Trends

Outsourced TWS production shipments up 16% YoY in H1 2022

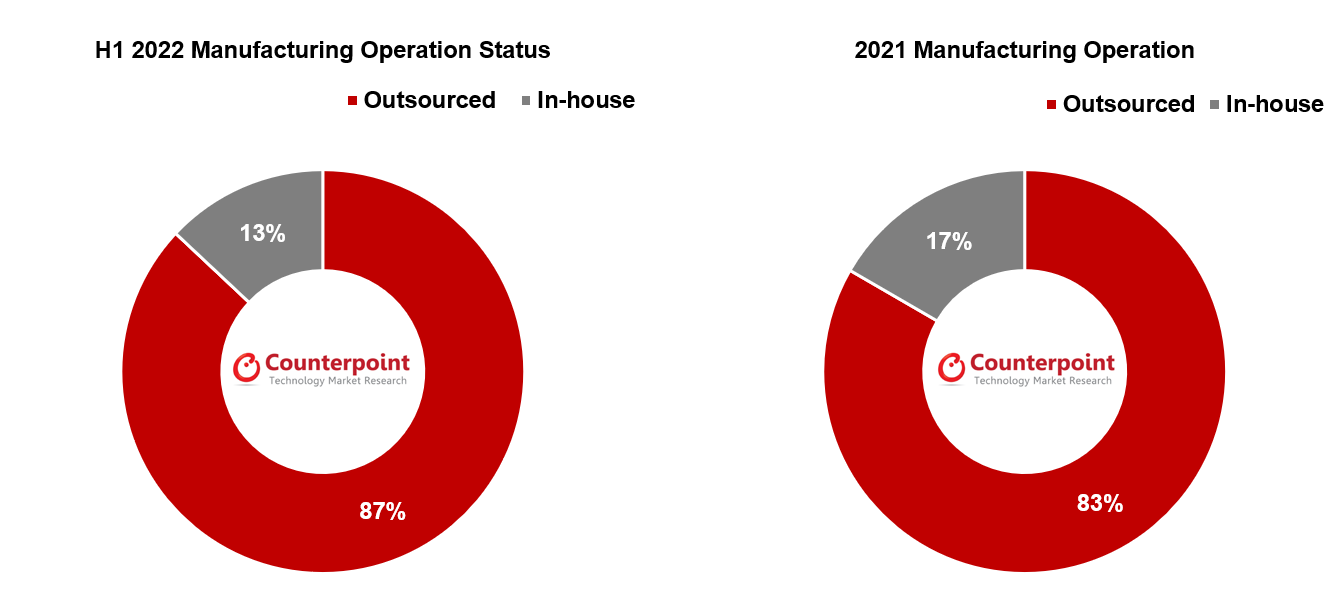

TWS shipments from outsourced manufacturing companies increased 16% YoY in H1 2022, according to Counterpoint Research’s Global TWS Hearables Manufacturing Tracker and Report, H1 2022. Meanwhile, total global TWS shipments grew 9.4% YoY in H1 2022. The share of TWS shipments from outsourced production (ODM/EMS) increased to 87% of total global TWS shipments in H1 2022 from 83% in 2021.

Commenting on the TWS market, Senior Research Analyst Shenghao Bai said, “Despite economic headwinds in H1 2022, the global TWS market continued to grow, especially in emerging markets. ODMs/EMSs stand to benefit from this growth trend because several key TWS brands rely on outsourced manufacturing.”

Senior Research Analyst Ivan Lam added, “Affordable TWS models were welcomed in H1 2022 as consumers tightened their purse strings in anticipation of a lurking recession. Brands such as boAt, Xiaomi and Skullcandy absorbed the demand for affordable TWS, mainly in Asia and Europe. The TWS production of these brands is completely outsourced. ODMs that mainly produce low-to-mid-end models registered more orders in H1 2022.”

Luxshare and Goertek remained the top-ranking ODMs/EMSs in the competitive global TWS landscape in H1 2022. The two companies jointly accounted for 33% of the global outsourced TWS manufacturing in H1 2022, down from 35% in H1 2021.

Commenting on the leading ODMs’ performances, Shenghao said, “Luxshare and Goertek both had higher shipments in H1 2022 due to the popularity of the Apple AirPods 3 and AirPods Pro. Luxshare will also benefit from Apple’s recently launched AirPods Pro 2. Among Tier-2 companies, Huaqin increased its cooperation with realme based on its partnership with Huawei, which boosted its TWS shipments in H1 2022. Huaqin will also continue to expand its cooperation with OPPO Group and HONOR to grow its TWS business. In H1 2022, Horn’s shipments increased due to strong orders from Skullcandy while Zhengrong’s growth was driven by Xiaomi’s new models.”

Diversification of manufacturing in the global electronics industry has continued. ODMs such as Cosonic, AAC and Zhengrong have been expanding their operations to Southeast Asia or India. These companies are also diversifiying their portfolios into other smart devices such as smartwatches, smart speakers and smart home devices.

Commenting on these trends, Ivan said, “To benefit from the growth of TWS in emerging markets, some Chinese ODMs are investing in more manufacturing sites overseas. Establishing local factories can help companies build connections with local clients more easily and capitalize on lower labor costs. Also, portfolio diversification can help ODMs stay ahead of competition and lower exposure to risks. We expect an acceleration in the expansion to regions outside China after COVID-19 restrictions are eased. However, one should be wary of limiting factors such as sub-optimal supply chain ecosystems and local policy risks.”

CT Bureau

You must be logged in to post a comment Login