Company News

STMicroelectronics reports 2022 first quarter financial results

STMicroelectronics a global semiconductor leader serving customers across the spectrum of electronics applications, reported U.S. GAAP financial results for the first quarter ended April 2, 2022. This press release also contains non-U.S. GAAP measures (see Appendix for additional information).

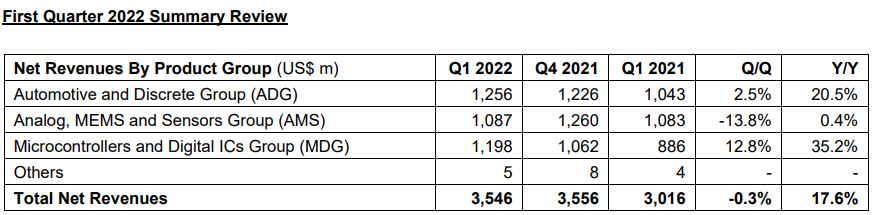

ST reported first quarter net revenues of $3.55 billion, gross margin of 46.7%, operating margin of 24.7%, and net income of $747 million or $0.79 diluted earnings per share.

Jean-Marc Chery, STMicroelectronics President & CEO, commented:

- “Q1 net revenues of $3.55 billion and gross margin of 46.7% came in above the mid-point of our business outlook range. This revenue performance, driven by strong demand in microcontrollers, was partially offset by temporarily reduced operations at our Shenzhen, China manufacturing facility due to the pandemic.

- “On a year-over-year basis, Q1 net revenues increased 17.6%, operating margin increased to 24.7% from 14.6% and net income more than doubled to $747 million.

- “ST’s second quarter outlook, at the mid-point, is for net revenues of $3.75 billion, increasing year-over-year by 25.3% and sequentially by 5.8%; gross margin is expected to be about 46.0%.

- “We continue to drive the Company based on a plan for FY22 revenues in the range of $14.8 billion to $15.3 billion.”

Net revenues totaled $3.55 billion, a year-over-year increase of 17.6%. On a year-over-year basis, the Company recorded higher net sales in all product groups except the Imaging sub-group, as expected. Year-over-year net sales to OEMs and Distribution increased 14.4% and 24.0%, respectively. On a sequential basis, net revenues decreased 0.3%, 130 basis points above the mid-point of the Company’s guidance. ADG and MDG reported increases in net revenues on a sequential basis while AMS decreased, as expected.

Gross profit totaled $1.65 billion, a year-over-year increase of 40.8%. Gross margin of 46.7% increased 770 basis points year-over-year, principally due to improved product mix and favorable pricing, and was 170 basis points above the midpoint of the Company’s guidance.

Operating income increased 99.5% to $877 million, compared to $440 million in the year-ago quarter. The Company’s operating margin increased 1,010 basis points on a year-over-year basis to 24.7% of net revenues, compared to 14.6% in the 2021 first quarter.

By product group, compared with the year-ago quarter:

Automotive and Discrete Group (ADG):

- Revenue increased in both Automotive and in Power Discrete.

- Operating profit increased by 175.1% to $235 million. Operating margin was 18.7% compared to 8.2%.

Analog, MEMS and Sensors Group (AMS):

- Revenue increased in both Analog and MEMS and decreased in Imaging.

- Operating profit increased by 31.5% to $246 million. Operating margin was 22.6% compared to 17.2%.

Microcontrollers and Digital ICs Group (MDG):

- Revenue increased in both Microcontrollers and in RF Communications.

- Operating profit increased by 137.3% to $407 million. Operating margin was 34.0% compared to 19.4%.

Net income and diluted earnings per share increased to $747 million and $0.79, respectively, compared to $364 million and $0.39, respectively, in the year-ago quarter. Following the adoption of the new U.S. GAAP reporting guidance applicable to convertible debt effective January 1, 2022, Q1 2022 net income does not include phantom interests associated with convertible bonds and diluted earnings per share reflects the full dilutive effect of outstanding convertible bonds. Prior periods have not been restated.

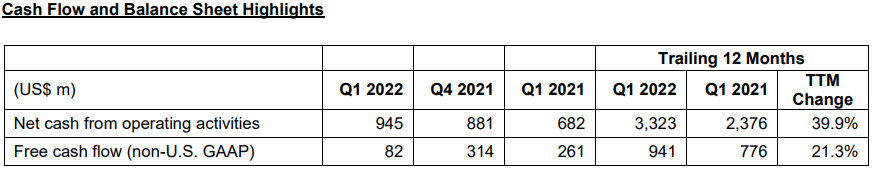

Capital expenditure payments, net of proceeds from sales, were $840 million in the first quarter. In the year-ago quarter, capital expenditures, net, were $405 million.

Inventory at the end of the first quarter was $2.15 billion, compared to $1.84 billion in the year-ago quarter. Day sales of inventory at quarter-end was 104 days compared to 91 days in the year-ago quarter.

Free cash flow (non-U.S. GAAP) was $82 million in the first quarter, compared to $261 million in the year-ago quarter.

In the first quarter, the Company paid cash dividends to its stockholders totaling $49 million and executed a $86 million share buy-back as part of its current share repurchase program.

ST’s net financial position (non-U.S. GAAP) was $840 million at April 2, 2022 and reflected total liquidity of $3.4 billion and total financial debt of $2.6 billion, including a $107 million increase in total financial debt in connection with the adoption on January 1, 2022 of the new U.S. GAAP reporting guidance applicable to convertible debt. Prior periods have not been restated. At December 31, 2021 ST’s net financial position (non-U.S. GAAP) was $977 million.

CT Bureau

You must be logged in to post a comment Login