5G Features

Creating a chain of trust for 5G networks with testing

5G’s specifications and need for time- and cost-efficiencies being much more stringent are resulting in new test practices being developed and refined.

As 5G brings changes to consumers and businesses, it also brings changes in how engineers perform tests. With 5G allowing speeds up to 100 times faster than existing cellular connections, latency in 1 millisecond range, and surpassing the current capabilities of physical fiber optics, 5G test practices are being developed and refined to ensure the consistent 5G performance that end-users demand.

5G testing means more than verifying the lightning-fast download speeds, super low latency, and expansive coverage density. Simplified, end-to-end 5G test solutions are playing a vital role in the development, deployment, and operational excellence of emerging 5G networks.

Test solutions have quickly adapted to complex use-cases and wholesale architectural advancements encompassing core, transport, RAN, and fiber network elements simultaneously. This has necessitated advanced emulation and verification technology in the 5G test lab that is scalable to full 5G deployment in the field.

5G fiber networks are being challenged to meet fronthaul and backhaul demands with the bar set higher for speed, bandwidth, reliability, and synchronization while network function virtualization (NFV) and edge computing introduce additional visibility obstacles. This convergence of dynamic system elements makes automated, real-time intelligence platforms another important pillar of 5G network performance testing and optimization necessary.

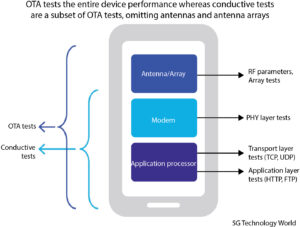

Over the air testing is now essential. The tight integration in 5G user equipment means that wired testing is no longer viable. Temperature plays a role, too.

In 3G and earlier wireless networks, wireless terminals, handhelds, cell phones, and UEs were tested using hard-wired or cabled connections. This was sufficient because the main cause of transceiver failures was high mobile speeds (also known as Doppler effect), causing shorter coherence time (the time when a channel is constant). This produced estimation errors and a high delay spread, which caused inter-symbol interference due to large echoes of the signal. None of these issues are antenna-dependent.

4G introduced multiple input-multiple output (MIMO), an antenna technology where multiple antennas appear at both the source (transmitter) and destination (receiver). On top of the Doppler and delay spread, a device’s transceiver needed testing against correlation – a metric of how well two or more signals can be separated in the same frequency band. Correlation is a function of the antenna and propagation; thus, in addition to propagation, tests must include the antennas.

In 5G, the antenna is even more predominant because of massive MIMO, which uses the spatial domain to deliver the signal. Therefore, antennas (now an antenna array) are an integral part of the transceiver performance.

| Main tests required at various phases of 5G product life cycle | |

| 5G testing | Test cases |

| Transmitter conformance testing | Power spectrum mask, transmit power vs time, CCDF, I/Q vs time |

| Receiver conformance testing | EVM, channel response, spectral flatness |

| Interoperability testing | This test ensures that 5G devices from one vendor will work with 5G devices from the other vendors in the network without any issues. |

| Network stability tests | 5G system works without having any issues at long run during handover and other tests. |

| Inter-RAT tests | This test ensures 5G device works well across all the RATs (Radio Access Technologies) for which it has been designed for. |

| RF-related tests | Other than the above, RF tests for 5G device such as phase noise, 1dB compression, third order intercept points, harmonics, spurious, noise figure, image rejection are only equally important to be performed. |

Many 5G test processes are parallel those of 4G LTE, but 5G’s specifications and need for time and cost efficiencies, are much more stringent. Designers of use-equipment (UE), systems, and networks must account for compliance testing to ensure 5G products meet established guidance. Critical compliance tests include RF exposure, radio testing, and electromagnetic compatibility (EMC).

Standards-based design is a key element in wireless communications. If the design does not follow the communications standards, not only will the non-standard equipment itself not function correctly, but in the worst case, other communications equipment may be adversely affected, resulting in lowered communications network performance overall. The advantages of standardization for both makers and vendors are that products following the standards are easier to sell and use, have cost advantages, and become easy to diffuse.

The third-generation partnership project (3GPP) is continuing its work in development of standards from 3G to the current 5G, and is progressing with future specification standardization details.

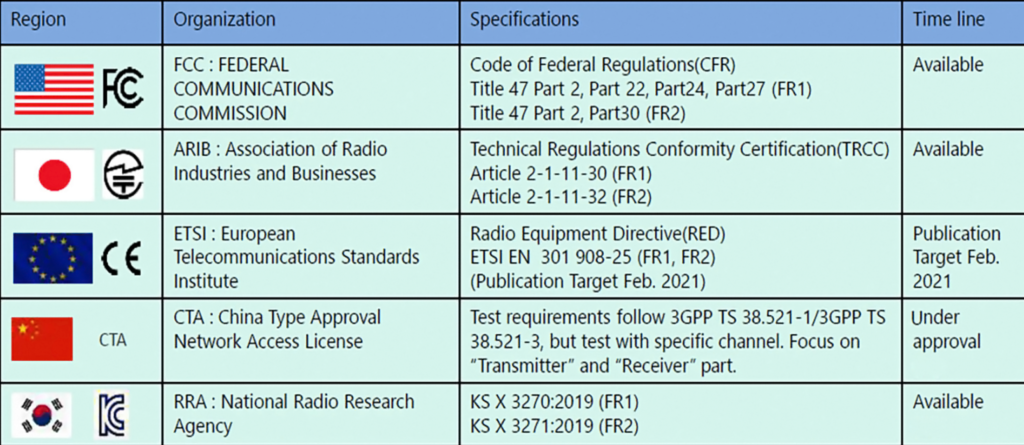

Testing requirements vary by country and region. Government and industry associations and standards have established regulatory specifications for 5G devices in relation to testing of the transmitter and receiver.

These tests differ from established RF exposure measurements that gauge the unintentional generation, propagation, and reception of electromagnetic energy from 5G devices and systems into human tissue. All UE manufacturers and mobile carriers must guarantee product operation that falls within safe parameters for both RF exposure and EMC.

RF exposure test processes need to be enacted by UE, system, and network designers, as well as mobile operators to ensure they meet stringent guidelines set forth by industry and government agencies. EMC compliance, while always a test consideration in wireless designs, has become more in focus with 5G’s commercialization.

ANSI and IEEE have passed a series of test standards for regulatory compliance. To verify regulatory compliance for EMC and RF exposure, 5G UE manufacturers, system manufacturers, and mobile operators must meet these standards, while still providing a clear and efficient upgrade path as 5G evolves.

The global 5G testing equipment market size is expected to reach USD 3.46 billion by 2027, and USD 3.24 billion by 2026, according to Polaris Market Research. There has been an increase in the adoption of 5G testing equipment in various industries, such as network construction, network maintenance, and network optimization.

Signal and spectrum analyzers hold supreme position in the market. This is due to its speedy and easy signal analysis, along with its capability to capture and analyze phase-associated details of the signal. The oscilloscopes segment held a remarkable market share in 2019 owing to rising intelligence of electronic equipment, a surging demand for signal storage, and self-evaluated facilities, user-interface enhancements, inflating bandwidth, and modular instrumentation. Vector signal generators, and network analyzers also have an appreciable market share.

In terms of revenue, rental holds dominating position in the market with the highest share. Renting out of 5G test equipment is one of the vital key approaches acquired by major vendors in the communication testing market, relative to outright purchase that has been the norm so far.

However, most end-users intend to develop their equipment portfolios, thus creating new revenue sources. Diverse factors like structure, power needs, and cost requirement are kept in mind before the overall deployment of 5G testing devices. Though this is a time-consuming procedure, new revenue sources are predicted to show a speedy growth momentum through the foreseen future.

Some of the major players include Anritsu, Artiza Networks Inc., EXFO Inc., Fortive Corp., Intertek Group Plc., Keysight Technologies Inc., MACOM Technology Solutions Holdings Inc., Rohde & Schwarz GmbH & Co. KG, Siklu Communication Ltd., Teradyne Inc., Trex Enterprises Corporation, and VIAVI Solutions Inc.

Sudden outbreak of the Covid-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in disruptions in import and export activities of 5G testing equipment. Government measures to curb economic activities seemed to have a larger impact on a country’s imports than the direct health and behavioral effects of the pandemic itself.

The pandemic remains in progress and its trade impacts during 2021, and beyond may differ from its more immediate impact, as workers, firms, and governments learn how to deal with and adapt to it, and as vaccinations start to allow societies to return to their pre-pandemic modes. Moving forward, how these changes will affect the trade impact of the pandemic and the possible interaction between Covid-related effects in importing and exporting countries is key.

You must be logged in to post a comment Login