Headlines of the Day

Revenue growth aided by tariff hike

TRAI released its Telecom quarterly financial data for 3QFY22. Below are the key highlights:

Steady revenue growth – Bharti and RJio are key gainers

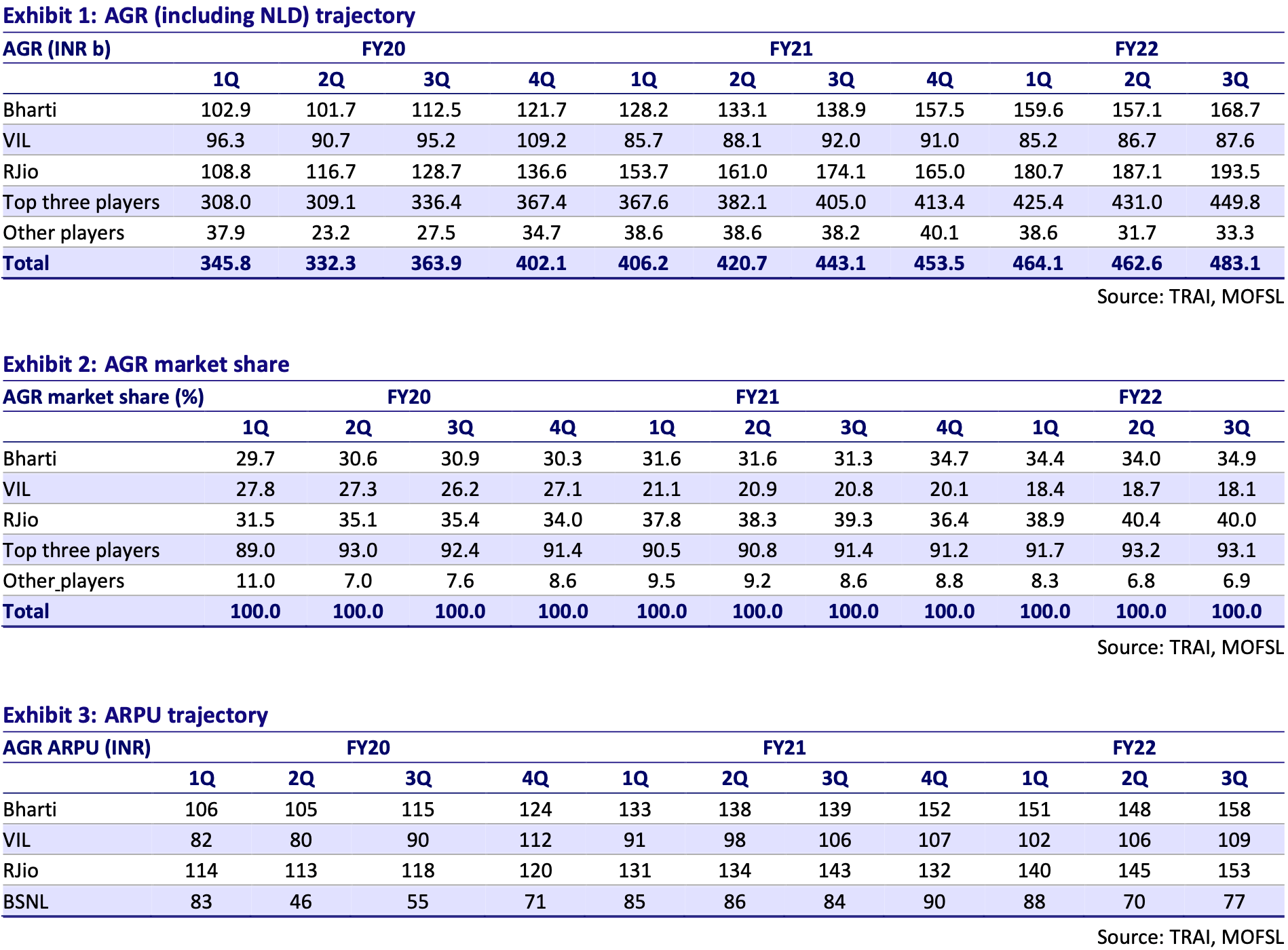

The Telecom industry grew 4% QoQ (AGR including NLD), backed by the tariff hikes announced in Dec’21 by all the three telcos. Bharti/RJio witnessed 7%/3% QoQ growth, adjusted for Bharti’s INR15b spectrum sale to RJio (in Mumbai, Delhi, and Andhra Pradesh), of which INR10b was received upfront, while the rest was through transfer of deferred spectrum liability. Subsequently, Bharti/RJio have garnered 34.9%/40% market share (AGR including NLD). Bharti gained 90bp market share reaching 34.9%, its highest ever.

Bharti and RJio consolidate their position

The industry in witnessing consolidation of SIM cards as is evident from the flux in subscribers (overall subscribers fell 1% QoQ). Industry AGR ARPUs grew 6.8% QoQ. Bharti and RJio have been the key beneficiary of the 2% QoQ fall in VIL’s subscribers, diluting the 2% ARPU growth accruing from the tariff hike and translating in a mere 1% QoQ AGR revenue growth. Bharti saw a 6.8% ARPU growth and was able to maintain its subscriber base at 355.6m as it was the key beneficiary of the consolidation in SIM cards. Though RJio’s 6% QoQ ARPU was partly impacted by the 2% clean up in inactive SIM cards, it was able to grow overall revenue by 3%.

Bharti gains from VIL’s skew towards Metro and A circle

Bharti grew 10% QoQ in the Metro and A circle, faster than B and C circles. It gained 150bp in the Metro and A circle, adjusted for the spectrum sale payout to RJio in 2QFY22. Baring four circles – Gujarat, Uttar Pradesh (West), Haryana, and Bihar, it gained in each circle. VIL has grown in all circles, benefitting from the tariff hikes. Growth was higher in B/C circle at 4%/7%, but lower in the A circle. Subsequently, it lost market share in A and B circles. RJio remains the undisputed leader across Metro and A, B and C circles, but its market share plateaued in 3QFY22.

Valuation

Bharti: With Google’s fund infusion of INR52b and strong operating cash flow from tariff hikes, Bharti should see a healthy deleveraging of INR80-100b (6%) and sustained annual deleveraging of INR200b (15-20%) going forward. We see potential re-rating upsides in both the India and Africa businesses, aided by steady earnings growth. Assigning a FY24E EV/EBITDA of 10x/5x to Bharti’s India Mobile/Africa business, we arrive at our SoTP-based TP of INR910.

VIL: The significant amount of cash required to service its debt leaves a limited upside for equity shareholders, despite the higher operating leverage opportunity from any source of ARPU increase. Its low EBITDA would make it challenging to service its debt without an external fund infusion. Assuming 10x EV/EBITDA and a net debt of INR1,975b, leaves a limited opportunity for its equity shareholders.

RJio will reap the benefit of tariff hikes accruing in the near term as we see healthy ARPU improvement. We assign an EV/EBITDA multiple of 17x on Mar’24E EBITDA, arriving at TP of INR890/share (for its 66% stake). The higher multiple captures the revenue opportunity in Digital, potential tariff hikes, and steady market share gains.

A Motilal Oswal Financial Securities report

You must be logged in to post a comment Login