Headlines of the Day

Recession-resilient growth drivers, ICICI Securities

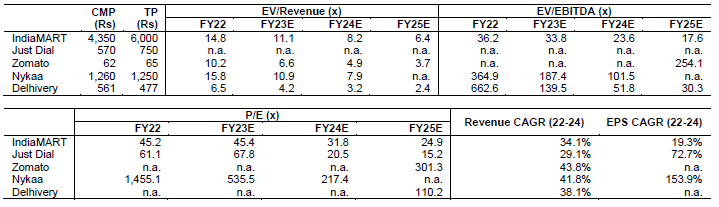

According to our proprietary model, B2B e-commerce total addressable market (TAM) is poised for a CAGR of ~55.8% over FY23E-FY25E. However, IndiaMART and Just Dial, the two listed stocks in the space, have corrected by ~55% and ~40% over the past one year. On the other hand, strategic investors and private financial investors have turned bullish on the space. In our view, this divergence is unlikely to last much longer. We expect both IndiaMart and JustDial to outperform the broader markets over the next year given their large exposure to the fast growing B2B e-commerce space.

What will drive growth in the segment?

We have built a proprietary bottom-up model to predict growth of the eB2B space across different sub-segments. We estimate penetration led growth in the segment as digital penetration of B2B space is expected to increase to 2.3% in FY25E from 1.2% in FY23E. The resultant marketplace revenue opportunity is likely to increase to US$16.5bn from US$6.8bn during the same period at a CAGR of 55.4% (base case). Our revenue opportunity assumption in downside case is 27.6% CAGR and that in upside case is 82.1%. Our underlying GDP assumption for FY23-FY25E is: i) average growth 6% YoY (base case), ii) 2% YoY (downside case), and iii) 9% YoY (upside case). For more details, please refer model methodology.

Why now?

The MSME space, which is one of the key focus areas of the India government in terms of employment generation over the next decade, had been hit hard by the pandemic. The overall contribution from the informal segment (a large proportion of the MSME space) has declined as its proportion of GVA fell to ~11% from ~13% over the past 2 years. As the MSME space recovers, we observe a sharp increase in the adoption of online channels .

Stock implications

Large exposure

We reinitiate coverage on IndiaMART with a BUY rating and target price of Rs6,000 (~38% upside)

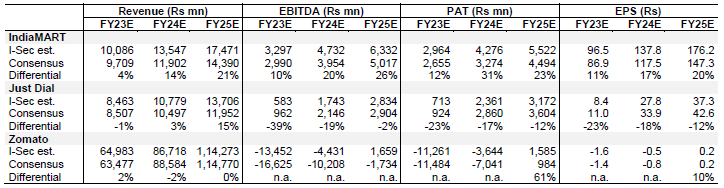

We believe IndiaMART is likely to deliver strong revenue growth trajectory in FY23E (~34% YoY) despite declining margins as the company hires aggressively to capture growth in the discovery and classifieds space over FY23E-FY25E (Industry CAGR of ~64.6%). We believe the margins reported in FY22 were one-off and we are not overtly concerned with likely decline in FY23E. We expect margins to improve in FY24E/FY25E as the increased collections arising from investments in the workforce start to reflect in revenue. We estimate ~350bps EBITDA margin improvement from FY23E to FY25E. The stock has already corrected ~55% over the last year and, at current valuations of ~37x 1-year forward EV/EBITDA, we think it is a compelling BUY, given relatively attractive growth prospects. We value the stock at ~34x FY24E EV/EBITDA. We believe the stock at current valuations has a favourable risk-reward ratio of 3.1:1 (heavily skewed to the upside).

Reinitiate on Just Dial with BUY and target price of Rs750 (~32%upside)

Just Dial now has ~26% revenue exposure to the B2B e-commerce segment. We think this is likely to be the primary growth driver for the company and estimated to increase to ~36% of overall revenue by FY25E aided by growth in the segment. The stock has corrected ~40% in the last year due to concerns regarding growth prospects and fears that the parent may delist the entity. However, we think these concerns are overpriced into the stock and current valuations at ~3.8x 1-year forward EV/EBITDA provide a good opportunity to BUY. Given the compelling risk-reward skew (4.7:1), we reinitiate coverage on Just Dial with a BUY rating and a target price of Rs750. We value the stock at ~7x FY24E EV/EBITDA.

Limited exposure

We reinitiate on Zomato with HOLD rating and target price of Rs65

We think adhering to the management’s guidance for attaining EBITDA-breakeven for the Zomato business by Q1FY24 would require careful calibration of employee expenses and marketing spends. We estimate pre-ESOP EBITDA margin of -1.3% for FY24E (breakeven from Q3). The Hyperpure business (the B2B e-commerce vertical of Zomato) is likely to benefit from the growth in the overall segment. However, scale-up of Hyperpure will be contingent on significant investments into building refrigerated supply-chains and technology used for tagging and batching of fresh farm produce. We reinitiate coverage with a HOLD rating on the stock given the uncertainties around integration of Blinkit and its impact on profitability. We arrive at a DCF based target price of Rs65 on the basis of WACC 12.5% and terminal growth 5% assumptions. At current valuations, we believe risk reward is evenly balanced (1.3:1).

Maintain HOLD on FSN e-commerce ventures with target price of Rs1,250

Nykaa continues to invest in growing new businesses along with having resilient unit economics of BPC and fashion vertical driven by focus towards driving higher conversion and quality traffic. Further, investments in the differentiated value proposition of content, curation and convenience are yielding result. We model revenue and EBITDA CAGRs of 42% and 90% respectively over FY22-FY24E. Maintain HOLD rating with a revised DCF-based target price of Rs1,250 (from Rs1,400).

Maintain SELL on Delhivery with target price of Rs477

We value the stock at 30x FY26E (at our base case where we see Delhivery capture ~25% of the profit pool) and discount the same by 2 years (CoE assumed at 10%). At our base case, we value the stock at 2.7x/2.0x EV/sales for FY24E/FY25E. This appears reasonably valued compared to the Indian internet players, while appearing expensive as compared to global delivery / Chinese delivery players (exceptions being ZTO, Blue Dart, TCIE and Concor) – presumably due to high embedded growth. Maintain SELL rating with a revised target price of Rs477 (from Rs484).

For report, https://www.communicationstoday.co.in/recession-resilient-growth-drivers/

CT Bureau

You must be logged in to post a comment Login