CSPs

All eyes on the powers that be

Once again, the fate of the entire industry: the telecom service providers, the equipment manufacturers, the OEMs, and the allied verticals depends on the stance of the government. Will it come forward with a pragmatic and rationalistic levy policy and make the ecosystem conducive for growth and investment or continue to target the CSPs for filling its coffers?

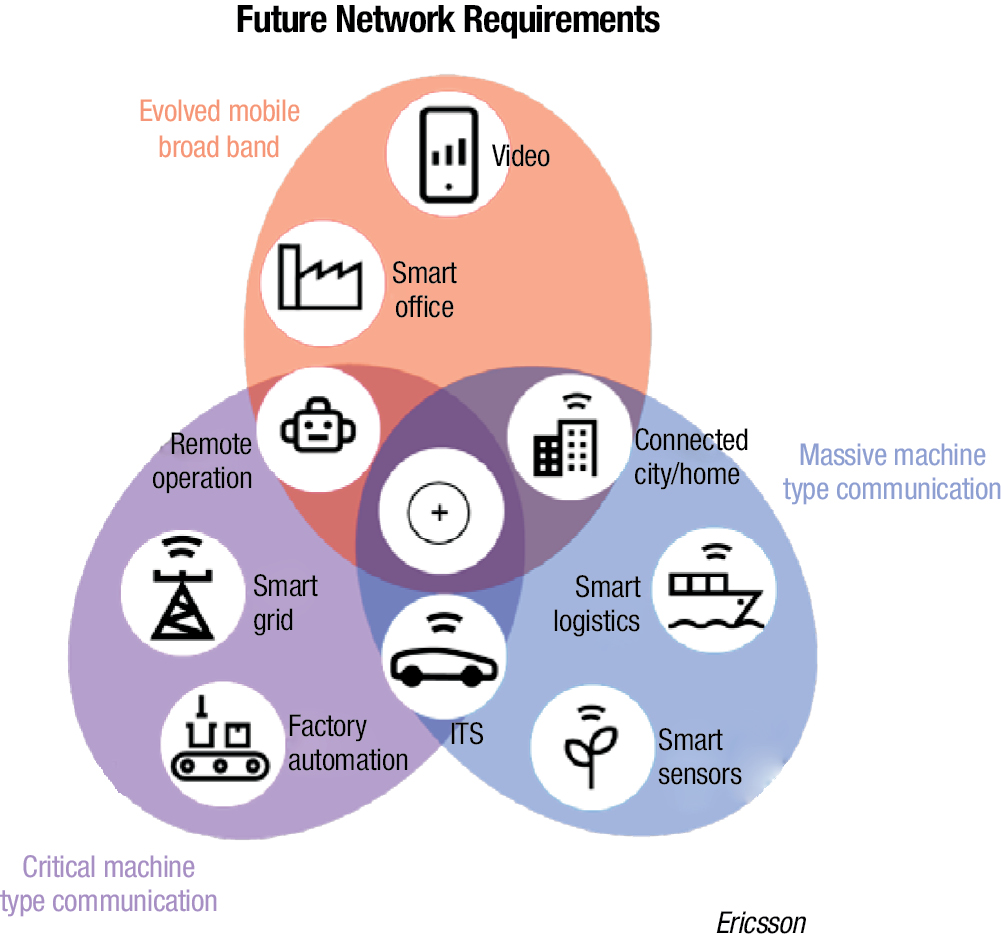

The world is racing toward a new digital era, powered by 5G, IoT and the 4th industrial revolution. By 2024, there will be 4.1 billion global cellular IoT connections and 1.5 billion 5G subscriptions – the latter of which is set to be the fastest generation ever to be rolled out on a global scale. Almost half of the connections will be in the US, and 30 per cent in China. The ICT industry is strongly collaborating to provide the fillip to other innovations that are set to drive the move- IoT, M2M, AI, AR, industry 4.0, and AI, amongst other technologies.

This will bring unprecedented new opportunities and by 2026, investments in industry digitalization will generate USD 619 billion revenue opportunity for telecom service providers.

This will bring unprecedented new opportunities and by 2026, investments in industry digitalization will generate USD 619 billion revenue opportunity for telecom service providers.

A recent Ericsson report etimates that India will account for 5 percent of the global 5G connections. 5G mobile services are expected to create USD 27.3 billion revenue potential for India by 2026, out of this USD 13 billion is the addressable revenue opportunity for mobile operators in the country if they take up roles beyond being connectivity and infrastructure providers to become service enablers and service creators. This will be on top of revenues from traditional services. The largest opportunity will be seen in sectors like manufacturing, energy and utilities followed by public safety and health sectors. Some of the 5G use cases that could be implemented using the unique features of 5G technology include industrial control and automation, autonomous driving, safety and traffic efficiency services, hospital applications and medical data management amongst others.

The consumer

Customer preferences have undergone a change as conversations move from voice-based hello to emoji, gaming change from candy crush to PUBG and payments from cash to e-wallets. India has the world’s highest data usage per smartphone at an average of 9.8GB per month. With 150 crore gigabytes per month of mobile data consumption India is now world’s number 1 mobile data consuming country, higher than USA and China’s mobile data consumption put together.

India has reached a point where 800 million people are waiting to be a part of the connected ecosystem. As the government is supportive, more people have the possibility to join the wireless networks. And out of the 400 million that are connected, a big portion of that is ready to pay for quality service. They will be ready to pay for a guaranteed quality which is untouched revenue potential in the market.

The uptake of traffic is so fast, that the operators providing managed servicesneed to take actions in real time. So, it’s becoming a complicated job. They need to invest as much they we can on automation and AI. As the traffic grows, the complexities of the network also grow, and it becomes important to automate.

The India Story

The overall financial health of the Indian telecom sector is dire. India’s telecoms service providers are highly leveraged with over USD 100 billion in debt. Additionally, the industry has Rs 35,000 crore stuck on input credit on GST and a USO fund of Rs 50,000 crore sitting uninvested with the government.

Bharti Airtel, posted a loss of Rs 2866 crore in the quarter ended June 30, 2019, from a net profit of Rs 97 crore in the year earlier as finance costs rose and its consolidated net debt stood at Rs 1.16 lakh crore. Vodafone Idea posted a net loss of Rs 4,878.3 crore for the quarter ended June 30, 2019, gross debt of the company stood at Rs 1.20 lakh crore, and net debt of Rs 99,260 crore.

As the incumbents struggle with the competitive intensity and the declines in revenue, available cash flows are increasingly being used to service interest payments. Jio reported quarterly revenues of Rs 11679 crore in the April-June period.

With the exception of Jio, the bulk of network assets are still servicing 2G customers, many of whom are poor contributors in terms of average revenue per user (ARPU). In a belated rear-guard action, both Airtel and VIL have taken the step of mandating a minimum spend on their prepaid accounts. This move was taken to drop non-revenue generating and shore up their reporting metrics prior to fund-raising efforts. Bottomline, the Indian industry is not currently financially geared to making the necessary investments that are required for nationwide 4G deployments, let alone 5G.

All of the operators are struggling with extremely low average ARPUs figures and are trying to balance the potential long term financial gains that 5G will bring, with some astronomic capital expenditure demands in the short term.

With challenges as Nokia expressing its inability to continue offering network operations and maintenance services to BSNL, due to non-payment of dues of about Rs 800 crore; and the possibility of Anil Ambani, chairman, RCom serving a jail term of three months if he had not cleared overdue balance payment of Rs 462 crore to Ericsson; the dire situation of both the service providers and the vendors cannot be taken lightly.

What investment can we expect from the CSPs?

RJio. In the 42ndth AGM speech recently, Mukesh Ambani, Chairman, RJio stated that, “Unlike other industry players your company had the foresight to PRE-INVEST in the network assets. And for this reason, I can report to you today that the investment cycle for Jio is now complete. Only marginal investments in access are now required to grow capacity to meet growing demand.” Jio is 5G ready. “ The core and aggregation layers of our converged network have been 5G ready since day one. And because of our early adoption of the ongoing enhancements to LTE technology our wireless network is already 4G PLUS. And we can upgrade this to 5G at minimum incremental cost.”

Bharti Airtel. Bharti Airtel will need to invest an incremental USD 5 billion (Rs 35,000 crore) over the first three years even for a selective 5G rollout, and an additional USD 3 billion (Rs 21,000 crore) for 4G expansion, for which mobile pricing will need to be revised upwards, primarily to support upcoming investments in 5G spectrum and networks, estimates Rajiv Sharma, co-head of research at SBICap Securities.

The company’s leadership is pinning its hopes on strong revenue growth in the coming quarters as it does not expect to compromise on network coverage, especially to maintain their current revenue market share levels. “Airtel, Vodafone Idea and Jio will definitely pump in CapEx to ensure similar 4G coverage to hold on to revenue share,” stated DS Rawat, managing director, Bharti Infratel at the investor call following the Bharti Infratel quarterly results announcement.

“Vodafone Idea has just concluded its rights issue and Bharti Airtel’s will open soon, which will give them adequate fresh funds to engage in aggressive tower network build-outs for expanding 4G coverage amid surging data consumption, a scenario that promises a favourable impact on our business prospects,” Bharti Infratel chairman Akhil Gupta said. He announced that he expected strong emerging appetite for data services in the rural markets to boost revenue growth prospects for tower companies. All major telcos, he said, are expanding their mobile broadband footprints aggressively in the rural markets amid strong data consumption trends.

On another occasion, Randeep Seekhon, CTO, Bharti Airtel added, “We remain committed to building a state-of-the-art future-ready network as part of our network transformation program – Project Leap – and deliver best-in-class digital experience to our smartphone customers.”

For 5G services. Sharing key ingredients to 5G adoption, Sekhon said, “robust 4G network, physical infrastructure, low cost 5G devices, applications and 5G-ready workforce will be crucial for developing the technology, while the importance of physical and power infrastructure along with backhaul cannot be undermined. Automation will help us become competitive in the world and 5G will help us with that but we need to overcome several infrastructure-related challenges. Small cells and fibre backhaul can help overcome the physical infrastructure challenges up to some extent”.

Vodafone Idea.Vodafone Idea has planned to invest Rs 27,000 crore in networks over two years, 2019 and 2020. This does not include capacity created by reusing equipment from the synergy of operations between Vodafone and Idea, which is estimated to be valued at around Rs 6,200 crore.

The service provider is in the process of merging two networks and has a plan to exit more than 90,000 sites to cut on duplication and reduce capital and operational expenditure.

VIL has partnered with Nokia to roll out its next generation, future ready LTE network across multiple service areas. As part of the agreement, Nokia will deploy state-of-the art telecom equipment, including Single RAN Advanced, massive Multiple Input Multiple Output (MIMO) and small cells. These deployments will enable Vodafone Idea subscribers to enjoy higher-bandwidth applications and services.

Nokia’s Single RAN solution will enable Vodafone Idea Ltd. to simplify its network installation and management. The deployment of massive MIMO technology will enhance capacity and speed. Further, the installation of Nokia’s small cells will supplement operator’s macro network and ensure improved coverage and capacity, both indoors and outdoors, in line with the HetNet architecture to enable their next generation networks.

Vodafone Idea Limited is also deploying Dynamic Spectrum Sharing (DSR) to make the most productive use of the spectrum and is extensively utilizing UBR radios to further lower OpEx per site and ease the deployment challenges.

Vodafone Idea Limited is also deploying Dynamic Spectrum Sharing (DSR) to make the most productive use of the spectrum and is extensively utilizing UBR radios to further lower OpEx per site and ease the deployment challenges.

BSNL. Bharat Sanchar Nigam Limited has signed up with Ciena to prepare its network for the impending evolution toward 5G. The network operator is collaborating closely with Original Equipment Manufacturers (OEMs) and technology partners to showcase a strong 5G ecosystem that enables innovation for new use cases and business models. The 5G trials are expected to take place in any of the preferred Urban Metro Area. Specifically, Ciena and BSNL intend to jointly evaluate front haul, mid haul and backhaul transport-based use cases and scenarios to address resiliency requirements and latency concerns.

It has also signed up with Ericsson to work together on developing new 5G use cases, knowledge sharing on 5G technology concepts, industry and innovation trends including 3GPP standardization progress. The plan is to create a roadmap for 5G and Internet of Things (IoT) deployments in India. The partnership will leverage Ericsson’s 5G Center of Excellence established earlier this year at IIT Delhi to work on evaluating benefits of 5G technology in areas like rural connectivity, connected healthcare, industrial automation, public safety, video surveillance, energy and agriculture amongst others.

Way forward

The government is planning to auction5G spectrum in the latter part of this year. And it expects to collect USD 84 billion for the licenses, ten times more than its comparatively affluent European counterparts. The minister for communications & IT,Ravi Shankar Prasad has declared that 5G trials are going to begin in the next 100 days and the OEMs are certainly ready from a technology point of view. Globally, Ericsson has nine customers who have launched 5G services on its equipment and commercial 5G deals with another 13 operators, Nokia boasts 43 commercial 5G agreements in total; and Huawei has reportedly signed 46 commercial 5G contracts.

The moot question is, are the operators in any position to pitch in about USD 20 billion each for the spectrum? Analysts estimate a telco, typically, needs to invest around USD 5 billion for a selective 5G rollout. Does it even make sense to invest at these levels, when the requisite ecosystem is not expected to bedeveloped for the next two to three years? Do we have a robust 4G network, the backhaul, RoW and shared network between operators, so that 5G can be truly offered to the consumer.

The telecom sector to be viable needs to have affordable 5G spectrum, reduced levies, more fibre backhaul and improved right of way for a successful advent and adoption of 5G in the country. And for 5G to be truly present, the 4G network needs to be developed and made robust. Sufficient spectrum for 4G is there, backhaul, RoW and shared network between operators are required. 5G in India, as with everywhere else in the world, is going to launch on a non-stand-alone basis, which means it will be built on top of the existing 4G framework. This is an absolute imperative to get the 4G story right. 4G networks must be spread right across the country and be robust enough to deal with enormous volumes of traffic.

“It’s not a spectrum issue, it’s not a radio issue, it’s a backhaul issue. We have to have fibre everywhere as far as I’m concerned. We could even make it a shared fibre network, to ensure that everyone has access to that essential fibre that will power their 5G backhaul. Either that, or we need a massive release of microwave spectrum in the E-band for mobile backhaul. If you give me either of those things, we could see speeds of 100Mbps+ on our exiting 4G networks today,” emphasised Balesh Sharma, ex-CEO, Vodafone India.

The government will need to be bold and have vision. “We trust the government to proceed with wisdom (on spectrum pricing). This is the right time for the Indian government to make a decision and give clarity, India should take a collaborative and open approach to achieve the revenue target for the ICT sector”, aptly putsJay Chen, CEO, Huawei India.

Any delays will very likely derail the entire transformative experience the government has planned for India. The PM’s vision of Digital India bridging the urban-rural divide; BharatNet’s success; new initiatives like Jan Dhan Yojana, Skill India, Make in India, and ensuring ICT-enabled digital and financial inclusion for every citizen are very likely to remain an unrealised dream! Ensuring that 5G is a success cannot be undermined!

“The cost of doing business here has to come down. If you look at the investment that we are making for 4G, for every Rs 100 that we earn, we spend Rs 34 on CapEx. For most other companies in this industry, that figure would be closer to Rs 16 or 17. An additional Rs 31 goes to the government for tax. This needs to be fixed.

“The cost of doing business here has to come down. If you look at the investment that we are making for 4G, for every Rs 100 that we earn, we spend Rs 34 on CapEx. For most other companies in this industry, that figure would be closer to Rs 16 or 17. An additional Rs 31 goes to the government for tax. This needs to be fixed.

The industry ARPU 3-4 years ago stood at Rs 400. Now it is Rs 105. We need a situation where the cost of doing business goes down. Margins are absurdly low at the moment. Current conditions are unsustainable. If ARPU is just increased from around $1.50 to around $3.00, which is not a huge increase in terms of consumer cost, that would totally change the game for us.”

Gopal Vittal

CEO,

Bharti Airtel.

You must be logged in to post a comment Login