Company News

Internet: Q4FY23 preview: Strong B2B; B2C may be underwhelming

Q3FY23 was a difficult quarter for most B2C e-commerce companies and investors were expecting recovery in Q4FY23E. However, our channel checks indicate B2C growth may underwhelm expectations. We note signs of consumption fatigue across online food ordering and BPC e-commerce. This is in contrast to the buoyancy in some offline discretionary categories such as travel and hospitality. We believe this is due to 1) wallet share recalibration among different consumption baskets and 2) sustained trend of online-to-offline migration first seen in Q2FY23.

In our view, B2B e-commerce is likely to continue on a strong growth trajectory in Q4FY23E led by penetration increase as small businesses explore means of increasing their digital footprint both on supply and demand sides. This is in line with our thesis highlighted in the note ‘B2B e-commerce: Recession-resilient growth drivers’.

Our key picks are Delhivery, IndiaMart, Just Dial and Nazara Technologies.

What to expect from Q4FY23 results

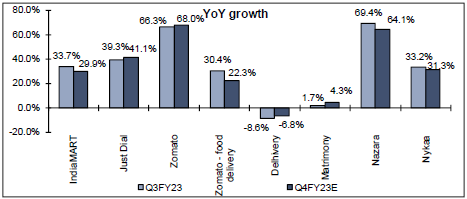

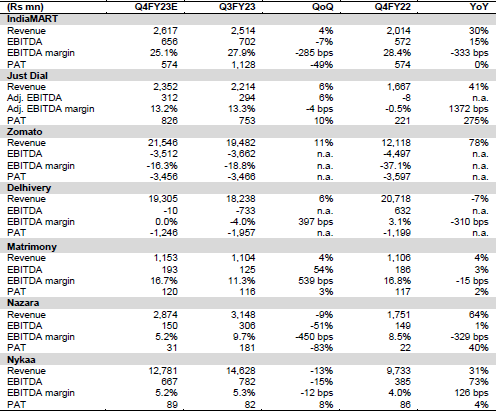

- Zomato: We estimate food delivery GOV to remain flat sequentially (+14.2% YoY) in Q4FY23E despite the activation of Zomato Gold membership, given a seasonally weaker quarter and online consumption fatigue trends as noted above. We estimate 1% QoQ decline in food ordering AOV as delivery fees have been waived off for Gold members. We estimate food ordering contribution margin to remain stable QoQ as restaurant take rate improvements may offset delivery subsidy increases. We estimate Hyperpure business (B2B) to grow 26% QoQ and Blinkit to grow 30% QoQ led by an increase in geographical reach. Overall, we estimate adjusted revenue growth of 9.5% QoQ and 68% YoY and flattish consolidated EBITDA QoQ in Q4FY23E, indicating sustainable growth in new businesses.

- Nykaa: Q4 is historically a weak quarter for Nykaa. Q4FY23E also experienced online consumption fatigue. In our view, the management’s decision to activate a new sale event in Q4FY23E was to counter these headwinds. We estimate overall GMV to grow +38% YoY (-11.3% QoQ) led by 30% YoY GMV growth (-13.8% QoQ) in BPC segment and 43% YoY growth (-5% QoQ) in fashion segment. Overall, we estimate revenue growth of 31.3% YoY in Q4FY23. We believe cost control measures are likely to aid EBITDA margin expansion of 120bps YoY (flat QoQ). We estimate EBITDA to grow 73% YoY and PAT to grow 4% YoY.

- Delhivery: We estimate express parcel shipment volumes to decline 4% YoY (flattish QoQ) in Q4FY23E given a high contribution of Shopee in the base quarter. We believe Delhivery is likely to have gained market share in 3PL category in Q4FY23E. We estimate sustained improvement (17.4% YoY) in PTL volumes as Delhivery continues to improve SLAs. However, PTL volumes may still remain c30% below pre-acquisition levels in Q4FY23E. Overall, we estimate Delhivery’s revenue to grow 5.8% QoQ (-6.8% YoY) in Q4FY23E. We estimate Delhivery to deliver positive adjusted EBITDA in Q4FY23 for the first time since listing. This, in our view, could be a positive trigger for the stock.

- IndiaMART: As MSMEs continue to shift to digital platforms, we estimate IndiaMART’s revenue to continue to grow 29.9% YoY (4.1% QoQ) led by 25-30% growth in collections in Q4FY23E. We think subscriber additions are likely to be sustained at 8,000-9,000 level in the quarter. Q4 is historically a weak quarter for EBITDA margin. We estimate EBITDA margin may decline by 280bps QoQ (-330bps YoY) due to lumpy other expenses in Q4FY23E. Overall, we estimate EBITDA to grow 14.7% YoY and PAT to be flattish YoY in Q4FY23.

- Just Dial: Given the robust outlook around B2B e-commerce and management’s conscious efforts to increase exposure in the space, we believe Just Dial’s B2B revenue is likely to grow faster (10.1% QoQ, 63.7% YoY) during Q4FY23E. Overall, we estimate revenue to grow at 41.1% YoY and 6.3% QoQ. EBITDA margin is likely to remain stable sequentially at 12.3%, though with an improvement of 16pps YoY. We estimate EBITDA to grow by 6% sequentially to Rs312mn in Q4FY23E vs loss of Rs8mn in Q4FY22.

- Matrimony: We estimate matchmaking services to grow 4.3% QoQ in Q4FY23E, reversing the trend of sequential declines seen in Q2/Q3FY23. We believe marriage services (~3% of revenues) should continue to grow faster at 11.2% QoQ. We estimate overall revenue to grow 4.5% QoQ and 4.3% YoY led by improved billings. We estimate EBITDA margin to expand to 16.7% in Q4FY23E (+540bps QoQ, flat YoY). EBITDA and PAT are likely to grow 3.4% and 2.5% YoY by our estimates.

- Nazara: We estimate revenue to grow 64.1% YoY (-8.7%QoQ) in Q4FY23E, broadly in line with the management’s full year guidance. In our view, this will be led by sustained strong growth in e-sports (97% YoY), gamified early learning (22% YoY) and ad-tech segments. We estimate EBITDA margin to decline to 5.2% in Q4FY23E (historically weak margin quarter) vs 9.7% in Q3FY23 and overall EBITDA to remain flattish YoY.

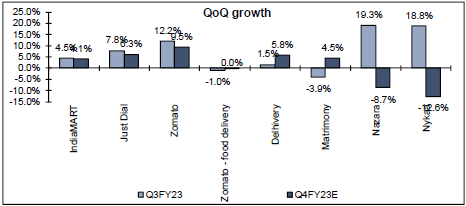

Chart 1: QoQ growth comparison

Key picks: Delhivery, IndiaMart, Just Dial and Nazara

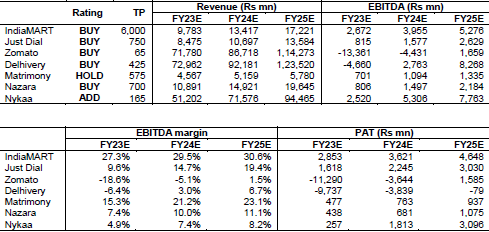

We have BUY rating on Delhivery for the following reasons: 1) Lowest cost structure compared to peers, 2) technology and trust moat, 3) hands-on management, 4) strong balance sheet, and 5) uncharacteristically high brand recall (compared to peers). We believe Delhivery’s current valuations provide a great opportunity to enter this high-quality stock. We value Delhivery using the time discounted forward EV/EBITDA methodology calculating EV at 20x FY26E EV/EBITDA and discounting at 20% to arrive at our price target of Rs425. Key risks: i) EBITDA margin profitability being pushed beyond Q4FY23 and ii) medium-term revenue growth visibility worsens further due to global headwinds.

We believe IndiaMART is likely to deliver a strong revenue growth trajectory over FY23-FY25E as it is a potential key beneficiary of the strong growth in B2B e-commerce expected over the next few years. The stock has already outperformed Nifty 50 over the last year (~+15% vs -2% for Nifty 50) and, at current valuations, we still believe it is a BUY, given its likely growth prospects. We value the company at 40x 1-year forward EV/EBITDA. Key risks: i) slower-than-expected B2B e-commerce growth and ii) inability to increase paid subscriptions.

Just Dial’s risk-reward skew is heavily in favour of the upside at current valuations, hence, sustained improvement in operating performance is likely to result in stock rerating from hereon. The stock has corrected ~18% in the past one year due to concerns regarding growth prospects and fears that the parent may de-list the entity, in our view. We believe these concerns are priced into the stock and current valuations at ~8x 1-year forward EV/EBITDA provide an attractive opportunity to BUY. We value the company at 16x 1-year forward EV/EBITDA. Key risks: i) slower-than-expected B2B e-commerce growth and ii) inability to increase paid subscriptions.

We have BUY rating on Nazara Technologies given its strong revenue growth trajectory in eSports business and gradual profitability improvement in gamified early learning (GEL). The stock has corrected ~68% from its peak (of Rs1,601). At current market price, it is trading at 46x 1-year forward P/E. We have a target price of Rs700 on the stock for Mar’24. Our target multiple is 41x FY25E EPS (1.5SD below the 2-year average historical P/E). At current valuations, we believe risk-reward skew is compelling. Key risks: i) company’s inability to establish its gaming accessories business leading to lower margins and ii) impact due to increased competition/ slowdown in US markets.

Table 1: Q4FY23 preview

CT Bureau

You must be logged in to post a comment Login