Headlines of the Day

Bharti Airtel stage good recovery, ICICI Securities

Subscriber watch: Bharti Airtel stage good recovery, ICICI Securities

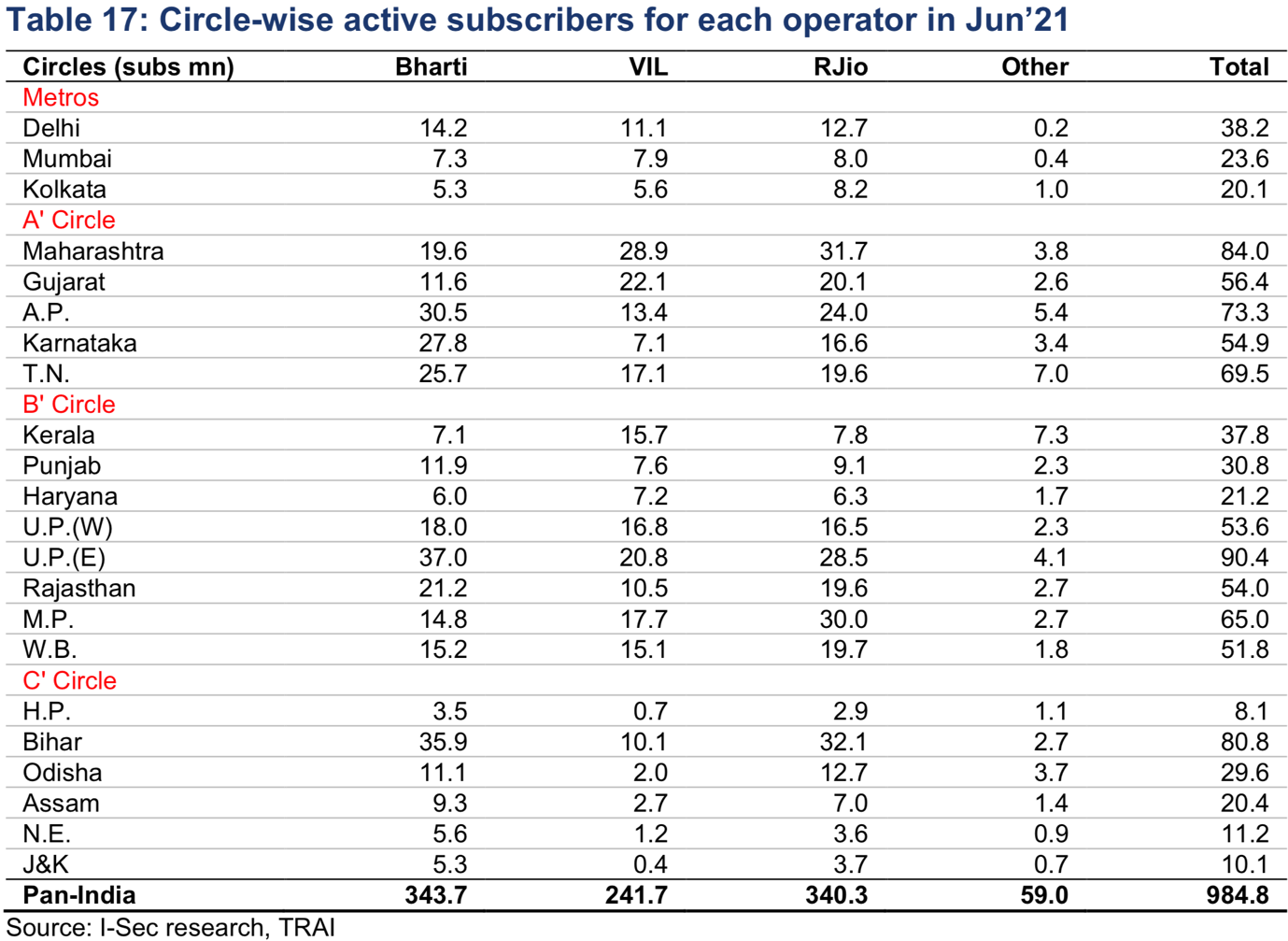

The Telecom Regulatory Authority of India (TRAI) has released its monthly data on subscribers (subs) for Jun’21. Industry-active subs rose by 1.4mn with Bharti Airtel’s (Bharti) net add bouncing to 2.4mn, which however means it has not entirely recovered the loss of May’21.

Reliance Jio’s (RJio) net add stood at 2.4mn and we see the impact of JioPhone offer subsiding. Industry-wide mobile broadband (MBB) subs rose by 11.1mn with Bharti’s addition was at 4.3mn, which is much higher than the May’21 loss.

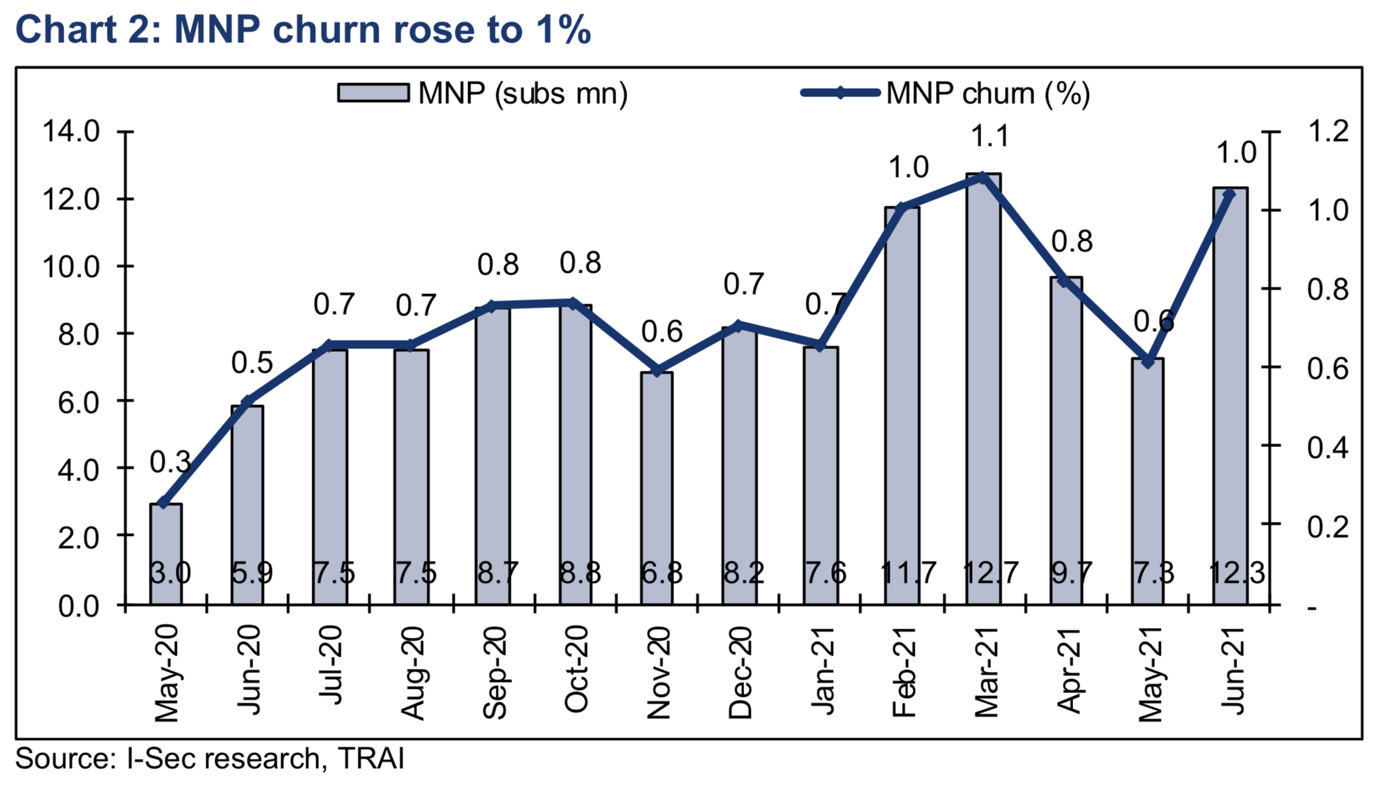

Bharti’s MBB sub market share improved by 29bps to 28.8% on active basis, while RJio’s declined by 26bps to 50.6%. MNP has been high at 12.3mn with MNP churn rate at 1%.

This is a worrying sign as it suggests VIL may be losing quality customers through the MNP route. Wired broadband sub add was steady for RJio at 0.22mn while Bharti’s normalised at 0.13mn.

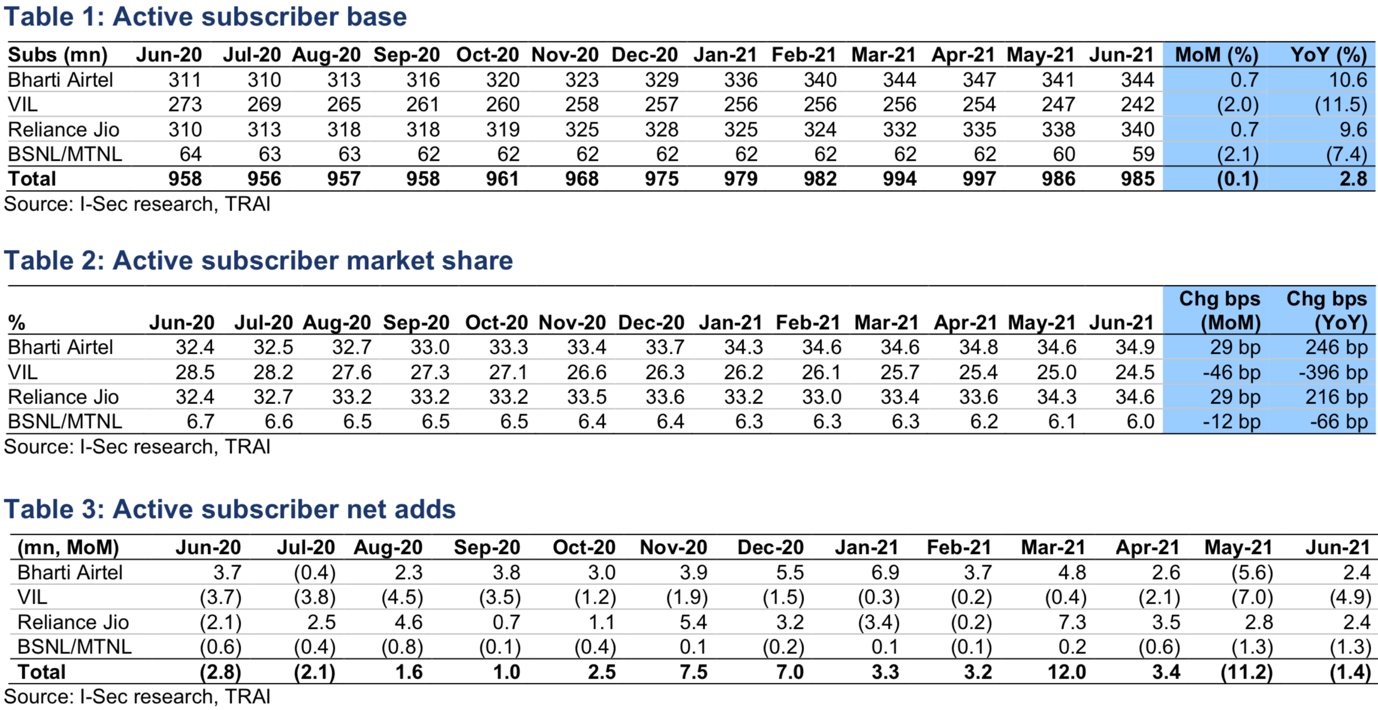

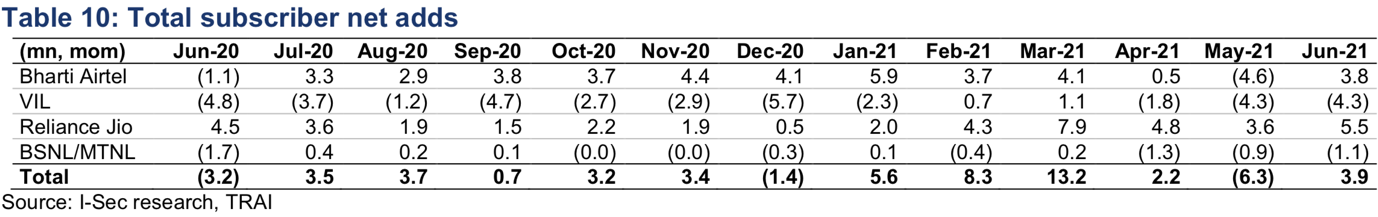

-Industry-active subs dipped by 1.4mn, largely from VIL-

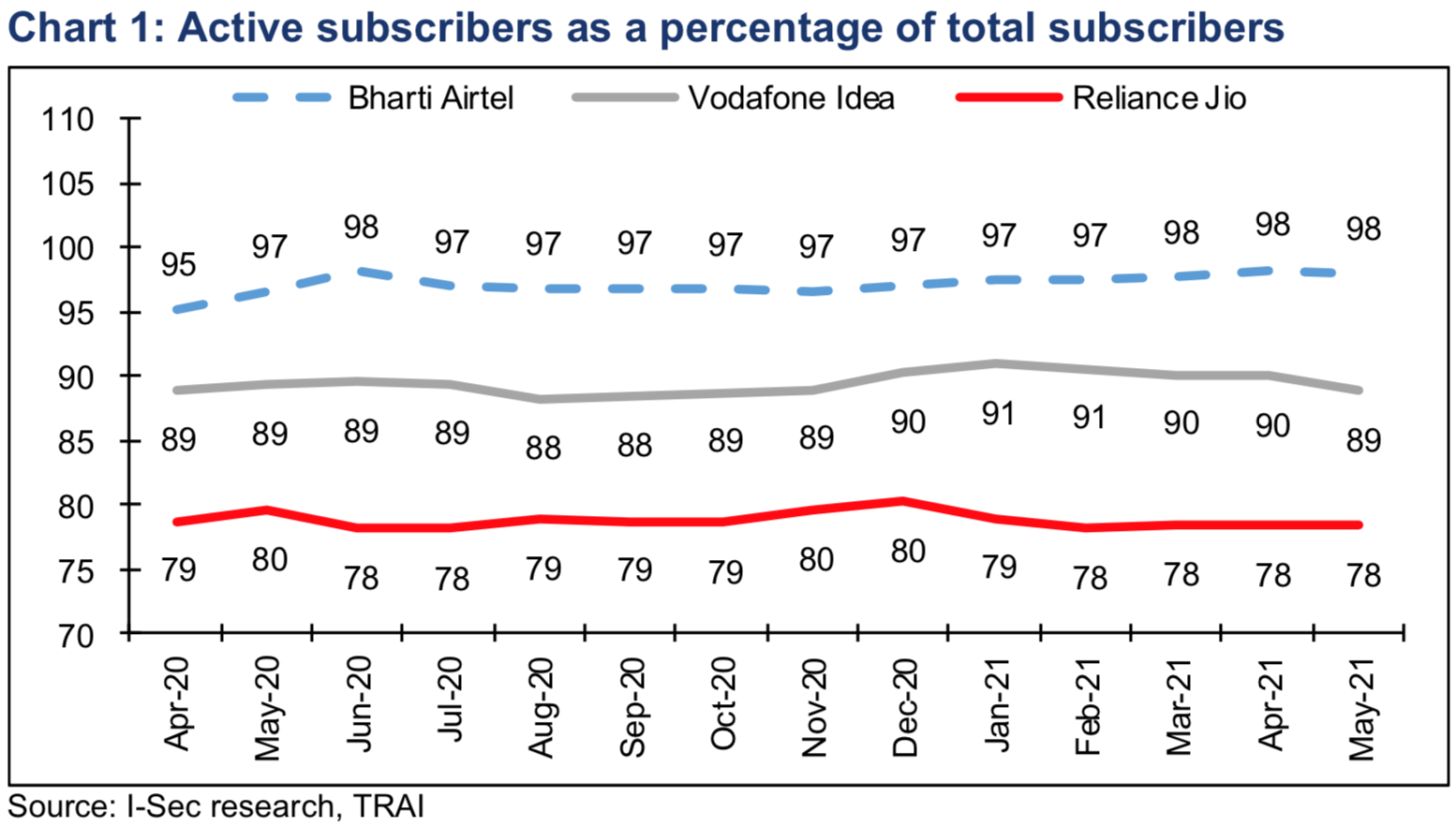

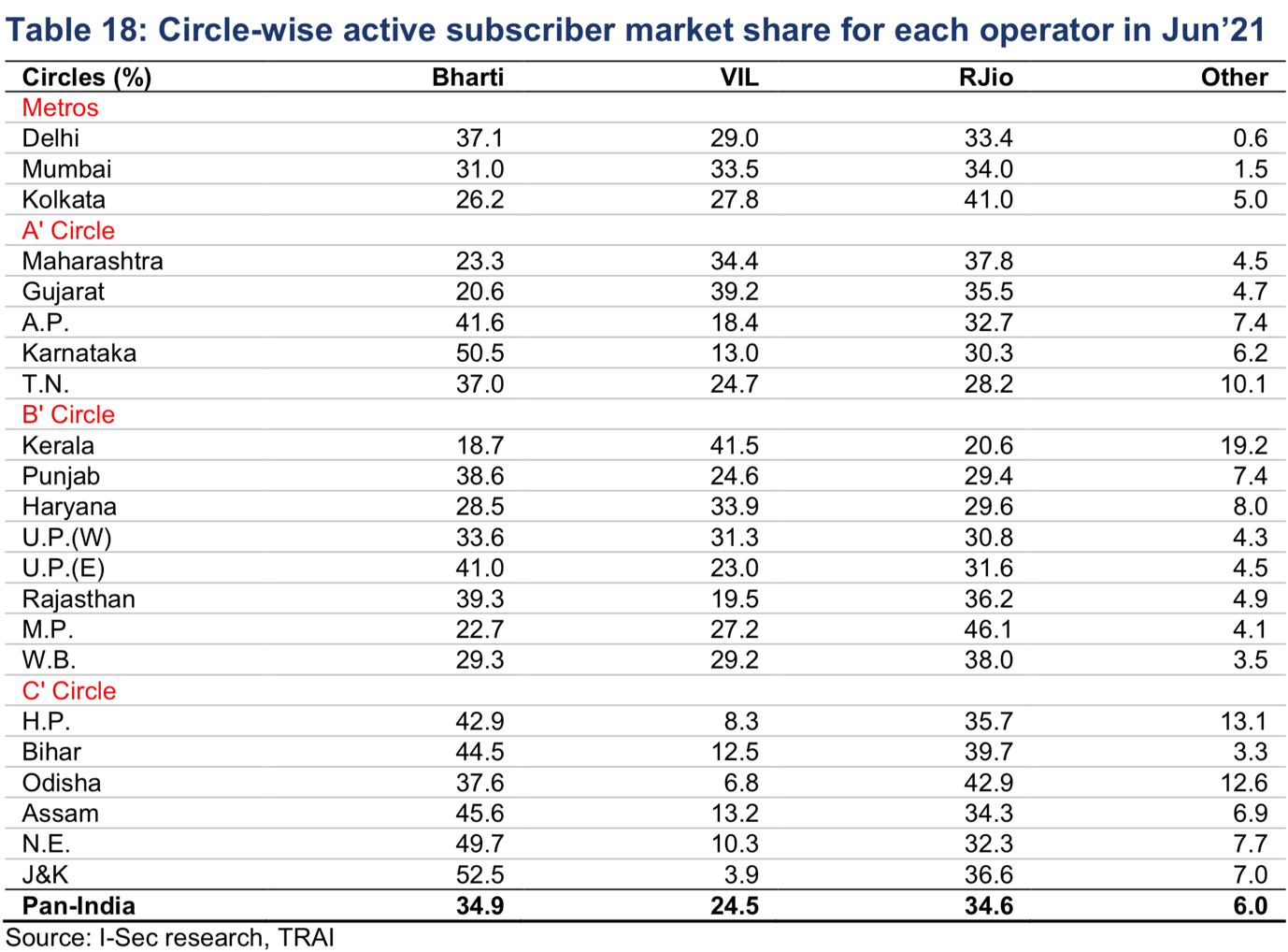

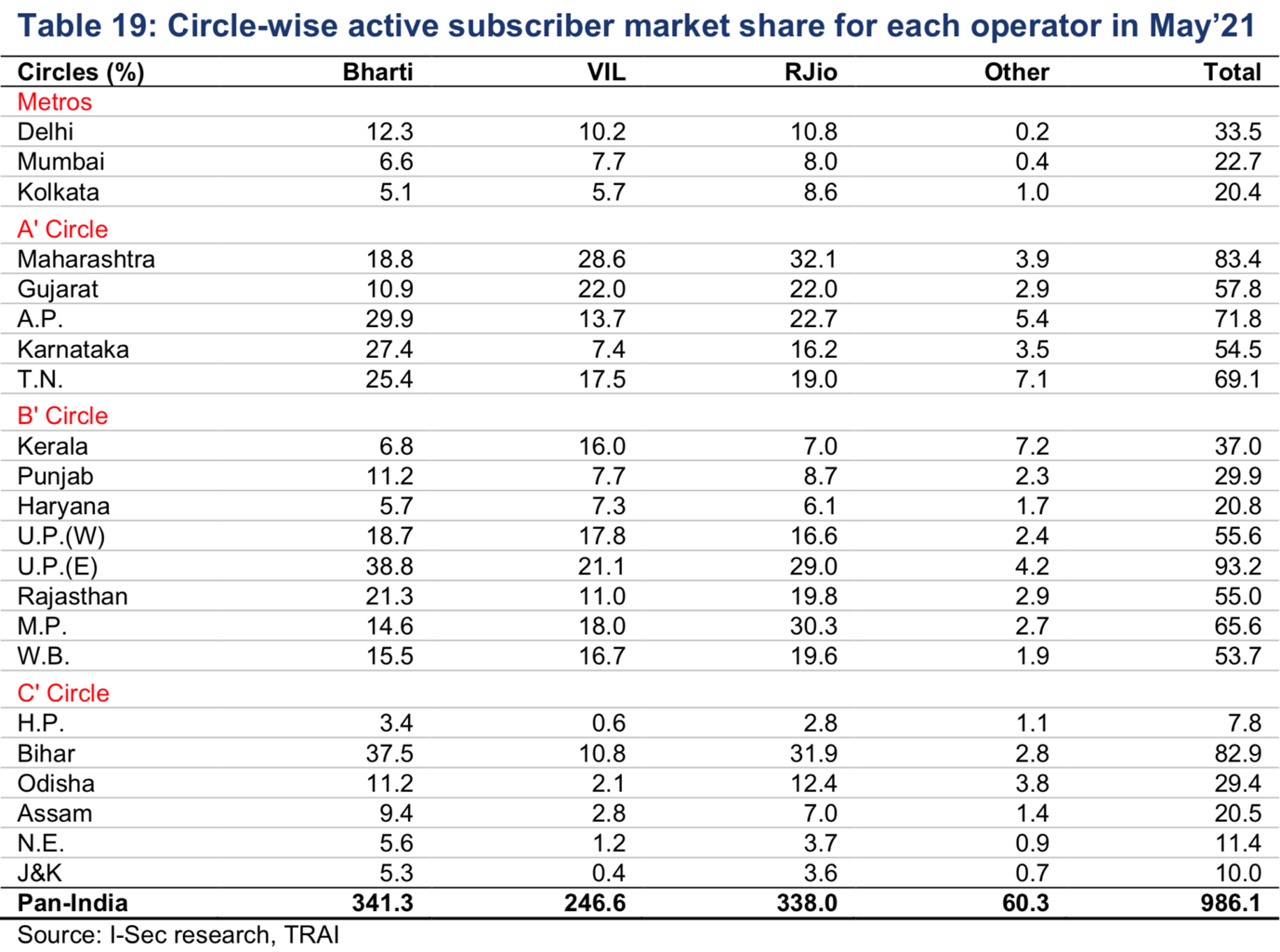

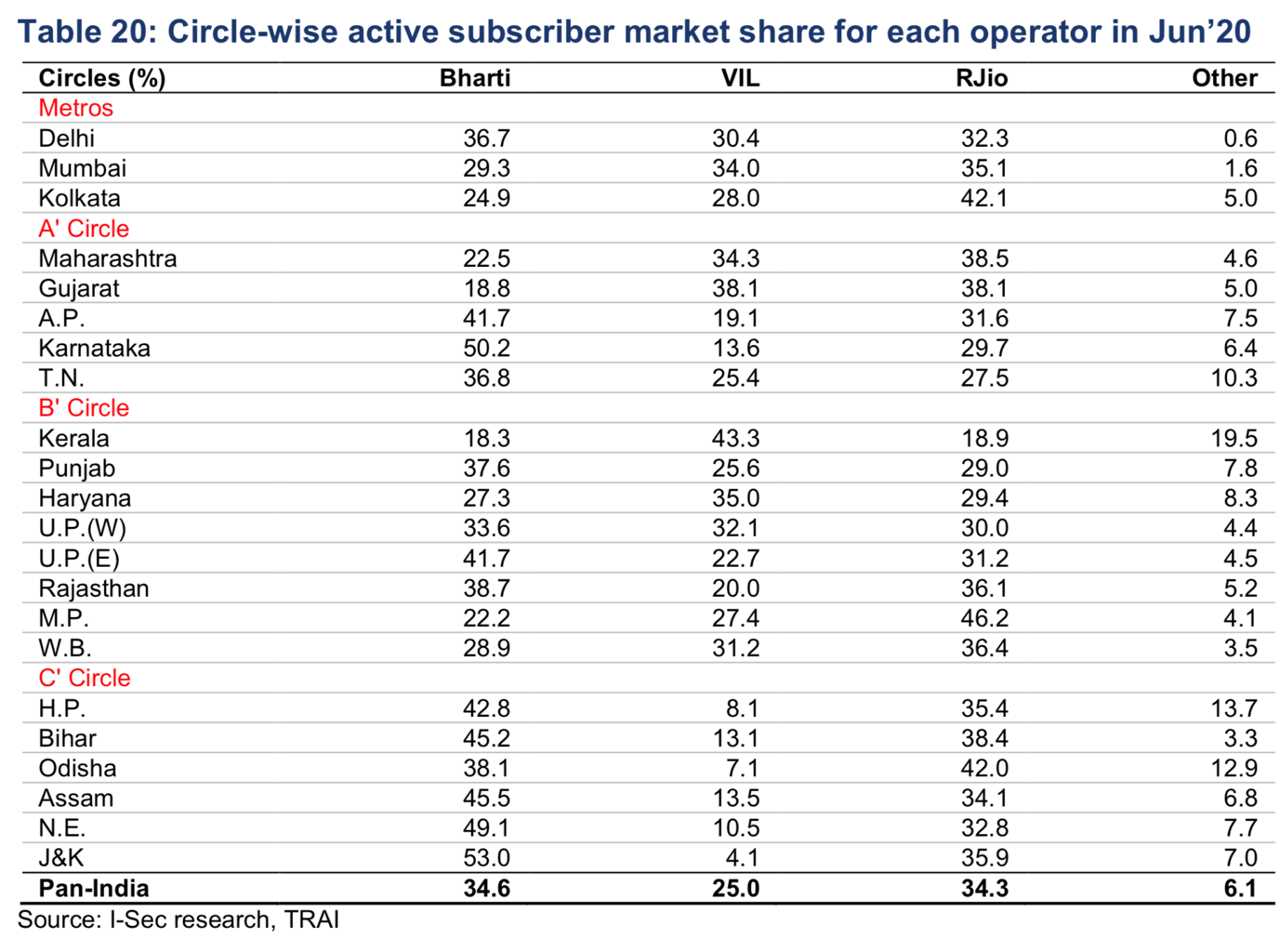

• Industry-active sub base dipped by 1.4mn to 985mn (down 0.1% MoM, up 2.8% YoY) due to the lockdown impact on VIL and BSNL/MTNL.

• RJio’s active sub base grew by 2.4mn (2.8mn in May’21) to 340mn in Jun’21, which is decelerating post its launch of the aggressively priced JioPhone offer in Mar’21.

• Bharti’s active sub base expanded by 2.4mn to 344mn, which was a good recovery after the disappointing decline of 5.6mn in May’21, but it is yet to fully recover the subs it lost in May’21. Its total sub base jump 3.8mn in Jun’21.

• VIL’s active subs dipped by 4.9mn (7mn in May’21) to 242mn in Jun’21. Total subs reduced by 4.3mn, which is disappointing as things will become difficult for the company if sub slippage continues.

• RJio’s active sub market share improved by 29bps to 34.6% MoM, while Bharti’s stood at 34.9% (down 29bps MoM) and VIL’s fell 46bps MoM to 24.5%. Bharti however continues to maintain lead in active sub market share.

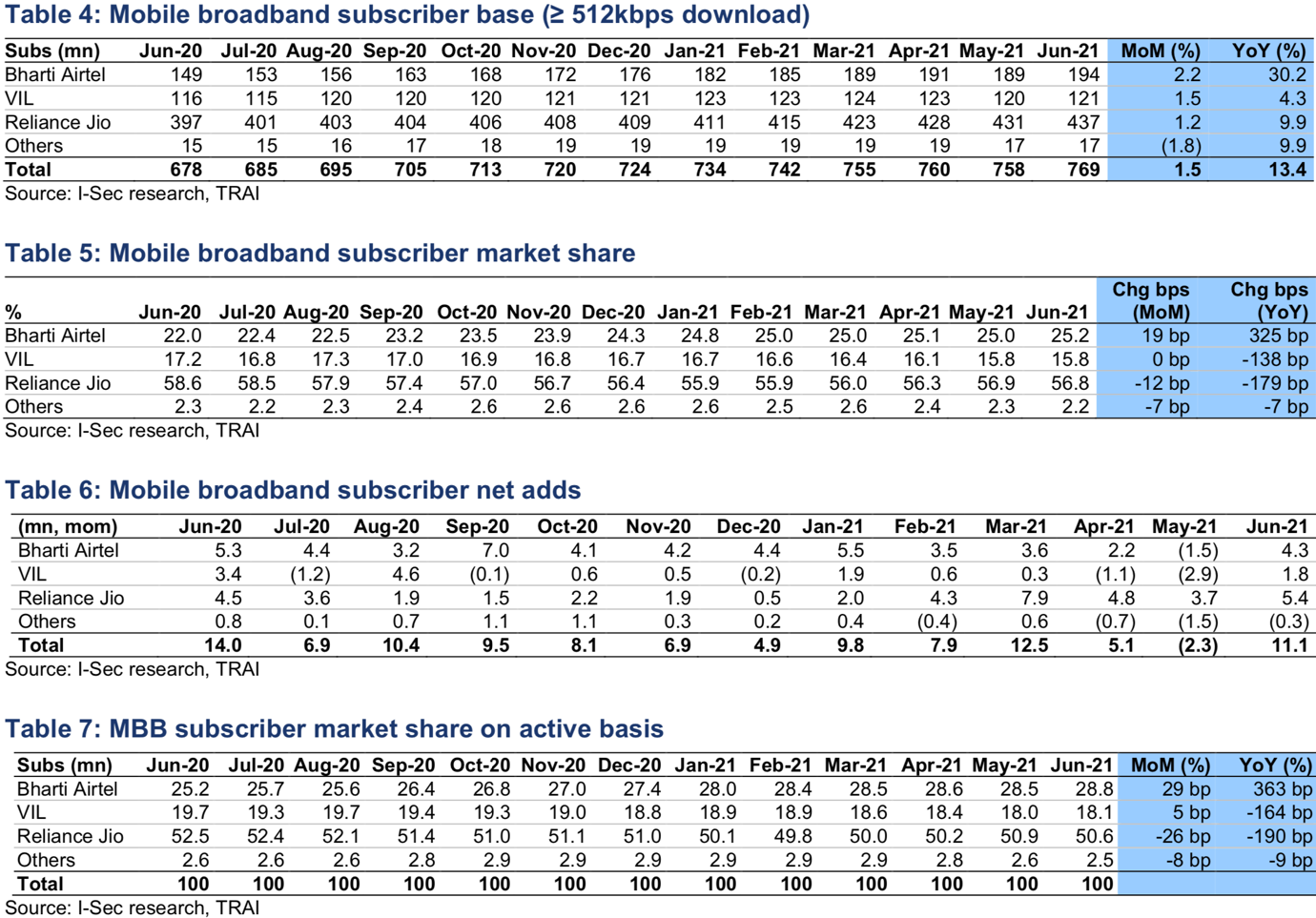

-Industry MBB (mobile broadband) subs rose by 11.1mn-

• Industry-wide MBB subs rose by 11.1mn to 769mn in Jun’21. Bharti added 4.3mn subs in this category, much more than what it lost (1.5mn) in May’21. Its average net add stood at 4.2mn per month in the 10 months before May’21.

• RJio’s MBB sub base grew by 5.4mn to 437mn. Adjusted for inactive subs, its MBB market share stood at 50.6% (down 26bps MoM) while Bharti’s was 28.8% (up 29bps MoM) and VIL’s 18.1% (up 5bps MoM).

• VIL’s MBB sub base rose by 1.8mn to 121mn, which is disappointing.

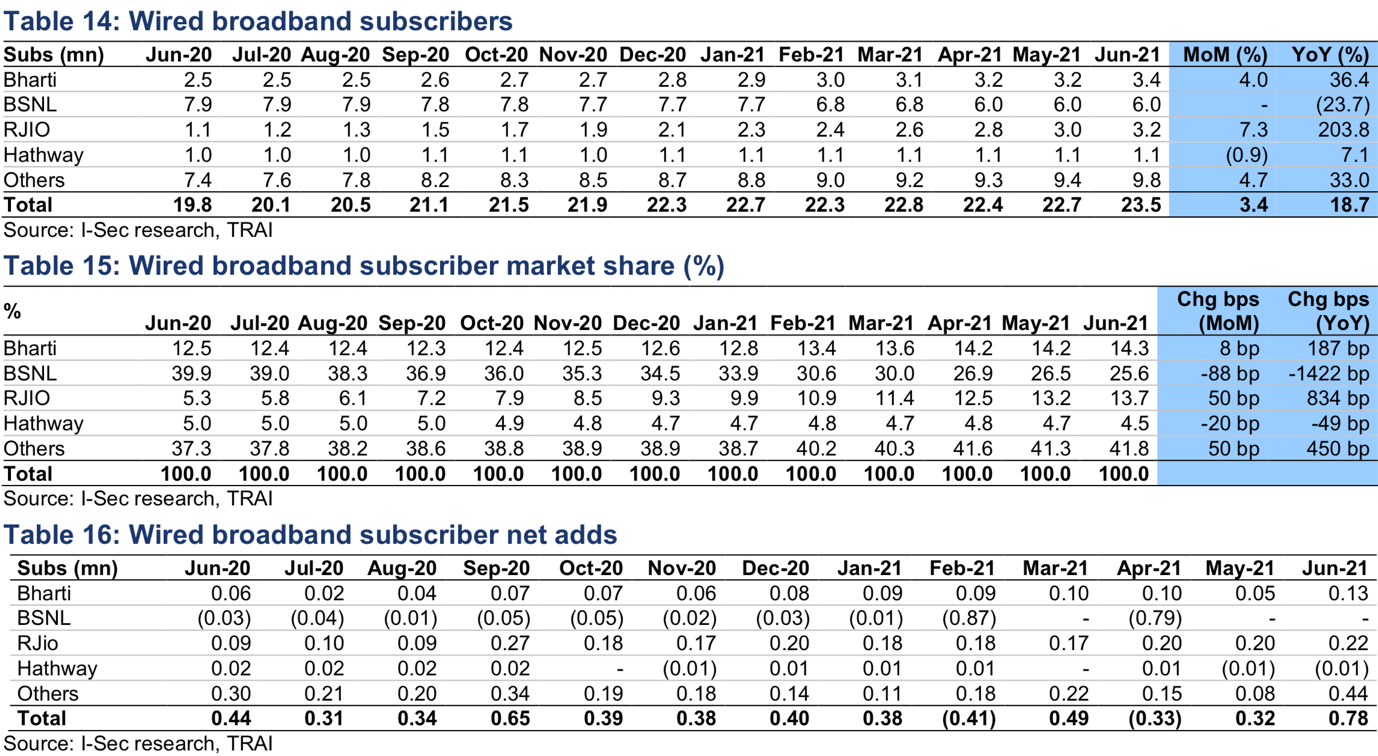

-RJio’s wired broadband sub add was steady at 0.2mn to a total of 3.2mn-

• Wired broadband sub base was up by 0.78mn MoM to 23.5mn (3.4% MoM / 18.7% YoY growth) in Jun’21. Net add for Bharti was 0.13mn vs a slower add of 0.05mn in May’21.

• RJio’s market share improved to 13.7% (up 50bps MoM), and net add stood steady at 0.22mn. Bharti’s market share was 14.3% (up 8bps MoM). BSNL’s sub add was flattish at 6mn and its market share was down by 88bps MoM to 25.6%.

-Industry MNP churn rate rose to 1%-

• Industry porting rose sharply to 12.3mn in Jun’21. MNP churn rate was at 1%. The major loss of subs was for VIL – and this is a cause of worry.

-Active subs: Industry added 1.4mn subs-

Active subscribers, or visitor location register (VLR), is a temporary database of subs who have roamed in a particular area that an operator serves.

Each BTS is served by exactly one VLR, hence the unique registration. The VLR data is calculated on the basis of active subs in VLR on the date of peak VLR of a particular month for which the data is being collected. This data is collected from switches having a purge time of not more than 72 hours.

-Mobile broadband subscribers: Industry added 11.1mn-

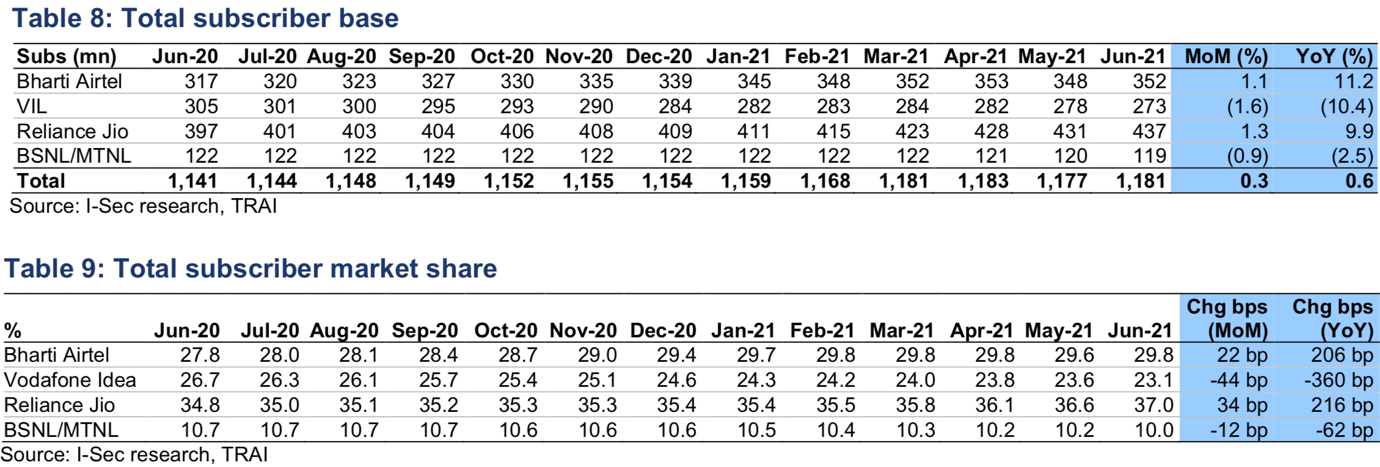

-Total subscriber base-

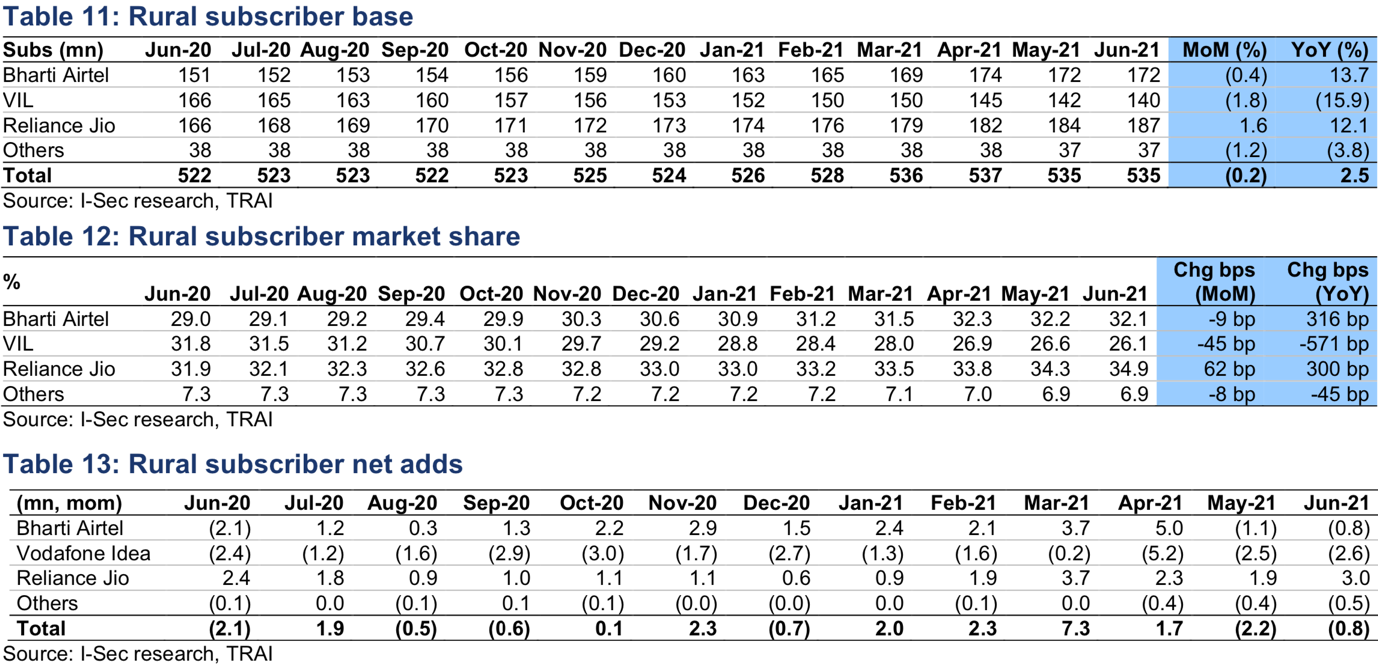

-Rural subscribers-

-Wired broadband subscribers-

CT Bureau

You must be logged in to post a comment Login