CT Stories

Embracing O-RAN

The 5G network is substantially different from 4G LTE, beginning with frequency band. 5G picks up where 4G leaves off, spanning the spectrum from 6 GHz to 300 GHz. Higher frequencies support significantly smaller cell sizes, enabling 5G cells to provide highly localized coverage in locations such as neighborhoods, manufacturing plants, or even within houses and other structures.

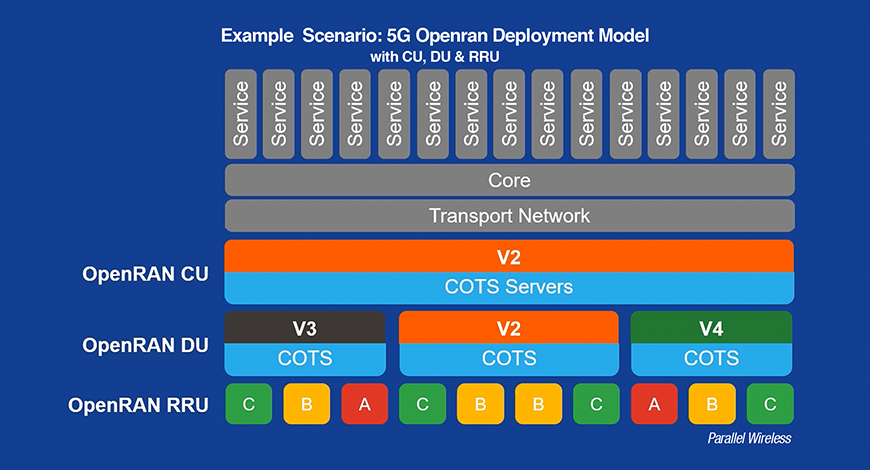

5G disaggregates the 4G BBU into a radio unit (RU), distributed unit (DU), and centralized unit (CU). Decoupling these functions brings carriers flexibility because they can co-locate the RU, DU, and CU or deploy them in different locations as needed.

The RU, DU, and CU include all of the functions and interfaces necessary for a software-defined network, or virtual RAN (vRAN). The network orchestration and automation layer at the core does, however, need software to manage the process. LTE networks manage this task through proprietary hardware and software. Cost constraints in 5G has inspired carriers to look for a standardized, open-source option that leverages COTS hardware. In response, four key open-source initiatives have emerged, the Akraino Edge Stack, the O-RAN Alliance, the Open Networking Automation Platform (ONAP), and the Open Computing Project (OCP).

Open-RAN

Even though 5G has standards and is in deployment, it is very much still undergoing change. One such place where 5G is changing from its initial concept is in the space between the wireless aspect and the wired network that carries the bits. Because 5G must support several overall use cases, the need has arisen for a flexible architecture on the front end, just after the radio, known as the radio-access network (RAN).

Most of the CapEx required to build a wireless network is related to the RAN segment, reaching as high as 80 percent of the total network cost. Any reduction in the RAN equipment cost will significantly help the bottom line of wireless operators as they struggle to cope with the challenges of ever-increasing mobile traffic and declining revenues.

Open RAN doesn’t mean open source. The open part comes from a proposed standard, in development by the O-RAN Alliance, to standardize software interfaces between segments of the RAN. The intent is to let carriers pick and choose portions of the RAN that are currently encapsulated in a cell site’s baseband unit (BBU). The disaggregation would also let multiple companies compete to supply the baseband components in the baseband segment of the network between the radio and the core.

An open architecture gives carriers more flexibility. Operators can place the components, RU, DU and CU wherever in the network they want. That flexibility will bring in more players and increase competition, which will reduce costs.

Open RAN is not just a technology issue. It’s also financial. Operators will not get more revenue from consumers. It has to show that it will reduce costs over proprietary systems. Interoperability is imperative to force innovation and drive down costs. And that in turn involves testing and the industry will need to develop test procedures and perhaps need independent third-party test labs to verify standards compliance and interoperability. Test-equipment companies are now adding open RAN testing as part of specifications developed by the O-RAN Alliance. Indeed, open test & integration centers are now coming online.

Open RANs will take several years to appear in the wild. Unless ordered by governments, carriers will likely not incur the costs of removing new 5G equipment with equipment that supports open interfaces just for the fun of it. Over time, as upgrades are needed, carriers seem more likely to embrace open RAN, even if they call for it now.

The O-RAN Alliance and then the Open RAN Policy Coalition

The Telecom Infra Project (TIP) was founded by Facebook in 2016; TIP has a program called OpenRAN. And then there is the O-RAN Alliance, which was formed in 2018, when the C-RAN Alliance and the xRAN Forum decided to merge, in part because they were doing many of the same things. And now TIP OpenRAN and the O-RAN Alliance have so much overlap, they recently signed a liason agreement in which they vowed to coordinate with each other so that they would not keep stepping on each other’s toes.

The O-RAN Alliance was founded by operators to clearly define requirements and help build a supply chain eco-system to realize its objectives. To accomplish these objectives, the O-RAN Alliance’s work embodies two core principles, Openness and Intelligence. Established as a German entity it had as its founder members, AT&T, China Mobile, Deutsche Telekom, NTT DOCOMO and Orange.

A Who’s Who of America’s communications infrastructure vendors, software groups and mobile operators formed the Open RAN Policy Coalition on May 6, 2020. It looks to ensure that governments will not hinder the movement towards open RANs. The Coalition currently consists of 47 companies that range from carriers to customer-equipment start-ups. The organization announced on June 12 the addition of 14 new members.

There are major reservations on why this coalition was formed. The new Coalition’s goals are duplicative of existing industry efforts. While the list of corporate members of the new Coalition is nearly identical to the list of members of the existing Alliance, its announcement came just weeks after a bipartisan group of Senators proposed a USD 1 billion investment fund into the open infrastructure effort. The companies involved include AT&T, Verizon, Juniper Networks, Cisco, Amazon’s AWS operation, Facebook, IBM, Intel, Qualcomm, Dish Networks, Microsoft and XCOM-Labs, as well as some of the smaller companies leading the charge to a more open approach toward 5G RAN, notably US companies such as Altiostar, Mavenir and Parallel Wireless.

The perception is that the new Coalition’s attributes make it appear as if it has more to do with politics than it does with business or technology. In fact, what it appears to be is a vehicle for curtailing the business opportunities of Huawei and other Chinese companies such as ZTE!

Creating a foundation for 5G

5G will multiply the opportunities for SD-WAN, giving a major boost to SD-WAN adoption. While some enterprises use 4G LTE to rapidly set up a new site or as a backup to a fixed network, mobile connections are not widely used in SD-WAN underlays. 5G, however, could have a significant role to play as a main access technology for branch sites, alongside fiber and xDSL.

The combination of 5G and SD-WAN displays performance reliability. Some use cases, such as 360-degree AR or telemedicine, will benefit greatly from the superior speeds and latency from 5G compared to xDSL.

SD-WAN can help pave the way for a 5G future while solving existing network challenges to deliver a higher-quality user experience. At its most basic, SD-WAN acts as a traffic cop, intelligently routing data in real time as it travels over core networking components such as the Internet.

Through flexible SD-WAN, the service provider offers its customers intelligent and dynamic routing of their data between on-premises sites and the cloud, backed by best-in-breed security. The flexible SD-WAN solution dynamically selects the best route based on availability, bandwidth and security requirements. It allows organizations to make the best use of their networking, computational and storage resources, and helps improve performance, availability, security and disaster recovery. A real-time HD video conference can be automatically routed over 5G if there is a traffic bottleneck on the fiber/MPLS connection.

As cloud services like IaaS and SaaS become the leading method for delivering applications to branch offices, more and more branches are connecting to cloud providers in addition to corporate data centers.

SD-WAN combines multiple physical WAN links into one logical network and provides traffic prioritization to accelerate performance of applications that are deployed in internal data centers and in the cloud. When integrated with Wi-Fi 6, SD-WAN can enable IoT, edge computing and end-to-end traffic visibility at the branch.

WAN bandwidth demands are increasing on an average of 20 percent to 30 percent per year, and as a result SD-WAN is becoming more attractive because it enables hybrid WANs that can blend expensive wired circuits such as MPLS with less costly but also bandwidth-rich internet connections. By adding 4G LTE and 5G services to the mix, IT leaders gain wireless links that can complement, and in some cases replace, existing wired services.

4G LTE is already in widespread use at branch locations to ensure high availability and reliability in the event of slowdowns or outages in primary wired circuits. It also provides rural sites with additional WAN options beyond DSL and T-1 circuits. As leading wireless operators compete for 5G customers, more options may emerge such as unlimited data plans that could provide branch locations with higher bandwidth at fixed costs.

5G also promises a number of other advances including speeds greater than 1Gbps, low latency and network segmentation. Some of these features need more work before they become available, but the reality is that existing 4G and 5G networks offer performance as good as or better than many wired internet connections. Connection speeds at or above 1Gbps can meet the WAN demands of most branches, even as traffic to and from them continues to grow.

Some important ways that SD-WAN supports both existing processes and the transition to 5G are:

Optimizing routing. SD-WAN allows organizations to prioritize routes and resource delegation according to the criticality of an application;Providing solid computing speed close to the edge. 5G can dramatically reduce data transport times, but this benefit is lost if devices and applications don’t have the computing performance to process high volumes of data quickly. SD-WAN allows organizations to move computing functions to the cloud, where resources are more scalable and can be located closer to edge devices; and

Enabling edge-to-edge security. 5G splits network frequencies into slices (i.e., multiple virtual networks) that reside on a shared infrastructure. As the number of network slices and user devices increases, the number of attack vectors also grows. SD-WAN inherently provides an extra layer of data security for these zones by sending data through encrypted private tunnels. And in addition, enables consistent security policy enforcement and monitoring across all these zones, devices and network slices–even as the speed and volume of data skyrocket with 5G.

Market dynamics

5G is opening a big window for vendors that have not traditionally played a big role in cellular networks. 5G and a confluence of transformational shifts in mobile networks is fostering a more favorable environment for widespread use of their technologies.

Those leading vendors will emerge as a strong alternative in this regard, that have played a support role to more traditional telecom vendors and carriers. For instance, Cisco is in talks with more than 100 network operators about 5G and more than 40 are currently deploying Cisco 5G solutions, including Rakuten, which is building a fully virtualized, software-defined mobile network in Japan. Cisco manages the whole supply chain and integration of vendors for Rakuten’s mobile network. It fundamentally alters the supply chain because there are different radio vendors, different radio software vendors, and the vendor has the ability to build the integrated systems. The customised platform, targeted at service providers includes components designed to help the operators reduce the cost of building and operating internet-scale networks, which becomes especially relevant as operators prepare massive 5G rollouts.

Global SD-WAN market revenue crossed the USD 1 billion mark in 2019, with revenue and customer sites growing more than 100 percent from 2018 to 2019. In April 2020, Omdia reported that SD-WAN global vendor revenue reached USD 2 billion in 2019, up from USD 1.1 billion in 2018, poised to hit USD 4.8 billion in 2024. Frost & Sullivan pegs this figure at 1.23 billion in 2019 and USD 6.267 billion in 2024.

The market size of the SD WAN Infrastructure industry in 2019 was USD 2.3 billion, projected to grow 44 percent in 2020. From 2016 to 2021, the industry growth is projected to be an average of 52 percent.

Leading SD WAN vendors include Aryaka Networks, VeloCloud (VMware), Silver Peak Systems, Viptela (Cisco), Cisco Meraki, Infovista, Citrix, Talari (Oracle), FatPipe Networks, Fortinet, and Cradlepoint. SD WAN vendors transcend companies traditionally in the service provider, networking, and cybersecurity industries.

Hybrid cloud and multi-cloud connectivity continues to be huge focus for SD-WAN vendors, with most announcing integration with leading cloud platforms. As enterprise applications get distributed across multiple clouds, the traditional WAN architecture of backhauling traffic to a hub site and then routing to cloud is inefficient and expensive. The hub-and-spoke model is especially inefficient considering the growth in remote working, which is here to stay in the long run. SD-WAN enables enterprise IT to predefine business policies through the SD-WAN controller, to specify which cloud applications are suitably accessed directly through the internet versus backhauled to a hub site.

Network and application security remains a priority for enterprises. While most leading SD-WAN vendor solutions come with a stateful firewall, vendor platforms are evolving to support integrated security features such as antivirus, URL filtering, malware protection, and intrusion detection/prevention systems (IDS/IPS), which will in turn drive demand for secure SD-WAN solutions.

North America continues to lead in terms of global SD-WAN revenue share, albeit lower than that in 2018, with Europe gaining traction, followed by Asia-Pacific and Japan, and Latin America.

Globally, businesses are showing a preference for managed SD-WAN solutions. This is pushing SD- WAN vendors to build partnerships to help tap into the market potential. The SD-WAN vendor partner channel typically includes NSPs, MSPs, system integrators, application service providers, and VARs.

Leading SD-WAN vendor solutions come with integrated security, WAN optimization, and routing capabilities. Cost savings from using hybrid networks, superior WAN performance from application- aware routing, and simplicity and ease of use from integrated functions such as stateful firewall, routing, and WAN opt are expected to drive market migration from a single-function, hardware- centric approach to a software-centric approach, where a single composite image of software can deliver multiple functions.

The economic downturn due to COVID-19 will impact SD-WAN spending in the near term. Highly distributed verticals such as retail and manufacturing are impacted negatively from the pandemic, which will slow market growth in the next couple of years. As businesses reassess their technology spend, SD-WAN will emerge as a top choice for their networking needs, which will contribute to higher growth rates

beyond 2022.

You must be logged in to post a comment Login