Headlines of the Day

Telecom Q3FY22 preview: Steady quarter; tariff hike impact limited, ICICI Securities

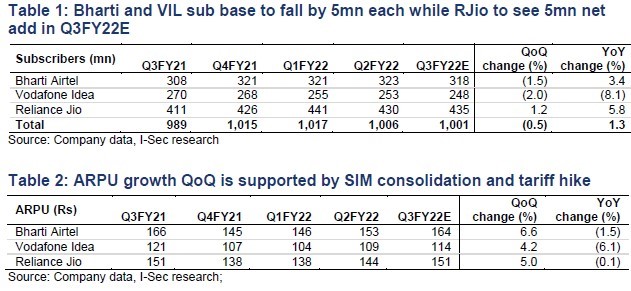

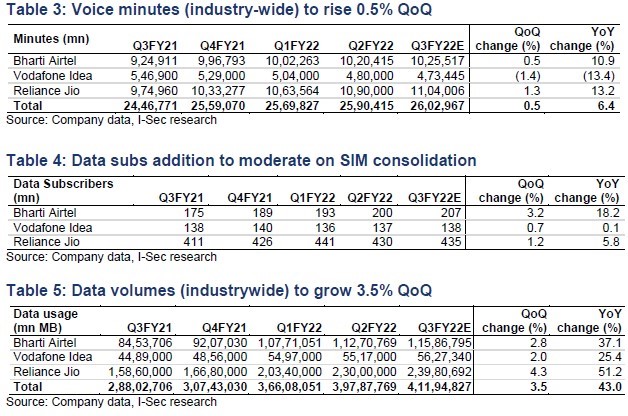

The revenue in Q3FY22 will see steady growth for mobile services as the impact of 20% prepaid tariff hike will be limited only for one month. SIM consolidation will drag down subs for Bharti Airtel (Bharti) / Vodafone Idea (VIL), while Reliance Jio (RJio) will see net add on JioPhone Next launch. ARPU growth will look strong in the range of 4-7%QoQ with Bharti showing strong uptick from tariff hike, 4G addition and dip in low-end subs. We expect next quarter to show bulk of tariff hike impact. Mobile services revenue will see growth of 3-4%. Data sub addition will remain weak from SIM consolidation and slower shift to 4G. Indus will see steady tenancy addition of 3,500. Tata Communications (TCom) will see gradual-than-expected recovery in data revenue. Q4FY22E would be critical for mobile service providers as it would establish leader in incremental revenues coming from tariff hike which would put ground for long-term market share.

• Steady quarter; subs dip from SIM consolidation on tariff hike. Q3FY22E is expected to be steady as impact of tariff hike of 20-21% on prepaid category wef Dec’21 had limited flow-through into revenue. However, Bharti and VIL will see decline in subs due to 1) steep increase in base 2G tariff from Rs49 to Rs99 for 28days in past two quarters; and 2) 20% tariff hike in other prepaid plans. RJio would continue to add on JioPhone Next launch, also from the introduction of Re1 recharge. Data subs addition would be limited as Oct’21 was already muted and tariff hike would have slowed shift to 4G. ARPU growth would look strong from the exit of lower end subs, and one-month benefit of tariff hike. RJio will benefit from subs churn of previous quarter. Bharti / VIL / RJio will see ARPU growth of 6.6% / 4.2% / 5% QoQ to Rs164 / Rs114 / Rs151, respectively in Q3FY22.

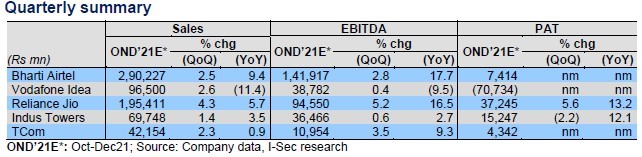

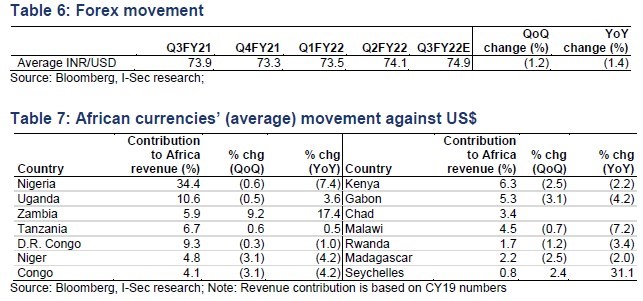

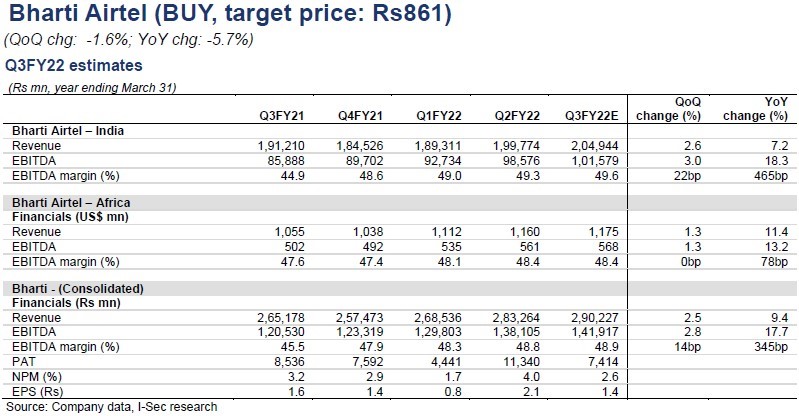

• Bharti’s consolidated EBITDA is expected to be up 2.8% QoQ (17.7% YoY) to Rs142bn. Bharti’s India revenues are likely to grow 2.6% QoQ (7.2% YoY) to Rs205bn led by mobile segment (up 3.7% QoQ / 6.6% YoY). India EBITDA is expected to be up 3% QoQ to Rs102bn. Bharti’s Africa US$ revenue and EBITDA are likely to grow 1.3% QoQ to US$1,175mn and 1.3% QoQ to US$568mn, respectively. Consolidated revenue is expected to rise 2.5% QoQ to Rs290bn and EBITDA 2.8% QoQ to Rs142bn. Net profit is seen at Rs7.4bn.

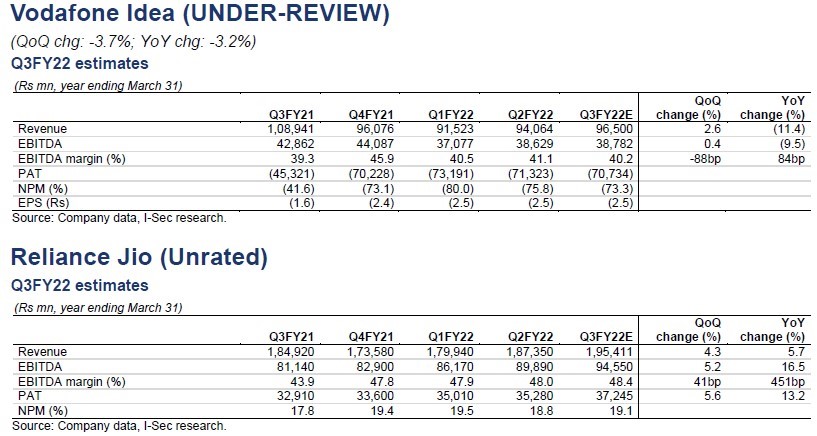

• VIL’s EBITDA to rise 0.4% QoQ to Rs38.8bn. VIL’s revenue is expected to rise 2.6% QoQ to Rs97bn. This would be due to continued loss of subs (down 5mn). EBITDA is expected to be flattish QoQ due to one-off gain of Rs1.5bn in Q2FY22, and higher marketing spend. Net loss seen at Rs71bn for VIL (nil tax rebate).

• RJio’s EBITDA to rise 5.2% QoQ. RJio’s revenue is likely to grow 4.3% QoQ to Rs195bn on tariff hike benefit in mobile services, and consistent addition of FTTH subs. EBITDA to grow 5.2% QoQ to Rs95bn with incremental EBITDA margin at 58%. However, net profit is likely to rise only 5.6% QoQ to Rs37bn on recognition of amortisation and interest cost on Rs571bn spectrum bought in Mar’21 auction.

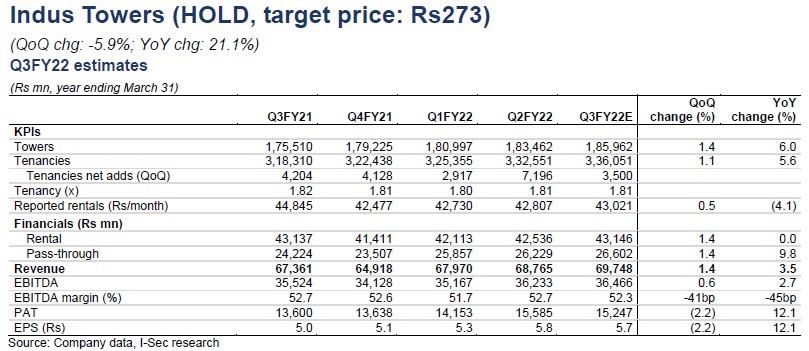

• Indus’ tenancies to rise by 3,500. Rental per tenant may rise 0.5% QoQ to Rs43,021 benefitting from rise in single-tenant tower which earns much higher rental/tenant. Rental revenue to rise 1.4% QoQ (flattish YoY) to Rs43bn. EBITDA is likely to rise 0.6% QoQ (+2.7% YoY) to Rs36bn which continues to be impacted from nil spreads in energy and QoQ rise in other expenses. We expect net profit to drop 2% QoQ (on higher tax rate) but rise 12% YoY to Rs15bn.

• TCom’s EBITDA to rise 3.5% QoQ to Rs11bn (excl. real estate). Voice revenues may drop 2.0% QoQ and EBITDA margin may be 6.5%. We estimate data revenues to rise 3% QoQ (3.3% YoY) where execution pick-up is gradual than expected. EBITDA margin is likely to remain stable QoQ at 29.2%. We estimate net profit at Rs4.3bn.

• Indus’ tenancies to rise by 3,500. Rental per tenant may rise 0.5% QoQ to Rs43,021 benefitting from rise in single-tenant tower which earns much higher rental/tenant. Rental revenue to rise 1.4% QoQ (flattish YoY) to Rs43bn. EBITDA is likely to rise 0.6% QoQ (+2.7% YoY) to Rs36bn which continues to be impacted from nil spreads in energy and QoQ rise in other expenses. We expect net profit to drop 2% QoQ (on higher tax rate) but rise 12% YoY to Rs15bn.

• TCom’s EBITDA to rise 3.5% QoQ to Rs11bn (excl. real estate). Voice revenues may drop 2.0% QoQ and EBITDA margin may be 6.5%. We estimate data revenues to rise 3% QoQ (3.3% YoY) where execution pick-up is gradual than expected. EBITDA margin is likely to remain stable QoQ at 29.2%. We estimate net profit at Rs4.3bn.

CT Bureau

You must be logged in to post a comment Login