CT Stories

India poised for the fastest global rollout of 5G services

The launch of 5G services has propelled India’s position as an economic and tech powerhouse globally. Bharti Airtel launched 5G services in eight major cities on October 1, with the promise to cover the maximum areas by March 2023 and the entire country by March 2024. RJio launched the services in four cities and will complete the pan-India rollout by end of 2023. BSNL will upgrade its yet-to-be-launched 4G services to 5G by August 2023.

The launch of 5G services has propelled India’s position as an economic and tech powerhouse globally.

5G is likely to benefit the Indian economy by USD 455 billion between 2023 and 2040, or more than 0.6 percent of the GDP forecast for 2040 (and the global economy by USD 960 billion in global GDP2 by 2030), according to GSMA. 5G will be a key enabler of enterprise digital transformation processes across manufacturing, energy and utilities, banking, transportation, healthcare, sports, and retail in the country. The technology will push robotics, artificial intelligence, and the internet of things as drivers for the fourth industrial revolution. A series of innovative technologies, using 5G to leverage these key tech drivers, were showcased by domestic and global tech giants at India Mobile Congress held in the Capital, October 1–4, 2022.

India is aiming to roll out an end-to-end ecosystem for 5G, being only the fifth nation after Finland, Sweden, South Korea, and China, to do the same.

As the capital expenditure for 5G commences, India is emerging to be the second-largest market for telecom in the world. GSMA estimates that the industry will spend ₹1.5 trillion (USD 19.5 billion) in the development of advanced infrastructure for 5G by 2025 (and ₹1 trillion on 4G). Airtel and Jio have set a target to cover at least 75 percent of the country with 5G services by March 2024. Over a period of time, 4G CapEx will be displaced with 5G, as bulk of the 4G rollout has already happened.

CapEx spends of Indian telecom companies in FY18–22 went up nearly two-and-a-half times, from 9 percent to 17 percent, from ₹1.44 trillion during FY13–17, to ₹3.45 trillion during FY18–22, according to a Centrum Broking study. The growing importance was primarily because of the huge investments that the three telcos – Reliance Jio, Bharti Airtel, and Vodafone Idea – made while rolling out 4G services since 2017-end across the country. Only in FY22, investments in the 4G cycle petered down substantially after these companies covered over 95 percent of the country with 4G.

Reliance Jio has committed to a total CapEx investment of ₹1.1 trillion (USD 14.6 billion) for 5G gear. Planning to roll out pan-India 5G by December 2023, the telco is planning to raise around USD 2.5 billion (about ₹20,600 crore) through an offshore syndicated loan. It is in talks with the Bank of America, B&P, HSBC, and Société Générale to arrange the overseas loan. Going forward, Jio may even upsize the loans as more banks may join the syndication. The tenor could be in the range of three to seven years. Separately, two European export credit agencies – EKN and Finnvera – may issue guarantees to the global lenders for extending the offshore loan to Jio.

|

AGR, by quarter (₹ bn) |

|||||

| Telco | Q1

FY22 |

Q2

FY22 |

Q3

FY22 |

Q4

FY22 |

Q1

FY23 |

| Airtel | 149 | 167 | 169 | 185 | 189.4 |

| Vi | 85 | 87 | 88 | 94 | 94.7 |

| RJio | 181 | 187 | 193 | 209 | 218.1 |

| BSNL/

MTNL |

31 | 25 | 26 | 25 | 31.5 |

|

AGR market share (%) |

|||||

| Telco | Q1

FY22 |

Q2

FY22 |

Q3

FY22 |

Q4

FY22 |

Q1

FY23 |

| Airtel | 33.3 | 35.9 | 35.4 | 36.0 | 35.5 |

| Vi | 19.1 | 18.6 | 18.4 | 18.3 | 17.7 |

| RJio | 40.5 | 40.1 | 40.8 | 40.8 | 40.9 |

| BSNL/

MTNL |

7.1 | 5.4 | 5.6 | 5.0 | 5.9 |

Bharti Airtel’s CapEx spend for next three years is expected to be ₹75,000 crore, with advancement of CapEx that will happen over the course of this year, and normalizing in an 18-month period. The telco is planning a pan-India coverage by 2024. “Bulk of the rollouts is done, which means that CapEx that goes into radio on 4G will get displaced by 5G, and which is why I say over a three-year period, our CapEx profile will fundamentally remain the same,” Gopal Vittal had said at an earnings call on August 9, 2022. Airtel has signed 5G network agreements with Ericsson, Nokia, and Samsung. Airtel has had a longstanding relationship for connectivity and pan-India managed services with Ericsson and Nokia while the partnership with Samsung will begin this year onwards.

Vi is planning for the bulk of its CapEx to go in 17 circles, where the telco has acquired 50-MHz quantity spectrum in the 5G auction held recently. And NSA is the preferred technology. “I imagine, over a very long period of time, you will have a migration over to SA, but I think it is a period of time and it is something that is certainly still being developed and being worked on. There’s not too many cases of SA networks that are out there. So, there is a plan for how NSA gets migrated over to SA. It is over a period of time, but today from an efficiency, from a CapEx utilization, from a largest impact to customers, predominantly NSA is the prevalent architecture across the globe and certainly, I believe is the right one to launch in our environment, and also the ecosystem has to develop as well, especially, in regards to devices and handsets on SA, which of course also takes a period of time,” Takkar had said in the Q1FY23 earnings conference call on August 4, 2022. The telco’s CapEx spend for Q1FY23 was ₹84 crore and ₹121 crore in Q4FY22.

Many networks across the globe have launched 5G in NSA and over a period of time, there is the standard parties are working through, suppliers are working through a glide path of how to go from NSA to SA, which is going to be the global standard. Jio, however, has announced an SA 5G rollout.

Research analysts at Credit Suisse, Viral Shah and Varun Ahuja, maintain that while a non-standalone network is relatively cheaper to deploy, it does not support true 5G functions of low latency and network slicing – both essential for eventual 5G enterprise use cases. “We believe that Airtel would also transition to standalone 5G eventually,” the note said, as the enterprise use cases evolve. “Having said that, we do expect that Airtel may have to acquire additional sub-1GHz spectrum over the next 3–4 years.” Both Jio and Airtel will have a competitive 5G network for consumer mobility, and the challenges in 5G adoption for operators are “likely to be in the execution and development of 5G ecosystem. While Jio will likely have a first mover advantage with better in-building coverage due to 700 MHz and better offerings like slicing due to standalone network, it remains to be seen how many postpaid subscribers would move to Jio. This is because the high-end base is lethargic, and such enterprise contracts are on back of relationships. Nevertheless, we see competition picking up in this base as Jio tries to poach, and Bharti and Vodafone try to defend. We find Vodafone Idea more vulnerable, given weak balance sheet and inability to invest to defend its user-base,” the brokerage said.

Harri Holma, a Nokia veteran and Bell Labs Fellow, however, reiterates, “What matters, is rollout speed. It’s not about architecture but who’s providing more radio capacity, using new spectrum most efficiently, which will be the differentiating factor. The rollout speed is going to define success.”

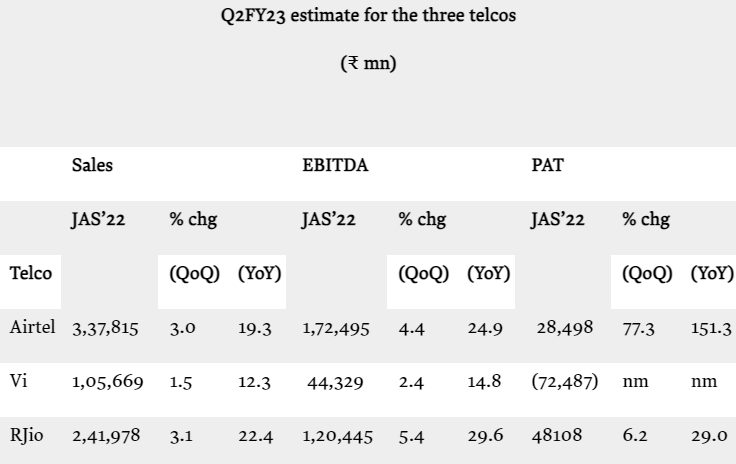

In Q2FY23, Bharti Airtel and Reliance Jio are set to report steady revenue growth with strong 4G customer additions while Vi’s modest revenue gains are likely to be further tempered by heavy customer losses.

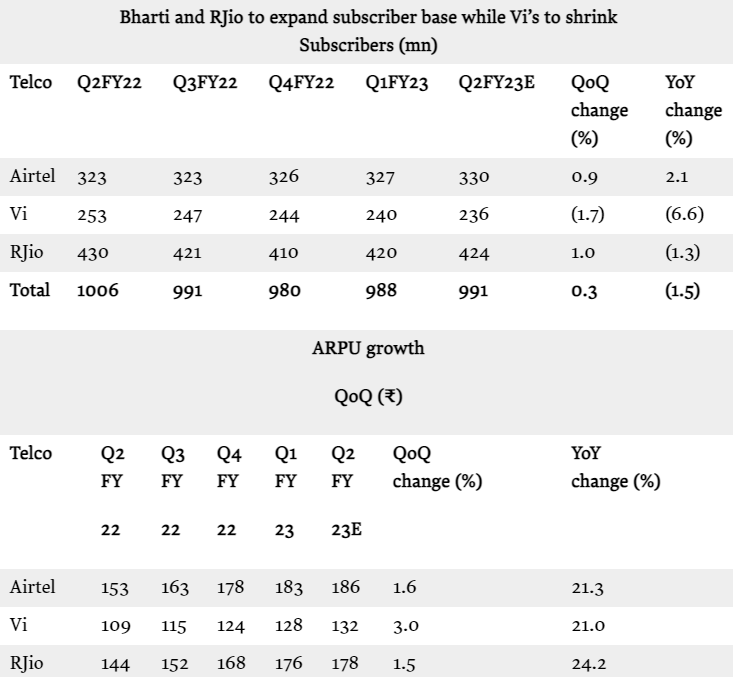

Q2FY23E estimates by ISec expect steady mobile revenue growth, aided by one additional day, and subscriber growth for Bharti and RJio. Vi subscriber base continues to shrink. 4G net add has decelerated for Bharti and Vi, which means lower benefit of premiumization. Revenue growth QoQ for Bharti (mobile), Vi, and RJio is likely at 2.2 percent, 1.5 percent, and 3.2 percent, respectively. Vi’s marketing aggression has increased in the past few months, which is helping it narrow revenue growth gap versus peers, thus, lower benefit of market share gains for Bharti and RJio in Q2FY23E. EBITDA margin expansion for mobile operators due to negligible SUC for part quarter is expected. SUC was 3–3.5 percent of AGR, which has reduced to negligible on the purchase of spectrum in July 2022 auction; full benefit of low SUC will likely reflect in Q3FY23E.

Spectrum (for 5G rollout) purchase in July 2022 auction is yet to be deployed, and interest cost related to spectrum and 5G rollout cost will be capitalized for all the three telcos. However, EBITDA is expected to benefit from lower SUC.

|

Gross revenue performance (₹ bn) |

|||||||

| Telco | Q1

FY 22 |

Q2

FY 22 |

Q3

FY 22 |

Q4

FY 22 |

Q1

FY 23 |

QoQ

(%) |

YoY

(%) |

| Airtel | 180 | 190 | 195 | 212 | 224 | 6.0 | 24.5 |

| Vi | 103 | 105 | 108 | 113 | 116 | 3.1 | 13.5 |

| RJio | 188 | 195 | 203 | 219 | 228 | 4.4 | 21.4 |

| BSNL/

MTNL |

22 | 19 | 26 | 43 | 28 | (34.1) | 26.5 |

| Total | 493 | 508 | 532 | 586 | 597 | 1.9 | 21.1 |

Q2FY23 would be a steady quarter for telcos with net subs add for Bharti (3 million) and RJio (4 million), while Vi will have subscriber dip of 4 million. 4G subscriber net add for Bharti (+5 million) and Vi (+3 million) is low due to expensive starting smartphone prices. ARPU is likely to show growth of 1.5–3 percent QoQ and will be aided by one additional day and premiumization (it would be lower vs earlier quarters). Vi may have the highest growth in ARPU, up 3 percent QoQ to ₹132; Bharti’s ARPU is likely to grow by 1.6 percent to ₹186, and RJio’s by 1.5 percent to ₹178.

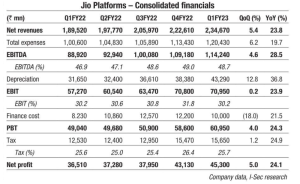

Bharti’s consolidated EBITDA is likely to grow 4.4 percent QoQ (+24.9 percent YoY) to ₹172 billion. Bharti’s India revenue is likely to grow 2.3 percent QoQ (19.6 percent YoY) to ₹240 billion, led by mobile segment (up 2.2 percent QoQ/22.6 percent YoY). India EBITDA may be up 4.3 percent QoQ (25.8 percent YoY) to ₹124 billion; it will benefit from lower SUC charges and operating leverage. Bharti’s Africa USD revenue and EBITDA is likely to rise 1 percent QoQ, each to USD 1270 million and USD 618 million, respectively. Consolidated revenue may rise 3 percent QoQ to ₹338 billion and EBITDA to 4.4 percent QoQ to ₹172 billion. Net profit is seen at ₹28.5 billion. Jio Platform’s EBITDA is likely to rise 5.4 percent QoQ. Jio Platform’s revenue may grow 3.1 percent QoQ to ₹242 billion, and benefit from subscriber add and growth in JioFiber. EBITDA is likely to grow by 5.4 percent QoQ to ₹120 billion and benefit from lower SUC. Net profit may rise 6.2 percent QoQ to ₹48 billion.

Vi’s EBITDA may increase 2.4 percent QoQ to ₹44 billion. Vi’s revenue may rise 1.5 percent QoQ to ₹106 billion, benefitting from premiumization. EBITDA is likely to expand 2.4 percent QoQ (up 14.8 percent YoY). Net loss is seen at ₹72 billion for Vi (nil tax rebate).

Discussions are on between DoT and Vi regarding equity conversion. The government in September 2021 had approved a relief package for the telecom sector and allowed telcos to convert the interest on such accrued dues into government equity. Vi had opted for such an equity conversion in January 2022. Once the conversion takes place, the government may own as much as 33 percent stake; the holding of Vodafone would fall to 31.8 percent from 47.61 percent and that of the Aditya Birla Group to 18.3 percent from 27.38 percent. A sticking point has been that the Vodafone Idea stock price has been hovering below ₹10 and as per the company law provisions, any equity infusion cannot be below par value.

The government had also allowed carriers to defer payment of AGR-related dues by four years. Since then, Vi has said it plans to raise ₹10,000 crore from external investors and another ₹10,000 crore as bank loan. In March this year, the promoters had infused ₹4500 crore into the company, but the majority amount was used to clear dues of Indus Towers. Vi’s debt due until the end of FY23 is ₹5200 crore. DoT has returned about ₹17,000 crore of bank guarantees, and that is the basis of Vi’s entire discussion for funding, The company has long been in talks with Apollo Global for the equity fund-raise, but nothing has materialized so far. The fund-raise is crucial for the company as it needs to invest in expanding its 4G network as well as to roll out 5G services to remain competitive.

“We have reported four quarters of sequential growth in several key metrics, including ARPU and 4G subscribers. We remain focused on providing superior data and voice experience, and are building a differentiated digital experience adding several digital offerings in the recent months. We successfully raised funds from promoters of ₹49.4 billion in total. We also continue to actively engage with lenders and investors for further fundraising. All these initiatives, coupled with significant liquidity provided by the government reform package and the recent tariff hikes, will enable Vi to make network investments and compete effectively to improve its overall position,” said Ravinder Takkar, non-executive director, Vi at the Q1FY23 earnings conference call.

|

AGR market share by Circle Q1FY23 (%) |

||||

| Circle | Airtel | Vi | RJio | BSNL |

| Metros | ||||

| Delhi | 37.1 | 14.6 | 44.0 | 4.4 |

| Mumbai | 31.2 | 28.7 | 32.9 | 7.3 |

| Kolkata | 28.8 | 23.2 | 35.2 | 12.8 |

| A’ circle | ||||

| Maharashtra | 28.9 | 21.6 | 47.5 | 2.0 |

| Gujarat | 21.1 | 27.6 | 45.6 | 5.7 |

| AP | 41.8 | 11.1 | 38.5 | 8.6 |

| Karnataka | 53.4 | 9.9 | 31.5 | 5.1 |

| TN | 40.4 | 17.5 | 36.5 | 5.5 |

| B’ circle | ||||

| Kerala | 22.6 | 36.4 | 31.7 | 9.3 |

| Punjab | 38.3 | 16.4 | 37.8 | 7.5 |

| Haryana | 32.1 | 18.7 | 45.7 | 3.5 |

| UP (W) | 33.1 | 15.7 | 44.4 | 6.7 |

| UP (E) | 41.9 | 10.1 | 45.6 | 2.4 |

| Rajasthan | 38.0 | 10.9 | 48.0 | 3.1 |

| MP | 21.8 | 14.7 | 59.9 | 3.6 |

| WB | 27.0 | 14.8 | 55.8 | 2.4 |

| C’ circle | ||||

| HP | 41.3 | 4.1 | 49.4 | 5.2 |

| Bihar | 40.5 | 3.6 | 54.5 | 1.4 |

| Orissa | 34.9 | 3.0 | 58.2 | 3.8 |

| Assam | 42.8 | 6.0 | 48.5 | 2.7 |

| NE | 46.1 | 5.2 | 35.6 | 13.1 |

| J&K | 46.6 | 1.4 | 48.1 | 4.0 |

|

TRAI |

||||

The telcos are likely to face challenges in execution and development of 5G ecosystem, according to BofA Securities and Credit Suisse. The key will be developing use cases to generate demand for 5G services.

On the 5G revenue opportunities, the use cases are still under development. The adoption of these use cases, and how long does it take for adoption of these use cases and what is the user demand of how quickly these can go, is still to be determined. When those use cases get adopted at mass scale, clearly, there is a revenue opportunity that exists in terms of what 5G will bring, although this is an area where the telcos as an industry have to work along with other industries and potential users to see how these use cases can develop over a period of time.

The telcos and smartphone companies are looking to collaborate and provide options for affordable ownership of 5G phones and connections. Simply subsidizing the device cost and offering a 5G connection may not be enough or easy. Carriers are exploring bundling in unlimited data, OTT services, and gaming, among others, to lure users, especially the higher-paying ones. Both Airtel and Jio are also working with Google to make 5G smartphones affordable, the latter working to introduce an affordable 5G smartphone. Currently, 9.75 percent of smartphones across India are 5G-capable, and by next year, almost 80 percent to 90 percent of the devices that will come in will be 5G devices.

Being the biggest single market for communication services, a high level of 4G adoption (79 percent) is indicative of a subscriber base ready to transition to 5G. As more and more 5G devices come in, all the 4G traffic will shift on to the 5G networks. 5G handsets under ₹10,000 will be an inflection point to drive 5G adoption in a price-sensitive market like India. Currently, most 5G smartphones are priced at a minimum of around ₹13,000 and handset makers are trying to bring the prices down to around ₹11,000 by year-end, and under ₹10,000 by next year.

As per Counterpoint, India’s smartphone user base crossed the 600-million mark during April–June 2022 quarter. The growth in upper and premium segments is primarily due to the availability of financing schemes, aimed at increasing device affordability. And the trend is not confined to the metros. According to insights from Flipkart, there has been more than 25-percent jump from January to July this year in the demand for premium smartphones on the platform and of that, there has been a 40-percent increase in the demand from Tier-II and beyond alone, with cities such as Guntur, Hisar, Moradabad, and Shahjahanpur, indicating strong preference for high-performance premium smartphones. Also, the platform has seen a growth of more than 60 percent in the number of new launches (in the premium segment) across brands like Apple, Samsung, Google Pixel, OPPO, Nothing among many others.

And contrary to speculation, leading smartphone manufacturers are working with the Indian carriers to test their devices to support both NSA and SA modes of 5G. “There is hardly any difference between SA and NSA mode 5G smartphones,” says Rajen Vagadia, president of Qualcomm India & SAARC.

Pricing between 5G and 4G is still being worked out. Globally, 5G by itself is not yet giving incremental ARPU to any operator anywhere in the world, but in India as tariffs are still very low, tariffs are expected to increase and with every increase, the economics will change and the return on capital will get much-much better.

The telcos took a price increase between 20 and 25 percent end-November last year, and they have seen the benefit of that, not only in revenue improvement but also in ARPU improvements as well, and those are settled in and have been absorbed in a seamless manner by consumers across the industry. The telcos are looking at further price increases. The ARPUs need to get to ₹200 first in the short term, and then eventually to ₹250 and then in the longer term around ₹300.

Apart from price increases to impact ARPU, other elements are starting to take place. 4G additions are important. Vi believes that as it deploys more funds, and as 4G coverage increases, there may be a further disproportionate acceleration of 4G suburban additions because these are areas that the telco does not cover today, and as it covers those geographies, it should be able to speed and increase 4G adoption, and as a result, ARPUs will go up as a result of that as well. And on number of other services, whether it is digital, whether it is ad platforms, whether it is enterprise services, each one will help drive ARPUs. There are multiple levers, multiple opportunities. Certainly, tariff increase is one of the most important ones, but certainly also there are others that the telcos can work on.

Satcom services is one area that has caught their attention. Jio with its satellite unit having received LoI for satellite communication services has joined the GMPCS race with Elon Musk’s SpaceX and Sunil Mittal’s OneWeb to offer reliable, high-speed internet everywhere. These mobile satellite networks can operate with LEO, MEO, and GEO. The age of the cellular dead zone may be ending.

BACKGROUNDER

5G spectrum auction

The 5G spectrum auction concluded on August 1, 2022, with a total bid amount of ₹1,50,173 crore. 72,098 MHz of spectrum was offered for auction, and out of that 51,236 MHz was sold.

Reliance Jio Infocomm acquired 24,740 MHz (in 700MHz, 800Hz, 1800Hz, 3300Hz, and 26GHz); Bharti Airtel Ltd acquired 19,867 MHz (in 900MHz, 1800MHz, 2100MHz, 3300MHz, and 26GHz); and Vodafone-Idea Ltd. acquired 6228 MHz (in 1800MHz, 2100MHz, 2500MHz, 3300MHz, and 26GHz). The operator wise spend was ₹88,078 crore by Reliance Jio Infocomm Ltd., ₹43,084 crore by Bharti Airtel Ltd., and ₹18,799 crore by Vodafone-Idea Ltd.

“We have committed to the industry that we should do annual auctions. We will go back to the industry and TRAI and schedule next calendar as per the needs of the industry and as per the TRAI advice,” said Ashwini Vaishnaw, Communications, IT & Railways minister, on the final day of the auction.

Jio acquired a unique combination of low-band, mid-band, and mmWave spectrum, resulting in increasing Jio’s total owned spectrum footprint to 26,772 MHz, the highest in India. This includes 2×10 MHz contiguous spectrum in both 700MHz and 800MHz bands across each of the 22 circles of sub-GHz spectrum; 2×10 MHz in 1800MHz band (with 2×20 MHz in six key circles), 40 MHz in 2300MHz band and 100 MHz in 3300MHz band across all the 22 circles; and 1000 MHz in millimeter wave band (26GHz) in each of the 22 circles, which will be crucial to enable enterprise use cases as well as provide high-quality streaming services.

Over the years, Airtel has been astute in its competitive spectrum-acquisition approach. It has assiduously accumulated the largest pool of low- and mid-band spectrum (sub GHz/1800/2100/2300 bands) in all circles. This has resulted in a saving of not only ₹40,000 crore that it would have had to incur for 10 MHz of spectrum but also save the need for more antennae, big radios, extra radios across the country in all the newer sites, extra power that will need to be deployed there and extra rentals of the radios, a 50-percent higher cost per GB. Massive capacities in the 3.5GHz and 26GHz bands will now allow Airtel to create 100× capacities at the least cost – a strategy for spectrum acquisition through auctions, M&A, and trading well executed.

In the recent 5G spectrum auction, Vi bought spectrum across two bands of 26GHz and 3300MHz. This is a well-planned strategy, as the right band to launch 5G services is 3300MHz band. The mmWave, which has much higher frequencies at 26 GHz, is predominantly for capacity and that also on the last mile. The ecosystem for that is expected to develop over a period of time. Vi expects to see a 3-percent reduction on AGR, based on the spectrum that the telco has acquired in the auction. Future CapEx is expected to go in the 17 priority circles, where it has acquired the spectrum. The fundraising discussions, including 5G CapEx plans, are taking place currently.

Responding to oft-repeated comment that Vi’s 5G spectrum spend is far lesser than its counterparts, Ravinder Takkar, non-executive director of Vi, clarified, “The 50-MHz quantity acquired is actually good enough for several years out. The way 5G works is that capacity gets created and unless the capacity gets used up over a period of time, is only when you need more and more spectrum. So, from that perspective, 50 MHz gives us a fairly long runway, and buying additional amounts at this point certainly, not just given our financial situation, but generally overall, we do not see the need for doing that today. Certainly, more spectrum can be acquired later as well. Across the globe, there are several networks that are running in the mid-band 5G networks in the mid-band area. We do not see any issue or challenges with providing enough capacity, certainly not for several years, if not even for a longer period of time. Of course, it depends on how consumption will go. We firmly believe that mid-band spectrum that we’ve acquired along with our current sub GHz spectrum assets that we have, which we have deployed, are very good to provide great customer experience for several years to come on 5G for Indian consumers. I don’t think that 700MHz provides any additional capacity from a 5G perspective or provides any competitive advantage that we are aware of.”

Subscriber watch-July 2022

Active subscribers

| Telco | Base Subs (mn) | Mkt share % |

Net ads mn mom |

| Airtel | 356 | 35.2 | (1.0) |

| Vi | 217 | 21.4 | (1.7) |

| RJio | 382 | 37.7 | (1.0) |

| BSNL/MTNL | 58 | 5.7 | (0.5) |

| Total | 1013 | 100 | (4.3) |

The government has assigned two carriers of 250 MHz each in E-band to the telcos for meeting their backhaul requirements as they prepare to launch 5G services. It may not be sufficient in the 5G era, given the requirement for high-capacity backhaul for supporting use cases and increased traffic. Clear policy guidelines on the allocation of the backhaul spectrum are awaited.

The fiberization of towers and backhaul is very limited in India. E-band allows hyper transmission between towers and back-to-the core network, using that spectrum in a manner which is very similar to fiber. It allows large bandwidth to be transported back and innovate and helps appending providing a very good 5G end-to-end experience rather than just limited to connectivity toward the towers and the site. With the significant multiplier impact provided by E-band, of where the capacity on backhaul compared to the current microwave capacity, the fiberization piece for the industry will come down. Over a very long period of time, as capacity builds up, say ten years from now, if a lot more capacity is needed on 5G, additional spots on E-band may not work, and fiberization of towers will become imperative, but that will happen anytime soon.

The latest data on subscribers is available for July 2022, courtesy Telecom Regulatory Authority of India. Industry-wide active subscriber base dipped by 4.3 million MoM (vs dip of 0.2 million in June 2022 and +2.8 million in past 6 months) with Bharti Airtel losing 1 million subscribers (vs net add of 2.3 million in June 2022 and +1.4 million in past 6 months). RJio active subs fell by 1 million in July 2022 (vs +3.1 million in past six months). Vi saw its active subs decline by 1.7 million, thus posing a key concern. Industry-wide mobile broadband (MBB) sub net add improved to 5.7 million (vs increase of 5.6million in Jun’22). Bharti’s MBB subs rose 2.6 million and its market share expanded to 29.2 percent (up 28 bps MoM) on active basis, while RJio’s dipped 26 bps to 51.4 percent. Vi’s MBB has been constant for past three months. MNP increased to 10.2 million with the churn rate at 0.9 percent (vs 0.8 percent in Jun’22). Wired broadband subscriber net addition slightly rose for Bharti at 0.14 million, while it dipped for RJio at 0.11 million (vs +0.27 million average in past 6 months).

Industry-wide active sub-base fell by 4.3 million MoM in July 2022 to 1013 million (down 0.4 percent MoM, up 2.4 percent YoY). RJio’s active sub-base saw a reduction of 1 million (average +3.1 million in past 6 months) to 382 million in July 2022. Total subscribers rose by 2.9 million to 416 million, and active subscribers as a percentage of total subscribers dipped to 92 percent, down 91 bps MoM. Bharti’s active subscriber-base contracted by 1 million (vs +1.4 million in past 6 months) to 356 million. Its total subscriber-base increased by 0.5 million. Vi’s active subscribers dipped 1.7 million (down by an average of 1.8 million per month in the past six months) to 217 million in July 2022. Total subscribers reduced by 1.5 million.

RJio’s active subscriber market share rose 6 bps MoM to 37.7 percent; Bharti’s stood at 35.2 percent (up 5 bps MoM) while Vi’s fell 8 bps MoM to 21.4 percent.

Industry-wide MBB (mobile broadband) subs rose by 5.7 million in July 2022 (up 0.7 percent MoM/down 0.8 percent YoY). This has been steady for past three months, but lower than historical adds.

Bharti’s MBB sub-base grew by 2.6 million to 217 million, which should slow the benefit of premiumization on ARPU. However, the net add is best in past 10 months. RJio’s MBB sub-base rose by 2.9 million to 416 million. Adjusted for inactive subs, its MBB market share stood at 51.4 percent (down 26 bps MoM). Bharti’s MBB market share was 29.2 percent (up 28 bps MoM) and Vi’s was 16.5 percent (down 3 bps MoM). Vi’s MBB sub-base remained constant at 123 million, flattish for past three quarters.

Wired broadband sub net add steady for Bharti while it slowed for RJio. Wired broadband subscriber base rose by 0.76 million MoM to 29.5 million (up 2.6 percent MoM/22.7 percent YoY) in July 2022. Bharti added 0.14 million subscribers (vs 0.11 million per month in past six months), and RJio added 0.11 million (vs 0.27 million per month in past 6 months). Other subscribers rose 0.48 million to 13.2 million for other operators.

Subscriber watch-July 2022

Mobile broadband subscribers

| Telco | Base (≥ 512 kbps download) Subs (mn) |

Mkt share % |

Net ads mn mom |

Mkt share on active basis % |

| Airtel | 217 | 28.0 | 2.6 | 29.2 |

| Vi | 123 | 15.8 | 0.0 | 16.5 |

| RJio | 416 | 53.5 | 2.9 | 51.4 |

| BSNL/

MTNL |

21 | 2.7 | 0.1 | 2.8 |

| Total | 777 | 100 | 5.7 | 100 |

|

I-Sec research |

||||

RJio’s market share rose to 21.3 percent (down 18 bps MoM) and that for Bharti increased by 16.9 percent (up 4 bps MoM). BSNL’s subscriber-base expanded by 0.01 million while its market share fell 31 bps MoM to 13.1 percent.

Industry-wide porting grew by 10.2 million (up 13.4 percent MoM) in July 2022. MNP churn rate was 0.9 percent (vs 0.8 percent in June 2022).

Industry AGR (including NLD) grew 4 percent QoQ/19.7 percent YoY to ₹534 billion. Bharti Airtel has lost AGR (including NLD) market share of 50 bps QoQ due to correspondingly higher growth for RJio. RJio has a bigger subscriber base with long validity recharge, which shows it benefited from tariff hike spillover. Bharti’s circle-wise AGR is not comparable for Q1FY23. It appears like the company has changed (cut) carriage charges for NLD, which has led to NLD AGR dip by 26.5 percent and boosted its circle-wise AGR. Vi’s AGR (including NLD) market share was down 50 bps QoQ to 17.7 percent. RJio’s AGR (including NLD) market share rose 6 bps QoQ to 40.9 percent, and benefited from tariff hike. BSNL’s AGR (including NLD) rose 23.7 percent QoQ to ₹32 billion (must have some one-offs), which optically impacted the top-3 players’ market share.

Industry AGR (including NLD) rose 4 percent QoQ/19.7 percent YoY to ₹534 billion. Top-3 operators’ AGR (including NLD) rose 3 percent QoQ/21.2 percent YoY, driven by tariff hikes. The benefit of premiumization has been limited and SIM consolidation should have offset some growth. Q1FY23 annualized revenue stood at ₹2135 billion, and AGR (including NLD) was ₹1902 billion for FY22. Industry gross revenue was up 1.9 percent QoQ (21.1 percent YoY) to ₹597 billion and included one-off gains for BSNL in Q4FY22.

Bharti’s AGR (including NLD) was up 2.6 percent QoQ/27.5 percent YoY to ₹189 billion. Bharti’s AGR (including NLD) market share dipped to 35.5 percent, down 50 bps QoQ/220 bps YoY. Its incremental AGR QoQ was ₹5 billion vs ₹9 billion for RJio. This was due to higher long-validity customers on RJio, which reflects the benefit of tariff hike in Q1FY23. However, Bharti’s circle-wise AGR analysis is not comparable in our view as we see NLD AGR has declined 26.5 percent QoQ to ₹18 billion. This indicates change (cut) in NLD carriage fees, which has led to increase (re-base) in circle-wise AGR for Bharti during Q1FY23. The circles that have shown high growth are Delhi (+9.9 percent QoQ), UP East (+17 percent), WB (+8.1 percent), HP (+12 percent), and Bihar (+15.9 percent). Bharti was already outperforming in C circles post expansion in 4G network.

Vi’s AGR (including NLD) market share fell to 17.7 percent (down 50 bps QoQ). Vi’s AGR (including NLD) rose 1 percent QoQ and 11.2 percent YoY to ₹95 billion. Within leadership circles, Gujarat, AP, TN, and Kerala underperformed while UP East, MP, and Mumbai have done well. Vi has performed well in its established circles with AGR growth of 2.9 percent QoQ. Non-focus circles continued to struggle with just 0.8 percent QoQ rise in AGR.

RJio’s AGR (including NLD) rose 4.1 percent QoQ/20.7 percent YoY to ₹218 billion. RJio’s AGR (including NLD) market share was 40.9 percent, up 6 bps QoQ. AGR growth has been relatively higher in metros at 4.5 percent QoQ and A circle at 4.6 percent QoQ as these circles have higher subs with long-recharge validity, and benefit of tariff hike would have kicked-in in Q1FY23. B and C circle AGR rose at 3.9 percent/3.5 percent, respectively. In circle-wise analysis, RJio has optically lost market share due to higher AGR allocation for Bharti (one-time rebase). However, RJio has under-performed in a few circles – Mumbai (down 1 percent QoQ) and Kolkata (down 0.6 percent QoQ) – while Delhi has done well with growth of 9.5 percent QoQ. Among non-metro circles, only HP under-performed with growth of just 0.5 percent QoQ.

Subscriber watch-July 2022

Total subscriber base

| Telco | Base Subs (mn) | Mkt share % |

Net ads mn mom |

| Airtel | 363 | 31.7 | 0.5 |

| Vi | 255 | 22.2 | (1.5) |

| RJio | 416 | 36.2 | 2.9 |

| BSNL/

MTNL |

113 | 9.9 | (1.3) |

| Total | 1148 | 100.0 | 0.6 |

Subscriber watch-July 2022

Rural subscribers

| Telco | Base Subs (mn) | Mkt share % |

Net ads mn mom |

| Airtel | 175 | 31.6 | (1.1) |

| Vi | 128 | 24.5 | (1.0) |

| RJio | 182 | 35.0 | 1.6 |

| Others | 36 | 6.8 | (0.2) |

| Total | 521 | 100.0 | (0.6) |

Subscriber watch-July 2022

Wired broadband subscribers

| Telco | Base Subs (mn) | Mkt share % |

Net ads mn mom |

| Airtel | 5.0 | 16.9 | 0.14 |

| RJio | 6.3 | 21.3 | 0.11 |

| BSNL/

MTNL |

3.9 | 13.1 | 0.01 |

| Hathway | 1.1 | 3.8 | 0.02 |

| Others | 13.2 | 44.9 | 0.48 |

| Total | 29.5 | 100.0 | 0.76 |

|

I-Sec research |

|||

Financial Year 2021-22

FY22 was pivotal for the industry. The year witnessed two Covid-19 waves, which impacted the economy in quick succession. Although the second wave turned out to be deadlier than the first in 2020, it had a moderate impact on the economy, given greater preparedness and staggered lockdowns.

Amidst the successive pandemic waves, the telcos continued to offer essential services on a war footing, and on many occasions went beyond the call of duty to serve society in a meaningful way. During the year, the business also continued to be resilient and showed consistent growth.

In a major industry development, all the operators have taken tariff interventions during the year across all unlimited prepaid bundled plans, entry-level combo voucher plans as well as post-paid plans. While the tariff interventions have helped drive ARPU improvement during the year, the industry continues to operate with unsustainably low tariffs.

On September 15, 2021, the government announced a comprehensive reform package for the Indian telecom sector, including measures to address the structural, procedural, and liquidity issues. To address the immediate liquidity concerns of the sector, the government had provided an option of up to four years of moratorium on AGR dues and spectrum instalments due between October 2021 and September 2025, with an option to convert interest arising from such deferment into equity upfront. Your company has already opted for deferment of spectrum and AGR dues as well as conversion of interest arising from such deferment into equity. Other reforms include clarity on AGR definition, reduction in bank guarantees, removal of penalty, reduction of interest for delay in payment of LF and SUC, etc. All these reforms are expected to provide long-term benefit to all the operators, including your Company. The reforms package and the implementation has been welcomed by all stakeholders of your Company, including the banks and investors.

India’s total telecom user base stood at 1166.9 million, on March 31, 2022. The Indian telecom market has undergone consolidation into three large telco players, and has seen pricing interventions. The total customer base has decreased by 3.3 percent over a span of five years till March 31, 2022. The tele-density as on March 31, 2022 was 84.88 percent – urban tele-density stood at 134.94 percent, whereas rural tele-density stood at 58.07 percent as on March 31, 2022.

Among service areas, excluding metros, Himachal Pradesh has the highest tele-density (138.44 percent), followed by Kerala (125.15 percent), Punjab (119.41 percent), Tamil Nadu (103.76 percent), Gujarat (95.08 percent), Andhra Pradesh (93.53 percent), Haryana (92.24 percent), and Jammu & Kashmir (88.55 percent). Among the metros, Delhi tops with 267.64 percent tele-density. Service areas, such as Bihar (52.88 percent), Madhya Pradesh (67.35 percent), Uttar Pradesh (67.68 percent), and Assam (68.50 percent) have comparatively low tele-density. The wire-line customer base stood at 24.84 million at the end of March 31, 2022 vis-à-vis 20.24 million at the end of March 31, 2021.

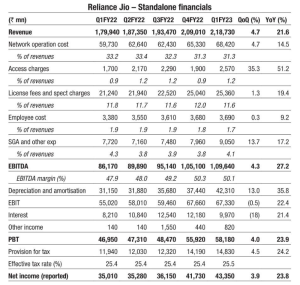

Reliance Jio Infocomm

RJio is mainly engaged in the business of providing digital services. For the full year FY22, Reliance Jio’s standalone PAT jumped to ₹14,817 crore against ₹12,015 crore in FY21. Revenue advanced to ₹76,977 crore as of March 31, 2022, compared to ₹69,888 crore as of March 31, 2021.

Performance Update Digital Services reported strong underlying revenue and EBITDA growth in FY22 on the back of continued traction in connectivity platform and tariff hikes in mobility services. Gross revenue of ₹100,161 crore on a year-end subscriber base of 410.2 million and an EBITDA margin of 47.3 percent attest to Jio’s superior network operations and cost position. Annual operating revenue for Jio Platforms crossed USD 10 billion in FY 2021-22.

FY 2021-22 saw over 130 million new users join the network on a gross basis, and data traffic grow at ~46 percent Y-o-Y to more than 91 Exabytes. Post the 2021 spectrum auction and trading agreement with Bharti Airtel, Jio’s spectrum footprint has increased 56 percent to 1732 MHz (average life of over 14.5 years). JioPhone has successfully transitioned over 100 million 2G users to 4G in the country over the past four years. Jio, in partnership with Google, announced the launch of JioPhone Next during the year. This is the most affordable smartphone anywhere in the world.

Jio’s 5G stack is 100 percent homegrown and a comprehensive 5G solution that is fully cloud native, software-defined, and digitally managed. This 5G stack encompasses radio and core network, software architecture, and hardware equipment, including outdoor small cells and gNodeBs. Jio’s network is built on a converged and future-proof architecture that allows for seamless upgrade from 4G to 5G and beyond. 5G coverage planning has been completed in top 1000 cities, based on targeted customer consumption and revenue potential using heat maps, 3D maps, and ray-tracing technology.

Over the past few years, Jio has forged long-term, strategic relationships with leading global technology companies. Key partnerships that materialized during the year are Google and Jio worked closely to create the Pragati OS, JioThings-Jio has entered into multiple partnerships with leading corporates and government institutions to provide smart connected vehicle, smart electricity metering, and smart utility solutions.

Investments. JPL and SES, a leading global satellite- based content connectivity solutions provider, entered into a 51:49 joint venture for next-generation scalable and affordable broadband services in India by leveraging satellite technology. JPL invested USD 15 million for a 25-percent equity stake in Two Platforms Inc., an artificial reality company with focus on building interactive and immersional AI experiences. JPL invested USD 200 million for a ~17 percent equity stake in Glance, a leading AI-driven lock-screen platform. In conjunction with global partners and world-class submarine cable supplier SubCom, Jio is deploying two next-generation cables centered on India.

Outlook. Jio’s investments to build a world-class digital infrastructure will pave the way toward a premier digital society in India. These solutions are now being implemented at scale to be later taken to the global audience. Newer revenue streams across the connectivity and technology platforms will accelerate the growth momentum and drive operating leverage. These endeavors would not just create a significantly positive socio-economic impact but also generate strong shareholder returns over the next several decades.

ISec observations. Reliance Jio Infocomm (RJio) revenues grew by a strong 8 percent QoQ despite Q4FY22 being shorter by two days, which shows that the latest tariff hike (in December 2021) was absorbed much better than the previous one (in December 2019). However, the number of subscribers continues to decline on clean-up of inactive subs and SIM consolidation. RJio may see some more benefit of tariff hike in Q1FY23 – of about 3–4 percent. Negative surprise was in FCF generation, which was impacted from higher working capital due to rise in receivables, and CapEx. FY22 CapEx stood at ₹257 billion (adjusted for spectrum payment). The CapEx also likely includes OpEx capitalization as the company’s fiber-based businesses are yet to be fully rolled out. RJio remains confident of acceleration in its FTTH sub-base, and enterprise business.

Balance sheet and cashflows. Intangible asset (largely spectrum) CWIP was still high at ₹286 billion, which means only 50 percent of the spectrum bought in March 2021 auction has been put for use; amortization will rise as the company deploys more spectrum; Gross debt (including deferred spectrum liability) was ₹785 billion; Trade receivables increased 3x to ₹43 billion; Lease liability repayment increased 85 percent YoY to ₹14.6 billion; Cash tax was ₹1 billion, @ 0.5 percent tax rate based on cash income tax paid for FY22; and Change in working capital was a negative ₹64 billion; thus cashflow from operations fell 6.2 percent YoY to ₹298 billion.

Negative surprise was in the CapEx spend of ₹288 billion. This includes the ₹31 billion cash spent on spectrum bought in March 2021 auction, and ₹10 billion paid to Bharti Airtel for 800MHz band spectrum. If we exclude these spectrum payments, network CapEx was elevated to ₹257 billion. Thus, FCF was just ₹10 billion.

Bharti Airtel

Airtel witnessed the highest ever consolidated revenues of ₹1,165,469 million for the year ended March 31, 2022, as compared to ₹1,006,158 million (re-casted revenue ₹969,992 million) in the previous year, an increase of 15.8 percent (an increase of 20.2 percent on a re-casted basis). Full-year revenues of India and South Asia stood at ₹824,877 million as compared to ₹726,980 million in the previous year, an increase of 13.5 percent (up 19.4 percent on a re-casted basis). The revenues across 14 countries of Africa, in constant currency terms, grew by 23.3 percent. Increase in revenue was majorly led by 4G customer addition and growth in data demand across the portfolio.

|

Bharti Airtel – Financial Summary Profit & loss statement (₹ mn, year ending March 31) |

||

| FY21 | FY22 | |

| Operating Income (Sales) | 10,06,158 | 11,65,469 |

| Operating Expenses | 5,52,441 | 5,90,130 |

| EBITDA | 4,53,717 | 5,75,339 |

| % margins | 45.1 | 49.4 |

| Depreciatiion & Amortisation | 2,94,044 | 3,30,907 |

| Net Interest | 1,50,910 | 1,64,375 |

| Other Income | (928) | 24,232 |

| Recurring PBT | 14,263 | 1,07,597 |

| Add: Extraordinaries | 1,59,145 | 3,85,358 |

| Less: Taxes | 89,325 | 41,779 |

| • Current tax | ||

| • Deferred tax | ||

| Less: Minority Interest | 27,195 | 40,503 |

| Net Income (Reported) | (1,50,835) | 42,301 |

| Recurring Net Income | 8,310 | 25,315 |

| Company data, I-Sec research | ||

The company incurred operating expenditure (excluding access charges, cost of goods sold, license fees, and CSR costs) of ₹384,621 million, representing an increase of 13.6 percent over the previous year.

Consolidated EBITDA stood at ₹581,103 million, an increase by 25.9 percent over the previous year on reported basis. The company’s EBITDA margin for the year increased to 49.9 percent as compared to 45.9 percent in the previous year, exhibiting Airtel’s continued focus on improving operational efficiencies.

Depreciation and amortization costs for the year were higher by 12.5 percent and stood at ₹330,907 million as the company continues to invest in future-ready network.

Consequently, EBIT for the year was ₹248,531 million, increasing by 49.6 percent, and resulting in a margin of 21.3 percent vis-à-vis 16.5 percent in the previous year. The consolidated net profit for the year ended March 31, 2022 came in at ₹42,549 million as compared to a net loss of ₹150,835 million in the previous year.

The capital expenditure for the financial year ending March 31, 2022 was ₹256,616 million. Net debt declined by ₹4 billion to ₹1235 billion. The company generated FCF (after interest cost) of ₹58.5 billion; however, it spent ₹25 billion on stake buy in Indus Towers, ₹22 billion interest capitalized for AGR and rupee depreciation impact.

ISec observations. All segments firing except DTH. Home services. Home broadband customers grew 46 percent YoY to 4.5 million. Revenue grew by a healthy 46 percent YoY to ₹8.8 billion despite reset in ARPU; EBITDA rose 43 percent YoY to ₹4.8 billion. Enterprise. Revenue and EBITDA grew 12.9 percent and 10.7 percent YoY, respectively. Payments bank. Active users were up 26 percent YoY to 37 million and revenue grew 53 percent to ₹2.7 billion; EBITDA margin continues to expand. Africa. Revenue and EBITDA (in USD terms) grew 17.7 percent and 17.1 percent YoY, respectively.

Mobile revenue grew 25 percent YoY/9.5 percent QoQ to ₹176 billion – this, compared to RJio’s 20 percent/Vi’s 6.6 percent YoY, implies Bharti’s market-share win continued. Growth came from ARPU jump of 9.7 percent QoQ to ₹178, and sub-base growth of 1 percent QoQ to 326 million. It also benefits from steady 4G net add at 5.2 million, and post-paid subs add of 0.2 million to 17.8 million. Q4FY22 ARPU reflects a significant portion of benefit of tariff hike taken in November 2021 of 20 percent in prepaid category as its ARPU has increased 18 percent versus Q2FY22, adjusted to lower days. Bharti needs another tariff hike for ARPU of >₹200, and it is possible in FY23.

India EBITDA grew 9.9 percent QoQ/27.5 percent YoY at ₹114 billion, driven by India mobile EBITDA growth of 12.3 percent QoQ/33 percent YoY to ₹89 billion. Incremental EBITDA margin was 64.1 percent and was impacted by higher SG&A cost. India depreciation and interest cost rose 15.4 percent and 5.1 percent YoY, respectively. Interest cost on annual basis is expected to decline by ₹16 billion due to deleveraging, prepayment of high-cost spectrum debt, and return of bank guarantees. Net profit rose 84 percent QoQ to ₹9.5 billion, and EPS was ₹2.4/share for Q4FY22.

Strong FCF generation. Net debt marginally dipped to ₹1235 billion due to Indus stake purchase and AGR interest-cost recognition. Bharti’s operating cash flow, after lease payment and interest cost, was ₹131 billion, up 47 percent YoY. It had negative working capital on seasonality due to advance payment of levies to government, which will reverse in next quarter, and despite that the company’s FCF after interest cost was ₹58.5 billion, which it should use to reduce debt in coming quarters.

Other highlights. DTH. Performance affected after impact of NTO introduction and moving away from tariff forbearance regime. TRAI has called for fresh consultation on tariff, and the company remains hopeful; Home. Company has expanded presence in cities by 556 to 847 in past 12 months on the back of innovative LCO partnership model; it expects total FBB customers to rise to 40 million (from 27 million now) for industry, and plans for a substantial share in incremental subs; Enterprise. Excluding voice services, data services is growing in teens and much faster. It is significantly aided by change in distribution structure, and strong product portfolio. Bharti has enough headroom for growth in large-enterprise market, and RJio expansion is unlikely to change the trajectory; and Mobile. Rising 4G smartphone prices, and focus on high-end phones have impacted shipments of entry-level 4G phones. Bharti believes the situation will salvage and customers will buy higher-priced phones as connectivity and data are essential services. 5G rollout in urban areas should have accelerated the rollout for FY25 as 5G-enabled handset penetration crosses 14–15 percent; Indus gets 50–60 percent share of tower rolled out by Bharti, and it includes macro and leaner towers. Operating cost on leaner towers is <30k/month versus >70k/month on macro towers. Energy cost rise is a headwind for network cost; and 6) company had total cost saving of USD 1.2 billion in past few years.

| Bharti Airtel – Balance sheet (₹ mn, year ending March 31) |

||

| FY21 | FY22 | |

| Assets | ||

| Total Current Assets | 6,91,849 | 7,12,251 |

| of which cash & cash eqv. | 1,34,661 | 97,626 |

| Total Current Liabilities & Provisions |

10,04,053 | 9,71,433 |

| Net Current Assets | (3,12,204) | (2,59,181) |

| Investments | 2,75,504 | 2,34,723 |

| Strategic/Group | 2,34,346 | 2,34,346 |

| Other Marketable | 41,158 | 377 |

| Net Fixed Assets | 19,62,997 | 20,69,772 |

| Goodwill | 3,29,064 | 3,29,064 |

| Total Assets | 22,55,361 | 23,74,378 |

| Liabilities | ||

| Borrowings | 16,27,852 | 16,57,852 |

| Deferred tax Liability | (1,84,757) | (1,73,309) |

| Minority Interest | 2,22,739 | 2,22,739 |

| Equity Share Capital | 27,460 | 29,420 |

| Face Value per share (₹) | 5.0 | 5.0 |

| Reserves & Surplus | 5,62,067 | 6,37,676 |

| Net Worth | 5,89,527 | 6,67,096 |

| Total Liabilities | 22,55,361 | 23,74,378 |

Bharti India, market-share win continues. Bharti India’s mobile revenue rose 9.5 percent QoQ and 25.1 percent YoY to ₹176 billion. The growth was driven by an increase in ARPU on the back of higher 4G subscribers, postpaid subscriber additions during the quarter, and benefit of tariff hikes. In November 2021, the company had taken a price hike of 25 percent across prepaid category. EBITDA improved 12.3 percent QoQ/33.4 percent YoY to ₹89 billion, and EBITDA margin was 50.6 percent (up 130 bps QoQ and 310 bps YoY). Incremental EBITDA margin was 64.1 percent due to higher SG&A cost.

Subscriber-base rose 3.1 million to 326 million and was likely impacted by SIM consolidation, resulting from a series of tariff hikes. It has added 0.2 million post-paid subs taking the total to 17.8 million (7 percent YoY growth).

ARPU rose to ₹178 (up 9.7 percent QoQ/22.8 percent), which was benefited by tariff hikes, 4G subs add (though it has decelerated) and higher postpaid mix. The benefit of Nov’21 tariff hike is now reflected in ARPU of Q4FY22.

Mobile minutes rose 2.1 percent QoQ/5.4 percent YoY to 1051 billion, implying net addition of 21 billion minutes QoQ. Minutes of usage per sub came in at 1083 minutes per month, up 2.1 percent QoQ.

4G sub-base grew 2.7 percent QoQ/12.0 percent YoY to 200.8 million (+5.2 million) versus 3 million addition in Q3FY22. Total data subs rose by 5.5 million to 208.4 million, up 2.7 percent QoQ.

Data usage grew 4.8 percent QoQ (28.7 percent YoY) to 11,849 billion-MB. Data usage per sub came in at 19.2GB per month, down 2.7 percent QoQ.

Churn rate for Bharti was slightly better on QoQ basis to 2.8 percent in Q4FY22 versus 2.9 percent in Q3FY22. Gross subscriber addition came in at 30.5 million during the quarter (vs 27.8 million in Q3FY22).

Non-mobile businesses highlights: 1) Non-mobile revenue grew 2.1 percent QoQ/14.6 percent YoY to ₹58 billion and EBITDA rose 2.7 percent QoQ/12.3 percent YoY to ₹26 billion.

DTH revenue dipped 4.6 percent QoQ, and 1.6 percent YoY to ₹7.6 billion while EBITDA was down 6.9 percent QoQ/3 percent YoY to ₹5 billion. EBITDA margin came in at 65.6 percent, down 165 bps QoQ.

Airtel business (enterprise) revenue rose 1.8 percent QoQ/12.9 percent YoY to ₹42 billion and EBITDA rose 4.0 percent QoQ, and 10.7 percent YoY, to ₹16.5 billion.

Home services revenue jumped by a sharp 10.0 percent QoQ/45.8 percent YoY to ₹8.8 billion and EBITDA expanded 9.5 percent QoQ/42.7 percent YoY to ₹4.8 billion YoY.

Overall, Bharti’s India revenue rose 8.0 percent QoQ/22.9 percent YoY to ₹227 billion. India EBITDA grew 9.9 percent QoQ/27.5 percent YoY to ₹114 billion.

India CapEx stood at ₹43 billion (18 percent of revenues) in Q4FY22, and ₹204 billion (24 percent of revenues) in FY22.

Bharti Africa – Impressive performance continues

In constant currency terms, gross revenue rose 19 percent YoY to USD 1222million.

- In USD terms, reported revenue jumped 0.2 percent QoQ and 17.7 percent YoY to USD 1222million. ARPU dipped 1.5 percent QoQ to USD 3.2. Subs rose 2.7 million to 128 million.

- Mobile minutes were up 1 percent QoQ and 15.8 percent YoY, while data usage grew 6.4 percent QoQ and 46 percent YoY.

- Data subscribers rose 3.6 percent QoQ to 47 million (up 1.6 million in Q4FY22) and data usage rose 6.4 percent QoQ and 46.3 percent YoY to 509 billion MB. Data usage per subscriber stood at 3.7 GB per month, up 3.6 percent QoQ.

- EBITDA was USD 576 million in Q4FY22. It was up 17.1 percent YoY and down 4.3 percent QoQ, and EBITDA margin dipped 225 bps QoQ to 47.1 percent.

- Bharti Africa reported net profit of USD 190 million in Q4FY22 (vs USD 155 million in Q3FY22).

- Africa CapEx was USD 224 million in Q4FY22 (18.3 percent of revenue) and USD 656 million in FY22 (13.8 percent of revenue).

Strategic alliances and partnerships. Airtel continues to forge business partnerships with an aim to provide seamless customer experience with greater value proposition to end users. Airtel and Intel announced a collaboration to accelerate 5G in India. The telco is collaborating with Tata Group/TCS for Made in India 5G. Airtel and TCS successfully tested innovative use cases from TCS’ Neural Manufacturing solutions suite on Airtel’s ultra-fast and low-latency 5G network. TCS successfully tested two use cases on Airtel’s 5G testbed – remote robotics operations and vision-based quality inspection. The telco partnered with global cybersecurity company, Kaspersky. Its partnership with Apollo 24/7 enables Airtel to offer a wide range of e-healthcare services to its customers. Airtel and Tech Mahindra announced a strategic partnership to build and market innovative solutions for India’s digital economy. The two companies will also bring to the market customized enterprise-grade private networks, which will be at the core of the digital economy.

Mergers, acquisitions and disinvestments. Airtel concluded a host of M&A transactions, as a part of its growth and diversification strategy, and to harness economies of scale resulting from the consolidations. The telco has purchased additional 4.7 percent equity interest in Indus Towers from Vodafone Plc at ₹187.88 per share. Airtel acquired an additional 2.86 percent stake in Vahan Inc. as part of its Startup Accelerator Program and also agreed to acquire a strategic stake in Aqilliz – a blockchain-as-a-service company.

Outlook. With an investment of over ₹46 billion, Airtel has contributed toward the creation of massive digital highways for India and build a future-proof business across mobile wireless, home broadband, digital TV, enterprise solutions, and adjacent digital services, including Airtel Payments Bank. Airtel is well positioned to lead the growth by leveraging its strengths and taking prudent bets around different emerging opportunities. The ability to offer converged solutions, along with specialized services, puts Airtel in a sweet spot to drive the growth prospects, going forward. A customer-obsessed Airtel currently stands firm on this cusp with a robust future-ready growth engine, ably supported by a fantastic team of professionals and partners and a strong balance sheet, ready to scale newer heights.

Vodafone Idea Limited

Vi is significantly lagging peers on 4G investment, which is also the road to 5G. The company is yet to complete the ₹100-billion fund raise it has been negotiating for many quarters now. VI is significantly lagging peers on 4G investment, which is also the road to 5G. Future ARPU growth will depend on 4G net sub-add, monetization of digital properties and more tariff hikes. Annualized EBITDA (excluding the one-off) is ₹79 billion, which is short of the requirement to meet cash liabilities. Vi has ₹60 billion bank debt repayment and CapEx in FY23.

4G subs add unexciting. Vi’s sub net loss at 3.4 million was probably due to incremental hit from SIM consolidation on tariff hikes in November 2021. Postpaid subscribers rose by 0.2 million to a total of 20 million. Gross subscriber addition rose to 21.9 million (vs 19.9 million in Q3FY22); however, higher churn rate led to net sub loss. 4G subscriber adds are still struggling and stood at 1.1 million to take the total to 118 million. Minutes declined 2.8 percent QoQ (15 percent YoY) to 452 billion. Data usage was flattish QoQ (+7.8 percent YoY) at 5237 billion MB.

Tariff-hike benefits captured in revenues. Vi’s mobile revenues were up 5.8 percent QoQ (+5.8 percent YoY) to ₹91 billion. Revenues benefited from the ~20-percent price hikes taken in November 2021. ARPU was up 7.8 percent QoQ (+15.9 percent YoY) to ₹124. ARPU has grown 16 percent in past two quarters, and Vi said November 2021 tariff hike benefit has largely been captured in the revenues. ARPU growth in future will be driven by 4G subscriber add, revenues from digital properties, and likely frequent tariff increases. The management also hinted at higher tariff hikes to be taken in the unlimited data segment, and 2G to have relatively lower inflationary impact. Thus, 4G customer growth becomes doubly important for Vi.

Cash EBITDA (adjusted for Ind-AS 116) at ₹21.2 billion. EBITDA at ₹47 billion was up 21.8 percent QoQ (5.5 percent YoY) and included a one-off benefit of ₹1.5 billion. Q4FY22 annualized cash EBITDA (excluding the one-off) was ₹79 billion (sufficient to run the operations efficiently). Net loss during Q4FY22 stood at ₹65 billion. CapEx for the quarter was ₹12 billion (11.8 percent of revenues) and ₹45 billion for FY22 (significantly lower vs peers). Some cost benefit is expected from tower-rental renegotiations, which are yet to conclude.

Net debt piles up to ₹1964 billion. This includes deferred spectrum liability of ₹1139 billion, AGR liability of ₹660 billion, and bank borrowing of ₹180 billion. Bank borrowing has dipped from ₹230 billion in Q3FY22 post successful repayment of NCDs. Debt payable in next 12 months is ₹82 billion, and release of certain cash from bank guarantee will reduce payables to ₹60 billion, which the company has to meet from internal accruals.

Driving partnerships and digital revenue streams. Vi launched music service on Vi app for the entire base. The service has been launched in partnership with Hungama Music. The telco has launched several digital offerings for its customers over and above content. It partnered with Nazara Technologies, launched a new service-Vi Jobs & Education on the Vi App in partnership with Apna, partnered with English learning platform Enguru. Vi Jobs & Education has also partnered with Pariksha, which offers the aspirants preparatory support for central/state government jobs.

Outlook. Vi will continue its journey of becoming a truly integrated digital service provider through its several strategic initiatives as well as continue to make investments for expanding 4G coverage and capacity, especially in its 17 priority circles, and upgrade its networks toward 5G-ready network. The telco will continue to focus on improving ARPU by driving UL/4G penetration as well as digitization of customer servicing and distribution channels with an aim to provide the best of customer experience to retail and enterprise customers. In Business Services, it will increasingly focus on new and fast-growing segments, such as Cloud services and IoT. To further drive the digital agenda, Vi will look for deeper integration opportunities, with its partners using its platform capabilities to provide a differentiated telco++ experience and value for partners as well as customers. The telco will look to scale up its digital and content offerings with the intent of monetization.

Vi will remain focused on providing superior data and voice experience and building a differentiated digital experience, with focus on increasing 4G subscribers. It successfully completed the first tranche of fund raising in the form of preferential equity contribution of ₹45 billion from the promoters, and will continue to actively engage with lenders and investors for further fund raising. All these initiatives, coupled with the significant liquidity provided by the government reforms package and the recent tariff hikes, will enable the company to make network investments and compete effectively to improve its competitive position.

Bharat Sanchar Nigam Limited

A decade after India first got 4G and when private telecom players are at the cusp of 5G deployment, government-owned BSNL is yet to be allotted 4G airwaves. This has resulted in declining revenues and stagnating wireless market share for the company in the last few years.

The government wants to transform the beleaguered telco into a financially viable, sustainable, and vibrant player. The company plans to roll out the 4G network from November 2022 and will install 125,000 4G mobile sites in the next 18 months. “The minister has given us a clear path that August 15, 2023, should be the date when BSNL should be in the 5G domain. We are working in that direction, which we have received. We should be able to meet it (the target timeline),” said PK Purwar, CMD, BSNL.

The government maintains that BSNL is a market balancer and plays a crucial role in the expansion of telecom services in rural areas, development of indigenous technology, and disaster relief. Despite the commercial non-viability, BSNL provides wireline services in rural and remote areas to meet the government’s social objectives.

Spread over four years, the latest relief package worth ₹1.64 trillion comes with a cash component of ₹44,000 crore and a non-cash component of ₹1.2 trillion, with an aim to make the company profitable again by 2026-27. This includes administrative allocation of spectrum for 4G services at the cost of ₹44,993 crore through equity infusion, CapEx funding of ₹22,471 crore for the deployment of indigenously developed 4G stack and ₹13,789 crore of viability gap funding for rural wireline operations. This package comes three years after the government shelled out ₹69,000 crore focused on VRS, asset monetization, and fresh equity infusion and money for 4G service (₹24,000 crore was earmarked but not used). The VRS helped in as much as BSNL was able to cut its wage bill by almost half. The sanctioned strength of the staff of the company will be 71,442 number of employees, post restructuring.

Both the PSUs will get a sovereign guarantee to raise long-term loans through bonds for an amount of ₹40,399 crore, while BSNL’s statutory AGR dues of ₹33,404 crore will be converted into equity. BSNL will be able to restructure its existing bank debt of ₹33,000 crore. Another measure is the merger of BBNL with BSNL to facilitate a wider utilization of infrastructure laid under the BharatNet project – which aims to connect 650,000 villages with broadband by 2025, but is way behind its target. By March 2022, only 27 percent of the villages had received connectivity.

BSNL plans to get ₹20,000 crore from monetizing its assets like its land and buildings. The telco has kicked off a process to sell telecom towers, with 70 percent of them fiberized, to meet targets laid out by the Center as part of its national monetization pipeline (NMP). As part of NMP targets, BSNL has to sell 13,567 towers by financial year 2025 and MTNL, which operates in Delhi and Mumbai, has to sell 1350 towers. In all, the two state-owned telcos will sell 14917 towers in a phased manner. It has engaged KPMG as a financial advisor to administer the sale. BSNL owns 68000 telecom towers. It is selling only those towers that have co-location arrangements with third-party telecom service providers, such as Reliance Jio and Airtel.

BSNL has been given stiff targets, doubling BSNL’s subscriber base by offering 4G and 5G services to 200 million. But BSNL’s visitor location register (VLR) – which reflects the percentage of active subscribers – is a mere 51.81 percent, the lowest in the industry (the average is over 88 percent). It has 58 million active subscribers, or just over 5 percent share of the total active mobile subscriber base in the country. Its share of revenue is also pegged at similar levels. While all other players have cleaned up subscribers who do not pay, BSNL has carried them on in their books, impacting average revenue per user (ARPU).

To double the subscriber numbers is a tall order, especially when competition is launching 5G services to upgrade their 4G users soon. And the overall market is maturing, so it is growing marginally. Besides, it is not as though BSNL can leverage a large rural subscriber base, its market share here is just 7.38 percent (as of December 2021), the lowest among competitors. The minister for telecom, Ashwini Vaishnaw, has said that the BSNL should roll out both 4G and 5G in parallel. And whenever the technology by C-DoT for 5G is ready, it should start integrating these radios with 4G.

In 2021-22, total revenue of BSNL has increased by about 2.18 percent in current financial year from ₹18,646 crore to ₹19,052 crore. It incurred a loss of ₹6981.62 crore (previous year was ₹7441.12 crore). Net loss has decreased by 6.18 percent, and it is EBITDA-positive during this FY to ₹944 crore. While the Income from Services is ₹16,809.22 crore (previous year ₹17,451.80 crore), the Other Income is ₹2243.37 crore (previous year ₹1193.79 crore).

Total revenue has increased by about 2.18 percent in comparison to the previous year. Employee cost has increased by 7.33 percent in comparison to the previous year. Net loss has decreased by 6.18 percent, cash loss has increased to ₹1673.58 crore as compared to previous year’s loss of ₹1390.12 crore. Borrowing and finance cost has gone up.

Operating expenses were further reduced with various initiatives like implementation of Oorja, budget module in ERP, etc., timely processing of invoices. However, the ratio of Current Assets to Current Liabilities which should ideally be 2:1, stood at 56.88 percent.

The expenditure-control measures implemented by the management resulted in significant savings, specifically in power and fuel, repair and maintenance, and housekeeping. There is decrease in income from operations by 4 percent due to decline in landline and broadband revenues as well as demand of enterprise business was affected due to Covid-19 during the first half of 2021-22.

The Union Cabinet on July 27, 2022, approved revival measures having focus on infusing fresh capital for upgrading BSNL services, allocating spectrum, de-stressing its balance sheet, and augmenting its fiber network by merging Bharat Broadband Nigam Limited (BBNL) with BSNL. The measures are as follows:

- Allotment of spectrum at the cost of ₹44,993 crore through equity infusion.

- Financial support by equity infusion of ₹22,471 crore for CapEx.

- The Viability Gap Funding of ₹13,789 crore, for rural operations for the period 2014-15 to 2019-20.

- Authorized capital to be increased to ₹150,000 crore to accommodate the infusion of capital.

- Sovereign guarantee will be provided to BSNL to raise long-term bonds for an amount of ₹22,828 crore for debt restructuring over a three-year period.

- AGR dues of BSNL will be settled by conversion into equity. Funds will be provided by the government to settle the GST dues thereupon.

9-percent non-cumulative preference shares of ₹7500 crore will be reissued to the government.

Presently, BSNL has launched 4G services at a limited scale by utilizing the existing available spectrum, which is also being used for providing 3G services. In order to promote domestic technologies and Make in India initiative of the Government of India for telecom sector and full-scale 4G services launch, BSNL has followed proof-of-concept to implement the government policy mandate for 4G services launch, TCS, C-DoT, and Tejas combined has developed equipment and provisionally successfully conducted tests for deployability of 4G equipment, with certain punch points. BSNL has already placed order for 12,000 sites for early deployment.

Borrowings during financial year 2021-22. Opening balance of borrowings as on March 2021 stood at ₹30,102 crore. During FY22, the company borrowed ₹7784 crore and repaid an amount of ₹4871 crore. The balance of borrowings as on March 2022 stood at ₹33,009 crore.

The new business includes thrust on passive infrastructure sharing with other operators; leasing of bandwidth to other operators – the telco’s huge network infrastructure with significant capacity shall be leveraged to fulfil requirement of back-haul connectivity of new operator, which will reduce the total cost of ownership (TCO) of other operators; monetization of the real estate infrastructure; and monetization of the optical fiber cable assets.

Outlook. Implementation of revival measures for the company approved by the Union Cabinet is in progress. The Union Cabinet have helped the company to overcome the challenge significantly. The telco continues to focus on accelerated execution of government projects, prioritizing investments in profitable areas, driving ARPU up, with simplification of tariff and focus on partnerships to drive value and strengthening the balance sheet.

Acceleration of IoT, growing OTT consumption, rapid adoption in gaming and ecommerce open up deep addressable markets across all digital verticals for Indian telcos, as wireless connectivity remains the key enabler. Further, the telecom operators are not just offering voice and data services but also a suite of digital service applications, own as well as through partnerships, and are thus transitioning from being pure telecom service providers to integrated digital service providers, offering entertainment, information, cloud, and storage services.

|

BSNL– Consolidated financial results (₹ crore) |

||

| Item | 2021-22 | 2020-21 |

| Revenue from operations | 16,811.28 | 17,452.11 |

| Other Income | 2,243.37 | 1,193.79 |

| Total Income | 19,054.65 | 18,645.9 |

| Profit after tax | (6,981.63) | (7,441.11) |

| Net worth | 44,693.63 | 51,686.80 |

| Earning per share (₹) | (13.96) | (14.88) |

| Debt equity ratio | 0.9 | 0.73 |

India is expected to maintain strong growth with the pole position as the fastest-growing major economy, while the global economy is expected to witness some slowdown in growth YoY, vis-à-vis the sharp recovery last year and recent concerns due to the Russia-Ukraine conflict. India’s strong growth will be fuelled by the digital highways created by the telecom and digital players over the last few years. More and more users are now leveraging the digital infrastructure for day-to-day activities, including remote working, payments, entertainment, education, health services, and many more. India continued to witness strong smartphone shipments in 2021, even as supply and pandemic-related challenges created disruptions during the year. Increasing smartphone penetration will fuel the 2G to 4G uptrading and opening up higher revenue opportunities for mobile data services as well as digital services. Equally, with increasing use cases and consumption, data usage per user continues to rise, becoming one of the highest globally, while tariffs continue to be among the lowest globally, with a substantial headroom for hikes. India’s telecom market continues to be dominated by the prepaid segment, the postpaid segment is still under-penetrated. Upgrading of customers to high-value postpaid remains a lucrative opportunity for the industry going forward.

In addition to wireless data, home broadband is becoming more and more ubiquitous, with increased remote working and in-house entertainment. With Covid-19 providing the push, home broadband is expected to explode and grow exponentially over the next few years. Continued increase in wireless and wireline data penetration is driving multi-fold growth in usage and adoption of digital services, opening up opportunities for content, music streaming, digital advertising, payments, fintech, and digital marketplace. On the enterprise side, the market is dynamically changing with emerging categories and adjacencies, including data centers, security, cloud, CPaaS, and IoT now accelerating.

The telcos are working with the government to explore the potential of 5G, particularly with respect to drones and other applications that may require regulatory oversight. As the role of 5G continues to grow, policy makers are increasingly looking to create a favorable business environment that will encourage further investment and allow operators to extend next-generation digital services to all the citizens and accelerate the recovery from the pandemic.

6G is not even close to being standardized, but work is already underway to figure out what it might look like. While 5G’s focus has leaned toward revolutionizing industrial and business verticals, the ideas that float for potential 6G use cases might fundamentally change telecommunications itself – short-range point-to-point communications for high-capacity fronthaul and backhaul. The ability to have wireless connections within data centers. Intriguingly, there is also a concept emerging of using wireless frequencies for both communications and sensing capabilities. While decisions about 6G spectrum would not be made in 2023, the WRC 2023 will set the agenda for the next WRC in 2027 – when 6G will be right around the corner. The Indian government is certainly keen to see 6G services reach India before the end of this decade!

You must be logged in to post a comment Login