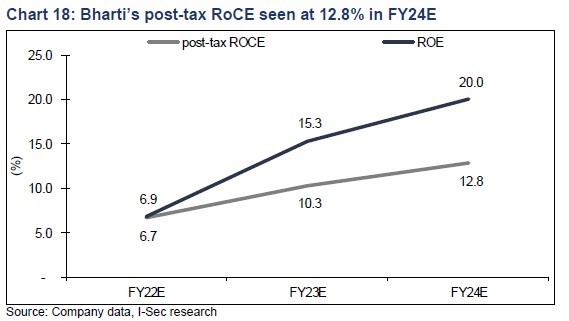

- Why BUY rating on Bharti? 1) Strong EBITDA (adjusted for Ind AS impact) performance – 20.4% CAGR over FY22-24E. This is driven by market share gain in mobile business and consistent growth in non-mobile business. We see upside risk if more tariff hike follows in mobile business, and better-than-expected growth in non-mobile business. Both these events are likely to play-out, in our view. 2) Deleveraging – long awaited event. FY23 will see 5G spectrum auction which will further increase debt. However, FY24 onwards we see >200bn net debt reduction (~5% of market cap). Free cashflow generation to remain consistent FY24 onwards; 3) reducing investment in business and structurally higher RoCE – Bharti has increased its spectrum holding significantly in the past decade. It needs only 5G spectrum and probably 700MHz in future. Further, government has increased right-to-use life of spectrum to 30years from 20years. Higher spectrum supply and limited players mean much lower spectrum payout and reduced capital employed in mobile business. This will lead to higher RoCEs in future; 4) 5G is expected to drive higher investment by enterprise in digitisation and rise in addressable market for telecom service providers. We see competitive scenario to remain stable in 5G services in India; and 5) optionality in digital investments such as entertainment apps (Wink and Xstream), payments bank, IOT, CPaaS etc.

Re-evaluating industry model

How has industry evolved after RJio disruption? Do we see near-term ceiling on ARPU increase?

Recently, operators have increased telecom service prices by ~20-25% in prepaid category. Our analysis shows cumulative industry consumer spend has only managed to reach levels of pre-RJio. Thus, we don’t see affordability issue in telecom services on aggregate level.

ARPU (spend per user) is still 15% below pre-RJio launch. Further, RJio has negatively impacted total subs due to SIM consolidation on bundled packs and adjustment to inflation over previous four years. Therefore, ARPU is still significantly below pre-RJio levels.

The above analysis does not factor addition of new service – data which has seen unprecedented adoption and data usage has grown multi-fold. Digital services, which run on telecom infrastructure, have helped individual and enterprise significantly reduce costs.

Accordingly, we conclude ARPU has significant headroom for growth from consumer surplus perspective. The deciding factor is competitive intensity and insatiable market share ambition among telecom service providers.

How do we see industry evolution from here?

Though the recent tariff hike was a welcome step, we anticipated operators will change tariff structure to tiered plans. Our hopes of removing unlimited data allowance in base pack were based on RJio’s introduction of Freedom Plan. We believe operators have lost the very opportunity to change tariff structure to tiered plans which would have enabled them to better monetise rising data usage. This significantly restricts operators’ ability to grow revenue in double digit beyond FY23E.

Our model assumes industry AGR revenue growth of 11.6% over FY21-25E; however, if we remove the impact of the recently announced price increase, it would drop to much lower.

What are the expectations from the key three operators?

RJio would likely remain the undisputed market leader with strong 4G subs base and rising addressable market with affordable smartphone including JioPhone Next. However, we have assumed its market share to peak in FY23. We estimate its market share to slightly dip FY24 onwards with Bharti continuing to grab higher incremental AGR. Bharti will benefit from SIM consolidation, significant improvement in network (particularly in B’ and C’ circles). We see AGR market share for Bharti at 36.1% in FY25E (32.7% in FY21) and RJio AGR market share to peak at 39.3% (38.3% in FY21). The underlying assumption is VIL will incur capex, and win back some market share but will remain below 20% in foreseeable future.

Recent telecom relief package has eased cashflow situation for VIL. The company has been in the process of raising equity. This should enable VIL to invest in 4G network.

Bharti’s free cashflow generation and deleveraging. What are the risks?

What are the expectations from Bharti’s FCFE?

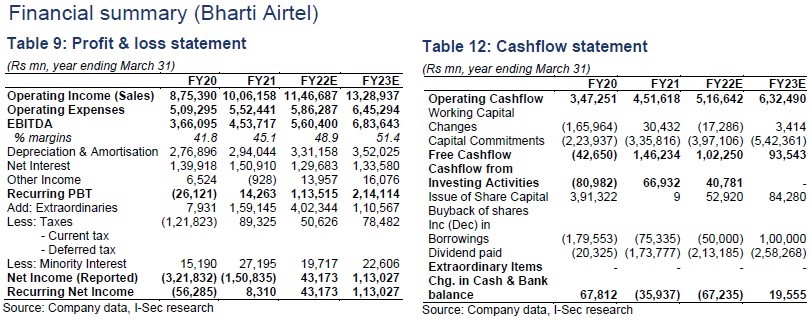

Bharti’s mobile revenue to grow at CAGR of 15.3% to Rs853bn over FY21-24E. This is driven by 9.7% CAGR in ARPU to Rs202. Company has ambition to achieve Rs200 ARPU in FY23, while we conservatively estimate it to reach that level in FY24.

This would drive mobile cash EBITDA (adj for Ind AS impact) growth at 31.9% CAGR to Rs404bn in FY24E. Our incremental EBITDA margin estimate for Bharti is in the range of 63-70%. It is slightly higher than normal range due to higher ARPU growth.

Our capex estimate for Bharti includes 5G spectrum investment of Rs300bn. Network capex investment has been stable as we estimate 5G rollout will be gradual; 4G investment would be entirely diverted to 5G.

Non-mobile EBITDA growth is conservative on strong traction in FTTH subs and likely rise in network investment by enterprise.

Our net finance cost assumes no saving on spectrum payment / AGR dues due to four years of moratorium. Therefore, underlying FCFE is truly deleveraging. Bharti to generate FCFE of >Rs200bn which would be used to reduce net debt.

How big is 5G risk for FCF?

TRAI has recently floated consultation paper for 5G spectrum, and other unsold spectrum from previous auctions. Government has increased C-band spectrum (3300-3670MHz) to 370MHz from earlier 275MHz, and it plans to also auction 28GHz spectrum which will boost investment in 5G.

Government has already announced certain relief related to spectrum with increase in right-to-use life of spectrum to 30 years (from 20 years) and nil SUC. Operators have raised their concerns on expensive 5G spectrum prices. Recently, the telecom minister indicated a change in spectrum pricing philosophy from revenue maximisation to maximisation of services to poor (link). Clearly, investment in spectrum will drop going forward which is the reversal of situation from CY10.

This is significantly positive (structurally) as it boosts RoCE of mobile business which is under-appreciated by investors.

5G is heavily oriented towards enterprise services and is likely to create large addressable market apart from existing mobile services. The new opportunities should come at a very minimal incremental investment.

Apart from upfront spectrum payment, 5G network rollout investment will follow new use cases and thus, will be gradual, with capacity requirement for mobile users. This will also coincide with the completion of 4G investment, hence, capping total capex to existing levels, in our view.

Has Bharti’s net debt peaked?

We estimate Bharti India’s net debt to peak with 5G spectrum auction in FY23E. FY24E onwards, Bharti India is likely to generate FCFE of >Rs200bn which will reduce net debt by 20% each year. The only risk to FCFE is the possibility of buying 700MHz spectrum which may take away 18 months of FCFE.

What are emerging opportunities?

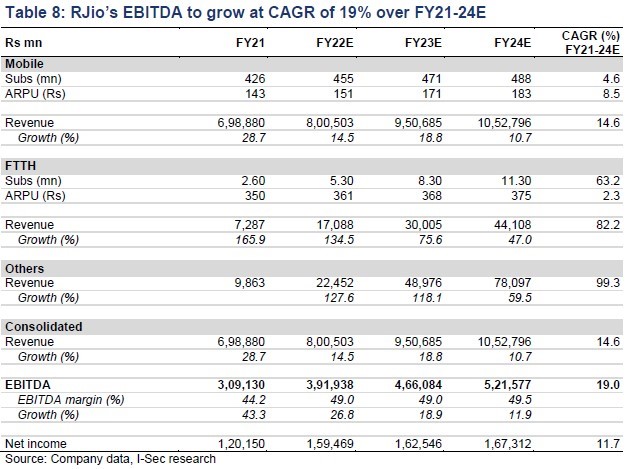

FTTH – long run way for growth; strong FCF profile

Bharti has been rapidly expanding its FTTH services reach through asset-light model. It has tied-up with LCOs for last mile connectivity. It has increased its reach to 523 cities from just 99 in Q1FY20. This is on the back of rising demand for FTTH from 1) lockdown and work from home which has significantly increased demand for reliable connectivity services at home; 2) increased affordability with reasonable pricing; and 3) unlimited data at base pack makes it dependable for large format video content, and replacing traditional cable services. Bharti has guided for achieving reach in 2,000 cities in near term which should significantly increase home-pass and addressable market.

We estimate FTTH services revenue to grow at CAGR 24.4% to Rs45bn over FY21- 24E; EBITDA CAGR of 25.5% to Rs27bn during same period. We have assumed little operating leverage due to asset-light model, and likely profit sharing with LCOs. However, EBITDA to FCFE conversion is likely to remain high.

Enterprise – digitisation to drive strong growth

We have released deep diving into enterprise business (link), and Bharti Airtel’s (Bharti) enterprise business housed under Airtel Business (link).

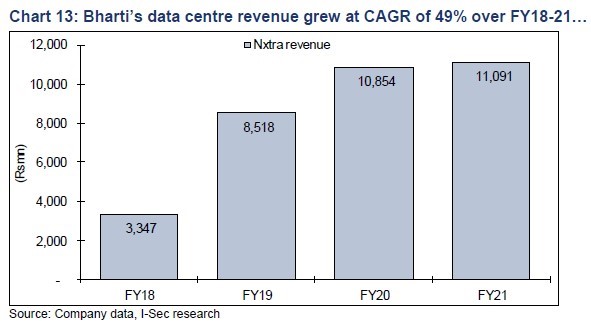

Airtel Business is under-appreciated considering it is the most profitable business for Bharti with RoIC of 35-40% in the past three years and EBITDA CAGR of 13% over FY17-21, which underpins our optimism for the business. Airtel Business will benefit from the shift to new sales model for tapping SME opportunity which is adopting digital solutions like never before. Considering SME buy-bundled services unlike customised solutions by large enterprises, Airtel benefits from existing relationships and launch of new digital platforms. Nxtra (data centre and cloud offerings) has grown >3.3x over FY18-21, and is likely to grow over >3x in next 3-4 years. Digital platforms like Airtel IQ, Airtel Secure and Airtel IoT open doors in new-age digital solutions which are growing fast >30-50%. We see a significant upside risk to our growth estimate of 7.7% CAGR for enterprise revenue (FY21-24E).

Data centre – Bharti planning big

Nxtra revenues (Bharti’s entity which deals in data centre and cloud services) have grown at CAGR of 49% to Rs11bn over FY18-21, but it has grown slower at just 2% in FY21. Its EBITDA has increased at a CAGR of 62% to Rs4bn during the same period. The margin has seen a significant jump in FY21 to 36.8% (from 25.7% in FY20).

Bharti has announced plans to expand its data centre capacity by 3x to 400MW by 2025 with investment of Rs50bn. We estimate Nxtra to have 100MW of data centre capacity in FY21, which works to revenue of Rs110mn/MW pa. Bharti is excited at the opportunity of rising demand for data centre in India which is likely to increase to 1,100MW from existing 450MW in next three years.

Data centre needs massive land bank. Our understanding is 3acres land is required for 20MW data centre. Thus, 300MW data centre capacity requires 45acre land. It takes at least 2-3yrs post land acquisition to commence data centre.

Our discussion with industry experts suggests capex (building & fitouts) for 1MW data centre is Rs350-380mn, excluding land. This means total capex for 300MW works to Rs100bn (2× investment outlined by Bharti).

Competition is sitting on large land bank in prime locations. NetMagic, largest data centre player in India (owned by NTT Japan), has bought 40-50acre of land in Mumbai to expand data centre. Tata Communications has huge land parcels in Pune, Chennai and Delhi where STT (associate company of TCom) plans may expand data centre. Notably, STT has announced expansion of data centre capacity to 400MW. New players such as RIL, Adani, Hiranandani etc also have plans to expand data centre.

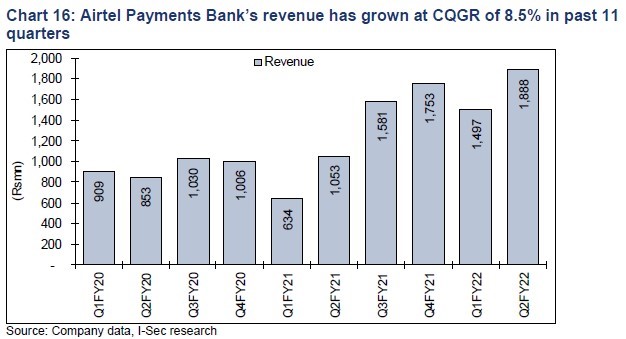

Payments Bank – credible performance vs peers

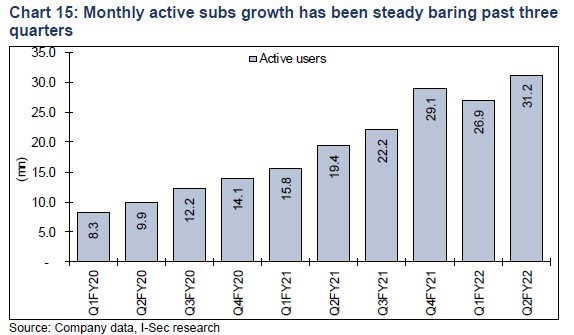

Bharti has seen credible performance in its payment bank business which has grown at CQGR of 8.5% in past 11 quarters (since Q1FY20); it has broken even at EBITDA level with Rs84mn and net income at Rs46mn in Q2FY22. Thus, payments bank has started adding to earnings for Bharti.

Its total customer base stands at 115mn with monthly active customer at 31mn. The company is seeing transaction of >1bn per month. It has merchant base of 8mn with total GMV of Rs1,283bn (Q2FY22 annualised).

Bharti’s valuations –stay BUY

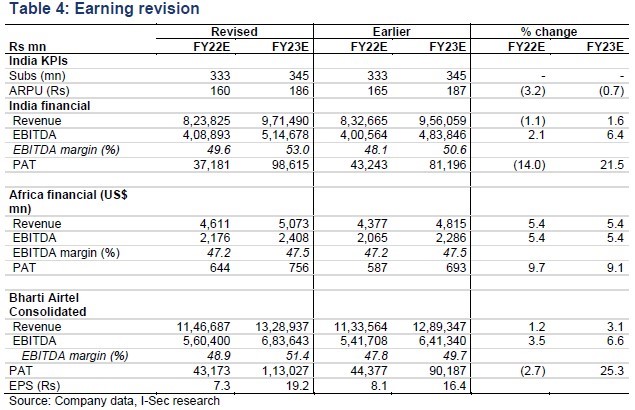

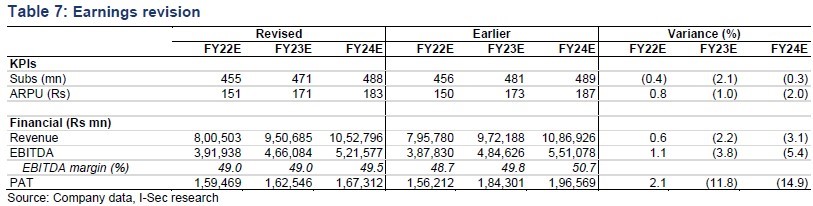

Earnings revision – what are the driving changes in model?

- We have incorporated equity infusion from rights issue. Nearly 25% of the issue money has been received in FY22; we assume the remaining two instalments would come in equal parts in FY23 and FY24. However, we have taken the entire equity dilution in FY22 itself.

- We have cut our FY22 ARPU estimate due to delay in tariff hike, but have broadly maintained our ARPU for FY23. Our ARPU estimates are conservative as they do not factor any large tariff hike in future.

- However, our India EBITDA estimates have seen an upgrade of 2.1% in FY22 and 6.4% in FY23 on better-than-expected cost control.

- We have increased our Africa EBITDA estimates by 5.4% each in FY22 and FY23 on stronger-than-expected performance in past few quarters.

- Our consolidated EBITDA has increased by 3.5% for FY22E and 6.6% for FY23E.

Valuation – why BUY?

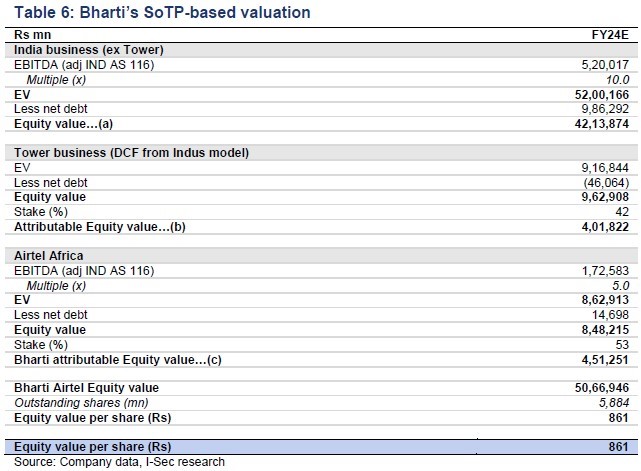

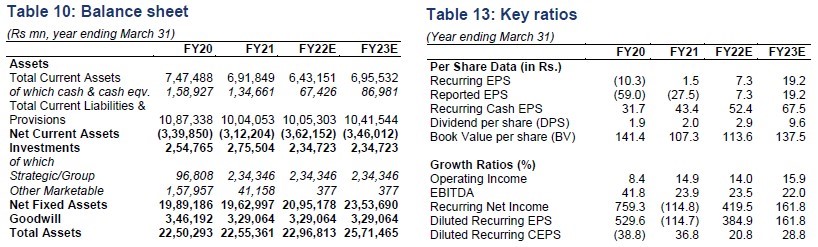

We roll forward our valuations for Bharti to FY24E and cut our EV/EBITDA multiple for India business to 10x (from 11x) as price hike event has played out. We increase Bharti’s target price to Rs861 (from Rs712).

We maintain BUY rating on Bharti due to

- Strong EBITDA (adjusted for Ind AS impact) performance – 20.4% CAGR over FY22-24E. This is driven by market share gain in mobile business and consistent growth in non-mobile business. We see an upside risk if more tariff hike follows in mobile business and better-than-expected growth in non-mobile business. Both these events are likely to play out, in our view.

- Deleveraging – long awaited event. FY23 will see 5G spectrum auction which will increase debt further. However, FY24 onwards, we see >200bn net debt reduction (~5% of market cap). Free cashflow generation to remain consistent FY24 onwards, in our view.

- Reducing incremental investment in business and structurally higher RoCE – Bharti has increased its spectrum holding significantly in the past decade. It needs only 5G spectrum and probably 700MHz in future. Further, government has increased right-to-use life of spectrum to 30years from 20years. Higher spectrum supply and limited players mean much lower spectrum payout and reduced capital employed in mobile business. This implies much higher future RoCEs.

- 5G is expected to drive higher investment by enterprise in digitisation and rise in addressable market for telecom service providers. We see competitive scenario to remain stable in 5G services in India.

- Optionality in digital investments such as entertainment apps (Wink and Xstream), payments bank, IoT, CPaaS etc.

Reliance Jio

CT Bureau

You must be logged in to post a comment Login