Headlines of the Day

Combined revenue of Jio, Airtel & Vi may rise by 20-25% in FY2023, CRISIL

On the back of the recent tariff hikes, the combined revenue of Reliance Jio, Bharti Airtel and Vodafone Idea may rise by 20-25 percent in fiscal 2023, said CRISIL in a report.

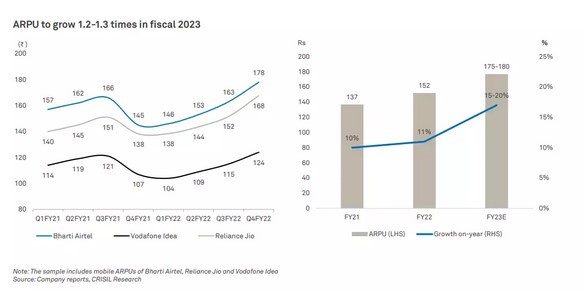

“In fiscal 2023, ARPU (average revenue per user) should grow 15-20% due to the full-year impact of tariff hikes in fiscal 2022 and fiscal 2023 (anticipated in the second half). However, this will be partially offset by the ‘downtrading’ of recharges,” the ratings agency said in a recently released research note.

Telecom operators are also expected to spend incrementally on networks and regulatory capex in fiscal 2023, which may impact the ARPU growth, and tariff hikes “could ease some pressure”.

“As a result, revenue of the top three players is expected to grow a robust 20- 25% this fiscal. Earnings before interest, tax, depreciation, and amortization is seen expanding 180-220 bps for the year,” CRISIL said.

Earlier, telcos had hiked tariffs in December 2019, the effects of which were first felt in fiscal 2021 with the average ARPU rising 11% to ~Rs 149, fueled by a higher realization amid tariff hikes and customer uptrading, CRISIL noted. “In fiscal 2022, ARPU growth slowed down to around 5%, driven by customer upgradations to 4G and the partial impact of tariff hikes taken in November 2021, added CRISIL.

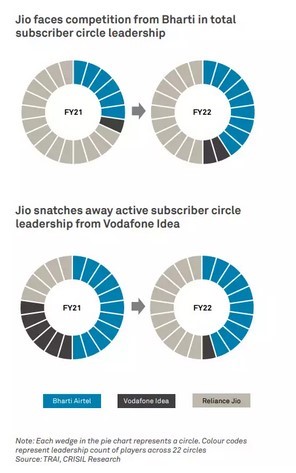

The private telcos lost 37 million subscribers last fiscal as SIM consolidation led to the shedding of inactive ones. But their active subscriber base grew 3% on-year, or by about 29 million.

While Jio saw its total subscriber base fall sharply between August 2021 and February 2022, the share of its active subscribers reached around 94% in March 2022, compared with 78% in the first quarter of last fiscal as the active subscriber base remained unaffected because of SIM consolidation.

Similarly, for Airtel, the share of active subscribers improved by a percentage point to around 99% in the fiscal fourth quarter. It added around 11 million active subscribers during fiscal 2022.

But Vodafone Idea lost some 30 million active subscribers in fiscal 2022. It continued to witness a decline in its subscriber base because of low capex in 4G and deterioration of services, while its peers have incrementally invested in 4G sites, CRISIL said.

CT Bureau

You must be logged in to post a comment Login