Trends

Premium Smartphone Market Collapses 8% In Q1 2019, Apple Shipments Drop 20%

Posted by Counterpoint Research

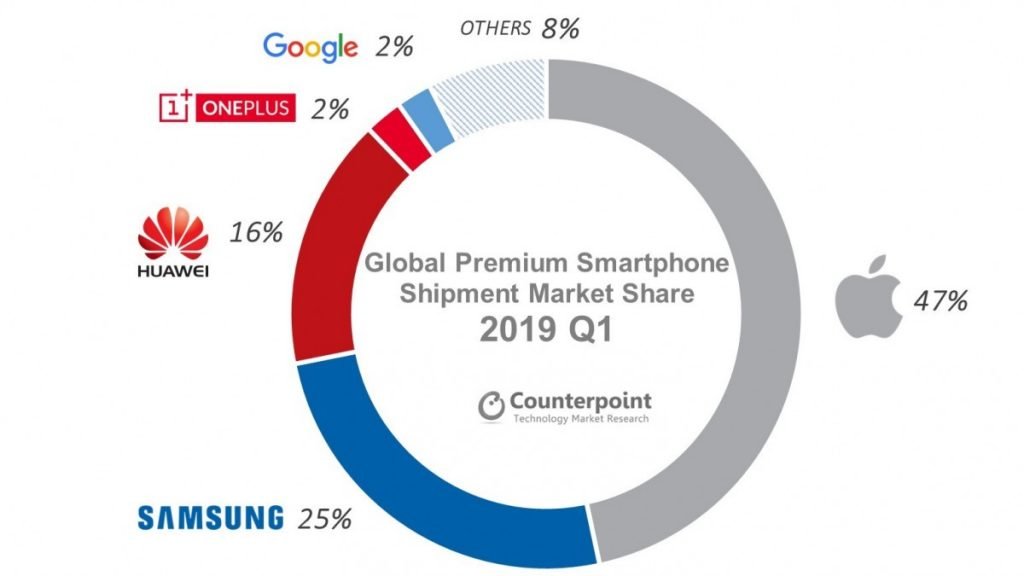

Apple’s declining shipments has pulled down the global smartphone premium segment. Data from Counterpoint Research’s Market Monitor Service for Q1 2019, shows that Apple’s shipments fell 20% year-on-year in Q1 2019, resulting in an 8% YoY decline for the global premium segment. However, as Apple is losing ground, Samsung is gaining share. During the quarter, Samsung ended up with one-fourth of the global premium segment, its highest ever share over the past year. This was also the first time when Samsung launched three devices instead of the usual two in its S series, thus covering wider price points.

According to our analysis, the trend of users holding onto their iPhones for longer has affected Apple’s shipments. The replacement cycle for iPhones has grown to over three years, on an average, from two years. On the other hand, substantial design changes in the Galaxy S10 series and the better value proposition it offers compared to high-end iPhones helped Samsung close the gap to Apple in the global premium segment.

Apart from Apple’s falling shipments, the sluggishness of the Chinese market was the other key reason for the decline in the global premium segment. Our estimates suggest that almost half of the decline in the global premium segment in Q1 2019 was due to the sluggish Chinese market. However, we expect that as 5G begins to commercialize in the future, the premium segment will grow. In 2019 and 2020, all the 5G devices are expected to launch in the premium segment.

Huawei also captured a double-digit share in the highly concentrated premium market. Impeccable camera quality, AI technology, and superior build quality of its flagship mate and P series drove the growth for Huawei during the quarter. Huawei even surpassed Apple to become the top player in the premium smartphone market in China – a market where Apple has been struggling.

However, the trade ban imposed by the US will restrict its continued global growth. The premium segment contributes to 18% of Huawei’s smartphone shipments. However, these are the most profitable price bands, and declining sales here will cripple Huawei’s marketing capability and R&D investment budgets for the future. Samsung and Apple are expected to gain from the gap created by Huawei in the future.

The premium segment remains the most difficult for OEMs to penetrate as it requires brand power to command such a high price across the world, which only a few OEMs possess. The top three players alone capture 88% of the market share in the premium market.

One of the brands that have managed to break into the premium segment is OnePlus, which continued to hold its position in the top five globally backed by OnePlus 6T. The momentum gained would help OnePlus 7, which is likely to outperform the 6 series. OnePlus has been steadily growing in Western Europe. It also held the second position in the premium segment in India, and the OnePlus 6T remained the best-selling premium smartphone during Q1 2019 in the country, a title it has held since its launch. OnePlus also entered in top five in the North American (NAM) market in Q1 2019. This was the second consecutive quarter when OnePlus featured amongst the top five brands in the premium segment globally.

In terms of region, NAM remains the largest market for premium devices with a 30% share of the global market, followed by China (26%) and Western Europe (17%). Chinese players are aggressively entering the European market, where competition is intensifying in the premium segment. Amid the decline, Canada (14%), Russia (15%), Mexico (46%) and Thailand (23%) are some of the markets which showed growth for the premium segment. ―CT Bureau

You must be logged in to post a comment Login