Headlines of the Day

Government relief to ensure VIL survival for now, ICICI Securities

The Union Cabinet announced the telecom relief package. While most of the relief has prospective impact, the major move was moratorium of four years for telecom dues (AGR and deferred spectrum liabilities) which, in our view, is a key cash flow relief measure for Vodafone Idea (VIL).

Furthermore, the option to pay interest through equity to the government and the government option to convert the dues into equity after four years, also ensures survival visibility for VIL beyond four years albeit with massive equity dilution for the existing shareholder.

Key highlights of package

- Extension of the moratorium on spectrum and AGR liabilities by another four years, effective October 2021

- An option for telcos to convert the interest amount accrued during the moratorium period into equity while the government, at the end of the moratorium, has the option to convert dues into equity

- Rationalization of AGR definition to exclude all non-telecom revenue prospectively

- Extension of spectrum license period to 30 years from 20 years for new licenses and providing an auction calendar with schedule of spectrum auction in the last quarter every year

- Allowing spectrum to be returned after a 10-year lock-in period

- Scrapping SUC on all future spectrum acquisitions and doing away with additional SUC of 0.5% for spectrum sharing

- Allowing 100% FDI through automatic route

VIL to get maximum relief but structural resurgence still away

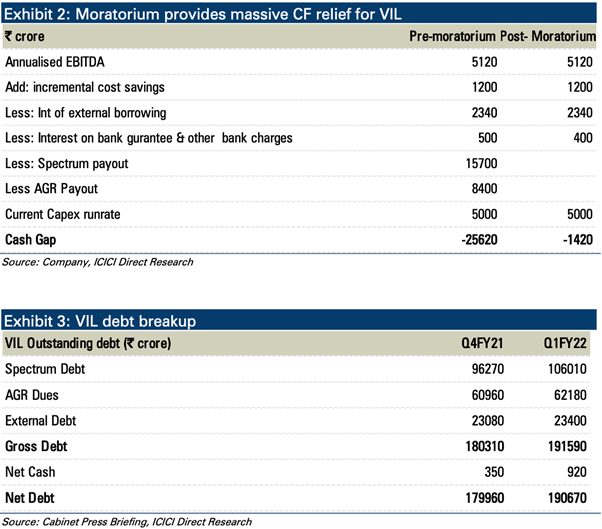

VIL, which had annual commitment of ~| 24000 crore towards spectrum payment and AGR dues, will be the key beneficiary. While the current rate of EBITDA/capex implies that cash burn will come down to ~| 1400 crore, the lagging network spends (its capex is one-fourth of Airtel’s India capex) will keep the risk of churn high.

Moreover, it would also need immediate fund infusion as it has ~| 6000 crore NCD repayment due in the next few months along with bank guarantee renewal of ~| 12000 crore. Importantly, post four years, the payout will balloon to ~| 47000 crore annually, if not converted into equity.

The conversion of interest and/or overall dues post moratorium period, however, would ensure survival but imply a sharp equity dilution for existing shareholder. Thus, key monitorable, going ahead, will be timing/quantum of tariff hike and fund raise to meet near term commitments. The likely improvement in survival possibility of VIL will also improve the overall value visibility for Indus Towers.

Airtel to utilise relief to cut external debt, expedite network investments

Airtel is comfortable in terms of cash flow generation (current ~| 18000 crore annualised cash flow is comfortable to meet ~| 11000 crore of spectrum and AGR dues annual payouts). The management commentary, however, suggests that the company will opt for moratorium to cut external debt and accelerate network investment.

This clearly implies that 5G spectrum and network spends by Airtel will be accelerated and likely in line to keep pace with Jio’s spends. We expect the relative market share gain for Airtel to continue, unless VIL arranges for immediate fund raise and substantial tariff hike decision is made.

We also highlight that both Airtel and VIL have been rooting for stepped up tariff hike in near term. However, likely launch of JioPhone next, extended pandemic situation and already available moratorium benefit does push the likely sharp increase in tariff in near term.

What’s the way ahead for VIL?

CT Bureau

You must be logged in to post a comment Login