International Circuit

Virgin Media O2 publishes Q1 results to 31 March 2022

Lutz Schüler, CEO of Virgin Media O2, said:

“The first quarter has seen us remain focused on delivering and innovating to pave the way for the rest of the year. We have started to ramp up network investments while improving our products and services with big challenger decisions like not reintroducing EU roaming fees. The delivery of fixed and mobile price rises will also support revenue growth and allow continued investment as connectivity demand continues to increase. We’re pushing ahead into Q2 with the launch of Stream, our new IP-based TV proposition which evolves traditional TV bundles and offers our broadband customers a flexible and innovative way to get their entertainment whilst offering significant additional value. With Q1 showing solid financial foundations from a stabilising top line and improved profitability, we remain on track to meet our 2022 guidance.”

Top-line performance supported by product and service enhancements

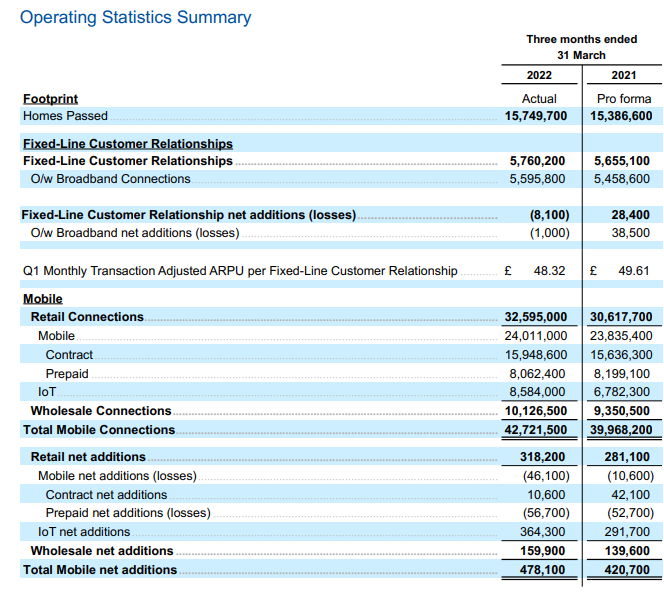

The fixed customer base ended the quarter at 5.8 million, with an 8,000 net reduction in Q1. Continued growth in Project Lightning areas was offset by declines in the existing footprint. Net adds were lower YoY primarily due to a reduction in gross acquisitions. Importantly total disconnections and Cable rNPS both improved YoY despite the implementation of the company’s fixed price rise effective from 1st March. The broadband base was broadly flat at 5.6 million in Q1, however the average speed across the company’s broadband base has increased 24% YoY and is now 231 Mbps which remains ~4x higher than the national average.

The contract mobile base increased by 11,000 in Q1, whilst total mobile connections increased 478,000 in Q1 due to strong growth in IoT, wholesale and contract connections. O2’s monthly contract churn remains low at 0.9%. From 1st April, both O2 and Virgin Mobile delivered price rises with limited impact on volumes to date.

Throughout the quarter the company has continued to invest and innovate to enhance its products and improve customer experience. This included being the only mobile network operator not to reintroduce EU roaming fees, amongst other initiatives.

In April, Virgin Media O2 also announced its new IP-based entertainment service, Stream from Virgin Media, offering customers a new way to bring TV channels, video apps and streaming subscriptions together in one place, at great value, delivered entirely through the company’s superior broadband. The service is available to new and existing customers taking a broadband only or broadband and home phone package with a £35 one-off activation fee, a 30-day rolling contract and a “Stream credit” which gives customers a 10% saving on their subscriptions when they add them via their Virgin Media bill.

Virgin Media O2 Business switched on a first of its kind multi-site private mobile network with British Sugar in January as part of a seven-year partnership. It also launched ‘Success Agreements’ for new large enterprise and public sector customers which takes a new approach to typical SLAs, helping to define specific goals or outcomes for individual customers with added flexibility.

Investment in the UK’s digital infrastructure continuing at pace

Project Lightning build was 101,000 in Q1, in-line with expectations and higher than the 93,000 premises added in Q4 2021 and 78,000 premises added in Q1 2021. The cumulative Lightning footprint is 2.8 million and the company remains on-track to add over 500,000 Lightning premises in 2022.

Following the completion of FTTP upgrade pilots in Q1, the company has now moved to deployment of full fibre across its entire fixed network at a cost of £100 per home with completion in 2028.

Furthermore, 5G services are now available in over 400 towns and cities and rollout remains on-track to hit 50% population coverage of 5G services by 2023. Boosting 4G also remains a key focus for investment and 4G capacity was upgraded in more than 93,000 postcodes during Q1.

Support for those affected by the events in Ukraine

In light of the events taking place in Ukraine, Virgin Media O2 removed charges for mobile data use in Ukraine and has been crediting back all charges for calls and texts made between Ukraine and the UK.

The company has also committed to financial and other support measures including direct donations to the Disasters Emergency Committee Appeal and increased contributions to the charity Migrant Help.

Coupled with ongoing work through the National Databank, these measures are providing data and devices to those impacted by the conflict in Ukraine.

The company is also providing job opportunities for anyone with refugee status through a fast-track application process for a diverse mix of more than 1,000 roles located across the country. Applicants will be assisted by dedicated advisors and, to further support job seekers, free English language lessons and medical assistance will be made available as part of a wider package of employee benefits.

Top-line stabilising, improved profitability and a return to growth in adjusted EBITDA less capex

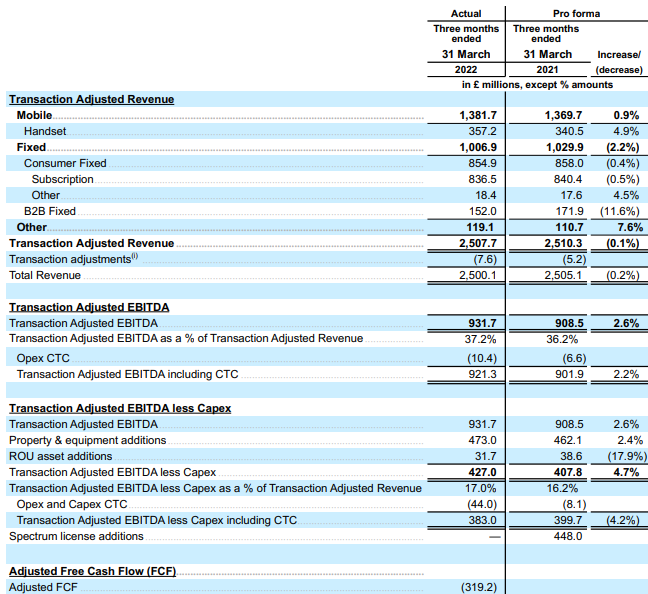

Revenue: Q1 transaction adjusted revenue of £2,507.7 million was broadly flat YoY, an improvement compared to the YoY revenue declines in Q1 2021 and Q4 2021. This performance was supported by increased growth in Mobile revenue which was up 0.9% to £1,381.7 million, including a 4.9% YoY increase in handset revenue. Consumer fixed revenue decreased by 0.4% YoY to £854.9 million. A 1.9% YoY increase in fixed-line customers was offset by a 2.6% YoY decline in transaction adjusted fixed-line customer ARPU due to a change in customer mix. B2B fixed revenue decreased 11.6% YoY to £152.0 million due to a high level of installation revenue for high-capacity data services within Wholesale in Q1 2021, while Other revenue increased 7.6% to £119.1 million underpinned by growth in revenues from O2 business customers along with continued growth related to the company’s smart metering programme.

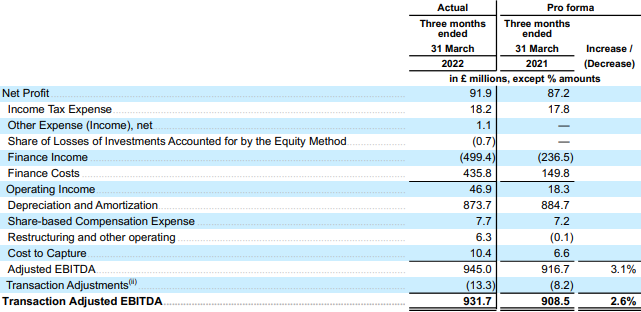

Adjusted EBITDA1: Q1 transaction adjusted EBITDA increased 2.6% YoY to £931.7 million, excluding £10.4 million of opex CTC – representing the best full quarter growth rate since Virgin Media O2 was formed. This was due to cost savings following the migration of the Virgin Mobile MVNO base from EE to Vodafone, lower sales commissions and the flow through of cost synergies. Transaction adjusted EBITDA margin improved to 37.2% in Q1 2022 compared to 36.2% in Q1 2021.

Adjusted EBITDA less Capex: Transaction adjusted EBITDA less capex increased 4.7% YoY to £427.0 million in Q1, before opex and capex CTC of £44.0 million. This was driven by the aforementioned growth in transaction adjusted EBITDA combined with a modest 2.4% YoY increase in P&E additions to £473.0 million, as the company continued to invest in its fixed and mobile infrastructure, and a reduction in ROU asset additions to £31.7 million in Q1.

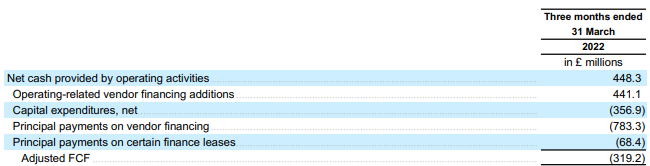

Free Cash Flow: There was an adjusted free cash outflow of £319.2 million in Q1.

2022 guidance reaffirmed: The company expects to deliver mid-single-digit growth in pro format transaction adjusted EBITDA (before CTC), supported by improved top-line growth and the delivery of synergies which will ramp through the year. Expect opex and capex CTC of over £300 million and P&E additions of around £2.1 billion as the company accelerates network investments. The cash distribution to shareholders is anticipated to be £1.6 billion including cash from recapitalisations to maintain leverage at the upper-end of the 4-5x range.

Strong capital structure to support business growth

At 31 March 2022, Virgin Media O2’s fully-swapped third-party debt borrowing cost was 4.6% and the average tenor of third-party debt (excluding vendor financing) was 7.2 years.

At 31 March 2022, and subject to the completion of the corresponding compliance reporting requirements, the ratios of Net Senior Debt and Net Total Debt to Annualised pro forma adjusted EBITDA (last two quarters annualised) were 3.23x and 3.55x, respectively, each as calculated in accordance with the most restrictive covenants, and reflecting the Credit Facility Excluded Amounts as defined in the respective credit agreements. Vendor financing, lease and certain other obligations are not included in the calculation of the company’s leverage covenants. If these obligations were included in the leverage ratio calculation, and Virgin Media O2 did not reflect the exclusion of the Credit Facility Excluded Amounts, the ratio of Total Net Debt to Annualised EBITDA would have been 4.62x at 31 March 2022.

At 31 March 2022, the company had maximum undrawn commitments of £1,378 million equivalent. When compliance reporting requirements have been completed and assuming no change from 31 March 2022borrowing levels, it is anticipated that the full borrowing capacity will available, based on the maximum the company can incur and upstream which is subject to a 4x net senior debt test.

Financial Results, Transaction Adjusted EBITDA Reconciliation, Property and Equipment Additions and Adjusted Free Cash Flow

The following table reflects preliminary selected financial results for the three months ended 31 March 2022 (actual) and 2021 (pro format):

The following table provides a reconciliation of net profit to Transaction Adjusted EBITDA for the three

months ended 31 March 2022 (actual) and 2021 (pro format):

The following table provides a reconciliation of our net cash provided by operating activities to Adjusted Free Cash Flow for the three months ended 31 March 2022:

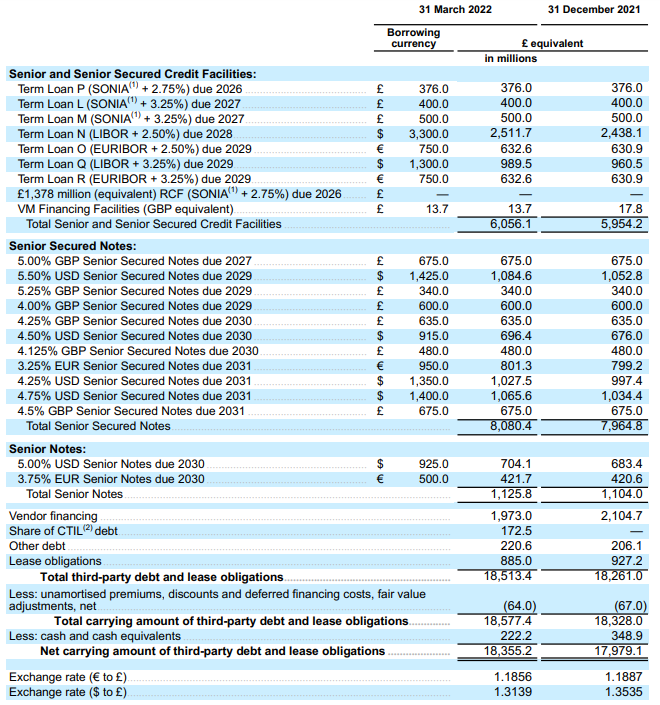

Third-Party Debt, Finance Lease Obligations and Cash and Cash Equivalents

The following table details the borrowing currency and pound sterling equivalent of the nominal amount outstanding of VMED O2’s consolidated third-party debt, finance lease obligations and cash and cash equivalents:

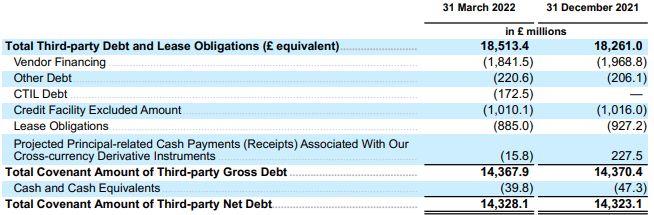

Covenant Debt Information

The following table details the pound sterling equivalent of the reconciliation from Virgin Media O2’s consolidated third-party debt to the total covenant amount of third-party gross and net debt and includes information regarding the projected principal-related cash flows of our cross-currency derivative instruments.The pound sterling equivalents presented below are based on exchange rates that were in effect as of 31 March 2022. These amounts are presented for illustrative purposes only and will likely differ from the actual cash payments or receipts in future periods.

CT Bureau

You must be logged in to post a comment Login