Performance Indicators

The Indian telecom services market

The Indian telecom sector has been on a roller-coaster ride over the past few years. After posting losses in excess of `40,000 crore in the last two years, the industry has consolidated, with the top three players – Vodafone Idea, Bharti Airtel, and Reliance Jio – accounting for over 90 percent market share in revenue terms.

The sector is gearing up for a three-way tussle with each of the operators having a different history and context. Overall, it is expected that the three will settle at the same market share by the end of 2020, albeit with rather different financial performance.

The wireless subscriber base in India, which was stable on-year at ~1172 million at the end of fiscal 2019, is projected to decline 2–3 percent on-year in fiscal 2020. This may primarily be attributed to the introduction of the minimum-recharge plan, which requires recharge of `35 per month for subscribers to remain active on a network. This has, in effect, led to subscribers deactivating multiple SIMs and switching to primary SIM cards.

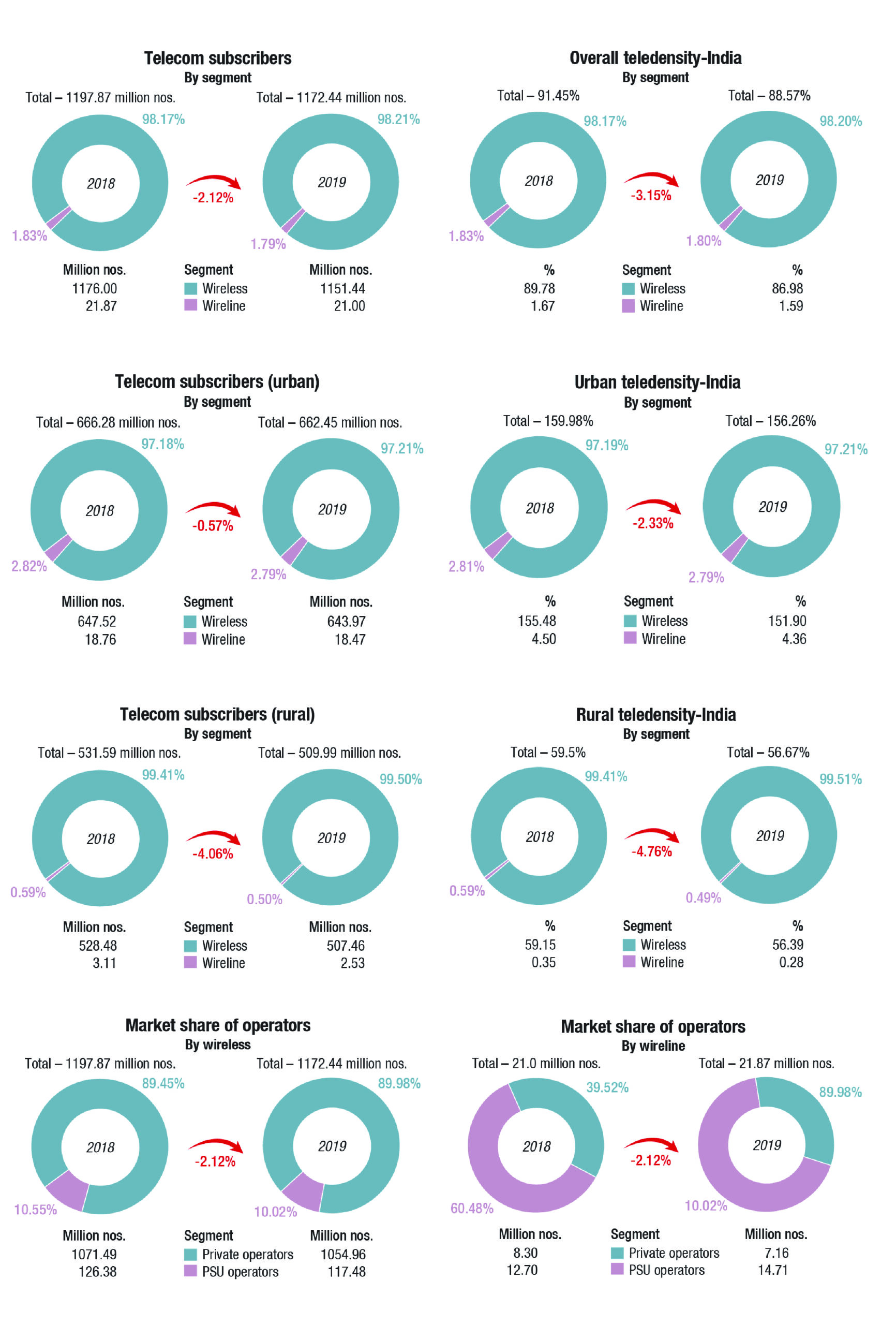

Telecom subscriber base

The number of telephone subscribers in India decreased from 1197.87 million at the end of December 2018 to 1172.44 million at the end of December 2019, registering a de-growth of –2.12 percent. The overall tele-density in India decreased from 91.45 percent to 88.56 percent, in the same period, with a yearly decline rate of 0.49 percent.

Telephone subscription in urban areas declined from 666.28 million in 2018 to 662.45 million in 2019, while, tele-density declined from 159.98 percent to 156.26 percent in the same period.

Rural telephone subscription decreased from 531.59 million at the end of December 2018 to 509.99 million at the end of December 2019, registering a de-growth of –4.06 percent, while tele-density decreased from 59.5 percent at the end of December 2018 to 56.67 percent at the end of December 2019.

Out of a total of 1172.44 million telephone subscribers, the number of wireless telephone subscribers is 1151.44 million and the number of wireline telephone subscribers is 21 million at the end of December 2019.

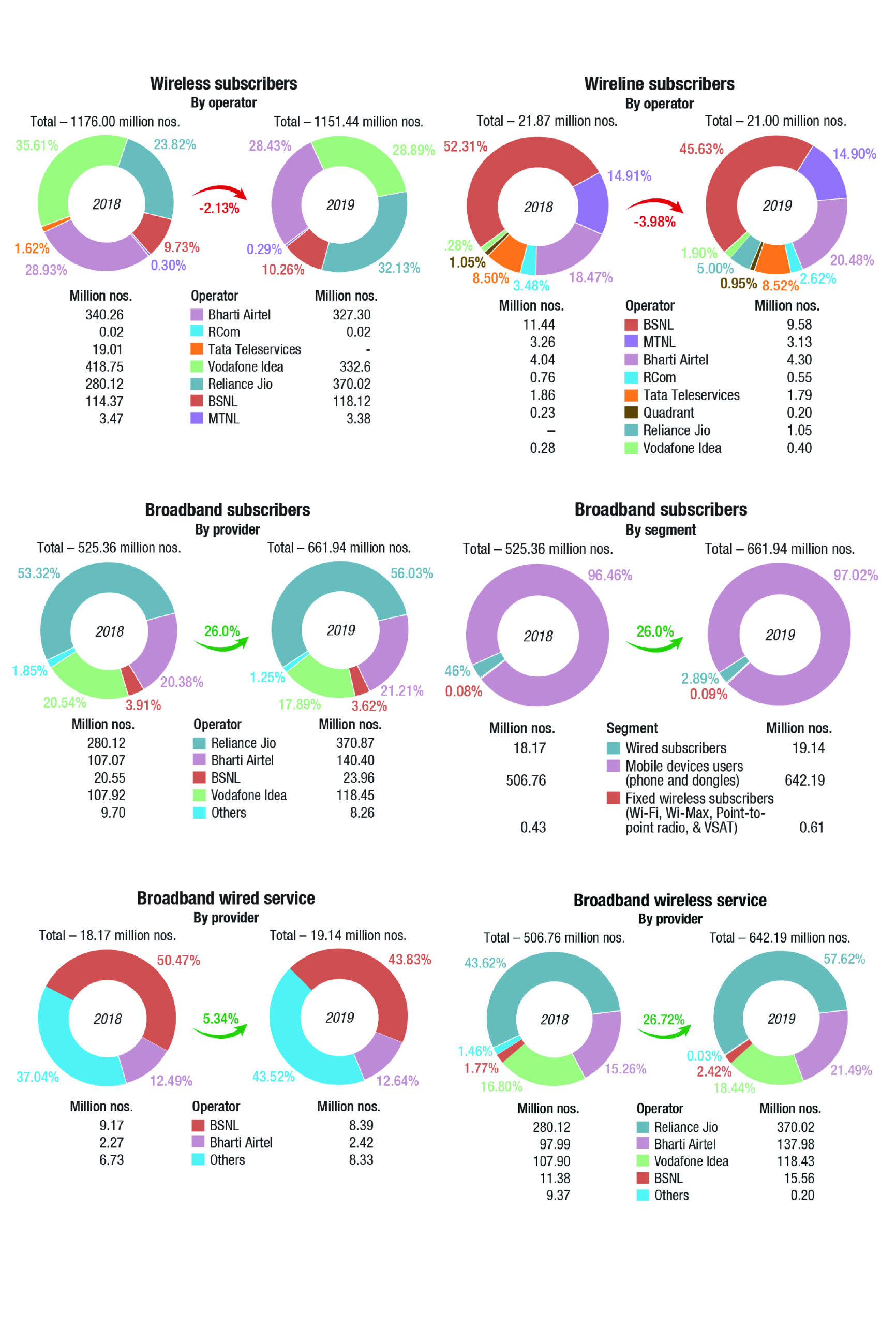

Total number of broadband subscribers increased from 525.36 million at the end of December 2018 to 661.94 million at the end of December 2019, registering a growth rate of 26 percent. Out of 661.94 million broadband subscribers, wired-internet subscribers are 19.14 million, mobile devices users are 642.19 million, and fixed-wireless subscribers are 0.61 million.

Top five service providers constituted 98.98 percent market share of the total broadband subscribers at the end of December 2019. These service providers were Reliance Jio Infocomm Ltd. (370.87 million), Bharti Airtel (140.40 million), Vodafone Idea (118.45 million), BSNL (23.96 million), and Atria Convergence (1.52 million).

In terms of net addition, only Reliance Jio Infocom Ltd. and BSNL became the gainer with net addition of 89.90 million and 3.75 million telephone subscribers respectively at the end of December 2019. All other access service providers showed negative growth in their telephone subscriber base during the same period.

In wired-internet segment, BSNL holds 45.63 percent market share with 9.58 million subscribers, followed by Bharti with 4.30 million subscribers. The total number of wired internet subscribers was 21.00 million at the end of December 2019.

The share of urban and rural wireless subscribers in total number of wireless subscribers was 55.93 percent and 44.07 percent respectively at the end of December 2019.

The private access service providers held 89.98 percent market share of the wireless subscribers whereas BSNL and MTNL, the two PSU access service providers, had a market share of only 10.02 percent at the end of December 2019.

You must be logged in to post a comment Login