Think Tank

Beyond the assembly line – Unleash the economic significance of domestic manufacturing

Indian economy has made important strides in the second quarter of 2023-24, it has witnessed a robust 7.6-percent growth. Key contributor, manufacturing grew at a stellar 13.9 percent, as compared to 4.7 percent in the first quarter. Contribution of manufacturing to GDP stands at about 17.0 percent. Positive signs could be because of slew of policies support to enhance manufacturing in the country. The government has an endeavor to further enhance the contribution of manufacturing to the country’s GDP to about 25 percent and to create high-quality jobs in the country.

Telecom is a strategic sector. IT and telecom manufacturing policies have witnessed significant progress in recent years, aligning with the government’s ambitious Make in India initiative and Hon’ble Prime Minister’s clarion call for an Atmanirbhar Bharat, or a self-reliant India, resonates as a transformative vision aimed at fostering economic independence and resilience.

Incentives, such as production-linked incentive (PLI) schemes have been introduced to encourage local manufacturing, fostering innovation and job creation in the sector. The policies also emphasize reducing dependency on imports, enhancing self-reliance, and ensuring the security of critical telecom infrastructure.

PLI scheme for IT products including mobile is a big success. PLI scheme is really helping Indian IT companies increase domestic manufacturing rapidly and to increase its export and make India a hub of manufacturing for especially mobile handsets. Global giant Apple’s India strategy has borne fruits.

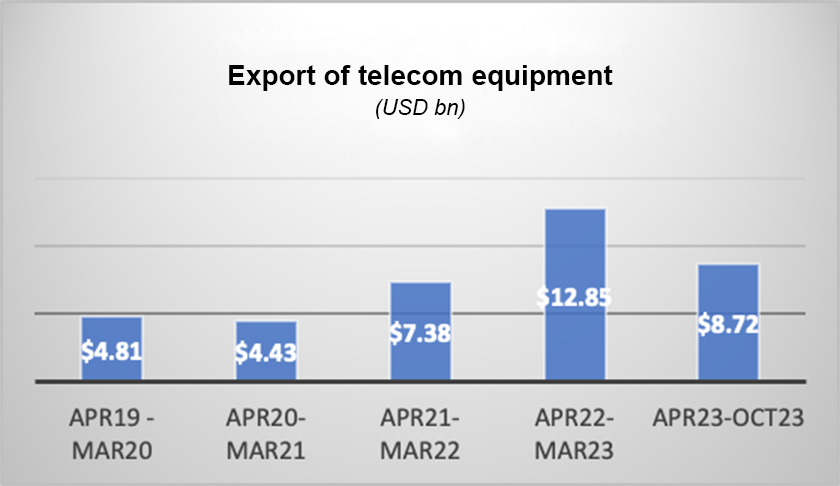

If we look at the import/export data of telecom and electronics products over the last five years to see the impact of policies on this sector, we observe as below:

- Export of telecom equipment is growing steadily from USD 4.4 billion in 2020-21 to USD 12.85 billion in 2022-23, and already touching USD 8.7 billion in the first seven months of this year.

- Out of this total export of telecom, major contribution is coming from mobile handset segment, i.e., USD 3.10 billion in 2020-21 to USD 11.10 billion in 2022-23 and already touched USD 6.5 in the first half of the year. The export of telecom, other than handset, is very meager.

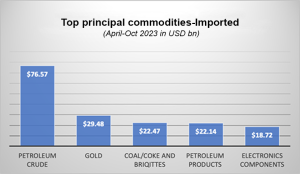

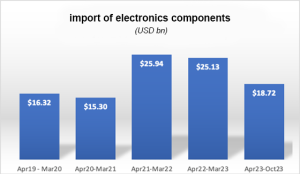

- Import of electronic components is increasing rapidly, i.e., it was about USD 15.3 billion in 2020-21 to USD 25.12 in 2022-23. The same has touched USD 18.72 billion in first seven months of this financial year. It is reflective of supporting the increased production/export of mobile handsets and other electronic devices, components/CKD import has increased.

- Which is fifth highest commodity of country’s total import at USD 18.72 billion. It is alarming.

- Total import of telecom products under HS code 8517 is steadily increasing from USD 13.5 billion in 2020-21 to USD 15.9 billion in 2022-23. In the first half of year 2023-24, it has touched USD 8.4 billion. So still, we have major reliance on import for telecom infrastructure products.

It is quite apparent that production of mobile handsets and its export has increased exponentially since launch of PLI scheme in the country. Primarily, assembly of these devices is happening in the country, and because of lack of component ecosystem and lack of involvement of high-end product design activities, low-level value addition is taking place here. Amount of import of electronic components at the same time is increasing exponentially.

It is obvious it is not opening high-end engineering jobs also. There is no target of value addition to be achieved domestically in the present PLI scheme.

Even such success stories are not there in telecom sector. Telecom networks segment is a different beast, and large volumes are not there as compared to the devices market.

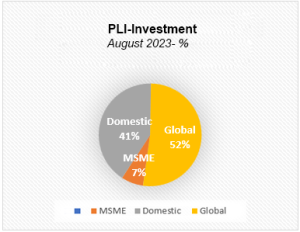

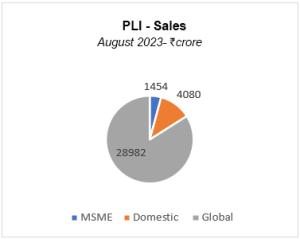

If we look at the telecom PLI scheme data as on October 2023, total investment of about Rs 2419 crore has already been made against the committed outlay of Rs 4115 crore. As per reports, only 50 percent of the companies could meet their year-end targets, including that of sales targets. Most of the companies missing the targets are MSME or domestic. Global MNCs, primarily EMS suppliers, have made investments and are able to meet the targets. Total sales achieved till October 2023 is Rs 34,516 crore against the scheme target of Rs 2.5 lakh crore by the year 2025-26.

Due to the intricate nature of R&D in complex telecom products, both in terms of time and financial investments, MSME companies have faced challenges in generating substantial sales within the initial two years of the scheme, hindering their ability to fully capitalize on the design-PLI program, which should meet the yearly incremental sales targets.

To effectively take the benefit out of the scheme, design-led domestic companies need to have scales of production for which they need domestic market access and export. It becomes evident that for the beneficiaries, market access plays a pivotal role in the success of the scheme. It is paramount that PPP-MII policy is implemented in letter and spirit across all public procurement entities so that domestic design-led companies availing PLI get an opportunity to expand their sale to meet their targets.

Another notable gap in the system became apparent, wherein even if companies achieved their targets in the second year, they would only receive incentives for the second year, as the first year’s target would have lapsed. This apparent lacuna calls for careful consideration by the government to ensure the efficacy and fairness of the PLI scheme, emphasizing the importance of refining the implementation process.

What we are doing right, under PLI schemes, is the large volume of assembly of IT and telecom products, which someone else has invented, and the IP of which amounts to maximum value addition in the overall value chain is owned by the OEM outside India.

If we analyze holistically, initial subsidy of about 6 percent is a catalyst for making further progress in the value chain and overcoming the initial inertia in a complex manufacturing domain to build the ecosystem further. Strategically, it provides jump start to the industry and help them devise a sustainable business model. At the same time, the Government of India cannot continue providing the subsidy to the low-level assembly only. Today, we recognize value only in EMS activities of CKD and provide huge incentives for that. Now there are two sides to be addressed on priority to move up the chain. One is design side and the other is further localizing component-level manufacturing. Policy support to build local component manufacturing is critical. It is learnt that Meity is working on a policy to incentivize this.

The government has been agile on the feedback on PLI scheme for IT sector and is continuously refining it. IT hardware PLI 2.0 has been also launched. It is a better-structured scheme, which gives additional incentive for local value addition not only to volume of assembly.

India needs to be strong in design-led manufacturing and build deep and broad manufacturing capabilities and know-how, and ultimately move toward high value-addition activities.

Another important policy, i.e., PPP-MII order (Preference to Make in India), is a good policy aimed at providing preferences to high value-add design-led domestic telecom products in the public procurements. But there are serious implementation issues. Indian industry, including MSME, is not able to take the real benefit out of the scheme; also certain ambiguities need to be removed.

Invariably, most of the public procurements stipulate engineering, procurement, and construction (EPC) contracts/turn-key contracts, wherein the value of the IT and telecom products amounts to only 10–15 percent of the total contract value while civil and other infrastructure, which is essentially domestic, constitute its bulk portion. Bidders can claim more than 50 percent domestic content in the overall project, meeting non-engineering compliances and even after supplying imported IT and telecom under the PPP-MII orders. In view of the same, it is proposed that local content compliance must be asked item wise in any EPC/turnkey/system integration contracts.

In the US, Build America Buy America Act (BABA Act) is intended to spread development of US manufacturing industry. Made in America policies are designed to increase reliance on domestic supply chains and ultimately reduce the need to spend taxpayer’s money on foreign-made goods.

They have created, Made in America Office (MIAO) within the White House Office of Management and Budget (OMB) that monitors the implementation and waiver of such polices in the strictest manner. The office ensures that any waivers if any from Made in America laws are applied clearly, consistently, and transparently across federal agencies. The MIAO will analyze the information it gathers from waivers to support US manufacturing and more resilient supply chains.

This site also provides relevant market intelligence to those interested in doing business with the US government. By centralizing information on past and pending waivers, they aim to maximize opportunities for US producers to supply goods and services to the federal government. It is believed that when American taxpayers’ money is spent, it should support American workers and businesses.

The US Government has also recently announced an allocation of over USD 40 billion to deploy affordable, reliable high-speed internet service to American families through the broadband equity, access, and deployment (BEAD) program.

Made in America polices and Buy American provisions in the BEAD program are driving the onshoring of new manufacturing of electronic products across broadband internet industry in the US.

Furthermore, Japan is offering subsidies exceeding USD 500 million to numerous companies, urging them to invest domestically. This initiative aims to decrease dependence on China and bolster the country’s domestic manufacturing capabilities. Likewise, the European Union is intensifying its policy interventions, allocating €160 billion for digital innovation, including areas like chips and batteries.

Cultivating national champions in key technological domains is often a pivotal goal in a nation’s growth strategy. India should similarly adopt this approach to reinforce our highly skilled domestic manufacturing.

I am concerned that if we do not transition to the high-end engineering segment in manufacturing, our nation will continue to be known for delivering high-end IT services and low-value manufacturing services. Innovation capabilities and ownership of intellectual property will stay overseas, leaving us perpetually dependent on foreign technologies.

Embracing investment with rightful policy support in advanced technology R&D and manufacturing is essential. We must identify where real value lies. This embrace of investment can generate high-end work opportunities and significant jobs, alleviating people from poverty and fostering a just society.

The article is authored by Sanjeev Kakkar, a Telecom Expert. He has held various CXO level positions in technology companies. Views expressed are personal.

You must be logged in to post a comment Login