Trends

Optical satellite market to reach USD 4.1 billion by 2028

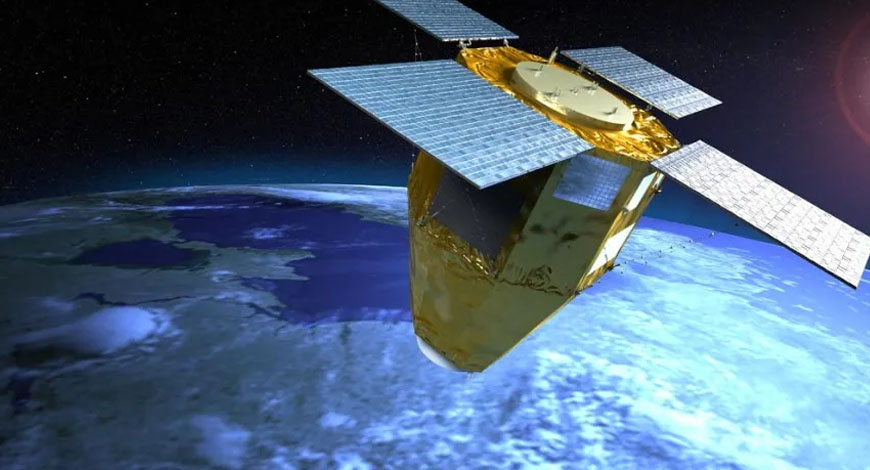

The optical satellite market is valued at USD 2.0 billion in 2023 and is projected to reach USD 4.1 billion by 2028, at a CAGR of 15.1% from 2023 to 2028, according to Research and Markets.

This market study covers the optical satellite market across various segments and subsegments. It aims to estimate this market’s size and growth potential across different parts based on size, operational orbits, application, component, end user, and region. This study also includes an in-depth competitive analysis of the key players in the market, their company profiles, key observations related to their product and business offerings, recent developments, and key market strategies they adopted.

Over the last few decades, the optical satellite industry has continued to evolve with expanding use cases, better cost efficiencies, and a more significant impact of new technological developments in satellites. The optical satellite market is experiencing growth driven by increasing communication and demand for high-resolution earth observation and imaging capabilities across multiple sectors, including agriculture, forestry, urban planning, disaster management, and defense.

Technological advancements, particularly in cost-effective, compact satellite platforms, are improving market accessibility. Growing involvement of commercial space enterprises and government investments in space infrastructure are stimulating competition and innovation.

Major companies profiled in the report include SpaceX (US), Lockheed Martin Corporation (US), Ball Corporation (US), Airbus Defene & Space (Germany), and L3Harris Technologies, Inc. (US), among others.

Based on application, the earth observation segment is estimated to have the second largest market share in 2023.

The earth observation segment in the optical satellite market is being driven by evolving global security dynamics. The Earth observation segment in the optical satellite market is being propelled by increasing demand for high-precision geospatial data across sectors like agriculture, urban planning, and environmental monitoring.

Technological advancements, particularly in cost-effective small satellite platforms, are expanding market accessibility. Growing environmental concerns, along with government and commercial investments in space infrastructure, underscore the need for optical satellites in monitoring and addressing environmental challenges. This competitive landscape is driving innovation and enhancing the market’s overall growth prospects.

Based on size, the small segment is estimated to have the second largest market share in 2023.

The small segment within the optical satellite market is being driven by cost-efficiency and versatility. The advancements in miniaturization and cost-effective satellite technology have lowered entry barriers, fostering heightened competition.

The escalating demand for precise Earth observation and imaging services in sectors such as agriculture, logistics, and environmental monitoring is bolstering the requirement for compact, agile satellites capable of delivering targeted data. This competitive landscape is propelling growth in the small satellite segment.

Based on regions, the Asia Pacific region is estimated to have the second largest market share in 2023.

The Asia Pacific region is witnessing robust growth in the optical satellite market driven by key business factors. The region’s thriving economies are generating increased demand for high-resolution Earth observation and imaging services across various industries. Governments in the region are making substantial investments in space infrastructure and satellite technology, which is accelerating the development and deployment of optical satellites.

Additionally, the presence of a rapidly expanding commercial space sector, particularly in countries like Japan and China, is intensifying competition and driving innovation, contributing to market expansion. Research and Markets

You must be logged in to post a comment Login