Performance Indicators

The Indian telecom services performance indicators

The year 2018 saw the consolidation of the Indian mobile telecommunications market into three large private players – Reliance Jio, Bharti Airtel, and Vodafone Idea – accounting for more than 90 percent of revenue and 80 percent of spectrum holding.

The merger of the Indian unit of Vodafone Plc. with Idea Cellular in August created India’s largest telco by number of subscribers (418.75 million), overtaking Bharti Airtel with 343.52 million subscribers and Reliance Jio’s 280.12 million.

The merger of the Indian unit of Vodafone Plc. with Idea Cellular in August created India’s largest telco by number of subscribers (418.75 million), overtaking Bharti Airtel with 343.52 million subscribers and Reliance Jio’s 280.12 million.

The Indian telecommunications sector is gearing up for a three-way battle among Reliance Jio, Bharti Airtel, and Vodafone Idea with each of the three operators having different history and context. Overall, one could expect the three operators having similar mobile subscriber numbers by the end of 2019, but with rather different financial performance.

The Indian telecommunications sector is gearing up for a three-way battle among Reliance Jio, Bharti Airtel, and Vodafone Idea with each of the three operators having different history and context. Overall, one could expect the three operators having similar mobile subscriber numbers by the end of 2019, but with rather different financial performance.

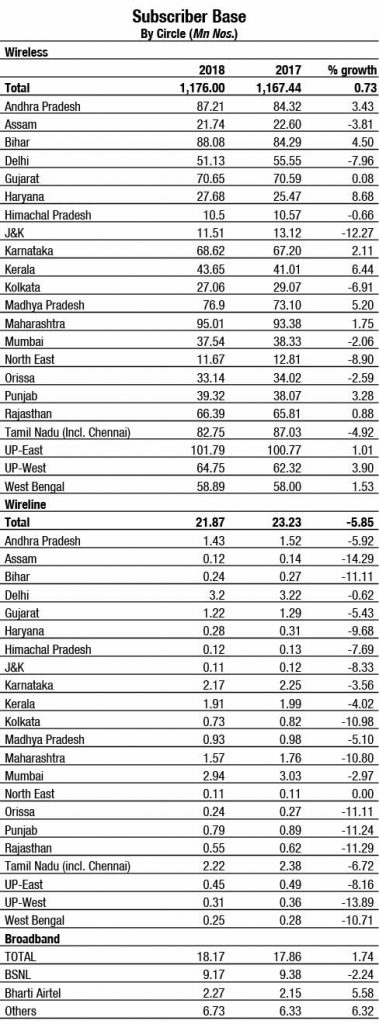

Telecom subscriber base

The number of telephone subscribers in India increased from 1190.67 million at the end of Dec-17 to 1197.87 million at the end of Dec-18, registering a growth rate of 0.60 percent. The overall teledensity in India decreased from 91.90 at the end of Dec-17 to 91.45 at the end of Dec-18 with a yearly decline rate of 0.49 percent.

Telephone subscription in urban areas declined from 688.25 million at the end of Dec-17 to 666.28 million at the end of Dec-18 at the yearly decline rate of 3.19 percent. However, urban teledensity declined from 168.29 at the end of Dec-17 to 159.98 at the end of Dec-18, with yearly decline rate of 4.94 percent.

Rural telephone subscription increased from 502.42 million at the end of Dec-17 to 531.59 million at the end of Dec-18 at the yearly growth rate of 5.81 percent. Rural teledensity also increased from 56.66 at the end of Dec-17 to 59.5 at the end of Dec-18, with yearly growth rate of 5.01 percent.

Rural telephone subscription increased from 502.42 million at the end of Dec-17 to 531.59 million at the end of Dec-18 at the yearly growth rate of 5.81 percent. Rural teledensity also increased from 56.66 at the end of Dec-17 to 59.5 at the end of Dec-18, with yearly growth rate of 5.01 percent.

Out of 1197.87 million of total telephone subscribers, the number of wireless telephone subscribers is 1176 million and the number of wireline telephone subscribers is 21.87 million at the end of Dec-18.

Total number of internet subscribers increased from 445.96 million at the end of Dec-17 to 604.21 million at the end of Dec-18, registering a growth rate of 35.49 percent. Out of 604.21 million internet subscribers, wired-internet subscribers are 21.42 million and wireless internet subscribers are 582.79 million.

The internet subscriber base is comprised of broadband internet subscribers 525.36 million and narrowband internet subscribers 78.86 million.

After merger of Vodafone Ltd. and Idea Cellular during 2018, Vodafone Idea Ltd. became the market leader with 34.98 percent in access segment in terms of number of subscribers with 418.75 million subscribers at the end of Dec-18. Bharti Airtel held the second position with 340.26 million subscribers at the end of Dec-18.

In terms of net addition, only Reliance Jio Infocom Ltd. and BSNL became the gainers with net addition of 120 million and 6.45 million telephone subscribers respectively at the end of Dec-18. All other access service providers showed negative growth in their telephone subscriber base during the same period.

In wired-internet segment, BSNL holds more than 50 percent market share with 11.44 million subscribers, followed by Bharti Airtel with 4.04 million subscribers. The total number of wired internet subscribers was 21.42 million at the end of Dec-17.

Himachal Pradesh service area has the highest rural tele-density of 121.57 followed by Tamil Nadu service area (89.02). Assam service area has the lowest rural tele-density of 45.14 followed by Bihar service area (45.52).

Vodafone Idea Ltd. is the telecom service provider with highest proportion of rural telephone subscribers (52.67 percent), followed by Bharti Airtel (48.98 percent) to their total telephone subscribers at the end of Dec-18.

Gross revenue (GR) and adjusted gross revenue (AGR) of telecom service sector for the year 2018 has been Rs 237,417.22 crore and Rs 144,446.29 crore respectively.

You must be logged in to post a comment Login