Industry

Sterlite Technologies Limited

STL is all set to play a pivotal role in this decade of network creation. The company recently shared its ambition of becoming one of the top 3 optical players globally.

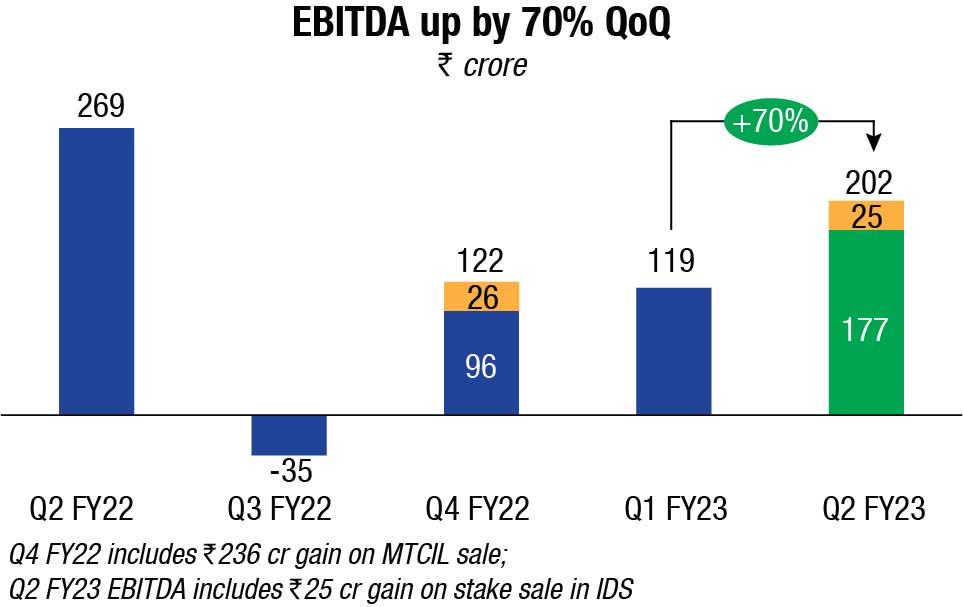

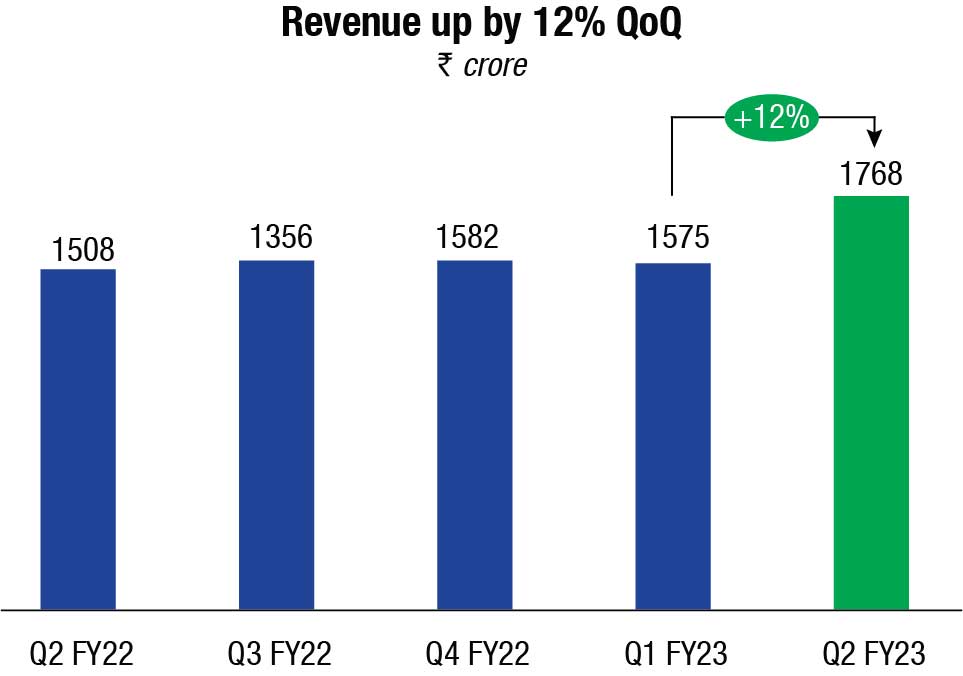

In Q2 FY23, STL reported profitable growth with revenues of ₹1768 crore, up by 12-percent QoQ and 17-percent YoY. Nearly 70 percent of revenue came from Americas and Europe.

STL is exhibiting global growth and consistently gaining market share in its key markets., STL now holds 11 percent of the global OFC market share (ex-China). Also, STL’s traction on the Optical Interconnect business has increased. The Optical Interconnect attach rate (the attach rate is the number of dollars of the Optical Interconnect sold, for every dollar of cable sold) has increased from 3 percent in FY21 to 11 percent in FY22, and the target is to increase it further

5G, FTTH and data center rollouts are picking up pace globally and optical demand is on a strong upward trajectory, with the optical fiber cable market size expected to reach USD 10 billion by 2024. India’s much awaited 5G rollout has started and will strongly hinge on fiber with telcos planning to lay ~2,00,000 cable kilometers and spend between USD 1.5 billion to USD 2.5 billion on fiber roll-out in next 2 to 3 years. STL has already made strategic investments for this demand cycle and is playing a pivotal role in this ongoing decade of network creation, both in India and internationally.

At the recently held India Mobile Congress 2022 in New Delhi, India, STL announced a breakthrough innovation in the optical fiber developed at the STL Center of Excellence, India’s first multicore fiber and cable. The multicore fiber has 4 times the transmission capacity than a normal fiber, with essentially the same diameter and other parameters. This optical fiber reduces cable surface area by 75 percent in plastic and the plastic in the ground by around 10 percent. STL launched the Gram Galaxy solution too, that will enable faster, and highly scalable rural network buildouts. The vendor also unveiled 5G Cosmos, an optical solution for towers and small cells that lends speed to the 5G rollout.

Ankit Agarwal

Ankit Agarwal

Managing Director,

STL

The world has now recognised broadband as a basic necessity. 5G, FTTH, and rural connectivity efforts are all coinciding to connect the remaining 40 percent of the world. Fiberisation is going to be front and centre in this decade of network creation and STL is fully prepared to meet this demand with global capacities, great talent and technology-led solutions. We are constantly innovating to build these networks fast and in the most sustainable way.

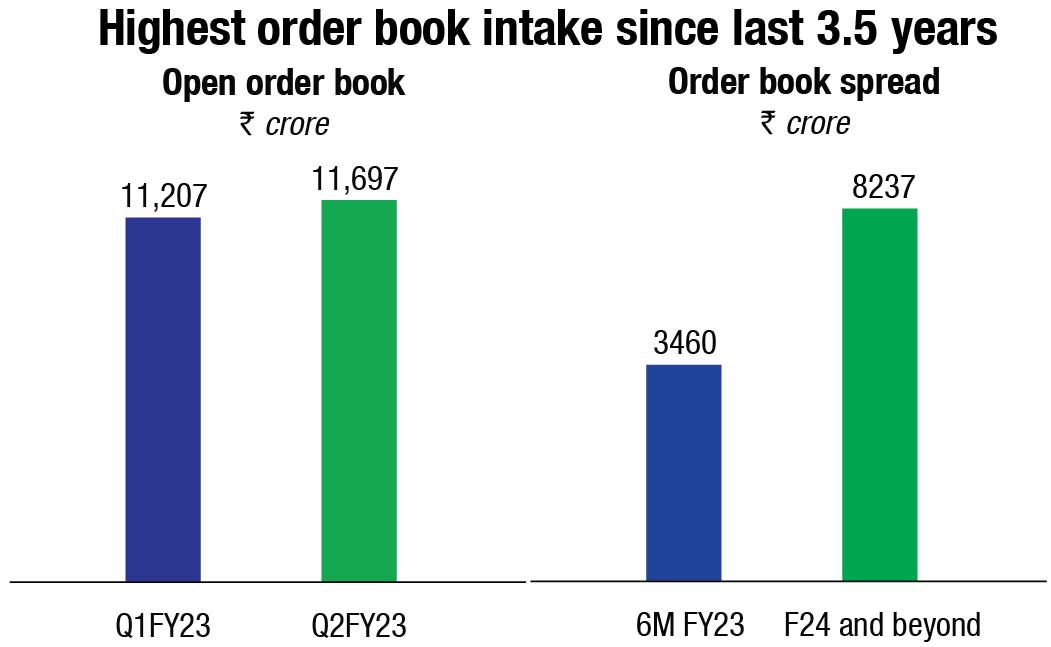

We hold our purpose of transforming billions of lives very close to our hearts and are very excited about this opportunity to connect the unconnected. This quarter saw one of the highest order intakes of ₹3,200 crore. I really want to congratulate the entire team for delivering such a strong performance in a complex operating environment. There is good traction for our solutions, and we believe that our focused efforts will create stakeholder value and bring us closer to being amongst the top 3 optical players globally.

In the Global Services business, STL is building a profitable order book by picking projects in its focus segments. And the company has secured a good order book in India and UK and increased its execution pace. In Q2 FY23, STL delivered revenue of ₹463 crore, which is 11-percent higher quarter-on-quarter.

In terms of production facilities overseas, the one in the US that has come up now, is poised to be a world class optical fiber cable facility. Similarly, in China, the company is restarting operations and plans to scale these up, reaching full capacity utilization by Q1 FY24.

In line with the strategy to focus on selective segments, STL has divested the IDS business in Q2 FY23 and sold its stake to Hexatronic Group.

In terms of capital allocation, the priority is investments in the optical business. STL is investing in OFC capacity expansion, Optical Interconnect expansion and new product development. It has improved margins and working capital cycle in the optical business.

STL’s financials continue to improve. Its open order book at end of Q2 FY23 has gone up to ₹11,697 crore, having secured a new order book close to ₹3200 crore in the quarter, the highest order intake in the last 3.5 years. Its revenue mix is shifting to customer segments of priority, with the share in telco and cloud segment increasing.

In terms of notable wins in Q2 FY23, apart from the multimillion dollar contract of cables in Americas and for Optical Interconnect in Europe, STL has also secured multiple other new orders. In the European market, new orders for the Optical Interconnect solutions from an alternate player have been secured. The company is collaborating with Vocus Group in Australia to provide optical fiber cables.

STL has started building new capability to pivot from network software to digital business. The company expects the operating profit to improve by ₹40-50 crore in this segment by Q4 FY23. In Q2 FY23, the revenue for this unit stood at ₹40 crore in Q2 FY23, the combined operating loss for this segment was ₹102 crore for the quarter attributable to higher initial manpower cost in the digital business.

In terms of cash flow, the net debt has gone up by about ₹457 crore in H1 FY23, mostly due to increase in contract assets of ongoing projects in the services business. The cash generated from operations and net investment inflow helped in payment of CapEx and dividends. Optical business has funded its growth itself by improving margins and working capital days.

Moving forward, the vendor is working to release cash from working capital, particularly from services business. With the completion of large existing public projects like T-Fiber and collection of completed projects coming through, this can be achieved. The target is to reduce net debt to EBITDA by Q4 FY23. Also, as production in the US and China is ramped up, the management does not see any significant debt increase from these levels. In terms of credit rating, STL has a stable credit rating at AA.

You must be logged in to post a comment Login