Headlines of the Day

Tariff hike impacted subs addition for Bharti / VIL, ICICI Securities

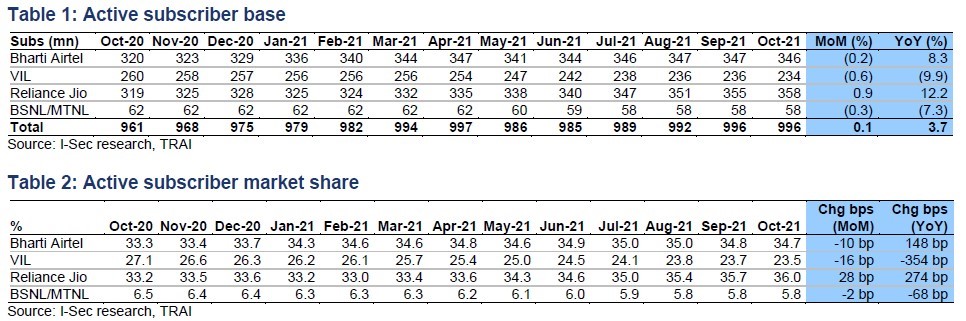

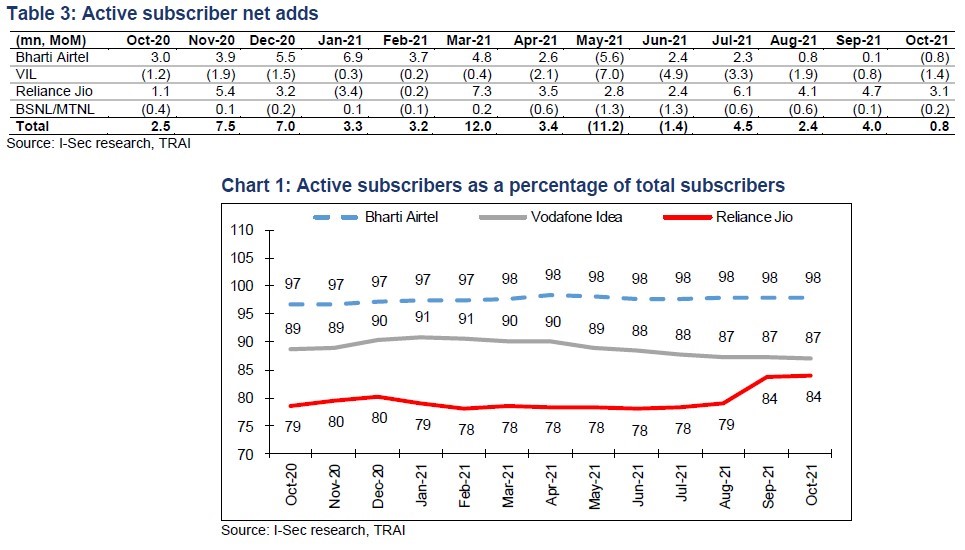

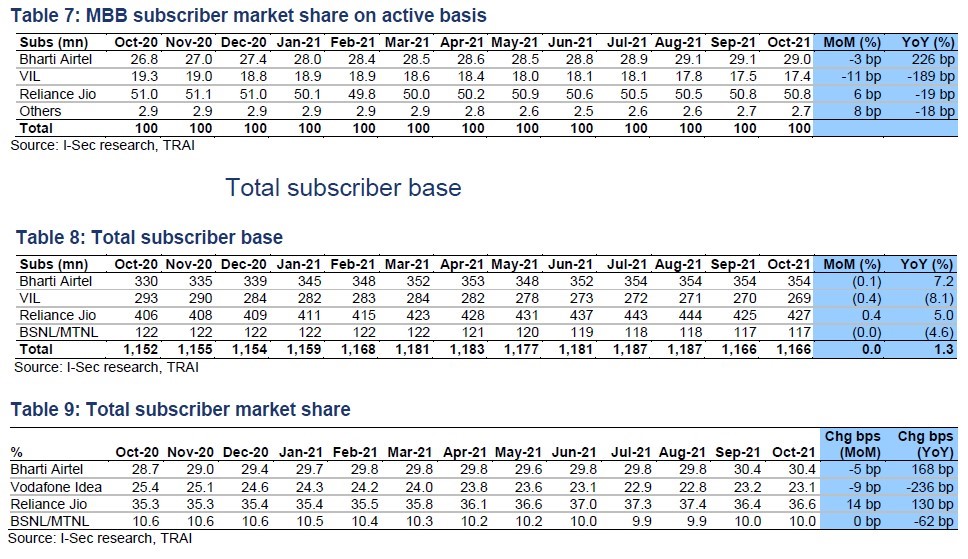

The Telecom Regulatory Authority of India (TRAI) has released its monthly data on subscribers (subs) for Oct’21. Industry-active subs rose 0.8mn with Bharti Airtel’s (Bharti) net loss of 0.8mn which it should be impacted from 2G base price increase to Rs79 (from Rs49) in July’21. Reliance Jio’s (RJio) net add decelerated to 3.1mn. Industry-wide mobile broadband (MBB) subs rose slower 3.9mn with Bharti’s addition was at 1.3mn, which is much lower considering festive season and higher sale of smartphones. Bharti’s MBB sub market share dip 3bps to 29% on active basis, while RJio’s improved by 6bps to 50.8%. MNP has dip to 7.3mn with MNP churn rate at 0.6%. Wired broadband sub add was steady for RJio at 0.22mn while Bharti’s normalised at 0.13mn.

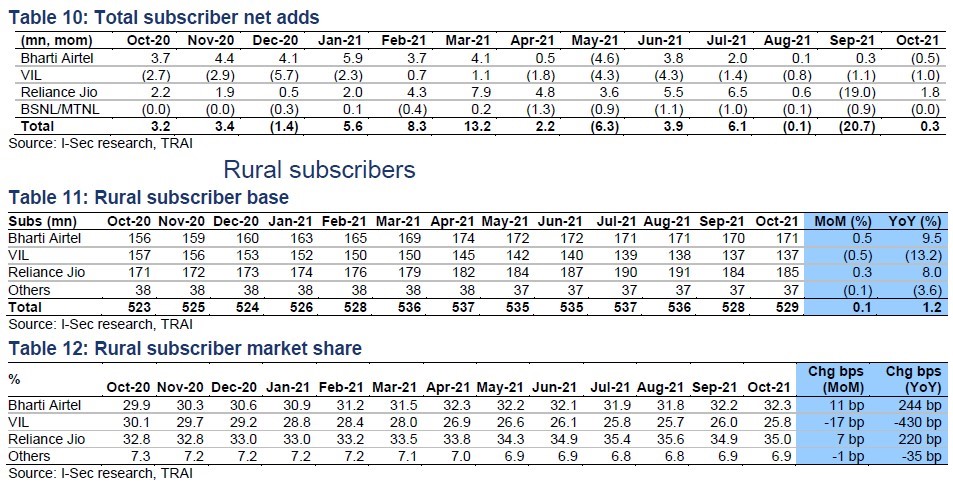

Industry-active subs rose only 0.8mn.

- Industry-active sub base rose 0.8mn to 996mn (up 0.1% MoM, up 3.7% YoY); and likely impacted from tariff hike taken by Bharti / VIL on base pack in 2G.

- RJio’s active sub base grew by 3.1mn (average 5mn in past three month) to 358mn in Oct’21.

- Bharti’s active sub base dip by 0.8mn to 346mn, which has remained weak for past three-month post tariff hike in base pack to Rs79 (from Rs49). Its total sub base decrease 0.5mn in Oct’21.

- VIL’s active subs dipped by 1.4mn (0.8mn in Sep’21) to 234mn in Oct’21. Total subs reduced by 1mn. Despite sharp rise in 2G prices, VIL has broadly held the subs base is better than expected. We would wait to see translation of tariff hike to revenue in H2FY22.

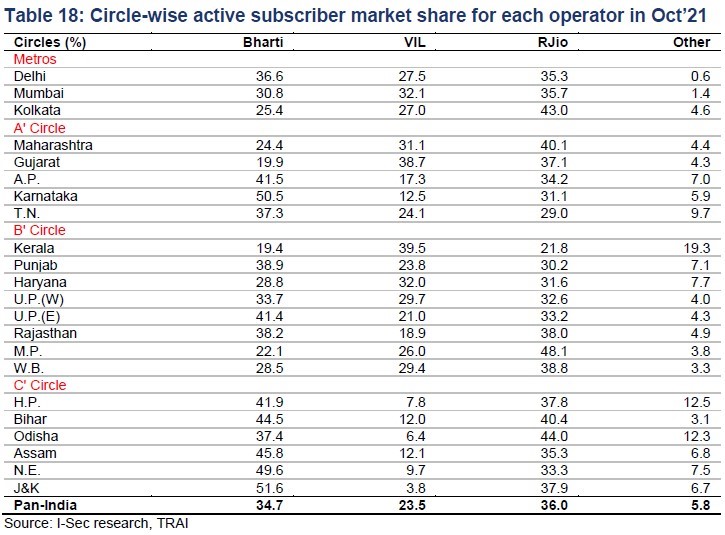

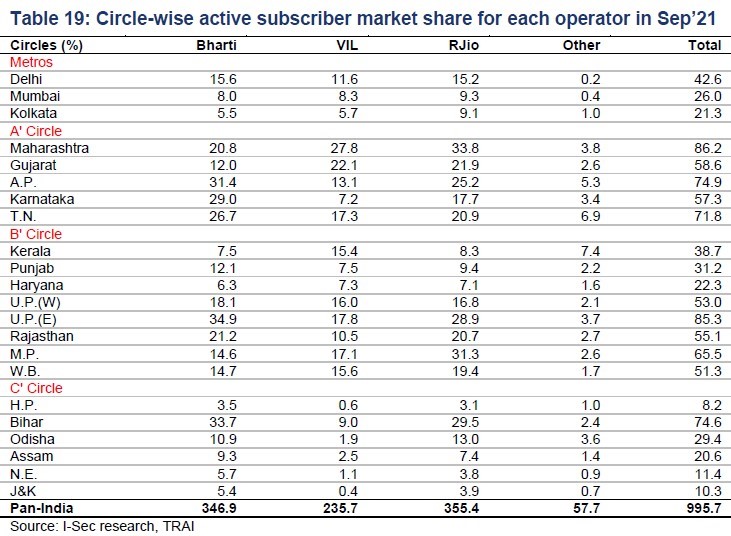

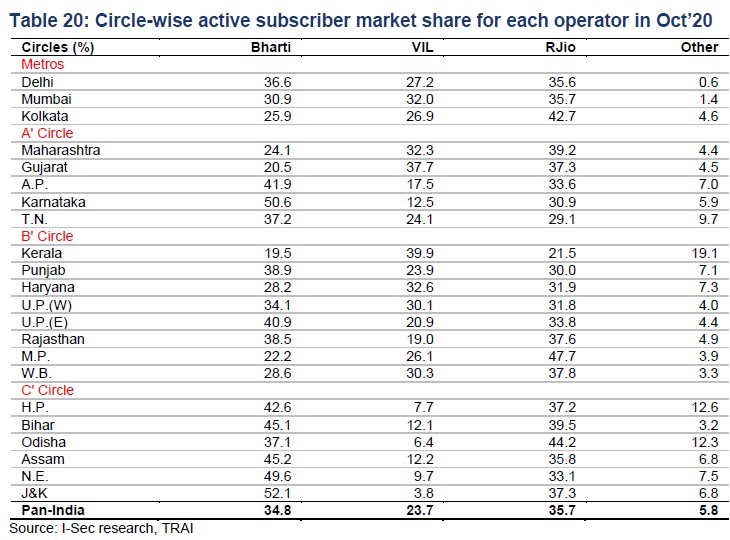

- RJio’s active sub market share improved by 28bps to 36% MoM, while Bharti’s stood at 34.7% (down 10bps MoM) and VIL’s fell 16bps MoM to 23.5%. RJio continues to maintain lead in active sub market share.

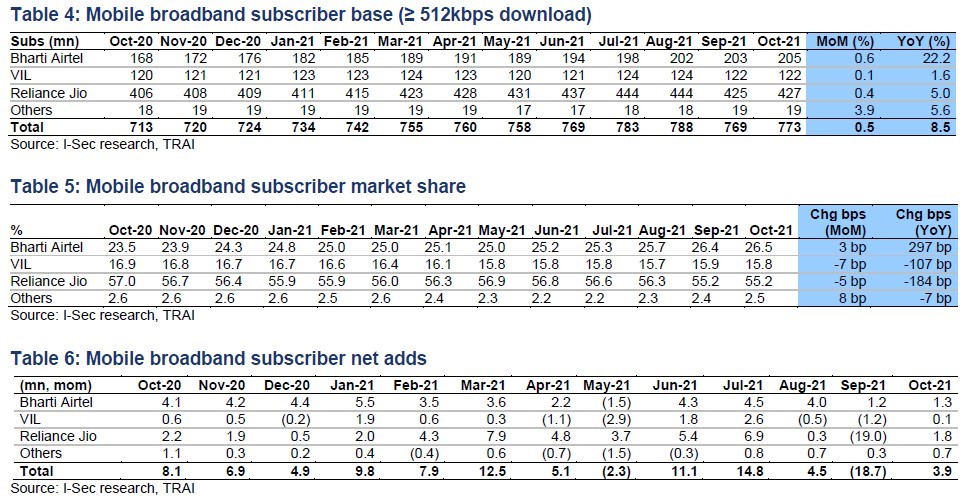

Industry MBB (mobile broadband) subs rose by 3.9mn

- Industry-wide MBB subs rose by 3.9mn to 773mn in Oct’21. Bharti added 1.3mn subs in this category. Its average net add stood at 3.2mn per month in the 10 months.

- RJio’s MBB sub base grew by 1.8mn to 427mn. Adjusted for inactive subs, its MBB market share stood at 50.8% (up 6bps MoM) while Bharti’s was 29% (down 3bps MoM) and VIL’s 17.4% (down 11bps MoM).

- VIL’s MBB sub base rose only 0.1mn to 122mn, which is disappointing.

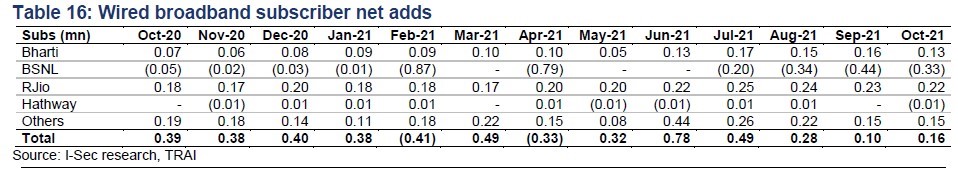

RJio’s wired broadband sub add was steady at 0.22mn to a total of 4.2mn

- Wired broadband sub base was up by 0.16mn MoM to 24.6mn (0.7% MoM / 14.1% YoY growth) in Oct’21. Net add for Bharti was 0.13mn.

- RJio’s market share improved to 16.9% (up 79bps MoM), and net add stood steady at 0.22mn. Bharti’s market share was 16.2% (up 43bps MoM). BSNL’s lost 0.33mn subs and its market share was down by 148bps MoM to 19.2%.

Industry MNP churn rate dip to 0.6%

- Industry porting dip sharply to 0.7mn in Oct’21. MNP churn rate was at 0.6%. Churn rate has remained elevated since Feb’21; and the reduction should come as relief to VIL.

Active subs: Industry added 0.8mn subs

Active subscribers, or visitor location register (VLR), is a temporary database of subs who have roamed in a particular area that an operator serves. Each BTS is served by exactly one VLR, hence, the unique registration. The VLR data is calculated on the basis of active subs in VLR on the date of peak VLR of a particular month for which the data is being collected. This data is collected from switches having a purge time of not more than 72 hours.

Mobile broadband subscribers: Industry added 3.9mn

CT Bureau

You must be logged in to post a comment Login