Trends

Middle East’s smartphone market surges 24% in Q4 2023

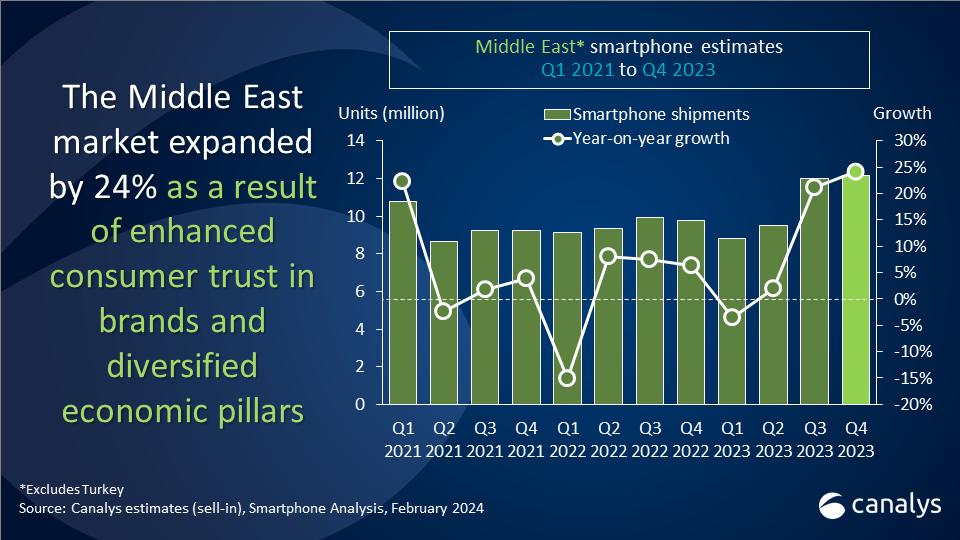

Canalys research reveals Middle East (excluding Turkey) smartphone shipments hit 12.2 million units in Q4 2023, representing a 24% increase over the previous year. Throughout 2023, total shipments reached 42.5 million units, indicating an 11% growth compared to 2022. Despite challenges stemming from reduced activity in the energy sector, due to ongoing restrictions in oil production, positive developments are evident in various non-energy sectors across the region. Particularly noteworthy is the strong rebound of travel and tourism in most GCC countries.

During Q4 2023, Saudi Arabia witnessed a significant 28% surge in smartphone shipments, with 3.6 million units driven by robust economic growth and a thriving tourism sector that attracted 27 million foreign visitors throughout the year, marking an increase of 11 million international tourists compared to 2022. Major real estate and infrastructure developments namely Qiddiya, Neom, the Red Sea Project, and Diriyah Gate have attracted a substantial labor force, potentially increasing demand for entry-level smartphones. Meanwhile, the United Arab Emirates (UAE) experienced a remarkable 22% expansion during the same period, attributed to consumer engagement in end-of-season sales events including the Dubai Shopping Festival, and promotions such as Black Friday and Yellow Friday by online retailers Amazon and Noon, alongside the launch of new smartphone models by various vendors.

Iraq’s smartphone market surged with an impressive 86% growth, despite rising restrictions on US dollar cash withdrawals by local banks exacerbating a shortage and driving up the parallel market exchange rate. US dollars are crucial for Iraq’s import-dependent cash economy. Meanwhile, vendors including TRANSSION and Xiaomi in Iraq are targeting younger demographics with marketing campaigns, capitalizing on a preference for smartphones with appealing designs, advanced technology, and affordable prices.

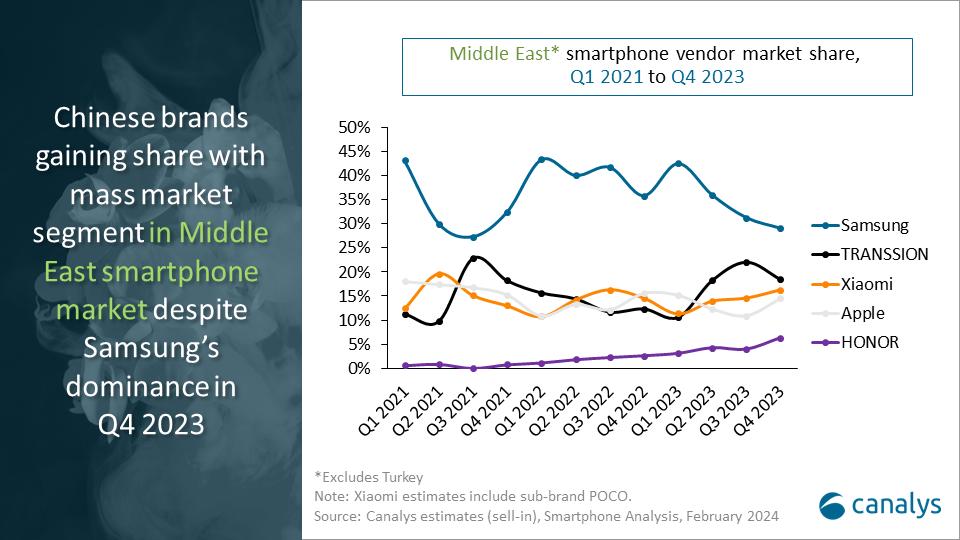

“Xiaomi, HONOR, and TRANSSION have emerged as leaders in the Sub-US$200 category, indicating a shift in consumer purchasing patterns amid rising living costs,” said Canalys Senior Consultant Manish Pravinkumar. “Xiaomi has actively expanded its offline presence in the region, increasing its footprint in retailers such as Sharaf DG in the UAE from four to 12 stores. It has also introduced improved offerings such as the Redmi 12C and restructured its team to enhance competitiveness. HONOR is following Huawei’s legacy strategy in the region, launching flagship devices including the Honor Magic 5 Pro, while also emphasizing brand visibility with successful models in the Honor XA/B series, which has gained wider acceptance in markets such as Saudi Arabia and Iraq. Motorola’s notable 49% growth demonstrates its commitment in the highly competitive landscape, with a focus on the Middle East and Africa markets. The vendor is dedicated to expanding its presence, aiming to enter over 10 additional markets.”

“Looking ahead, there is optimism for growth in the Middle East smartphone market in 2024, as regional economic activity shows improvement,” Pravinkumar adds.” In the short-term, channel partners are keen to replenish inventory, which was crucial for the market’s significant recovery in late 2023 and is anticipated to continue driving growth. In the long-term, the imminent introduction of a unified GCC tourist visa, likely to occur in 2024 or 2025, is expected to boost visitors, potentially benefiting various sectors, particularly tourism-related services. A surge in tourism could create demand for the latest devices and technology. Vendors looking to expand in the region should prioritize the establishment of stronger channel partnerships. Furthermore, they should continuously enhance their on-ground capabilities and focus on ensuring profitability through improved product offerings.”

|

Middle Eastern* smartphone shipments and annual growth |

|||||

|

Vendor |

Q4 2023 |

Q4 2023 |

Q4 2022 |

Q4 2022 |

Annual |

|

Samsung |

3.5 |

29% |

3.5 |

36% |

1% |

|

TRANSSION |

2.2 |

18% |

1.2 |

12% |

86% |

|

Xiaomi |

2.0 |

16% |

1.4 |

15% |

39% |

|

Apple |

1.8 |

15% |

1.5 |

16% |

16% |

|

HONOR |

0.8 |

6% |

0.3 |

3% |

199% |

|

Others |

1.9 |

15% |

1.9 |

19% |

1% |

|

Total |

12.2 |

100% |

9.8 |

100% |

24% |

Canalys

You must be logged in to post a comment Login