Trends

Display fab utilization forecast drops to 68% in Q1 2024

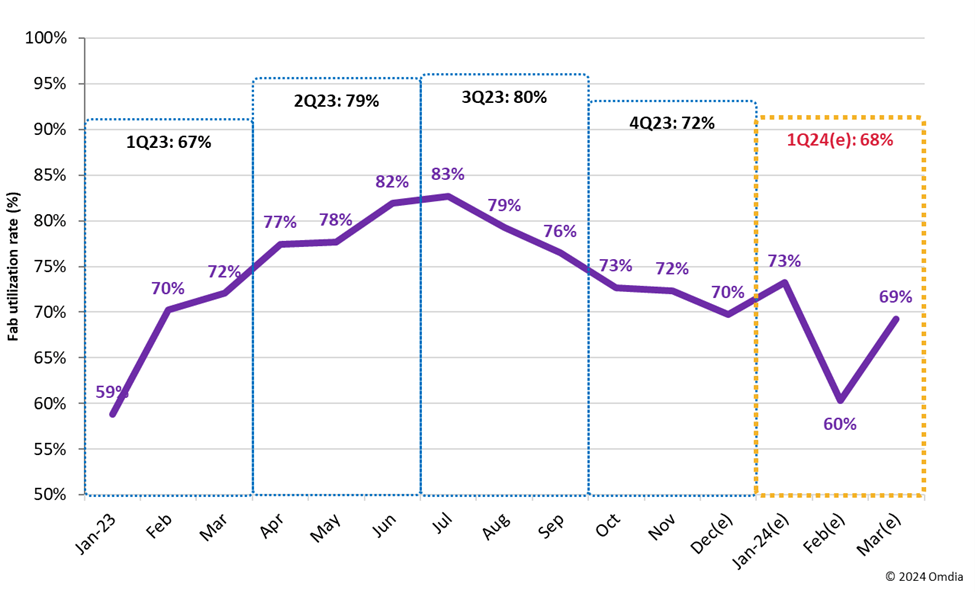

Owing to slower demand early in the year in 2024 along with panel makers’ efforts for LCD panel price protection, Omdia forecasts say display fabs’ overall utilization will lower below 68% in 1Q24, according to its latest Display production & Inventory Tracker – December 2023.

Figure 1: Display panel makers’ monthly fab utilization latest forecast

“North America TV sales on Black Friday and the Chinese Double 11 promotions in 2023 were slower than expected resulting in numerous TV inventories being carried over into the first quarter of 2024. TV display price pressures from TV brands and retailers have also been stronger. However, panel makers especially Chinese panel makers who took 67.5% of LCD TV display shipments in 2023 are responding to these conditions with further utilization cuts in 1Q24 highlighting their ambition to sustain LCD TV display prices by controlling LCD TV display supply,” said Alex Kang, Principal Analyst of Omdia.

“China’s big three panel makers, BOE, China Star and HKC Display lead in the fab utilization cuts scheduled for 1Q24 especially in February during the Chinese New Year holidays. These three makers decided to extend their Chinese New Year holidays from one to two weeks. As a result, their average fab utilization in February 2024 is 51% whereas other makers will be at 72%,” added Kang.

Reduced demand early in the year accompanied by many carried over inventories, have led LCD TV display buyers to strongly believe display price will continue to fall till the inventory clean up and 2024 new model demand can assist recovery, at least till the end of 1Q24. However, Chinese panel makers dominating the LCD TV display supply market. believe they can stop the price erosion much earlier than the industry’s expectation. Omdia believes there are three reasons behind this confidence.

- First, Chinese panel makers have the experience of managing LCD TV display prices through a production-to-order policy (which means fab utilization control) despite the slow demand of early 2023.

- Second, panel makers believe TV display demands will increase from 2Q24 because of large sporting events such as Euro 2024, the Paris 2024 Olympics and 2024 Copa América.

- And third, the recent rising shipping issues because of an increased threat of attack by Iran-backed Houthi rebels in Yemen targeting ships travelling to Israel led to more global shipping companies making the decision to stop their Red Sea routes from the middle of December 2023. As a result, transportation time and costs from Asia to Europe have increased significantly.

“Developments over the next few months will set the stage for panel makers, particularly Chinese panel makers who believe they can impact a faster LCD TV display price recovery,” concludes Kang.

Figure 2: Monthly fab utilization rate – China’s major 3 large-display makers (BOE, China Star, HKC Display), and others

Omdia

You must be logged in to post a comment Login