Industry

Enterprise networking market gathers pace

India’s economy has been impacted by the second wave of COVID-19 lockdown, which led to lower revenues for certain major OEM players, and deals getting pushed to 3Q and 4Q of 2021. The gradual roll-back of lockdown restrictions and businesses opening, along with the fast pace of vaccination across the country, indicates economic recovery for the second half of 2021.

India’s networking market, which includes Ethernet switches, routers, and WLAN segments, witnessed a reasonable 14.1 percent year-over-year (YoY) growth in terms of vendor revenues during 2Q21 (April–June). The increased YoY growth could be attributed to the weak base last year, caused by the first wave of the pandemic. However, Indian enterprises continued to invest in network infrastructure and the overall vendor revenues grew 5.6 percent sequentially, irrespective of the second wave of the pandemic.

Switching business in India had a strong 20.9 percent YoY growth during 2Q21. The very high growth could be attributed to a very slow 2Q20. However, the non-DC switching business, which remained slow due to the shutdown of campuses grew by 38.5 percent YoY, anticipating the hybrid work trend to be prevalent in the new normal. Key industries that contributed to the switching business include professional services, telecommunications, process manufacturing, and banking.

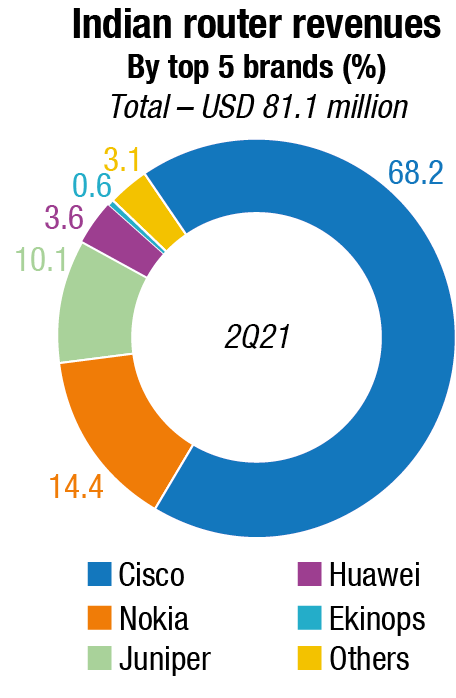

India’s router market too expanded by 18.6 percent YoY. Both the enterprise and service provider segments grew by 20.3 percent and 18 percent YoY, respectively. Service providers were investing in routing hardware, majorly around optimizing capacities, and building edge data centers, to enable enterprise use cases. Apart from telecom, other key verticals for routing include professional services, process manufacturing, and banking.

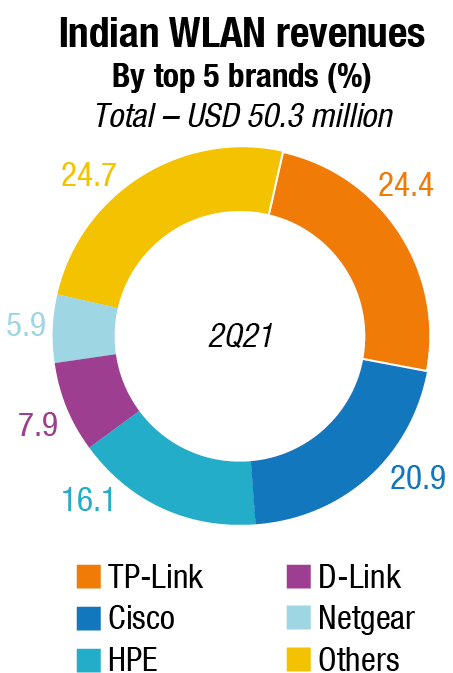

The Indian WLAN market had a marginal YoY decline of 7 percent during 2Q21, majorly driven by the consumer wireless segment. The market stood at USD 50.3 million (by vendor revenue). The enterprise-class WLAN sustained the recovery made in 1Q21, and recorded a YoY growth of 11.5 percent. Wi-Fi 6 contributed to 58.3 percent of revenues in the overall enterprise WLAN market, thereby becoming the obvious choice for enterprises refreshing their access points. Cloud-managed wireless is also picking up growth, with enterprises opting for the ease-of-management and better scalability. The market for wireless-as-a-service is also witnessing traction with vendors partnering with multiple telcos and ISPs to offer simplified solutions for small, medium, and large enterprises. Professional services, telecom, and process manufacturing were the top three verticals for enterprise wireless during 2Q21.

The consumer gateway router business declined sharply by 23.7 percent YoY owing to an adequate supply of gateway routers in the supply chain. The market for consumer gateway routers is expected to soften even further with Indian enterprises poised to open offices sooner than expected.

With a market share of 24.4 percent, TP-Link was the market leader in the WLAN segment during 1Q21. Within the enterprise-class WLAN segment, Cisco was the market leader with a 20.9 percent market share, followed by HPE with 16.1 percent.

The Ethernet switch, router, and WLAN markets are expected to grow in single digits in terms of compound annual growth rate (CAGR) for 2020–2025. Increased adoption of emerging technologies, such as cloud, IoT, mobility, etc., would drive incremental revenues. Large investments for 5G rollouts in the next couple of years are expected.

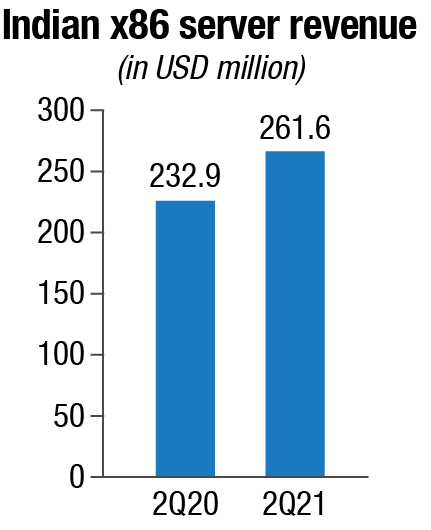

The overall server market in India witnessed a YoY growth of 6.4 percent in terms of revenue to reach USD 289.5 million in 2Q21 (April–June) versus USD 272.0 million in 2Q20. The x86 server market contributed to 90.4 percent of the revenue, which is 4.8 percentage points higher than the same quarter last year. The highest contribution in the x86 market mainly came from professional services, telecommunications, discrete manufacturing, and banking verticals. The professional services vertical spending was led by investments from fintech, cloud service providers (CSPs), telecom players, and IT/ITeS companies. In addition, increasing focus on digitization and modernization has led to higher investments from banking and discrete manufacturing as well.

The x86 server market increased YoY by 12.3 percent in terms of revenue to reach USD 261.6 million in 2Q21 from USD 232.9 million in 2Q20. During 2Q21, verticals, such as insurance, media, and resource industries witnessed the highest YoY growth in terms of revenue.

The non x86 server market decreased YoY by 28.8 percent to reach USD 27.9 million in terms of revenue in 2Q21 from USD 39.1 million in 2Q20. IBM continues to dominate the market with 41.1 percent of revenue share during 2Q2021 with an absolute revenue of USD 11.5 million. Oracle came at second position, followed by Hewlett Packard Enterprise (HPE), with a revenue share of 18.4 percent and 4.5 percent, respectively.

At present, the India x86 server market is expected to witness a YoY growth in value by 25.0 percent, during the period 2020-21.

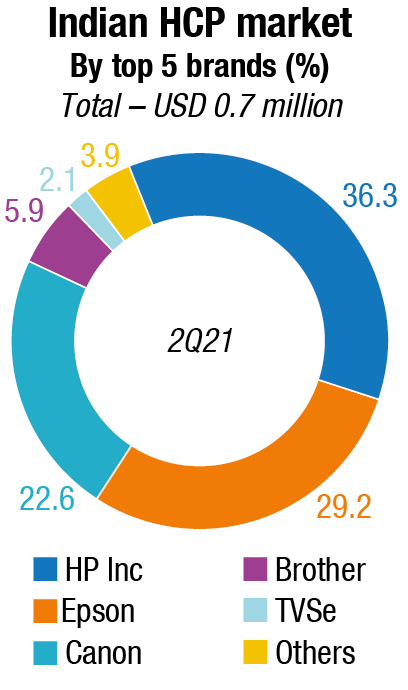

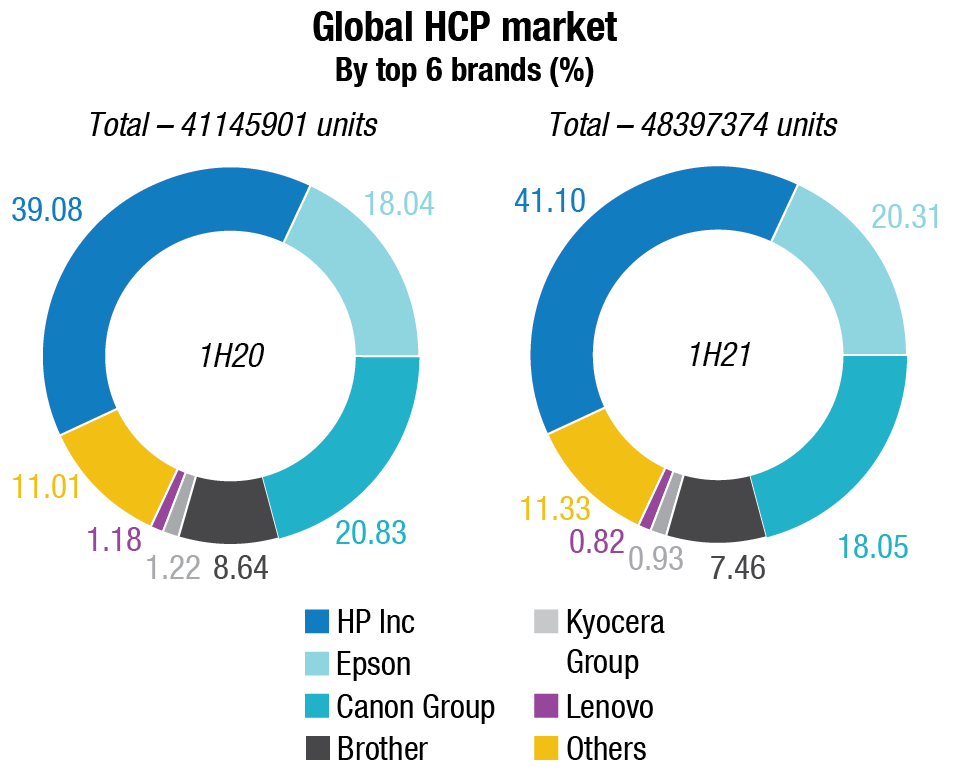

India’s hardcopy peripherals (HCP) market registered a shipment of 0.7 million units in 2Q21 (April–June), declining by 24.1 percent quarter-over-quarter (QoQ). However, from a YoY perspective, the market posted a growth of 103.5 percent in the April–June quarter. However, this highest-ever recorded growth rate is accounted for by the extremely shallow base last year in 2Q due to the country-wide lockdown.

The inkjet segment noted a YoY growth of 71.9 percent, accounted partly by the low shipment units in 2Q20 and partly by the continued demand from the home segment in 2Q21. As schools and colleges were forced to continue the virtual classes, demand from parents and students remains strong. However, this demand could not be fully fulfilled because of the disruption in the local supply chain due to lockdown in multiple states owing to the second COVID-19 wave. In addition, the chip-shortage issue has also been plaguing the industry, already resulting in brands struggling to stabilize the supply of in-demand ink tank printers specifically.

The laser printers segment (including copiers) recorded a YoY growth of 175.1 percent on the back of a strong showing of laser printers (excluding copiers) since SOHOs (small offices, home offices), SMBs, and a few medium-sized corporates did not shut down operations completely during the second wave, unlike last year. The laser copier segment observed a minor YoY growth of 27.8 percent as most enterprises extended work-from-home for their employees during the second wave.

“Various constraints, such as chip shortages, rising component prices, and increased fuel and transportation costs will continue to impact the supply of printers. However, we can expect continued demand for ink tank printers from consumer segment as virtual classes continues for most students. Enterprise demand is dependent on two factors, i.e., possible third wave and staff vaccination. Many large enterprises are planning to get 100 percent staff fully vaccinated within the next couple of months before resuming offices, which can boost laser copier demand in 4Q,” says Nishant Bansal, Senior Research Manager, IPDS, IDC India.

Global market

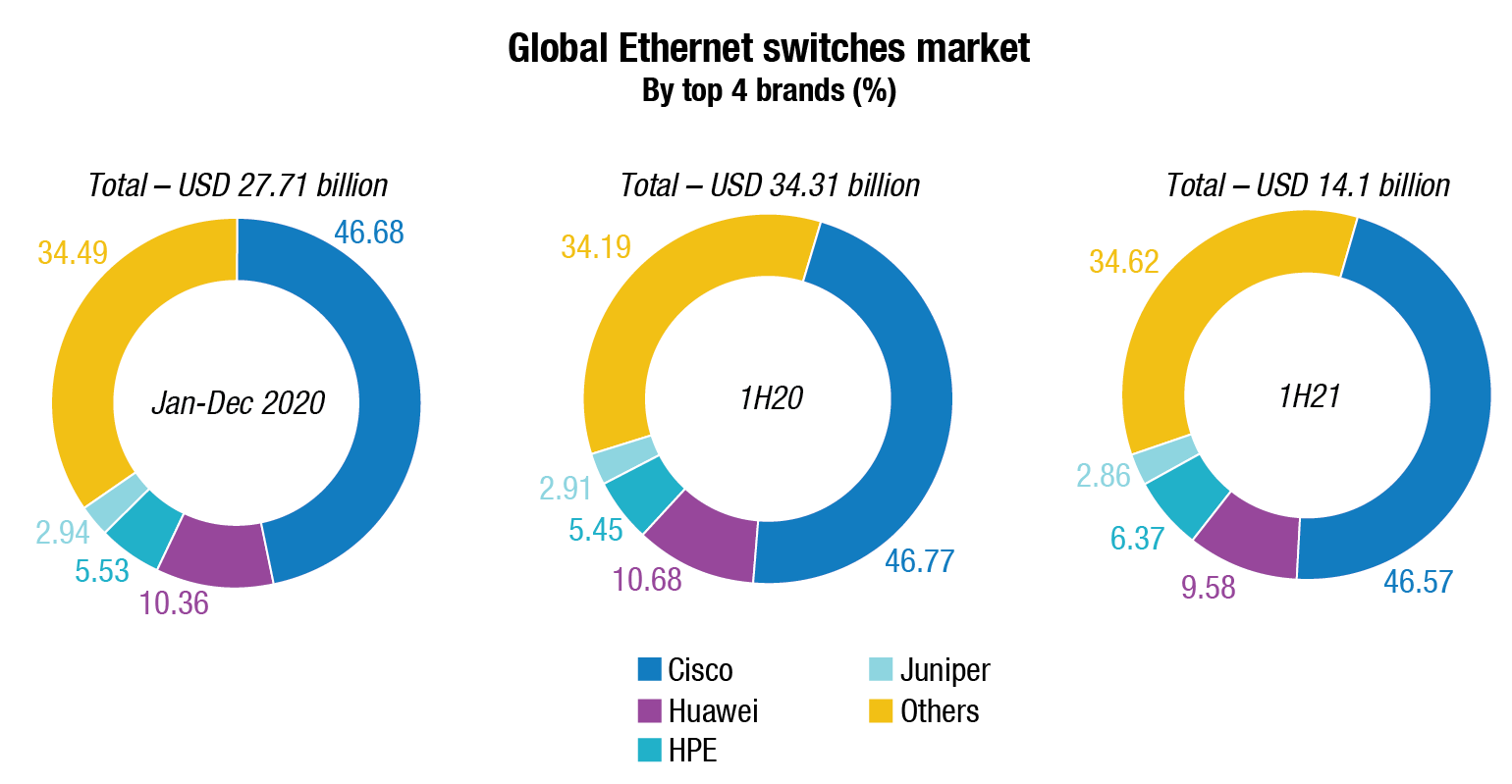

The worldwide Ethernet switch market recorded revenues of USD 7.4 billion in the second quarter of 2021 (2Q21), an increase of 10.8 percent YoY. The annualized growth builds upon the 7.6-percent growth in the first quarter of 2021. For the first half of the year, Ethernet switch revenues are up 9.3 percent over 2020. Compared to the second quarter of 2019 – before the COVID-19 pandemic – revenues increased 3.8 percent.

From a geographic perspective, the 2Q21 Ethernet switch market had strong results across most parts of the world. In Asia-Pacific, the People’s Republic of China revenues grew 11.6 percent YoY while Japan’s market increased 8.3 percent. More broadly in the Asia-Pacific region, excluding China and Japan, the market rose 20.5 percent YoY in the quarter, buoyed by the market in Singapore growing 58.2 percent annually.

In Europe, results were mixed – Western Europe’s market rose 23.1 percent YoY with strength from France, which grew 39.3 percent. Central and Eastern Europe’s market was essentially flat at 0.5-percent growth with Russia declining 4.8 percent. In the Middle East & Africa, the market increased 2.6 percent YoY. Across the Americas, revenues in the United States rose 6.2 percent, Canada’s market fell 1.0 percent, and Latin America’s market increased 8.1 percent YoY with Mexico rising 15.8 percent compared to a year earlier.

“IDC witnessed a strong start to 2021 for the global Ethernet switch market, as macroeconomic conditions improved and a growing number of organizations worldwide demonstrated perseverance and digital resilience in the face of the rolling challenges presented by the COVID-19 pandemic,” said Brad Casemore, research vice president, Datacenter and Multicloud Networks at IDC. “Enterprises made notable investments in their campus networks, while hyperscalers and other providers of cloud services continue to drive growth in high-bandwidth datacenter switching.”

Overall port shipments increased 28.4 percent, driven by strength in the non-datacenter portion of the Ethernet switch market. Non-datacenter Ethernet switch revenues grew 17.7 percent in 2Q21, with port shipments increasing 36.1 percent. The non-datacenter ethernet switch portion of the market makes up 88.6 percent of port shipments and 58.5 percent of total market revenues, with the balance of revenues and port shipments in the datacenter portion of the market. In the datacenter segment, revenues rose 2.4 percent YoY, while port shipments declined 10.6 percent.

The higher-speed segments of the Ethernet switch market continue to see significant growth, driven by hyperscalers and cloud providers. Market revenues for 200/400 GbE switches grew 132.5 percent from the first quarter to the second quarter of 2021, with port shipments more than tripling (+206.0 percent) on a sequential basis. 100GbE revenues increased 15.4 percent on an annualized basis, while port shipments rose 11.4 percent YoY. 25/50 GbE revenues increased 25.6 percent YoY while port shipments rose 1.3 percent.

Lower-speed switches, a more mature part of the market, saw mixed results. 10GbE port shipments rose 3.1 percent YoY, but revenue declined 8.4 percent. 10Gb switches make up 23.4 percent of the market’s total revenue. 1GbE switches increased 33.2 percent annually in port shipments and 14.4 percent in revenue. 1GbE accounts for 35.9 percent of the total Ethernet switch market’s revenue. 2.5/5GbE revenue increased 25.3 percent sequentially from 1Q21 to 2Q21, while port shipments rose 26.6 percent QoQ.

By company, Cisco finished 2Q21 with a 4.5 percent increase in overall Ethernet switch revenues and market share of 44.1 percent. Huawei’s Ethernet switch revenue increased 3.5 percent on an annualized basis, giving the company market share of 11.1 percent. Arista Networks saw Ethernet switch revenues increase 31.6 percent in 2Q21, bringing its share of the total market to 7.5 percent. H3C’s Ethernet switch revenue increased 10.6 percent YoY, giving the company market share of 7.0 percent in the quarter. HPE’s Ethernet switch revenue increased 46.4 percent YoY, giving the company a market share of 6.7 percent. Juniper’s Ethernet switch revenue increased 23.3 percent YoY in 2Q21, bringing its Ethernet switch market share to 3.1 percent. “Results in the Ethernet switch market were generally strong across the globe, indicating that most regions of the world continue to recover from the COVID-19 pandemic that caused decreased spending on network infrastructure,” notes Petr Jirovsky, research director, IDC Networking Trackers. “The growth in the second quarter of 2021, compared to the same period in 2019, indicates strong fundamentals of the market, which is a positive sign for the future.”

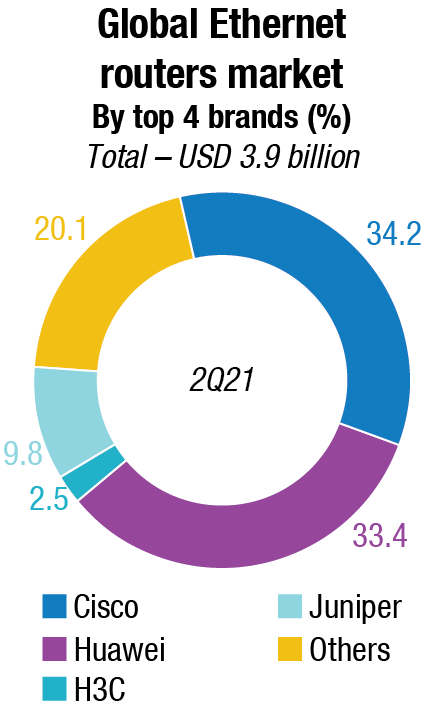

Worldwide enterprise and service provider (SP) router market revenues declined 0.5 percent YoY in 2Q21 to USD 3.9 billion. Cisco’s combined service provider and enterprise router revenue grew 2.4 percent YoY with enterprise router revenue decreasing 9.8 percent and SP revenues increasing 10.1 percent. Cisco’s combined SP and enterprise router market share stands at 34.2 percent in the quarter. Cisco’s combined SP and enterprise router market share stands at 34.2 percent in the quarter. Huawei’s combined SP and enterprise router revenue declined 8.5 percent YoY, giving the company a market share of 33.4 percent. H3C’s combined service provider and enterprise routing market, H3C’s revenues increased 32.6 percent, giving the company 2.5 percent market share. Juniper saw a 3.9 percent decline in combined enterprise and SP router sales, bringing its market share in the router market to 9.8 percent.

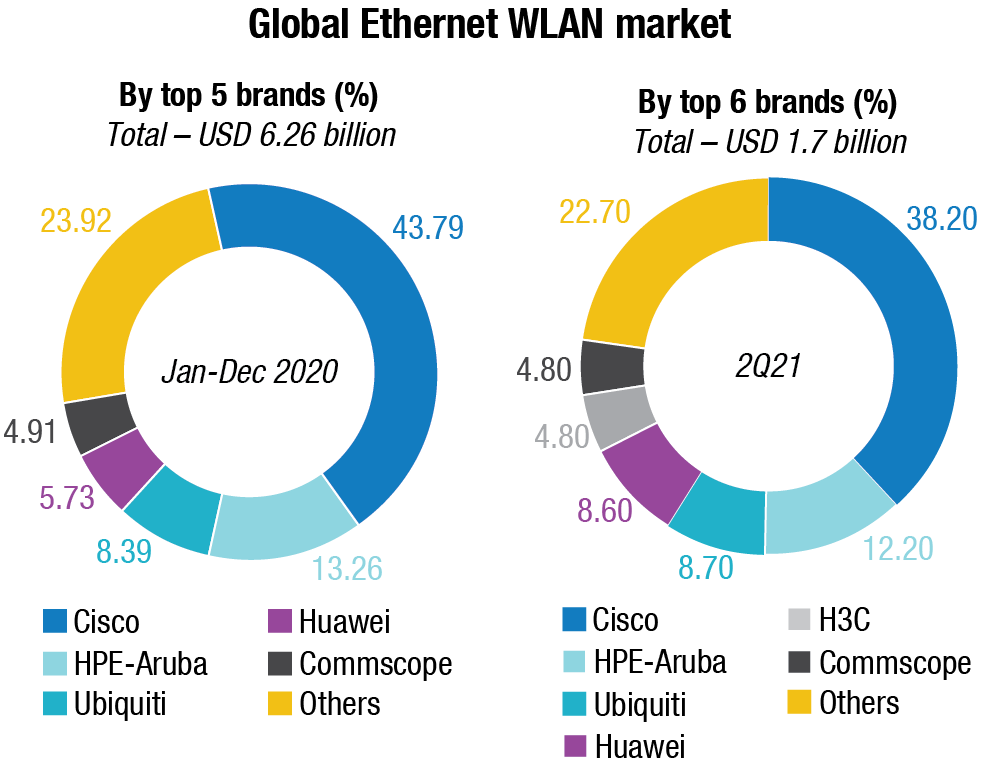

Enterprise WLAN market. Growth rates remained strong in the enterprise segment of the wireless local area networking (WLAN) market in 2Q21 as the market increased 22.4 percent on a YoY basis to USD 1.7 billion.

In the consumer segment of the WLAN market, revenues declined 5.7 percent in the quarter to USD 2.3 billion, giving the combined enterprise and consumer WLAN markets YoY growth of 4.6 percent in 2Q21.

The growth in the enterprise-class segment of the market builds on a strong first quarter of 2021 when revenues increased 24.6 percent YoY. For the first half of 2021, the market increased 23.5 percent, compared to first two quarters of 2020. Compared to the second quarter of 2019, 2Q21 revenues increased 10.8 percent, indicating that demand in the enterprise WLAN is strong.

Growth in the enterprise WLAN market continues to be driven by the latest Wi-Fi standard, known as Wi-Fi 6 or 802.11ax. Wi-Fi 6 access points made up 56.7 percent of the revenues in the Dependent Access Point (AP) segment and accounted for 45.0 percent of unit shipments within the segment. Wi-Fi 5 products, also known as 802.11ac, made up the balance of remaining Dependent AP sales.

Meanwhile, the consumer-class WLAN market declined 5.7 percent on a YoY basis. During the COVID-19 pandemic, the consumer WLAN market enjoyed robust growth as consumers upgraded their wireless connectivity at home. Compared to the second quarter of 2019 the market grew 10.1 percent, indicating that the market’s fundamentals remain strong. Wi-Fi 6 products continued to grow in the consumer market, rising to make up 24.5 percent of the consumer segment’s total revenue, up from 20.3 percent in 1Q21. Wi-Fi 5 APs still make up the majority of revenues (64.1 percent) and unit shipments (64.0 percent).

“The enterprise WLAN market showed strong growth in the second quarter of 2021. On a macro level, economies around the globe continue to re-open as vaccines are rolled out, causing organizations to consider their enterprise connectivity needs,” says Brandon Butler, research manager, Network Infrastructure. “Wireless local area networking remains one of the most important technologies for enterprises to provide seamless connectivity, with enterprise-grade security, management, and assurance.”

From a geographic perspective, the enterprise WLAN market saw growth across all regions of the world. Growth was particularly strong in Asia – the market in the People’s Republic of China grew 57.9 percent YoY, while Japan’s market increased 21.9 percent. Across the broader Asia-Pacific region, excluding Japan and China, growth was 11.1 percent YoY with Australia recording an annual increase of 19.6 percent. Growth was also strong in the Americas where the US market increased 14.3 percent, Canada’s market grew 18.0 percent, and the Latin America region increased 19.1 percent.

In Western Europe, the market grew 21.0 percent YoY with strength from Germany, which grew 26.0 percent. Central and Eastern Europe increased 18.7 percent while the Middle East and Africa region was up 18.6 percent YoY.

Sudharsan Raghunathan, Senior Market Analyst, Enterprise Networking, IDC India, says, “The pandemic had a significant impact on Indian enterprises, especially in the small and medium business space. While enterprises clearly understand that network transformation is imperative to stay abreast in the current business landscape, they are not in an immediate position to incur huge capital expenditures. Connectivity-as-a-service option will largely assist these organizations to navigate this challenge. The vendor landscape has been very actively positioning the network-as-a-service model to SMBs in partnerships with telcos and ISPs. This will enable enterprises navigate the challenges around over provisioning of resources, filling the skill gap, and access to SLA-driven connectivity without incurring heavy one-time expenditures.”

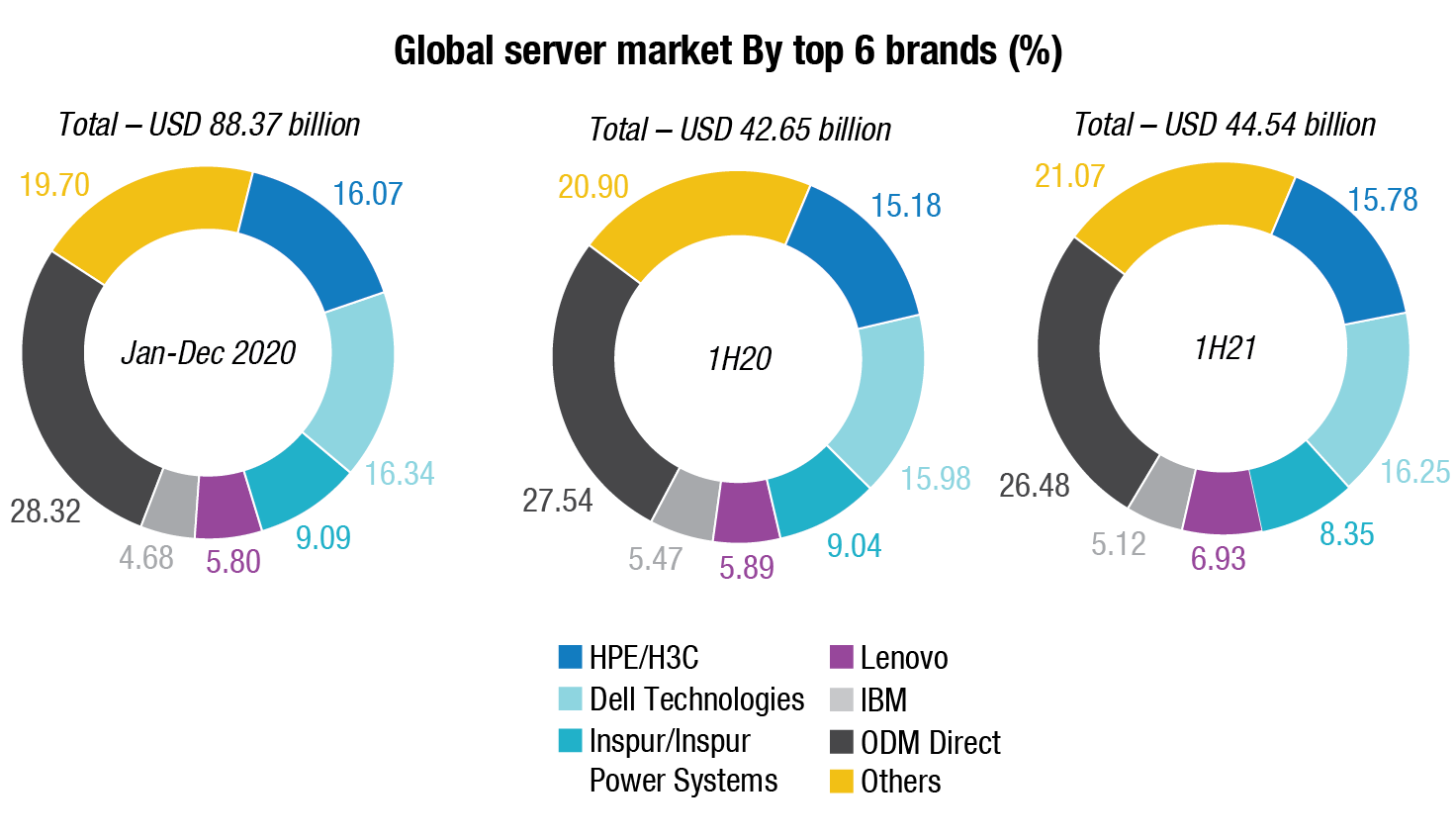

The worldwide server market revenue declined 2.5 percent YoY to USD 23.6 billion during 2Q21. Worldwide server shipments surpassed 3.2 million during the quarter, an increase of just 0.1 percent over the previous year.

Volume server revenue was up 5.6 percent to nearly USD 20.0 billion. Midrange server revenue declined 30.0 percent to USD 2.4 billion, and high-end servers declined by 32.7 percent to USD 1.3 billion.

“Broadly speaking, server market performance was muted in the second quarter as the market shifted slightly toward single-socket server configurations,” said Paul Maguranis, senior research analyst, Infrastructure Platforms and Technologies at IDC. “While servers purchased directly from ODMs declined YoY, some past backlog recovery within the hyperscale datacenter community contributed to a large jump in this segment when compared to the first quarter of this year.”

HPE/H3C(a) ended the quarter in a statistical tie with Dell Technologies for the top position in the worldwide server market. The revenue shares for the two companies were 15.7 percent and 15.6 percent respectively. Inspur/Inspur Power Systems(b) ranked third with 9.4 percent revenue share. Lenovo was in fourth place while IBM came in at fifth, with 7.0-percent share and 5.0-percent share respectively. The ODM Direct group of vendors accounted for 26.7 percent of total server revenue and declined 8.8 percent YoY to USD 6.3 billion while accounting for 32.2 percent of all units shipped during the quarter.

On a geographic basis, Asia-Pacific (excluding China and Japan) revenue was up 8.6 percent YoY. Server revenue in China grew 3.4 percent over the previous year, while Japan declined 21.2 percent YoY. Latin America revenue grew 4.6 percent, North America revenue declined 5.7 percent, and Europe, the Middle-East, and Africa (EMEA) revenue declined 2.3 percent YoY.

Revenue generated from x86 servers decreased 2.2 percent in 2Q21 to USD 21.4 billion. Non-x86 server revenue declined 4.5 percent YoY to around USD 2.3 billion.

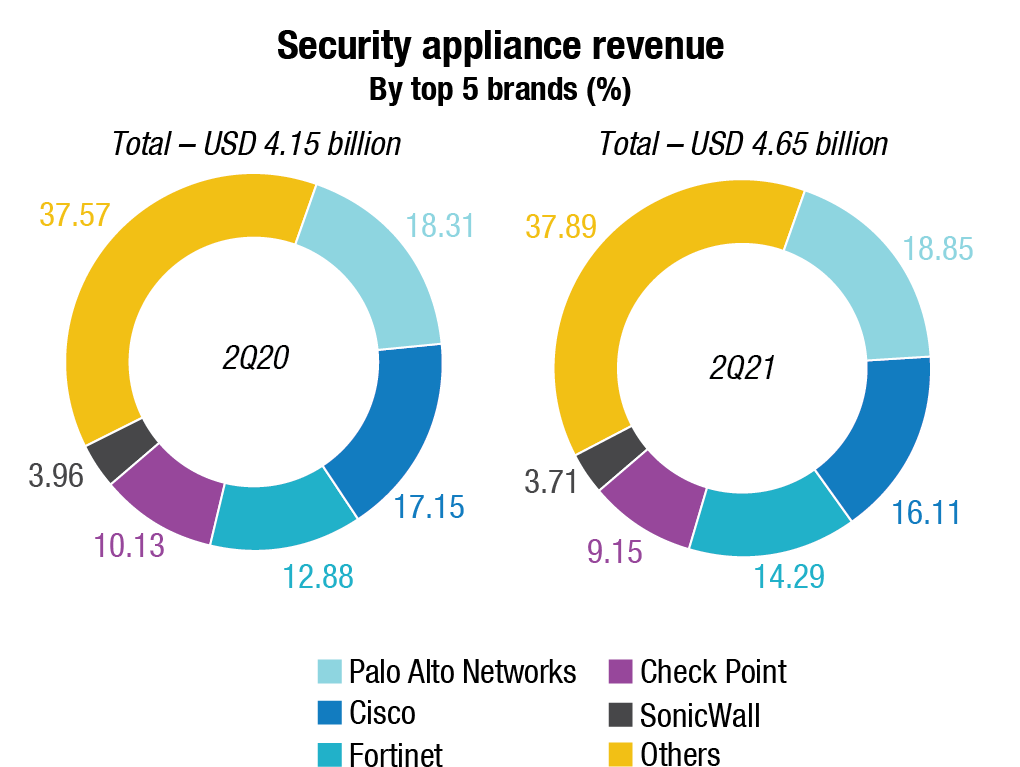

Vendor revenue in the overall security appliance market grew 12.2 percent YoY in 2Q21 reaching nearly USD 4.65 billion. This was an increase of more than USD 505 million compared to the second quarter of 2020. Total security appliance shipments grew 15.0 percent YoY in 2Q21 to nearly 1.3 million units.

The Unified Threat Management (UTM) market continued to grow at a healthy pace of 17.1 percent YoY and accounted for 65 percent of total vendor revenue for security appliances in 2Q21. All other security markets – Content Management, Intrusion Detection and Prevention (IDP), and Virtual Private Network (VPN) – had single-digit annual growth rates except for Traditional Firewall, which showed a slight decline in the quarter.

“The global security appliance market delivered another quarter of strong growth in 2Q21, which highlights the relevance of security hardware as part of mixed strategies designed to protect hybrid ecosystems within different vertical industries,” said Carlo Dávila, research manager, Enterprise Trackers at IDC.

On a global basis, the Americas (combined) accounted for 48.2 percent of the total security appliances market revenues in 2Q21, while the Asia-Pacific region (including Japan) had a dynamic growth rate of 23.4 percent in the quarter. The People’s Republic of China (PRC) was a standout with the fastest YoY revenue growth of 33.8 percent, followed by the Middle-East and Africa (MEA) with 14.9 percent growth.

The worldwide hardcopy peripherals market expanded for the fourth quarter in a row in the second quarter of 2021 (2Q21) with shipments growing 13.4 percent YoY to nearly 22.9 million units. Shipment value also increased during the quarter with YoY growth of 31.2 percent to USD 10.2 billion, signaling the return to office.

Notable highlights from the quarter include:

- Inkjet vendors continued to record high shipments to cater to ongoing demand and to fill order backlogs. The laser market also saw YoY growth, another sign that the return to office is underway.

- Seven out of nine regional markets witnessed YoY expansion in unit shipments. Similar to last quarter, the common theme for this quarter is that growth was driven by increased demand for low-end devices.

- HP Inc. and Epson grew 11.7 percent and 57.1 percent YoY, respectively while Canon declined 5.9 percent due to semiconductor shortages and stock issues. As with Canon, Brother also experienced significant challenges regarding production and stock availability causing it to contract 4.9 percent YoY.

During the early days of COVID-19, companies rushed to connect their workforces. This was phase one. They invested heavily in their existing infrastructure. Most enterprises, though, will not go back to working solely from the office anytime soon. In the backdrop of the world’s largest experiment in remote access and the decade’s most sophisticated security breach, enterprises will continue to increase bandwidth at key sites, and do whatever is necessary to get the company equipped to support widespread work-from-home efforts.

Worldwide IT and Business Services revenue is expected to grow by 3.4 percent in 2021. The services market is forecast to top USD 1.1 trillion in 2021. This has been consistent with what major vendors have been reporting in the first and second quarters of this year.

The market will continue to expand through 2023 and 2024 with growth between 3.8 percent to 4.0 percent annually. The mid-term and long-term market growth have also increased slightly by 20–50 basis points each year, pushing the market’s long-term growth rate to 4.3 percent, up from the previous forecast of 4.1 percent. A better economic outlook has contributed to the improved optimism, but the main driver was the stronger demand for IT and business services across several regions outside the U.S., particularly where large government-led digitalization programs and schemes are taking place (i.e., in Europe, APAC, etc.).

The Americas services market is forecast to grow by 2.4 percent in 2021, the outlook remaining largely unchanged with projects, managed services, and support services recovering in 2021.

Both Canada and Latin America’s mid-to-long-term growth (in constant currency) have been adjusted downward marginally. Both are still forecast to see continued recovery well into 2022 and 2023. The changes largely reflect the timing of local recoveries.

The near-term outlook for Europe remains sanguine and unchanged. Europe’s recovery this year will fuel global recovery for the IT services market, accounting for around 30 percent of annual growth worldwide. The Central and Eastern Europe’s growth rate will return to its pre-pandemic level (9%+) by the end of this year because of its relatively small base and the fast rebound from Russia.

The short-to-long-term growth rate for Middle East & Africa (MEA) will return to its pre-pandemic growth of 6.5 percent + by 2025. However, given the pandemic-related challenges MEA countries still face (slow vaccination rates, restrictions on travel, etc.), the timing of the region’s recovery cannot be specified.

In the Asia/Pacific region, mature markets continue to recover steadily: the growth outlook for the larger economies, such as Japan, South Korea, and Australia, remains in the 2–3 percent range while the smaller economies are clocking faster growth, particularly in this cycle.

You must be logged in to post a comment Login