CT Stories

Ushering in the 5G revolution in India

The telecom industry is at the next phase of growth as it moves closer to paving way for high-speed 5G services to public and enterprise.

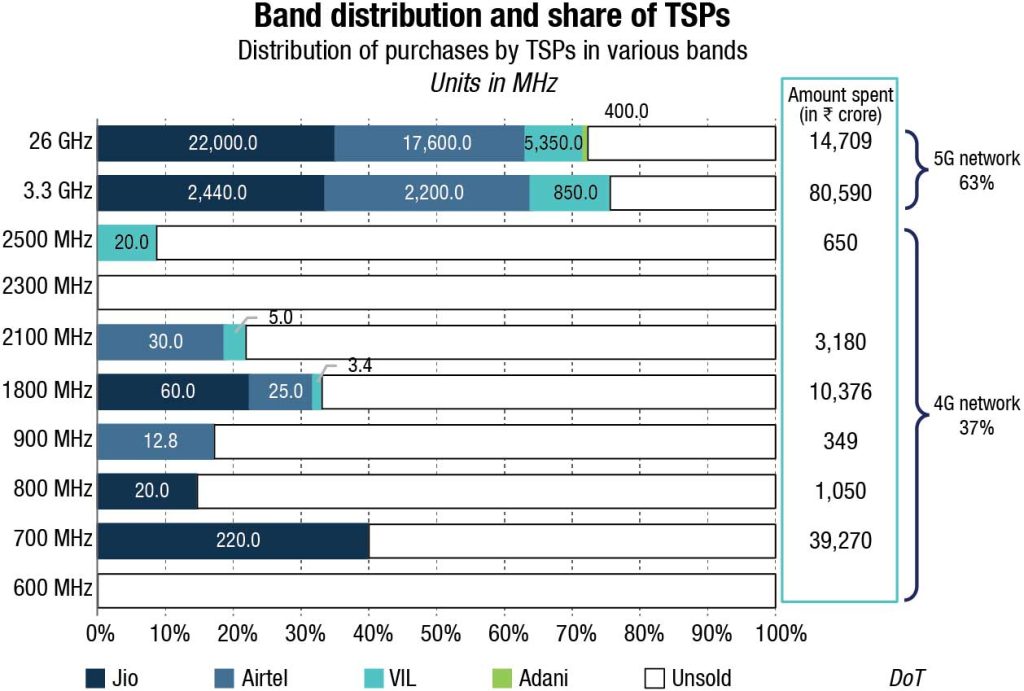

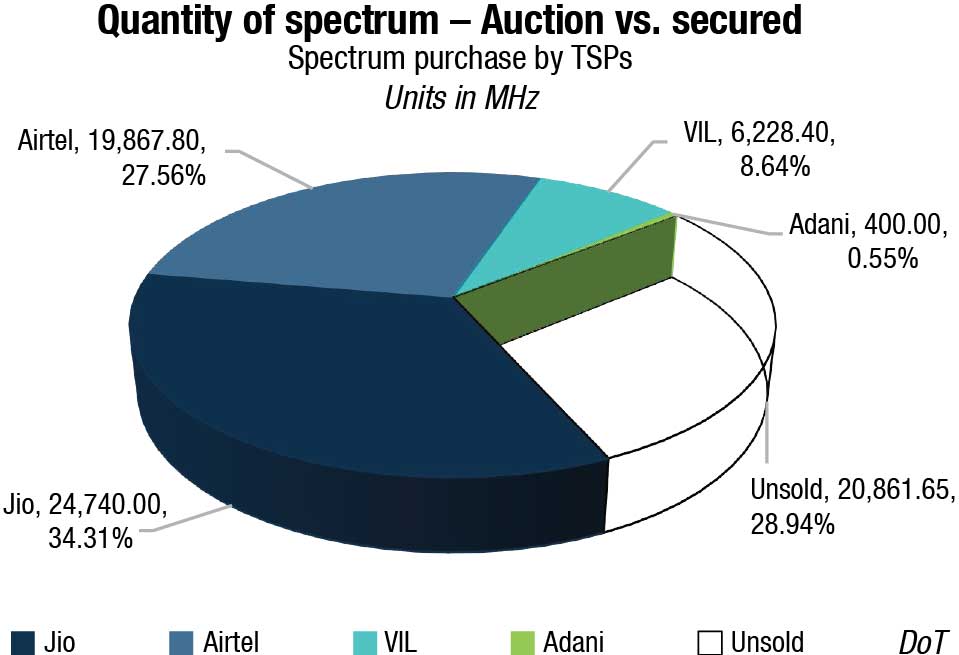

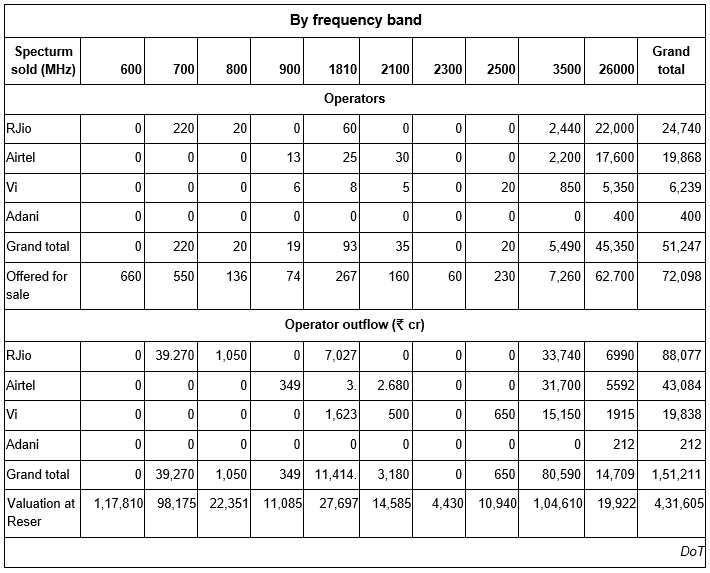

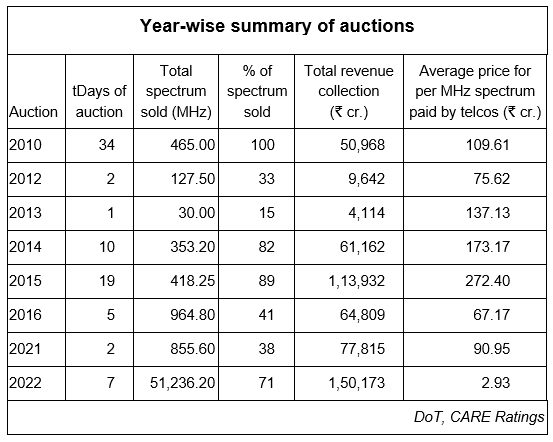

The 5G spectrum auction, concluded on August 1, 2022, after 40 rounds and 7 straight days of bidding, fetching ₹150,173 crore. This year’s auction saw a lower spectrum reserve price by 39 percent. The industry purchased the spectrum for 20 years across 3300MHz, 26GHz, 700MHz, and 1800MHz bands, along with small purchases in 800MHz, 900MHz, 2100MHz, and 2500MHz bands, while there was no participation in the 600MHz and 2300MHz bands.

RJio and Bharti Airtel emerged as the front runners, which saw 51.236 GHz, nearly 71 percent of the total 72.098 GHz, being sold. RJio acquired 24,740 MHz, Bharti Airtel 19,867 MHz, Vi 6228 MHz, and new entrant Adani Data Networks Ltd 400 MHz.

Ashwini Vaishnaw

Ashwini Vaishnaw

Minister for Communications,

Electronics & Information Technology and Railways, Government of India

Spectrum assignment letter issued. Requesting TSPs to prepare for 5G launch.

Jio has acquired spectrum in the 700MHz, 800MHz, 1800MHz, 3300MHz, and 26GHz bands in the auctions. The telco’s post-auction spectrum footprint is a unique combination of low-band, mid-band, and mmWave spectrum. Through this acquisition, Jio’s total owned spectrum footprint has increased to 26,772 MHz (uplink+downlink), the highest in India.

Bharti Airtel has acquired 9800 MHz spectrum in 900MHz, 1800MHz, 2100MHz, 3300MHz, and 26GHz bands by securing a pan-India footprint of 3.5GHz and 26GHz bands. In addition, the company was able to selectively bolster mid-band spectrum.

Vi acquired mid-band 5G spectrum (3300MHz band) in priority circles and mmWave spectrum (26GHz band) in 16 circles. The additional 4G spectrum acquisition in three circles of Andhra Pradesh, Karnataka, and Punjab will further improve the customer experience.

Reliance Jio Infocomm Ltd committed to pay ₹88,087 crore, Bharti Airtel to pay ₹43,084 crore, and Vodafone Idea to pay ₹18,799 crore, Adani Data Networks Ltd to pay ₹212 crore. All bands, except 1800 MHz band were sold at the reserve price.

The spectrum acquired in this auction attracts a zero percent spectrum usage charges (SUC). This amounts to an annual saving of ₹2261 crore for Bharti Airtel (with pan India SUC rates of 0.39 percent, as against the earlier 4.26 percent), ₹ 2078 crore for RJio (with pan India SUC rates of 0.19 percent as against the earlier 2.9 percent), and ₹640 crore for Vi (with pan India SUC rates of 0.66 percent as against the earlier 3 percent).

Spectrum dues have been paid by the four bidders on August 17, 2022 . DoT received a total of ₹17,874.4 crore. Bharti Airtel, that made advance payments for four years paid ₹8312.4 crore, Reliance Jio paid ₹7,864 crore, Vodafone Idea paid ₹1,680 crore, and Adani Enterprises paid ₹18 crore. The first payout by is higher than the DoT’s initial calculation of ₹13,365 crore.

According to the DoT’s norms, these companies can make full or partial upfront payments for the spectrum. Companies also have the option to make payments in 20 annual equal instalments, protecting the net present value of the bid amount with an interest of 7.2 percent.

Within hours of receiving the payment, letters for spectrum assignment were issued by DoT, and spectrum allocated the next day. With the assignment of frequencies, telecom operators can start the work for rolling out 5G networks.

The three telcos are in dialogue with the government on harmonisation of the 5G spectrum across all the bands. The spectrum harmonisation process brings together a bunch of radio wave holdings within a band into one contiguous block with the consensus of all telecom service providers thereby reducing interference in the bands purchased and leading to greater efficiencies for players. This is the standard operating procedure after the conclusion of an auction.

It is anticipated that Bharti Airtel is encountering interference issues in the 3.5 GHz spectrum band due to the Indian Regional Navigation Satellite System installation in six locations, in which case the harmonisation is out of question. Also, 3.5GHz is not free to use in some circles for both Bharti and Vi. They are also encountering interference issues around international borders.

On winning price being the same as the reserve price

K Rajaraman

K Rajaraman

Secretary, Department of Telecom,

and Chairman of Digital Communications Commissions

The job of the government is to ensure to put in place a transparent, fair, non-arbitrary, non-discriminatory process for a national resource. It is for the market to discover the price. The market is dynamic. The industry is not rooted in a static market. There are global factors, macroeconomic factors, and the state of the industry that dictate the price at which the telecom services providers are willing to buy.

The Department of Telecommunications (DoT) has also commenced an exercise to offer an additional 5500 MHz of 5G spectrum, worth over ₹35,000 crore. An internal committee has been formed to form a strategy to incorporate the mmWave band, 37.0-42.5 GHz. Once the proposal is finalised, the committee of secretaries, will officially notify the band as IMT, and then DoT will approach the TRAI to propose the base price for the airwaves, The band will be offered to both, the satcom and the telecom players.

DoT has sought fresh recommendations from TRAI on the allocation methodology for E and V bands. DoT will provisionally allocate two carriers of 250 MHz each (paired) in E-band (71-76/81-86) GHz to mobile operators administratively for meeting their backhaul requirements in the LSAs where they are holding access spectrum in IMT bands as they prepare to launch 5G services. It will be purely on temporary and provisional basis. The DoT has also increased the limit of maximum number of microwave access carriers that can be assigned to a telco. As per DoT, for metros and category A circles, eight carriers can be assigned as against the existing four, while in category B and C circles, six carriers can be assigned as against the existing three.

The DoT will be assigning backhaul frequencies to support the networks with lesser fiber connectivity and ensure a faster upgrade. By March 2023, more than 75,000 5G sites are expected to be set up.

Initially, 5G networks are likely to be launched in metros and category A circles that have high paying capacity, followed by smaller cities and towns. Wider rollout is expected from September 2022 onwards.

Airtel has announced that by March 2024, they will be able to cover every town and key rural areas as well with 5G. “In fact, detailed network rollout plans for 5000 towns in India are completely in place. This will be one of the biggest rollouts in our history,” said Gopal Vittal, chief executive officer of Bharti Airtel and South Asia during the company’s 1Q FY23 earning call. All the sites the company is rolling out would have a ready backhaul for delivering a world-class 5G network experience to the consumers. The telcos have access to the E-band spectrum and are fiberising towers to increase capacity.

Reliance Jio plans to offer 5G services in nine cities in the country by January 2023, probably starting with Delhi and Mumbai sometime later this year. Jio’s 5G coverage planning has been completed in top 1000 cities based on targeted customer consumption and revenue potential using heat maps, 3D maps, and ray tracing technology.

Spectrum auction is only the first step. Telcos will need to follow it up with heavy, capital expenditure on network equipment and fibre laying every year. Analysys Mason estimates that top three telcos could spend about ₹1.6 lakh crore to upgrade and expand their networks over the next five years to roll out 5G services. Crisil agrees and says that the telco spend on 5G infrastructure (barring spectrum) will be about ₹1.7 lakh crore over fiscal 2023-25, majority component being fiberziation.

TRAI in its report has said India would take three-four years for urban and eight to 10 years for rural 5G penetration. Additionally, Jio—with the intention to go public in 2024—needs to show that it’s ahead of the pack and can create more revenue streams.

Sunil Mittal

Sunil Mittal

Founder and Chairman,

Bharti Enterprises

Yesterday Airtel paid ₹8312.4 crore toward spectrum dues and was provided the allocation letter for the designated frequency bands within hours. E band allocation was given along with spectrum as promised. No fuss, no follow up, no running around the corridors and no tall claims. This is ease of doing business at work in its full glory. In my over 30 years of first-hand experience with DoT, this is a first ! Business as it should be.

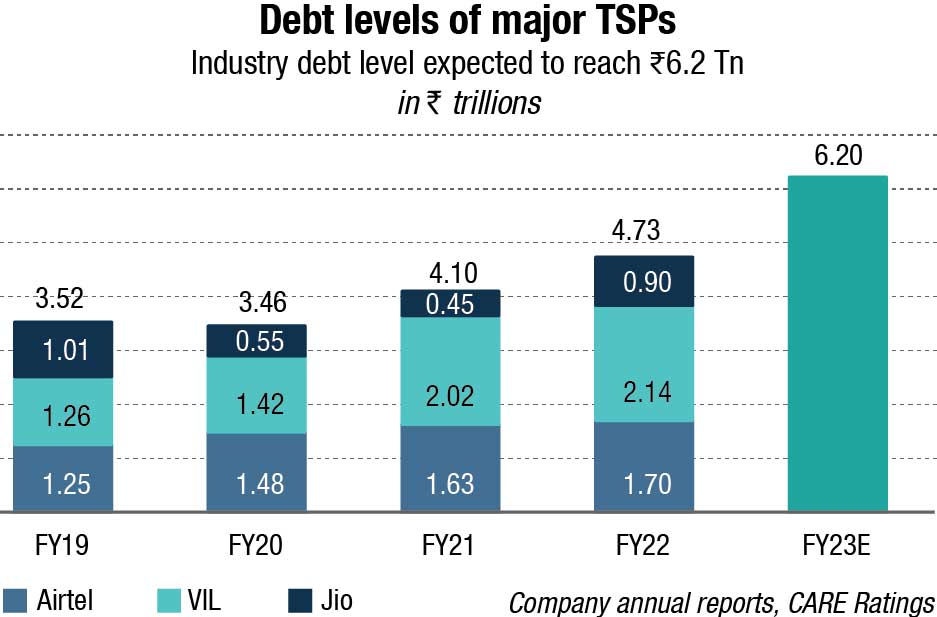

The credit profiles of Bharti and Jio will remain intact as their balance sheets have been strengthened by large equity raisings in the last three years, says Fitch Ratings. “We expect that Bharti’s net debt/EBITDA for financial year ending March 2023 (FY23) will be 1.5x-1.6x, well below the 2.5x level above the negative rating action. (Care Ratings pegs the aggregate debt levels of the industry could surge by nearly 30 percent to ₹6.2 lakh crore, including financial lease obligations by end of FY23.) Bharti’s and Jio’s free cash flow generation is expected to improve as operating cash flow growth will more than offset incremental spectrum-related payments and the increase in 5G-related CapEx. 5G CapEx in 2023-2024 will replace current 4G CapEx, as 4G coverage is largely complete. Telcos will also continue to strengthen their fibre infrastructure by connecting towers with fibre and backhaul infrastructure to prepare for the launch of 5G services.

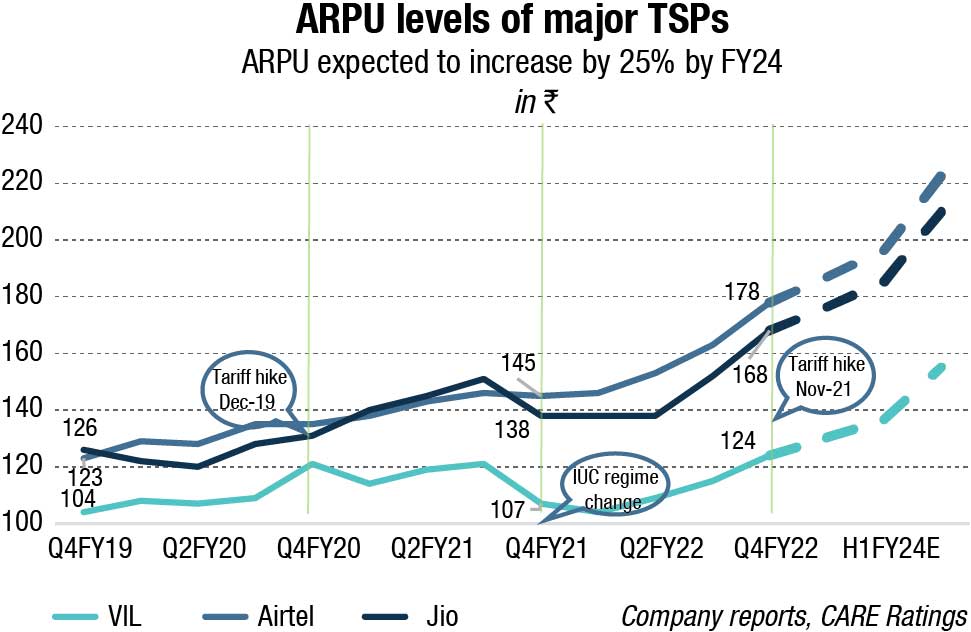

The telcos’ operating cash flows will likely improve on higher monthly average revenue per user (ARPU). We expect industry monthly ARPU (USD2) to grow by 15 percent-25 percent in the next 12-18 months, as telcos will likely increase headline tariffs in the next 12 months. We expect ARPUs to continue to increase in the medium term, as telcos will likely price 5G services higher than 4G. ARPUs will also grow as 2G and 3G users gradually migrate to higher-priced 4G and potential 5G plans. We forecast telcos’ EBITDA margin to expand by 200-300bps as telcos will realize cost savings on lower spectrum usage charges, given they will not have to pay usage charges on the spectrum bought in the latest auction.

However, the 5G business case will only gradually evolve with limited cash flow contribution in the initial years. Telcos’ will likely focus on 5G use case for enterprises initially to accelerate revenue growth in this segment.

|

Key metrices of 5G auction By spectrum quantity and amount payable |

|||

| Bidder | Amount (in ₹ cr.) | Spectrum won (in MHz) | % of total spectrum sold |

| RJio | 88,078 | 24,740.00 | 48.29 |

| Airtel | 43,084 | 19,867.80 | 38.78 |

| Vi | 18,799 | 6,228.40 | 12.16 |

| Adani | 212 | 400.00 | 0.78 |

| Total | 1,50,173 | 51,236.20 | 100.00 |

We believe the industry will continue to consolidate with Jio and Bharti together garnering 80 percent to 85 percent (March 2022: 78 percent) of the revenue of private telcos during 2023-2024. Jio’s and Bharti’s network positions will pull ahead of Vodafone Idea as they have larger sub-1GHz spectrum and about three times Vodafone Idea’s high frequency 5G spectrum. Sub-1GHz spectrum has better propagation qualities than higher-frequency spectrum,” concludes Fitch.

Jio paid a stiff ₹40,000 crore to buy 10 MHz of spectrum in the 700-MHz band, almost 45 per cent of its total spend in this auction. Jio strategy seems to be different from its counterparts, that are opting for a hybrid model NSA 5G, that will continue to use and share the 4G core. Jio is expected to set up a standalone (SA) independent 5G network, i.e., the radios, which enable the wireless interface, and the core (or 5GC, which controls the network) will be run on a 5G platform. This is a likely possibility as Jio has 328 MHz of spectrum in the low band of 850 MHz most of it powering 4G coverage, and the 600 MHz band has no ecosystem currently. 700 MHz fills that space.

Gopal Vittal

Gopal Vittal

MD and CEO,

Bharti Airtel

We are delighted to announce that Airtel will commence roll out of 5G services in August. Our network agreements are finalized and Airtel will work with the best technology partners from across the world to deliver the full benefits of 5G connectivity to our consumers.

SA enables monetise the investments made by developing use cases for customers. SA, for instance, enables opportunities as remote surgery, robotics, autonomous cars, machine-to-machine functions and drone applications, to name a few. That is because SA networks offer ultra-low latency and the use cases being developed on SA networks could be a key revenue earner beyond merely offering applications based on speed.

But running an independent SA 5G network needs support from a low spectrum band (below 1 GHz) and that is where 700 MHz is considered the best globally for 5G.

Airtel has stayed away from 700 MHz spectrum, as the telco maintains it has a large mid-band spectrum and will also ensures that its capital expenditure will remain around the existing levels. “It is a misconception that the 700 MHz band is a panacea for everything,” said Gopal Vittal, chief executive officer of Bharti Airtel and South Asia, in the Earnings Call for Q1FY23.

He elaborates, “In the SA mode, 5G comes as a top-up to an existing 4G radio layer. The 4G layer then operates independently. There are two issues here. The first is a lack of a well-developed ecosystem for SA devices. The second issue is propagation. The workhorse layer, 3.5 GHz has lesser propagation than even 2.3 GHz (which is the TDD band) and this impacts coverage in urban areas. As a result, SA can be effective, only if there is a sub-GHz layer that is also offering SA and the two work in conjunction. The role of the sub-GHz layer is only for coverage, it is not for capacity or speed. All it does is to provide coverage at the edge, deep indoor or in far flung areas. And it gives 4G-like speeds, nothing more.

In the second mode that 5G operates in, the NSA there are several advantages. First, the 3.5 GHz band extends at least 30 percent more of the downlink, which implies a 100 meters extra coverage. This gives substantially more coverage in urban areas, when mid-band is providing the upper. At the edge, when you need further extension of coverage and the mid-band doesn’t reach, the fallback in terms of coverage is provided by the sub-GHz layer 850 or 900, where we have a branch of spectrum all across the country.

The second advantage of NSA is that all devices work on this model. It is the most widely available ecosystem in the world. In the US and South Korea, where both SA and NSA have been launched, the traffic on SA is less than 10 percent of total 5G traffic.

The third advantage is it allows us to use existing 4G technology at no extra cost for the uplink, or what’s called the anchor band. Since we already have the radios and the spectrum that is live on our network.

Finally, NSA allows for faster call-connect time on voice.

“The spectrum acquisition will enable us to strengthen our position in our key markets, and it aligns well with our long-term strategic intent. With this, we now have a solid portfolio of spectrum across all bands in all our priority circles.”

This well thought out strategy for spectrum acquisition through a combination of auctions, M&A, and trading over the last few years, has allowed Airtel to avoid the need for adding an expensive sub GHz band and yet deliver a world class 5G experience.”

The brokerage companies, as always, have the last word. “5G will be a battle of giants. With their vastly differing 5G strategies, Bharti’s execution versus Jio’s and the evolution of their respective ecosystems will chart the course of their market share wins. It won’t be around technology but on faster adoption of their respective ecosystems,” says Edelweiss Securities. “If 5G adoption accelerates and the next spectrum auction is delayed, the 700 MHz band can provide Jio an edge in coverage and improve its market share,” adds BNP Paribas.

Vi’s incremental rollout will also have 5G deployment which should help create large data capacity, enough for many years. It believes 700MHz does not create any material advantage on data capacity. NSA (non-standalone 5G) will be the preferred technology for deployment, and existing network should be sufficient for coverage/capacity in 5G. E-band allotment should push fibre CapEx by many years. 5G CapEx is part of its planned CapEx budget and fund raise negotiation. However, aggressive deployment of 5G is dependent on VIL’s ability to raise more capital, while peers are gearing up for faster 5G deployment in India.

Akash M Ambani

Akash M Ambani

Chairman,

Reliance Jio Infocomm

The speed, scale, and societal impact of Jio’s 4G rollout is unmatched anywhere in the world. Now, with a bigger ambition and stronger resolve, Jio is set to lead India’s march into the 5G era. We will celebrate Azadi ka Amrit Mahotsav with a pan-India 5G rollout.

Vi’s weaker balance sheet is expected to put it at a disadvantage given the lack of adequate spectrum in the 5G space. Brokerage companies expect the telco to lose its high-end subscribers over time, and its 5G rollouts may remain constrained in the near term given its current cash EBITDA run-rate (₹84 billion) is insufficient to meaningfully increase CapEx, has large upcoming debt repayments (₹70 billion) and also delays in external fund raise. The telco after the auction said, “we have a solid portfolio of spectrum across all bands in all our priority circles. We also have the advantage of leveraging the global experience of Vodafone Group, which has proven expertise in deploying 5G in many markets. We will continue to invest in our future ready network to upgrade it for roll out of 5G services to our customers in future.”

The challenge for the three private telcos will remain to make their massive investments pay off as the lack of affordable 5G devices and limited geographical deployment may limit the number of users initially.

The Union Cabinet has approved a ₹1.64-lakh crore revival package for Bharat Sanchar Nigam Ltd. Notwithstanding duopoly, BSNL remains a critical link for a sizeable chunk of rural India despite the private sector making definite inroads into the hinterland. BSNL’s wireline service accounts for 23.72 percent of the country’s total rural market share in the category as of December 2021. RJio’s rural market share in wireline is at 1.24 percent, while Bharti Airtel, Vodafone Idea, and MTNL have zero to negligible rural presence in fixed phones. All-India numbers show BSNL is the leading operator in wireline with 7.59 million subscribers as of December 2021, followed by Bharti Airtel with 5.58 million.

BSNL plans to upgrade its 4G services to 5G services using indigenously developed core network by next year. “ C-DoT is making progress in the 5G NSA core network that will be ready by the end of August, and by December field tests will be completed. By next year, Indian 5G stack will be ready to deploy including in BSNL,” Ashiwini Vaishnaw, Minister of Railways, Communications and Electronics & Information Technology briefed the media. The All Unions and Associations of BSNL (AUAB) have expressed major opposition to this.

BSNL has the largest pool of optical fiber at every nook and corner of India. The public sector telco has also sought 30 MHz spectrum in the 3.5 GHz band and 5 MHz in the 700 MHz band, while 40 MHz in the 3.5 GHz band has already been earmarked for it.

TELECOM VENDORS

The telecom vendors have been preparing for the advent of 5G in India for the last three to four years. They have steadily invested in enhancing the skill sets of their people. Nokia’s global network operations center in Noida has been supporting 5G networks across the globe and its R&D facility in Bengaluru has been consistently and continually contributing to the evolution of 5G, 5G advanced, and now even 6G standards. Ericsson is expected to ramp up its capacity to meet the Indian 5G demand.

The vendors do not see any hindrance in the supply of the initial requirement of 5G radios. By March 2023, they estimate, 5G radios would cover 70,000-72,000 sites across the country, or around 10 percent of the existing towers. Nokia and Ericsson already manufacture 5G radios, and have also signed up for the production-linked incentive scheme for telecom.

They have signed 5G network agreements with Bharti Airtel to commence 5G deployment in August 2022. Nokia will provide equipment from its market-leading AirScale portfolio, including modular and scalable baseband as well as high-capacity 5G massive MIMO radios.

Bharti Airtel will deploy power-efficient 5G Radio Access Network (RAN) products and solutions from the Ericsson Radio System and Ericsson microwave mobile transport solutions. Ericsson will be providing 5G connectivity in 12 circles for Bharti Airtel.

Airtel has also partnered with Samsung. This is the first time that both companies will work together.

Samsung is looking beyond RJio in 5G. With Huawei and ZTE excluded from participating in the 5G rollout, Ericsson, Nokia, and Samsung will gain.

Analysts estimate that the total investment on building a pan-Indian 5G network with 3.5 GHz radio initially could cost ₹32000 crore and the complete roll-out, that could take four to five years could cost ₹80,000 crore.

The huge challenge that the vendors can face is from O-RAN. It counters the stranglehold of the global telecom gear makers over telcos to whom they sell proprietary technology and bundled hardware and software. All the three telcos are experimenting with O-RAN on 5G through trial runs. It is work in progress. O-RAN is backed by the global giants, Intel, Qualcomm, Amazon, Google, and Indian IT players like TCS and Tech Mahindra amongst others. Telcos are in close collaboration with tech firms who are building the various components, hardware and software, of the O-RAN network as well as looking at integrators who will put the software and hardware together. Jio designs its own O-RAN technology in some areas either through its in-house R&D team or through US-based Radisys, which it has acquired. NEC has set up an Open RAN lab in India to develop solutions on 5G. Whether it is hype or realty, only time will tell.

India is seeing tremendous growth in domestic manufacturing with the Production Linked Incentive (PLI) schemes. Last year, the government approved a proposal of 31 companies, the large ones being HFCL, Tejas Networks, and Dixon Technologies, under the PLI scheme. The companies have committed investment of ₹3345 crore over a period of four years.

The incentive being provided for a period of five years up to 2025-26 are on a wide range of telecom and networking equipment, including core transmission equipment, 4G/5G equipment, next-generation radio access network and wireless access equipment, customer premises equipment, internet of things, access devices, switches, and routers.

Telecom equipment manufacturers have made products worth ₹9000 crore with an investment of close to ₹420 crore. The production and investment have so far been driven by existing companies who were able to undertake expansions.

The telecom tower companies expect to invest over ₹2 trillion by 2025, half of it in the next two years. The investment by tower companies will include deployment of the crucial small cells, that help in the densification of the network and are mounted on public and residential infrastructure, such as poles, or street furniture, such as bus stands. They provide huge bandwidth capacity, especially in highly populated areas. Larger towers will also need to be added to take care of the expected data explosion.

The densification would include backhaul radios, antennas, and tower street furniture, among others. To cover half the country, 500 small cell deployments every square kilometre will be needed.

On a similar note, with fiberisation at 35.11 percent in India as of June 2022, more than 3 lakh km has to be covered at the pan-India level between fiscal 2023 and 2025, Crisil expects it will necessitate network CapEx of ₹1.5-2.5 lakh crore in the next 2-3 years.

The 5G auctions in India may have been delayed, but the timing seems to be right now. Not only has there been a decrease in the cost of 5G hardware as the technology and vendor ecosystem continues to mature, Indian operators’ move to embrace Open RAN will drive network costs even lower. Another key factor is the 5G device ecosystem, with 5G smartphone prices falling since the technology launched.

India’s transition into a digital economy will be led by telecom, and 5G presents a game-changing opportunity to drive the digital transformation of industries, enterprises, and the socio-economic development of India.”

You must be logged in to post a comment Login