Trends

Middle East smartphone markets have a gloomy start to 2023

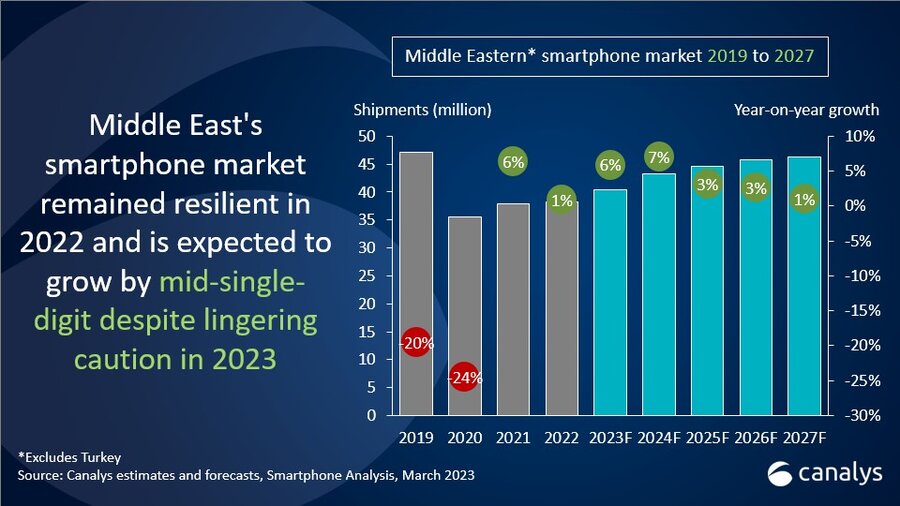

Canalys research shows that the Middle East smartphone market (excluding Turkey) is expected to grow 6% in 2023 to 40.4 million units. Saudi Arabia, the largest market in the region, is expected to expand by 9% as foreign direct investments increase and the market shifts from a conservative to an open economy. The UAE’s smartphone market is forecasted to increase by 6% due to the country’s robust expansion in non-oil industries like real estate, tourism and trade. Iraq, a cash-driven consumer market, showed strong potential in 2022 but needs restructuring policies to fight forex fluctuations. In comparison, Kuwait and Qatar are expected to grow marginally, following the momentum of rising oil prices and the FIFA World Cup in 2022, which increased travel and retail sales.

“Samsung and Apple continue to be the defacto brands in the channel with strong power to stimulate sell-through. On the other hand, emerging vendors still face challenges to drive more sell-in as channels cannot take in more inventory,” said Manish Pravinkumar, Senior Consultant at Canalys. “While Samsung is bolstering its position in the premium market with more supply and marketing investment in its recently announced S23 series, the supply of iPhones to the Middle east region is anticipated to rise in upcoming quarters. Emerging brands such as Xiaomi, Infinix, and Tecno will learn from their current challenges in channel management. Given retail channels’ demand for better profitability, these brands will look to incentivize the channel by offering rebates while restraining their spending in ATL marketing.”

“Middle East markets witnessed a post-pandemic shift in consumer and commercial dynamics,” said Sanyam Chaurasia, Analyst at Canalys. “2023 will bring a favorable business environment, supported by buoyant energy prices, recycling of the funds from oil towards reform programs in each country and creating space for further intra-GCC business investment. Meanwhile, telcos will aggressively push 5G to echo the government’s digitalization objectives. There will be more collaboration with smartphone brands on flagship 5G smartphone launches to increase average revenue per user (ARPU).”

“The ongoing 5G development will see a transformation within the smartphone user experience and drive the other digital ecosystem. Canalys expects half of the smartphones shipped in 2023 to be 5G-enabled. The regional competition remains stiff in the coming years, especially for emerging brands. The players with better inventory management capability and channel relationships will stand out in the upcoming quarters. Smartphone vendors should focus on organized retail – the most critical channel for consumers to experience newer products and technology. This is critical for the market challengers to have a significant store presence to stand out in brand awareness and win consumer mind share,” added Pravinkumar.

|

Middle East smartphone shipments and growth |

|||

|

Vendor |

2022 market share |

2021 market share |

|

|

Samsung |

40% |

34% |

|

|

Xiaomi |

14% |

15% |

|

|

Transsion |

13% |

15% |

|

|

Apple |

13% |

17% |

|

|

OPPO |

5% |

4% |

|

|

Others |

15% |

15% |

|

CT Bureau

You must be logged in to post a comment Login