Company News

Wipro, choosing riskier path for growth, ICICI Securities

Wipro has reported in-line growth in IT services at 3.1% QoQ CC, within its guided range of 2-4%, in Q4FY22. We believe organic growth will be ~2.5% QoQ CC (~50bps from Leanswift, Edgile). IT services margin was down 60bps QoQ to 17% (in line with our estimates, lower than street estimates by 50bps) and overall EBIT margin pre-forex stood at 16.3%, down 60bps QoQ. Decline in margins was on account of higher-than-expected employee costs. We believe Wipro will have more headwinds on margins going forward as attrition still remains high at ~24% – cost to backfill attrition is high and will impact margins. Even utilisation is high at 85%. We like to highlight that Wipro’s travel/facility costs are still at the lower end and are expected to increase further. Our EBIT margin estimates were already below street’s and remain intact at 16.1%/17.3% for FY23/24.

Wipro signed 9 large deals in Q4FY22 worth US$0.4bn, which we believe is the lowest in the last 2 years. Wipro’s ACV was up 30% YoY in FY22.

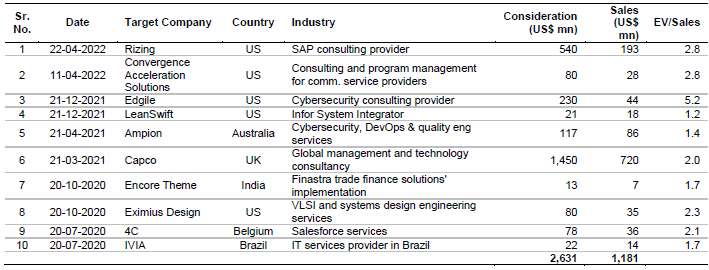

Wipro guidance of 1-3% QoQ CC growth for Q1FY23 seems very modest to us which translates to 0.7%-2.7% organic guidance. Rizing acquisition will be included from Q2FY23; we incorporate Rizing/CACS in our guidance which led to increase of modest 0.8%/1% revenue growth upgrade. According to our calculations, Wipro has done organic growth of ~14% YoY US$ in FY22 which is impressive. However, it is increasing its investments to plug the gaps by inorganic route. We believe acquisitions are necessary to plug the gaps in capabilities and expand into newer areas but large acquisitions or too many acquisitions (10 acquisitions since new CEO-exhibit 10) can drain margin profile (investments, retention etc), drag RoIC and dilute earnings. We found some acquisitions of Wipro very expensive (Table 1).

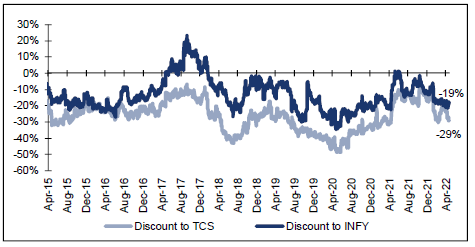

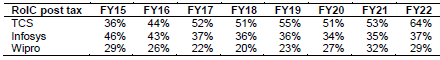

We broadly maintain our revenue growth/margin estimates as we were already lower than street. But higher amortisation expenses, lower other income and forex led to EPS cut of 6%/3% for FY23/24. Wipro has done really good progress with the new leadership which also reflects in strong organic growth in FY22. However, going forward, we believe Wipro has chosen a bit risker path for growth as compared to peers. Acquisitions will drain not just margins and RoIC but also dilute earnings. We now value Wipro on 18x FY24E earnings (~22% discount to Infosys target multiple of 23x) to arrive at a revised target price of Rs478. Wipro has the lowest RoIC and RoE compared to its peers (Infosys, TCS) which also justifies our lower target multiple (Table 2). Reiterate REDUCE rating.

10 acquisitions made by Wipro to the tune of ~US$2.6b since the new CEO joined

Source: Company data, I-Sec research

Expect Wipro’s valuation gap to increase more

Source: Bloomberg, I-Sec research

Wipro has lower RoIC than its peers

Source: Company data, I-Sec research

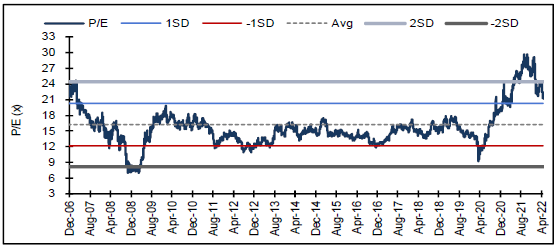

Wipro is currently trading at 21x 1-year forward P/E (~35% premium to historical long-term average of 16x)

Source: Bloomberg, I-Sec research

For complete report click here – https://www.communicationstoday.co.in/choosing-riskier-path-for-growth/

CT Bureau

You must be logged in to post a comment Login