Trends

6 Out Of Every 7 Smartphones Sold In India Belong To The Top 5 Smartphone Brands

Posted by CMR

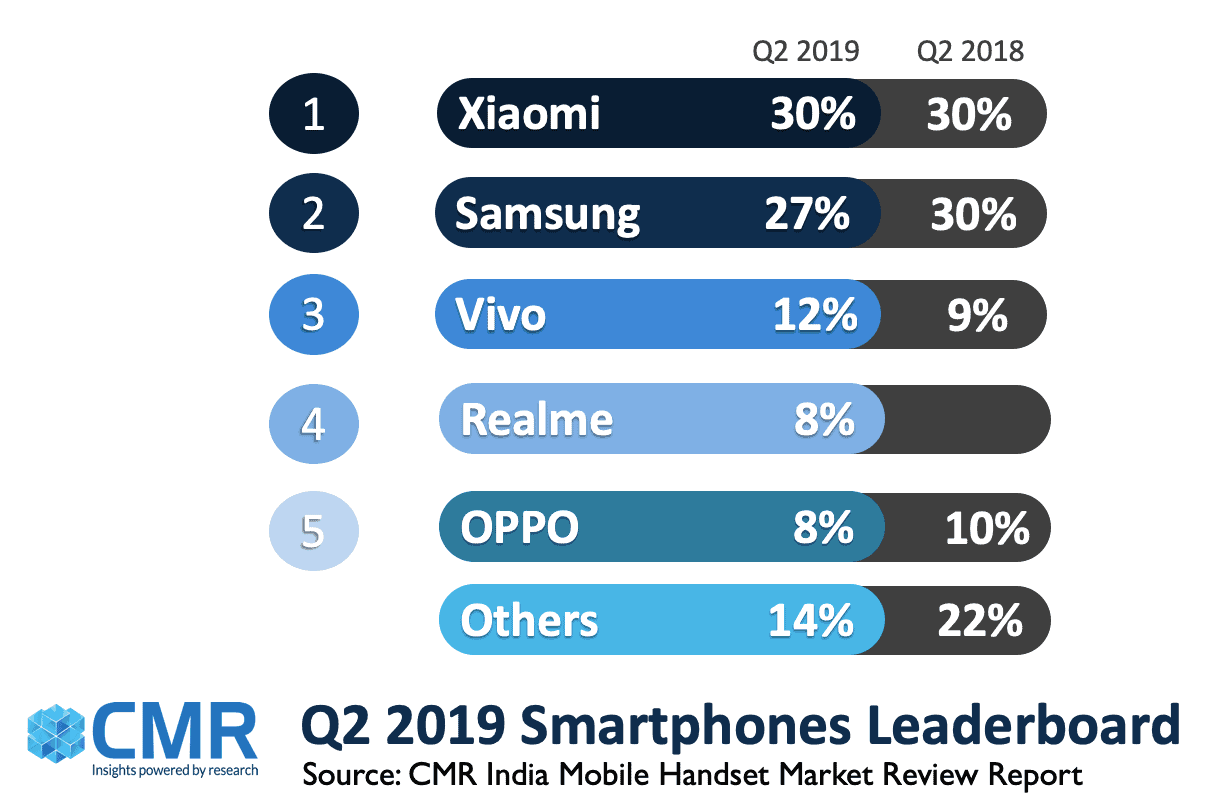

According to CMR’s India Mobile Handset Market Review Report for Q2 2019released today, the India smartphone market saw increasing consolidation with the top five smartphone vendors accounting for 6 out of every 7 smartphone sold in India. During the quarter, the smartphone market grew 5%, driven chiefly by new launches and discounts by online ecommerce retailers.

According to Prabhu Ram, Head-Industry Intelligence Group (IIG), CMR said, “As the smartphone market consolidates further with the top five brands, the potential market play for others has significantly decreased. To succeed in the India smartphone market, a India-centric approach, and strong thrust on innovation and value proposition is essential.”

The India smartphone market is increasingly driven by affordable smartphones (INR 7000 – INR 25000), with smartphone brands focused on driving consumer upgrades from entry-level buyers to affordable and premium segment (>INR 25000) with interesting new propositions,” added Prabhu.

During the quarter, Samsung closed the gap with the smartphone market leader, Xiaomi, on the back of its India-first strategy and a strong portfolio refresh, with Galaxy A and M series. The China-based BBK group, the parent company of OPPO, Vivo, Realme, and OnePlus, also pulled alongside Xiaomi capturing a combined 30% share.

“Realme, the youngest brand in the Indian smartphone market, with its focus on technological innovations, and market leading specs, as well as aggressive market pricing, was the fastest to secure 8% market share, on the back of its strong showing by Realme 3 and Realme C2 smartphone models, surpassing OPPO on the leaderboard,” said Anand Priya Singh, Analyst-IIG, CMR.

“While Indian brands continue to accede market space to aggressive Chinese brands, they are looking at reinventing themselves as symbiotic partners to fuel offline growth of Chinese brands, on the back of their market know-how and channel strengths, “ added Anand.

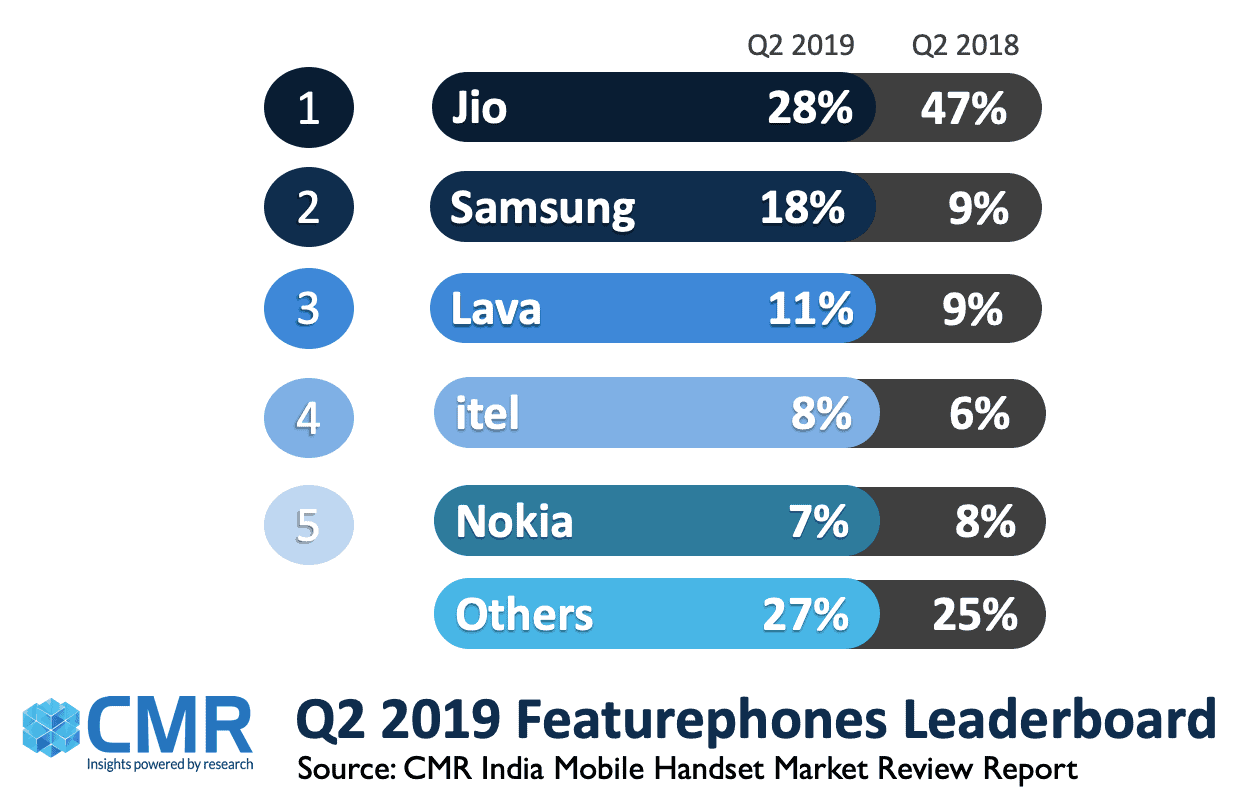

The feature phone market in India declined sharply by around 27% YoY, on the back of lower demand for JioPhone. Jio saw a 56% annual drop in shipments, in comparison to Q2 2018. On the other hand, Samsung, Lava and itel registered a positive growth during Q2 2019. Nokia had a YoY drop of 21% in shipments.

The top five feature phone brands contributed 78% of the shipments.

Future Outlook

“H2 2019 will see increased competition amongst smartphone brands, leading upto the festive period. Smartphone brands, including Samsung and Realme, will likely build up on their market success, and gain further grounds.,” added Prabhu.―CT Bureau

You must be logged in to post a comment Login