CT Stories

Miles to go…

As the world stepped into a new decade, for more reasons than one, governments started looking inwards. India was no different. Atmanirbhar Bharat, Digital India Policy, and Make in India initiatives were the buzzwords in the corridors of power. And the Indian telecom manufacturing industry too was invited to take the opportunity to realise its potential as a manufacturing hub.

India imports ₹1 trillion telecom equipment on an annual basis. The government does not want this to continue. DoT, TRAI, NITI Aayog, MeitY, DPIIT, TEMA, TEPC and others were given the mandate. Cancellation of BSNL 4G tender, outlay of ₹12195 crore under the PLI scheme for telecom, Cabinet Committee on Security’s approval for a National Security Directive on the Telecommunication Sector for a trusted products list are some of the proposals cleared.

The exercise had started as early as 2010, when TRAI released its consultation paper on Promoting Local Telecom Equipment Manufacturing and the stakeholders had responded to all the aspects that needed to be addressed, and subsequently the regulator’s recommendations were submitted. In September 2014, the government announced the Make in India initiative to encourage manufacturing in India and galvanize the economy with dedicated investments in manufacturing and services. Immediately after the launch, investment commitments worth crores were announced. Yet the telecom manufacturing sector did not attract much investment. In 2017, the TRAI once again revisited the issue and was asked to realistically assess India’s true potential in equipment manufacturing with the aim to arrive at recommendations that would enable the Indian telecom industry to transition from an import-dependent industry to a global hub for manufacturing.

The timing now seems to be right. The telcos have consolidated to three plus one, ARPUs have started moving up, 5G spectrum auction, and then building the network are on the anvil.

As COVID-19 refuses to relent, telcos find the needs of the subscribers changing, and rapidly evolving for services as distribution and marketing of e-learning solutions, OTT entertainment, and bundled productivity solutions for work-from-home setups. This gives rise to a need to improve and digitize backend infrastructure, develop new skillsets, enhance digital customer experience, and continue to innovate at scale, while keeping cybersecurity front and center of all their offerings.

And this is where companies specialising in network equipment and software step in. The cheese has moved. It is no longer an only-hardware game. Their network architecture, silicon, optics, software, and security, powered by mass-scale, throughput, AI/ML, IPV6, telemetry, and industrial IoT is coming into play. And it is these companies that will build 5G networks and offer innovative financial solutions, on top of cutting-edge technology to telecom service providers. For instance, Cisco is already engaged to get their network architectures ready for 5G. It has partnered with Airtel to launch its 5G-ready, 200G IP, and optical-integrated network and with Jio to build its huge All-IP digital services platform.

Getting down to basics. The cellular network consists of radio access network (RAN) and the mobile core, with a backhaul network interconnecting the base stations that implement the RAN with the mobile core. The backhaul network is a necessary part of the RAN, an implementation choice and not prescribed by the 3GPP standard. Indian telecom manufacturers, as of now have limited capacity in development of 4G radio equipment, and to build a 4G core, even more limited.

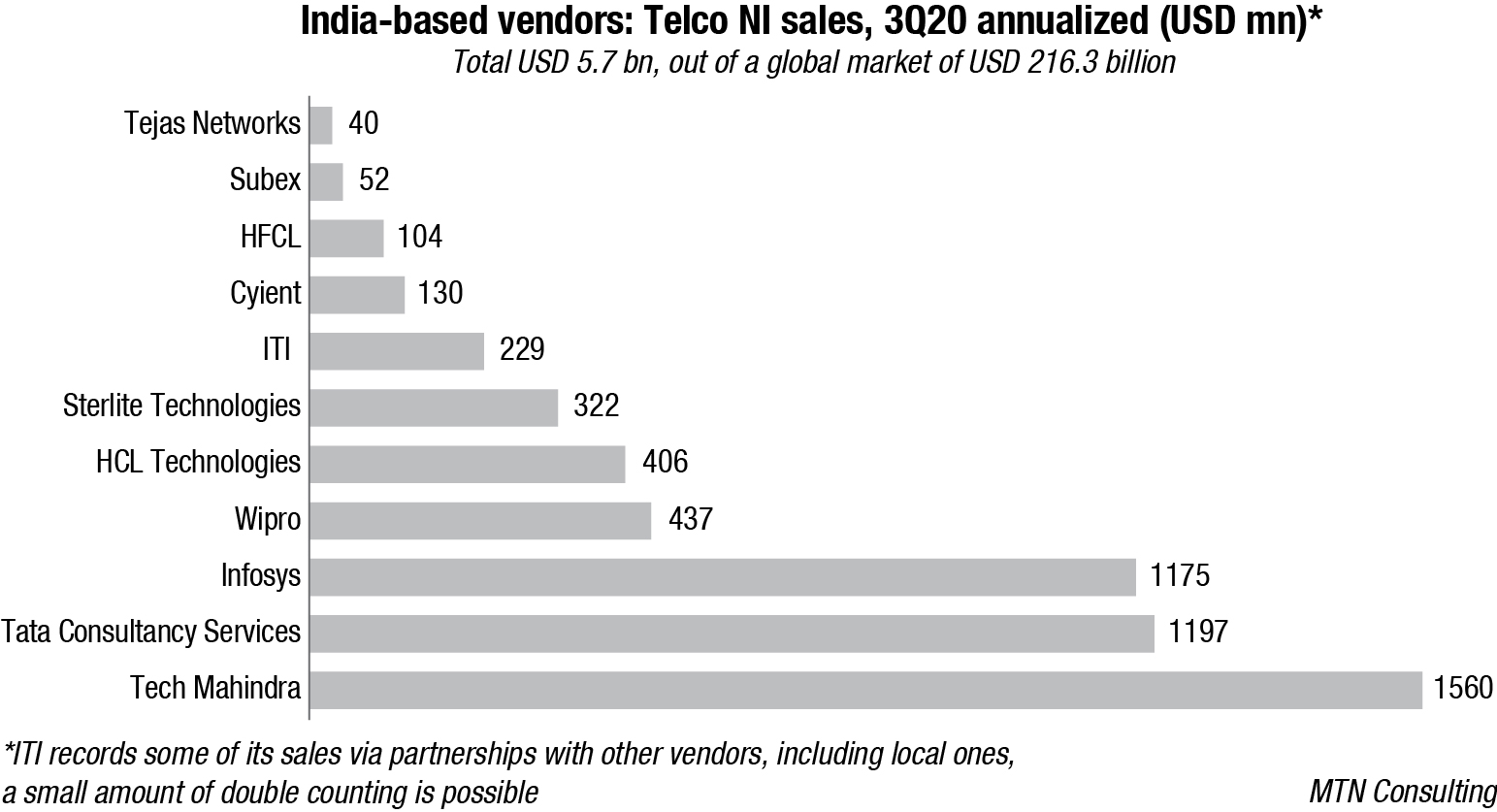

System integrators as Tech Mahindra, TCS, Infosys, and HCL have been invited to come forward. The core should be possible. They may depend on the Centre for Development of Advanced Computing, an R&D unit of MeitY, that claims to have developed an indigenous core, a base layer, that could then be used to develop a full-fledged core by any of the system integrators. Whether they are willing to front the requisite capital or find it worth their while to develop the software will need to be explored.

European Commission

The development of RAN equipment is however much more complex. While Tejas Networks’ has expertise in optical backhaul equipment and success in Malaysia, Africa, and Mexico’s GiGNet and Vihaan Network Limited’s in LWE affected regions is well acknowledged; managing 100 million subscriber networks, for instance for BSNL is another story, as is matching the 30 percent competitive price advantage of the Chinese vendors. 60 percent of BSNL’s network functions on ZTE equipment. It would perhaps take an Indian vendor two years before a full scale deployment for BSNL is possible.

Removing Chinese equipment from the Indian telco networks will not be easy. It would need at least four years. And, if the government insists, and push-comes-to-shove, the equipment could be swapped in less than a year, but that will increase their combined CapEx in the short-term by an estimated ₹15000 crore.

The Indian vendors would need major hand-holding by the government as has been done in other countries. Reportedly, Huawei, apart from USD 75 billion in tax breaks, got financing as well as cheap resources, that helped it become the world’s top telecom vendor.

The Digital Users Group (DUG), has gone a step ahead. The group recommends that the government push private telecom players to use domestically manufactured products, by encouraging them with a fiscal incentive scheme, which could be a reduction in AGR dues or a credit system for buyers. This is necessitated by the progressive phasing out of the Sec-35 (2AB) Income Tax relief which was earlier available to domestic R&D houses.

In terms of manufacturing competitiveness, India must begin with localizing electro-mechanical products at the earliest. Semiconductors can follow.

Also, DUG insists that the telecom equipment makers do not want grants for R&D. Instead, they want assured business. Advances against orders, and the reiteration of India’s technical capability to build world class products in India, for India, and for the world is supreme.

Ramesh Abhishek

Ramesh Abhishek

Director

Cyient & US India Business Council; and former secretary, DPIIT, Government of India

“More than 90 percent telecom equipment in India is imported and the government is very concerned about this. There is a dire need for a Phased Manufacturing Program (PMP) for telecom equipment. The government is open to new ideas from the industry on the fiscal incentives necessary to make domestic manufacturing happen in a large way or any other policy changes sought.”

For exports promotion, the group says that India’s industrial policy needs to be linked with the foreign policy and that Indian exports need to play a larger role where India has good brand equity across countries.

DUG also contends that the PLI scheme is not conducive to the telecom sector. And this was validated and echoed by over 100 industry experts, representing industry leaders, policy makers, and researchers from the telecom sector, who came together to attend the e-Summit on Atmanirbhar Bharat: India’s Challenge in Telecom Manufacturing and Exports. The telecom sector requires a design-led PLI scheme and needs to reward a higher value addition and design led operations in India.

Also, the line-of-credit for foreign aid should be reserved for only domestic manufacturers and not importers.

Another aspect worth considering is the quantum of outlay pegged at ₹12195 crores. Telecom has been one of the key contributors to India’s growth story over the years. It played a crucial role during the pandemic. With 5G on the anvil, it may be worthwhile for the government to consider an increase in the outlay by at least 50 percent, for the scheme to cater to the potential boom that awaits the telecom sector.

The scheme, through its detailed guidelines, must also ensure that manufacturing activities which result in a substantive value addition are the ones which get to avail the benefits of the scheme. Mere assembling of imported components or other forms of manufacturing which add little or no value addition to the product will not generate the kind of employment the government is hoping for.

The guidelines to the scheme should also create enough room for Research and Development (R&D) to be considered within the purview of manufacturing. This would ensure that the employment generation is just not restricted to low and medium skills group but also covers the growing highly skilled workforce. A robust focus on high-end manufacturing and R&D could help achieve that purpose.

Exclusive funds need to be provided to the R&D and manufacturing organizations to develop technology and related products to meet the Indian and global market needs. Simply promoting manufacturing will not serve the purpose. In 2019, Nokia and Ericsson spent close to USD 4 billion on R&D, while Huawei spends around USD 20 billion annually.

Also, the vendors need to be paid on schedule, partly at the time of placing the order, partly on delivery, and the balance amount one year after the equipment has been installed. In India, BSNL’s huge outstanding dues to its vendors is no secret. The state-run telco owes ₹15000 crore to various vendors, which include Nokia, ZTE, UT Starcom, BBNL, and ITI among

others.

Nokia and Ericsson maintain that they are as Indian as any other Indian manufacturer. The PLI scheme stipulates that, from the day the scheme is implemented, global companies to be eligible, have to make an incremental investment of ₹600 crore over four years. Investments in manufacturing made before that is not being considered nor is the substantial investment that the European gear makers have made in the country over the years.

Ericsson has been in India since 2014, exports 5G radios manufactured in India to Australia and southeast Asia, and 95 per cent of the equipment it sells to the Indian telcos is made here.

Nokia too seeks market access, which is fair and not restricted by the ownership of a company. With a team of 15000 people, the largest telecom manufacturing facility in India, an investment of ₹600 crore in the factory, ₹3000 crore worth production, of which ₹1500 crore are exports, over a dozen Indian component suppliers supported through its localisation program, world class Industry 4.0 manufacturing solutions deployed, Nokia maintains that they qualify as a Make in India manufacturer. Its existing investments need to be given due respect and acknowledgement, while deciding on the next steps, so that they do not end up in a situation that they cannot take advantage of the PLI policy, and are able to take manufacturing and the localization to the next level.

The international manufacturers are also seeking a notification from DoT that while calculating service costs, local content and value addition be included, so that they become eligible to be classified as local suppliers under the revised rules of the Public Procurement Order, 2017.

Under the revised guidelines issued by the Department for Promotion of Industry and Internal Trade (DPIIT) in June 2020, to be classified as a Class-I local supplier, firms need to have local content of over 50 per cent, which rules out foreign firms. To be eligible to be a Class-II local supplier, the vendor will need local content of over 20 per cent, but less than 50 per cent. And if the lowest bidder (L1) is a Class-I local supplier, the entire order will be awarded to the company.

However, in cases where the L1 bidder is not a Class-I supplier, only 50 per cent of the order will go to them. The rest will be offered to the lowest bidder amongst Class-I suppliers, and such a firm would be asked to match the L1 price. Where orders cannot be divided, the entire order will be given to a Class-I supplier if it is also the lowest bidder.

The MNCs contend that with manufacturing facilities in India, they currently have value addition of between 12 per cent and 14 per cent, based on the price of components, but if costs of services are added, this would be more than 20 per cent. Services like cost of installation, maintenance, logistics, which are substantial, apart from components, must be considered while determining value addition. These services incurred in India account for 10-20 per cent of the total cost of a component.

Also, components that go into making a mobile radio are imported only when not available within the country. Even in countries like China, the valueadd on telecom equipment is not more than 20 per cent.

All eyes are on Jio, that claims that it has a home-grown 5G network ready. The telco is ready to go ahead with both, the 5G core network, the underlying cloud infrastructure as well as the 5G-enabled OSS and BSS systems.

Jio’s backhaul network is ready to take the workloads of 5G and its network will not require any major upgrade for the latest high-speed technology. Along with its wholly owned subsidiary, Radisys Corporation and Rancore, it has aligned its efforts to develop open and interoperable interface compliant architecture based 5G solutions with a virtualized RAN with Qualcomm Technologies, Inc.

Dr Archana Gulati

Dr Archana Gulati

Joint Secretary

Digital Communications, NITI Aayog

“The COVID pandemic has reinforced the importance of good telecom infrastructure due to the increased dependence on digital solutions by enterprises, the government and the public. The need of the hour is to develop domestic supply chains and reduce dependence on imports, hence the PLI scheme. The government does not wish to see India only as a large market but also as a big manufacturer of telecom products.”

And yet, many in the telecom space, including Samsung, its exclusive partner for eight years, remain sceptical about what stage Jio’s 5G equipment is at. Developing a prototype is one thing; developing a perfected, commercial-grade product is another. Going from the former to the latter could take a year or two, or even four. Plus, designing locally and building components in Taiwan and Korea does not really qualify them as Made in India products.

Jio is also pushing for an acceptance of the India-centric 5G specifications proposed by TSDSI, that Jio has backed, and that can lead to the first Indian IPR on the global 5G stage. It says that any moves to block these talks will undermine local innovation. Airtel and Vi have cautioned the government about gaps in the India-centric 5G specifications proposed by TSDSI, that not only do they not mesh with global standards recommended by the 3GPP but adoption of a purely India-centric 5G radio standard will entail hardware changes in base stations and mobile devices, increasing rollout and phone costs.

What are the Indian telecom manufacturers up against? While India is one of the world’s largest wireless markets, the Indian telecom equipment sector has not been able to keep pace with the growth and expansion of the country’s telecom services. Only a handful of technology vendors, such as Tejas Networks, Sterlite Technologies, HFCL, and Vihaan Networks have emerged in the last few decades. To get a stronghold in the Indian market, some smaller ones may find it prudent to go in for collaboration or manufacturing partnerships with the foreign vendors, if the opportunity arises, at least till the bias against the Indian vendors can be shed and their technology expertise proven.

They have a tough road ahead. The telcos have already renewed their commitments with their current partners and tied up with some other large manufacturers to power 5G networks.

Nokia India has won over 108 telecom deals that includes radio, core business, application business, fixed network and GPON in 2020, with the Airtel radio deal of USD 1 billion having been the largest. This includes the nine new deals it has been awarded by Airtel. The government and private entities also ramped up their network spends, helping Nokia win new business.

Huawei has been awarded an order for ₹300 crore by Bharti Airtel in March 2021 as part of an ongoing replacement for its National Long Distance (NLD) network, that is at present run by the Chinese vendor. Reportedly, the RFP to replace Huawei’s NLD network is still on. The telco had initiated the deployment of MIMO, in partnership with Huawei as part of its ongoing network transformation program. Huawei also continues to be its network gear supplier in Karnataka and UP (West).

Ericsson has renewed its agreement with Bharti Airtel in July 2020 to provide pan-India managed network operations through Ericsson Operations Engine. The telco replaced Huawei with Ericsson in Rajasthan and Rest of Tamil Nadu circles. Subsequently, in October 2020, Bharti Airtel extended its multi-year contract with Ericsson for deploying 5G-ready radio network, strengthening their long-standing partnership.

ZTE continues to be Airtel’s network gear supplier in Punjab, Haryana, and Kolkata circles and is also maintaining networks in three circles for Vodafone Idea. For BSNL, ZTE is currently maintaining six service areas.

Global technology companies to develop 5G networks based on O-RAN technology have been tied up with. For instance, Airtel plans to work with Rakuten, NEC, Taiwanese Sercomm, Red Hat in the US, and Mavenir. The telco’s R&D centre shall put together these disaggregated solutions so that they can be used together in the network. And the telco recently announced that both Nokia and Ericsson had given a commitment to it to make 5G network equipment in India, allowing local telecom operators to source network elements locally and contribute towards building the economy. IBM and Red Hat have been selected to build Airtel’s new telco network cloud. Airtel will build its next generation core network, analytical tools, and new consumer and enterprise services on top of this cloud platform based on open standards.

India is at a crossroads. The government will have to overextend itself, so India can have its own Huawei. The soil is prepared, consumer demand and manufacturers are both there, do the powers-that-be have it in them to sow the seed and nurture it?

You must be logged in to post a comment Login