Trends

The wireless infrastructure market continues to defy all odds and the pandemic

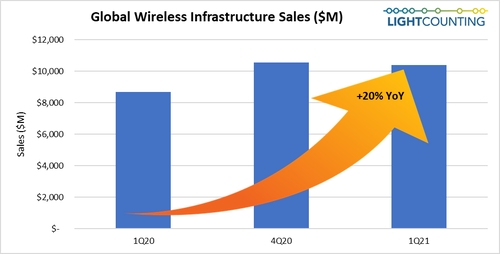

1Q21 delivered an unprecedented monumental wireless infrastructure market that totally dodged the typical seasonality effects and stayed alive and kicking in China despite the Lunar Year celebration hiatus. The 5G rollout momentum seen in North America, and North East Asia reported in 2H20 continued in 1Q21 and was augmented by strong 5G activity in Europe, and 4G upgrades in India, before the pandemic hit. As a result, the global wireless infrastructure market grew 20% YoY driven by 5G RAN, 5G core, and vEPC sales. Rakuten Mobile’s 5G network buildout drove open vRAN sales, which in turn solidified Altiostar’s leading global market position in this segment.

“Of course, unexpectedly strong 5G rollouts in China helped Huawei and ZTE to stay on the market share leaderboard along with Ericsson and Nokia, which executed a quintessential comeback. Meanwhile, the rise of Samsung and Nokia’s comeback at the expense of Huawei and ZTE in Europe are the other significant 1Q21 dynamics we observed” said Stéphane Téral, Chief Analyst at LightCounting Market Research.

The 2 years in a row of double-digit growth made the market resemble a step function and lifted the foundation of our entire forecast: 5G is higher and the 4G decline is less pronounced due to strong expansion in India. This unusual 1Q21 puts 2021 on strong footing for a return to normalcy with 5% YoY wireless infrastructure market growth driven by all regions except CALA, and the pattern of our revised long-term wireless infrastructure forecast continues to show a bell shape. It’s worth noting that due to uncertainties in China and India, our Asia Pacific forecast was revised downward while we raised our North America one, our total market size barely budged.

Therefore, our service-provider 20-year wireless infrastructure footprint pattern analysis points to a 2020-2026 CAGR of -2% characterized by low single-digit growth through 2022, followed by low single digit declines throughout 2026, which reflects the differences in regional and national agendas, including COVID-19 impact. The model considers all the 5G 3-year rollout plans that we gathered from many service providers and indicate strong activity through 2022 and 2023. LightCounting

You must be logged in to post a comment Login