Power Management

An Endless Power Demand at Data Centers

Data centers are expanding uncontrollably, and consuming increasing amounts of power. And this demand is only expected to continue to increase over the next few years.

Data centers are expanding uncontrollably, and consuming increasing amounts of power. And this demand is only expected to continue to increase over the next few years.

The Indian data center power market is estimated at Rs 2180 crore (USD 325 million) in 2016. On the basis of products, the UPS segment dominated the market in 2016. The growing implementation of cloud computing coupled with the need for sensitive and ubiquitous data has encouraged the installation of data center UPS.

Grand View Research pegs the global data center power market size at USD 6046.0 million in 2016, whereas MarketsandMarkets values it at USD 13.54 billion in the same year, and expects a compound annual growth rate (CAGR) of 9.92 percent over the next five years. Techavio estimates the market value size as USD 14.24 billion in 2015, poised to reach USD 28.84 billion, at an incremental growth of USD 14.24 billion.

The data center power market ecosystem comprises ABB (Zurich, Switzerland), Emerson Electric Company (Missouri, U.S.), Schneider Electric (Rueil-Malmaison Cedex, France), General Electric (New York, U.S.), Eaton (Dublin, Republic of Ireland), Delta Power Solutions (Taipei, Taiwan), Raritan Inc. (New Jersey, U.S.), Rittal GmbH & Co. KG (Illinois, U.S.), Server Technology, Inc. (Nevada, U.S.), Tripp Lite (Illinois, U.S.), CyberPower System (Taipei, Taiwan), Black Box Corporation (Pennsylvania, U.S.), Caterpillar Inc. (California, U.S.), and HP Enterprise Company (California, U.S.). These players have adopted various strategies, such as partnerships, agreements, and collaborations; mergers and acquisitions; and new product developments to achieve growth in the global data center power market. Other stakeholders of the data center power market include cloud vendors, systems integrators, application designers, and development service providers, and network service providers.

The increasing need of cloud storage has resulted in a large volume of data centers around the world, which in turn, consume a huge amount of energy. It is estimated that every year around 3 percent of the generated electricity is consumed by such facilities. In order to reduce the power usage efficiency (PUE) ratio and increase efficiency, data center designers deploy advanced power management solutions such as intelligent rack PDU, smart UPS, and battery monitoring equipment. This trend is one of the key factors driving demand in the data center power industry, which is anticipated to continue further over the forecast period.

PUE refers to the ratio of the amount of energy used to run a data center to the energy used to run a server in it. This ratio explains the efficiency of data centers. The rising cost of energy and increasing awareness to save electricity has resulted in designers opting for intelligent power management solutions. Intelligent power strips, PUE monitoring devices, and battery monitoring devices are some of the newest technologies used to optimize energy consumption in data centers and reduce the PUE ratio.

The market has witnessed an unprecedented growth in technologies and services driven by data centers. Due to this, various enterprises have started sourcing computing to cloud-based infrastructures. Cloud computing requires a high computational power; however, it offers benefits such as enhanced scalability, efficiency, and flexibility of business operations, which has resulted in a number of medium-sized enterprises to incorporate effective data centers such as web hosting cloud and colocation data centers. Additionally, the increasing usage of data centers has, in turn, resulted in the rising adoption of mega and cloud data centers. These facilities require power in large quantities for peak data-intensive operations, which subsequently drives demand for UPS and PDUs.

Traditional data centers are continuously being replaced by newer ones featuring advanced technologies and power management capabilities. The shift of the industry toward colocation and hyper-scale data centers is expected to fuel the demand for data center power equipment over the forecast period. However, the high initial investment required for these solutions and inadequate availability of compatible devices are some factors that may hinder the market growth in future.

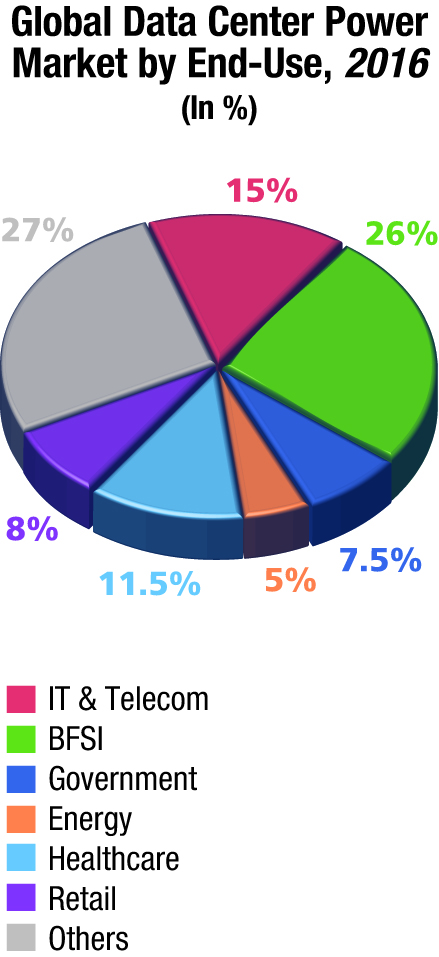

End-Use Insights

A high demand has been witnessed for data centers in Banking and Financial Services Institutions (BFSI) globally, which is majorly driven by an increasing focus of the industry on digitization. Moreover, in order to increase banking capacities, the industry has shifted toward cloud computing and cloud networking. This has resulted in a huge demand, thereby driving growth of the market over the forecast period.

The telecom sector emerged as the fastest growing segment in the global market. The developing telecommunication infrastructure requires similar facilities to manage an enormous amount of data, resulting in the increasing development of new data centers. This is anticipated to catapult the demand for power systems solutions.

Regional Insights

Regional Insights

North America held the largest market share in 2016 as the region has the highest number of data centers in the world. Additionally, the United States. alone accounted for over 30 percent of the global market of data center power in 2016. Various norms and regulations have been introduced and implemented by governments and regulatory bodies in order to reduce carbon footprints and energy consumption. This has resulted in the huge adoption of efficient power management devices in data centers in North America. Additionally, the Asia-Pacific region is expected to witness a higher growth rate owing to the rapid increase in the volume of colocation data centers in emerging countries, such as India and China.

Energy use in data centers throughout APAC is rising to match skyrocketing demand. 26.5 percent of the total energy used by data centers around the world is consumed by the APAC region and there is no sign of a slowing demand. Lack of energy management methods coupled with the unprecedented rise in demand, are the major concerns to the data center power market in the APAC region.

The skyrocketing demand while the supply is scarce is evident in the very high retail colocation space pricing in the APAC region as compared to the US pricing, it is 2.75 times higher. Increasing power and cooling requirements driven by the increasing need for high density blade servers is placing Malaysia, India, and China on site selection maps, where land is less scarce as compared to traditional places like Hong Kong and Singapore. This is expected to drive the prices down as investments are set to reduce.

The increasing power and utility prices in this region are becoming roadblocks to this market. The rapid rise in power consumption has driven the state providers to increase the prices by at least 10 percent over the last couple of years. The decreasing price due to increasing competition with the increasing number of new entrants into the market is also cutting into the profits of data center providers.

The increasing power and utility prices in this region are becoming roadblocks to this market. The rapid rise in power consumption has driven the state providers to increase the prices by at least 10 percent over the last couple of years. The decreasing price due to increasing competition with the increasing number of new entrants into the market is also cutting into the profits of data center providers.

Competitive Vendor Landscape

Vendors in this market space are focusing on power distribution units (PDUs) that are intelligent. These intelligent PDUs are essential in transferring power to the demanding infrastructure such as server, storage, and network infrastructure of a data center. This type of PDUs will be the most widely adopted, providing an edge to vendors who have also integrated all data center power infrastructure solutions with DCIM software for efficient monitoring and management. Vendors are also focusing on offering software that aids in real-time monitoring of data center power consumption by any given infrastructure segment.

Technavio has announced the top seven leading vendors in their recent global data center power market report until 2020.

ABB provides automation and power technologies to diverse industries, including utilities, transport, infrastructure, and other industries. The company sells its products in more than 100 countries. In FY2015, the company generated revenue of around USD 35 billion, where its power product revenue recorded higher growth compared to other segments. In FY2015, all the business segment revenue declined compared to FY2014 because of low lower base orders and large orders.

Delta Electronics is a global power management solutions provider. It offers energy efficient power products, including UPS and PDUs. The company has R&D facilities in various countries, including Taiwan, China, Europe, India, Japan, Singapore, Thailand, and the United States. In power electronics segment, it offers a comprehensive selection of high-efficiency power supplies, thermal management, and electronic components and systems for use in portable devices, cloud computing infrastructure, home appliances, and medical device applications.

Eaton provides power management services. It serves various end-markets, including agriculture and forestry, aviation, community infrastructure, construction, data centers, energy, government and military, healthcare, machine building, mining, metals and minerals, oil and gas, and residential. It provides electrical, industrial, residential, single-phase power quality, emergency lighting, fire detection, wiring, circuit protection, and lighting products and structural support systems. These products are used in commercial buildings, data centers, residences, apartment and office buildings, hospitals, factories, and utilities.

Emerson Network Power is one of the leading providers of critical infrastructure technologies and life cycle services for ICT systems. It has a presence in more than 150 countries worldwide with support from local service providers and around 3500 infrastructure service professionals. It provides hardware and software solutions for thermal, power, and infrastructure management, enabling efficient and highly available infrastructure. In 2015, the company reported a net sale of USD 22.3 billion. Compared to 2014, the net sales of the company were down by 2 percent due to reduced industrial capital spending in sectors such as oil and gas and energy-related markets, along with impact from currency translations.

GE Industrial Solutions provides products and services, centering the electrical infrastructure from the substation to the facility’s critical infrastructure and all the power technologies between it. It works as a subsidiary of General Electric. The company operates as the subsegment under GE’s energy management segment which focuses on providing advanced technology solutions for the management and optimization of electrical power. It provides products such as circuit breakers, relays, switchgear, arresters, repair, and panel boards for various markets which include data center, telecom, and mining. The company generated revenue of USD 7.6 billion in the FY2015, which is around 4 percent higher compared to FY2014.

Legrand is a global leader in electrical and digital building infrastructures that include areas such as user interface, energy distribution, building systems, cable management, digital infrastructure, UPS, and installation components. On September 28, 2015, Legrand acquired Raritan, one of the leading providers of intelligent PDUs for data centers worldwide. The company is also involved in offering KVM, infrastructure management, and serial solutions for data centers. Together Legrand and Raritan is involved in offering transformers, circuit breakers, measurement and monitoring solutions, UPS, capacitor banks, PDUs, DCIM software, KVM-over-IP, and serial-over-IP products.

Schneider Electric is involved in offering products and services with expertise in automation management, electricity distribution, and components for energy management. It reported a revenue of USD 30.23 billion in 2015. Compared to 2014, the revenue of the company increased by around 7 percent in 2015, because of the steady growth in IT business and building and partner segments. It offers critical infrastructure products and solutions for data centers worldwide, including power infrastructure solutions through its IT business segment. The product portfolio of the segment includes UPS, surge protection devices, PDUs, software management services, and more.

Preventing an Outage

Certain events should not happen. They cannot be blamed on the weather, unscheduled maintenance, or even a power surge. Instead, they come down to poor planning. Major businesses, from airlines to Internet giants, have fallen victim to this – feeling the effects of preventable data center outages. Unfortunately, this happens more often than anyone in the industry is comfortable admitting.

An Eaton-commissioned survey of IT and data center managers across Europe, as outlined by Dennis O’Sullivan is EMEA data center segment manager at Eaton, found that 27 percent of respondents had suffered a prolonged outage leading to a disruptive level of downtime in the previous three months. The vast majority of respondents (82 percent) agree that most critical business processes are dependent on IT and 74 percent say the health of the data center directly affects the quality of IT services. Essentially, business depends on IT and IT depends on the data center to function. The fact that more than one in four data centers recently suffered a prolonged outage tells us that something is wrong at an industry level.

Prior Planning Prevents Poor Power Performance

Just as critical business processes depend on IT, the data center itself must provide resilience to keep the business running. It is a core asset in any business’ risk management strategy.

Employee error, a backup generator failing to kick in or a panicked decision – these can all be prevented by proper processes and power system design. Yet businesses often fail to follow the golden rule of data center power management: actions have consequences and consequences require action.

Organizations need a disaster recovery process in place that clearly defines which steps should be taken when re-energizing the data center. In a full outage situation where people are in a state of panic and under pressure to resume normal services, staggering the re-energization of systems in the data center may seem counter intuitive. After all, the goal is to get back online as quickly as possible. However, this process helps to avoid extending the outage.

UPSkilling Staff

In reality, a lack of power awareness and understanding is a common problem. Two-thirds of the data center professionals who took part in the research were not fully confident in power. Until organizations get to grips with power management – from UPS maintenance to battery inspection – we can expect to see more power-related outages.

However, there is a profound concern around skills availability. Many organizations find it hard to acquire and retain relevant expertise or talent, whether it is designing for energy efficiency, managing consumption on an ongoing basis, or dealing with power-related failures quickly and effectively to avoid and mitigate outages.

Building a Stronger Tomorrow

Alongside skills and power processes, the facilities infrastructure itself often needs upgrading to meet today’s efficiency, reliability and flexibility expectations. Around half of Eaton’s survey respondents report that their core IT infrastructure needs strengthening – and this increases to almost two-thirds when it comes to facilities such as power and cooling.

Power management is increasingly becoming a software-defined activity. Given the skills gap, software can play an important role in bridging the divide between IT and power by presenting power management options in dashboard styles that are familiar to an IT audience, making it easier to understand and even automate power infrastructure management. This technology can eliminate extended outages, such as the British Airways May Bank holiday outage this year, because the automated processes bring systems back online in a controlled and monitored fashion.

Data centers have moved toward more virtualized environments. IT and data center professionals are very familiar with using virtualization to maintain hardware. So why not use the same principles in power? All power distribution designs, and associated resiliency software tools, must be compatible with major virtualization vendors to future-proof the infrastructure. This approach will enable data center professionals to constantly maintain systems, thereby mitigating the risks associated with out-of-date infrastructure. Effective power management is a must have, not a nice to have!

You must be logged in to post a comment Login