Industry

Nokia

Nokia creates technology that helps the world act together. Connectivity and digitalization play a critical role in helping to solve many of the world’s greatest challenges. The company’s sustainability strategy is focused on the areas that will have the greatest impact on sustainable development and its profitability: climate, integrity and culture.

Of Nokia Corporation’s total net sales of € 6241 million, Nokia India constituted € 281 million (₹2250 crore) in Q3 2022, and of total global sales of €5399 million, Nokia India constituted € 250 million (₹2156 crore) in Q3 2021. The India net sales in Q1-Q3 2022 was € 722 million (₹5780 crore), compared to € million 787 million (₹6785 crore), in Q1-Q3 2021, an 8 percent YoY decline.

Share of net sales of Nokia India in the overall sales declined from 4.98 percent in Q1-Q3 2021 to 4.13 percent in Q1-Q3 2022 and to 4.5 percent in Q3 2022 from 4.63 percent in Q3 2021.

There was a slight decline in net sales in Q3 2022 related to Mobile Networks, due to the timing of 5G licenses in India. It is expected to ramp up over the coming quarters.

In 2021, Nokia India had seen a 9 percent increase over 2020, from € 954 million (₹8514 crore), in 2020 to €1039 million (₹8751 crore), in 2021.

Nokia India has increased their inventory for upcoming deployments. The global company’s increase in inventories amounted to €480 million in Q3.

Nokia India has 12,000 net m2 productive capacity in Chennai and manufactures base stations, radio controllers and transmission systems. The company has about ~ 17000 employees.

The group subsidiaries in India include Nokia India Private Limited and Comptel Communications India Pvt Ltd.

|

Nokia India |

||

|

Net sales in (€ mn) |

||

| Period | Nokia India | Nokia Corporation |

| Jan-Sept 2022 | 722 | 17,462 |

| Jan-Sept 2021 | 787 | 15,788 |

| July-Sept 2022 | 281 | 6241 |

| July-Sept 2021 | 250 | 5399 |

| Jan-Dec 2021 | 1039 | 22,202 |

| Jan-Dec 2020 | 954 | 21,582 |

|

Net revenue to external customers |

||

| 2021 | 2020 | |

| Nokia India | 1039 | 954 |

| Nokia Corporation | 22,202 | 21,852 |

Pekka Lundmark

Pekka Lundmark

President and CEO,

Nokia

“Our third quarter performance demonstrates we are delivering on our ambition to accelerate growth.

This did include some catch up sales as supply chain constraints eased. However, we are seeing good traction in the market for our products, and in North America in particular we continued our strong performance, and we also grew in Latin America and Europe. One of the highlights of the quarter was seeing the 5G journey taking off in India, expected to ramp up strongly in 2023. Nokia secured important deals with the big players as Bharti Airtel and Reliance Jio. These deals strengthen our confidence that we are firmly on a path to grow faster than the market.

As we start to look beyond 2022, we recognize the increasing macro and geopolitical uncertainty within which we operate. While it could have an impact on some of our customers’ capex spending, we currently expect growth on a constant currency basis in our addressable markets in 2023. Considering our recent success in new 5G deals in regions like India which are expected to ramp up strongly in 2023, we believe we are firmly on a path to outperform the market and to make progress towards achieving our long-term margin targets.”

Nokia Corporation

Third quarter performance demonstrates the vendor is delivering on its ambition to accelerate growth. Net sales grew 6 percent in constant currency as supply constraints started to ease and it maintained good profitability with comparable operating margin of 10.5 percent. This was slightly down year-on-year, as improving profitability in Mobile Networks and Network Infrastructure was offset by timing effects of contract renewals in Nokia Technologies.

Mobile Networks saw a strong quarter, which grew 12 percent in constant currency as the vendor benefited from improved competitiveness and improving supply situation. Net sales growth remained robust also in Network Infrastructure at 5 percent, driven by continued strong underlying demand trends.

Cloud and Networks Services declined 3 percent as it worked to rebalance the portfolio, but with improving gross margin.

Nokia Technologies continued to deliver good progress in its patent licensing growth areas, such as automotive and consumer electronics. These areas, which were negligible in 2018, now contribute over €100 million in net sales in the past 12 months.

Enterprise net sales growth accelerated to 22 percent in constant currency. The vendor has strong momentum in Enterprise, including adding 30 new private wireless customers in the quarter and a further new IP Routing customer in webscale. With this momentum, Enterprise is expected to remain the fastest growing customer segment.

|

Nokia Corporation Financial Highlights Profit and loss statement (€ mn) |

||||

| Item | Q1-Q3’22 | Q1-Q3’21 | 2021 | |

| Net sales | 17,462 | 15,788 | 22,202 | |

| Gross margin % | 40.30 | 39.90 | 39.80 | |

| R&D expenses | (3328) | (3096) | (4214) | |

| Selling, general and administrative expenses | (2174) | (2034) | (2792) | |

| Operating profit | 1436 | 1418 | 2158 | |

| Operating margin % | 8.20 | 9 | 9.70 | |

| Profit for the period | 1107 | 965 | 1654 | |

| EPS, diluted | 0.19 | 0.17 | 0.29 | |

Nokia expects:

- To deliver a largely stable operating profit performance in 2022 (assuming the conclusion of some outstanding deals) and over the longer term;

- The net negative impact of Group Common and Other to be € 250 million in 2022 and over the longer term;

- In full year 2022, Nokia expects the free cash flow performance of Nokia Technologies to be approximately € 450 million lower than its operating profit, primarily due to prepayments received from certain licensees in previous years;

- Comparable financial income and expenses are now expected to be an expense of approximately € 50–150 million in full year 2022 and over the longer term. There is currently greater uncertainty due to the foreign exchange volatility and associated impacts;

- Comparable income tax expenses are expected to be approximately € 450 million in full year 2022 and over the longer term;

- Cash outflows related to income taxes are expected to be approximately € 400 million in full year 2022 and over the longer term; and

- Capital expenditures are expected to be approximately € 600 million in full year 2022 and around € 600 million over the longer term with some variation year-to-year.

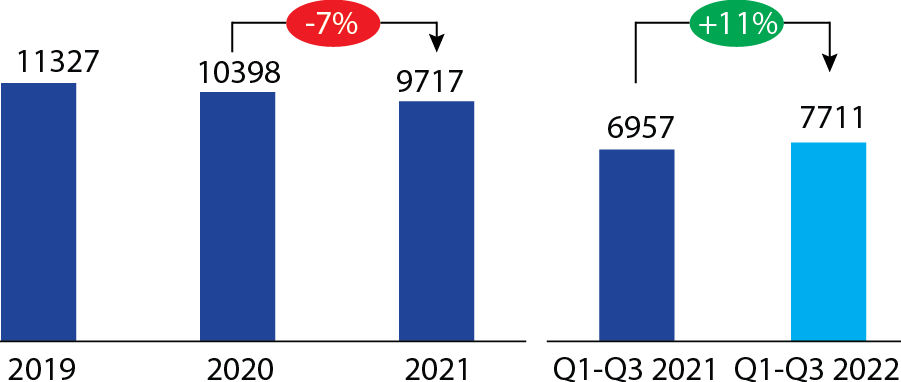

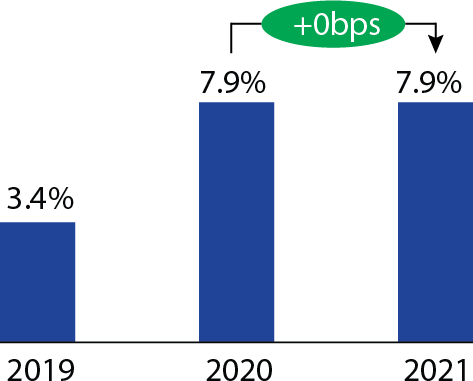

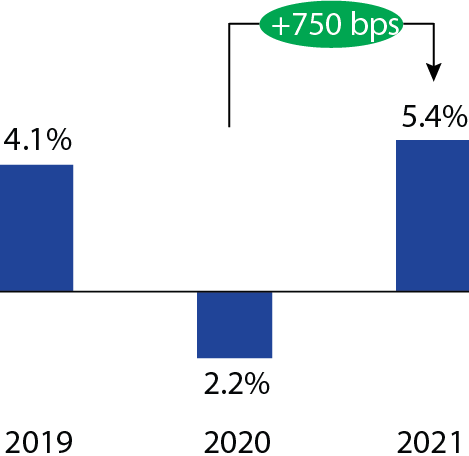

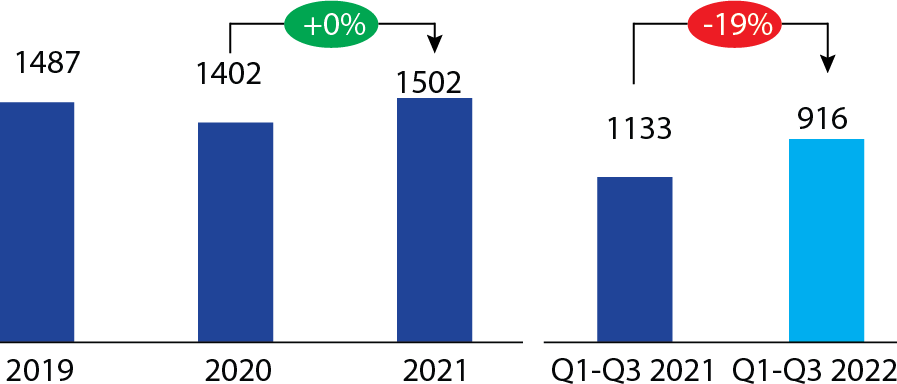

Mobile Networks

Mobile Networks provides products and services for radio access networks covering technologies from 2G to 5G, and microwave radio links for transport networks.

Segment net sales (€ mn)

Segment operating margin (%)

Outlook. As Nokia starts to look beyond 2022, the vendor recognizes the increasing macro and geopolitical uncertainty within which it operates. While it could have an impact on some of its customers’ CapEx spending, it currently expects growth on a constant-currency basis in its addressable markets in 2023. Considering recent success in new 5G deals in India, which are expected to ramp up strongly in 2023, Nokia believes it is firmly on a path to outperform the market and to make progress toward achieving its long-term margin targets.

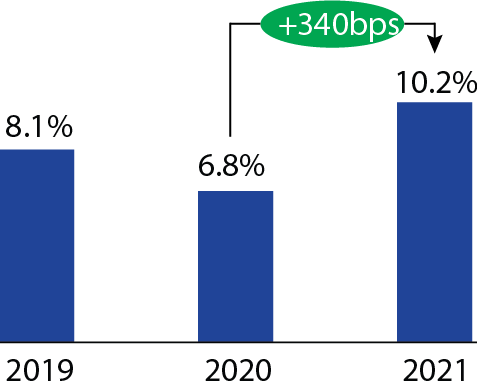

Network infrastructure

Network infrastructure provides fiber, copper, fixed wireless access technologies, IP routing, data center, subsea and terrestrial optical networks – along with related services – to customers including communications service providers, webscales (including hyperscalers), digital industries and governments.

|

Outlook – 2022 (€ mn) |

||

| Segment | Total addressable market | Assumptions |

| Mobile Networks | 52 | 6.5 to 9.5% |

| Network Infrastructure | 48 | 9.5 to 12.5% |

| Cloud & Network Services | 28 | 4 to 7% |

| Nokia Technologies | – | >75% |

| Nokia total addressable market | 127 | – |

Nokia Corporation’s long-term targets remain its responsibility to enable digitalization. It partners with its customers so that its technology can help meet some of the most pressing challenges the world faces such as climate change, the digital divide and stalling productivity growth. The company has significantly reduced the carbon footprint of its products, which in turn reduces the ecological impact of customers. Through technology leadership and trusted partnerships Nokia Corporation is making a difference in the world.

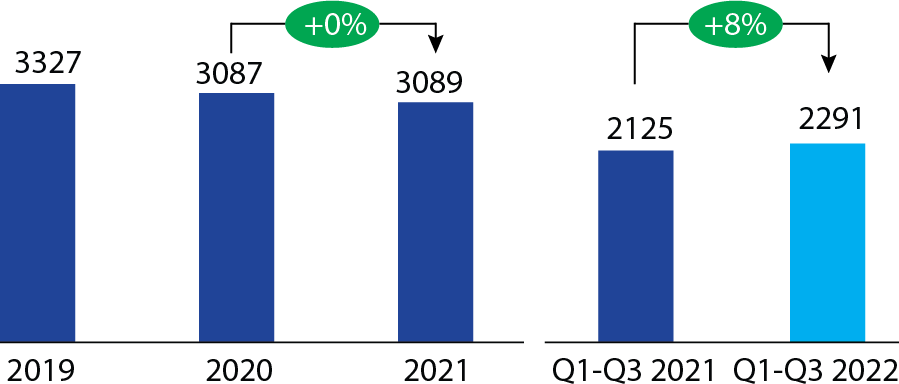

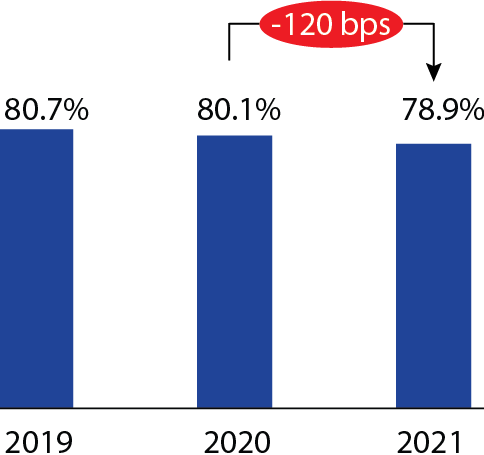

Cloud and Network Services

Cloud and Network Services enables CSPs and enterprises to deploy and monetize 5G, cloud-native software and as-a-service delivery models.

Segment net sales (€ mn)

Segment operating margin (%)

Nokia Technologies

Nokia Technologies is responsible for managing Nokia’s patent portfolio and monetizing Nokia’s intellectual property including patents, technologies and the Nokia brand.

You must be logged in to post a comment Login