Headlines of the Day

Reliance Jio -Revenue growth fails to impress, ICICI Securities

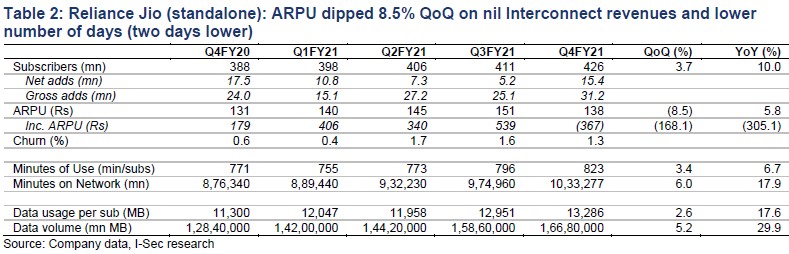

In Q4FY21, Reliance Jio Infocomm had multiple misses on the revenue front: 1) underlying revenue growth was just 1.7% QoQ, slowest since commercial launch; 2) adjusting for FTTH, mobile revenues grew by just ~1%; and 3) digital revenues (JPL consolidated minus RJio) dipped 6.4% QoQ. Though the company had strong subscriber (sub) addition of 15.4mn, they would have come at low ARPU, restricting revenue recovery. For FY21, RJio generated FCFE of Rs37bn (restricted due to capex of Rs261bn), which included upfront spectrum payment of Rs150bn. Net debt stood at Rs290bn and, if we include the entire spectrum commitment, it stood at Rs726bn. Capitalised capex was Rs150bn in FY21 (21.4% of revenues). We have cut our FY22E/FY23E revenues by 2.4% each year on slower revenue growth, but see tariff hike helping drive growth, likely in H2FY22E.

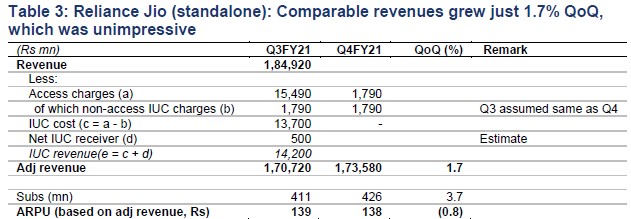

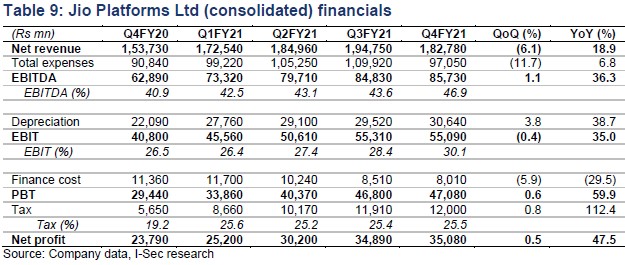

- Reliance Jio Infocomm (RJio) L2L revenues grew only 1.7% QoQ. In Q4FY21, revenues declined by 6.1% QoQ due to: 1) interconnect charges moving to ‘book & keep’ regime w.e.f. 1st Jan’21, which implies nil interconnect revenues; and 2) two days’ less in the quarter. Our L2L revenues for Q3FY21 was derived from deducting interconnect revenues, which is calculated from access charges adjusted for non-IUC revenues, and adding the Rs0.5bn received in net interconnect settlement. It shows RJio’s revenues grew by just 1.7% QoQ to Rs174bn, and L2L ARPU (excl. interconnect revenues) dipped by 0.8% QoQ to Rs138. Sub-base expanded by 15.4mn, likely helped by new tariff plan launch on Jiophone (at 18-33% discount); however, absolute ARPU (post GST) comes to just Rs46-56 (33-40% of blended ARPU) from the Jiophone users.

FTTH subs addition should have been steady at 1.8mn-1.9mn for Q4FY21 on the base of 2.1mn in Q3FY21. If we adjust for FTTH revenues, then, underlying mobile revenues should have grown at only ~1% QoQ, which indicates RJio may be running into a risk of revenue market share loss in Q4FY21.

- Engagement metrics have improved. Churn rate dipped to 1.3% (vs 1.6% in Q3FY21) improving its subs retention rate, while gross subs addition increased to 31.2mn (from 25.1mn in Q3FY21). Minutes grew 6% QoQ / 17.9% YoY to 1,033-bn, and data usage rose by 5.2% QoQ / 29.9% YoY to 16,680-bn GB.

- Network cost inflation was lower, aiding EBITDA growth. Network cost grew by only 1.8% QoQ, but increased by 26.2% YoY, to Rs57.5bn in Q4FY21. LF/SUC cost fell 4.3% QoQ despite rise in revenues, implying some likely one-off gains. EBITDA grew 2.2% QoQ / 34% YoY to Rs83bn, and net profit too grew 2.1% QoQ, though it was restricted by rise in depreciation.

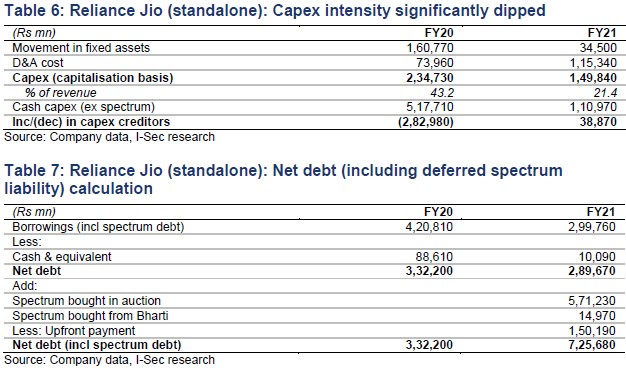

- Capex (excluding spectrum) has normalised. Cash capex was Rs261bn in FY21 though it includes Rs150bn upfront payment towards spectrum. Thus, capex towards network, including cost capitalisation, was Rs111bn. Capitalised capex, calculated basis movement of fixed assets plus depreciation, was Rs150bn (21.4% of revenues) in FY21. Therefore, the difference between capitalised capex and cash capex is rise in capex creditor of Rs39bn. Capitalised capex in FY20 was Rs235bn (43.2% of revenues). However, RJio is still carrying high capital works in progress despite commercial rollout of FTTH / enterprise business, which was at Rs170bn in FY21 (but dipped from Rs213bn in FY20).

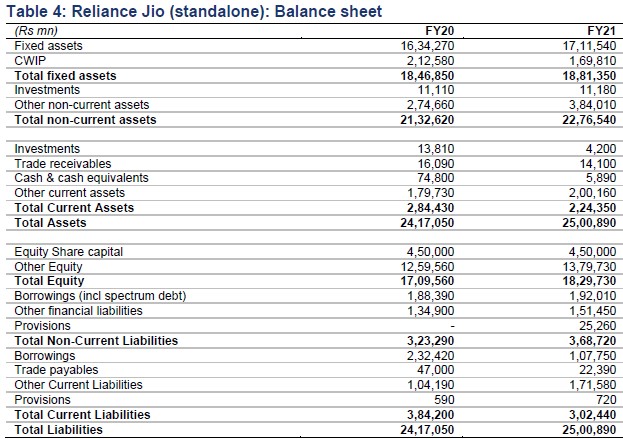

- Balance sheet remains healthy; net debt rose on spectrum purchase. RJio net debt (including deferred spectrum liability) in FY21 was at Rs290bn (vs Rs332bn in FY20). It has bid for spectrum worth Rs571bn in Mar’21 auction and has agreed to buy Rs15bn worth of spectrum from Bharti. It has made Rs150bn upfront payment, which is reflected in capex and sits in other non-current assets. However, it has not recognised other spectrum liabilities pending spectrum allocation. If we include the entire committed spectrum payment, then the net debt would jump to Rs726bn.

We estimate capex creditors should have gone up from Rs44bn in FY20 to Rs82bn in FY21, and interest accrued but not paid (on deferred spectrum liability) should increase to Rs85bn from Rs70bn in FY20. These items don’t form part of our net debt calculation.

- RJio needs tariff hikes to offset higher cost inflation. Network cost rose 30% in FY21 to Rs221bn and, considering rise in payment to tower and fiber InvIT, we estimate network cost inflation to remain high even in the next two years at least, not considering 5G rollout. Further, the recent spectrum purchase would add Rs29bn to D&A cost and Rs27bn to finance cost, which together are 8% of revenues. In case of low revenue growth as in Q4FY21, we see RJio running a risk of significant earnings decline in FY22. We believe the company will also need tariff hikes to maintain earnings growth momentum, which we have built-in for H2FY22E.

CT Bureau

You must be logged in to post a comment Login