Headlines of the Day

Vi FPO opens today

Vodafone Idea, has announced a follow-on public offer (FPO), aimed at raising up to Rs 18,000 crore. The FPO comprises a fresh issue totaling 16.3636 billion shares.

The FPO lot size is 1,298 shares. Bids for Vodafone Idea FPO can be made for a minimum of 1,298 equity shares and in multiples of 1,298 shares thereafter. The minimum investment amount required by retail investors will be ₹14,278.

The Vi FPO is scheduled to open for subscription on April 18, 2024, and close on April 22. The allotment for the Vi FPO is expected to be finalized on Tuesday, April 23, 2024. The FPO-issued shares will be listed on both Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) on April 25, 2024.

The price band for the Vi FPO is fixed at Rs 10 to Rs 11 per share, offering a 16.3 per cent discount from Friday’s closing price of Rs 13.15 per share.

The company has reserved 50% of the FPO for Qualified Institutional Buyers (QIB), 15% for Non-Institutional Investors (NII), and the remaining 35% for retail investors. For small non-institutional investors (sNII), the minimum lot size investment is set at 15 lots, equivalent to 19,470 shares, totalling Rs 0.2 million. For big non-institutional investors (bNII), the minimum lot size investment is 71 lots, corresponding to 92,158 shares, totalling Rs 1.13 million.

Axis Capital, Jefferies India and SBI Capital Markets are the appointed book-running lead managers with Link Intime India Private Ltd serving as the registrar for the issue.

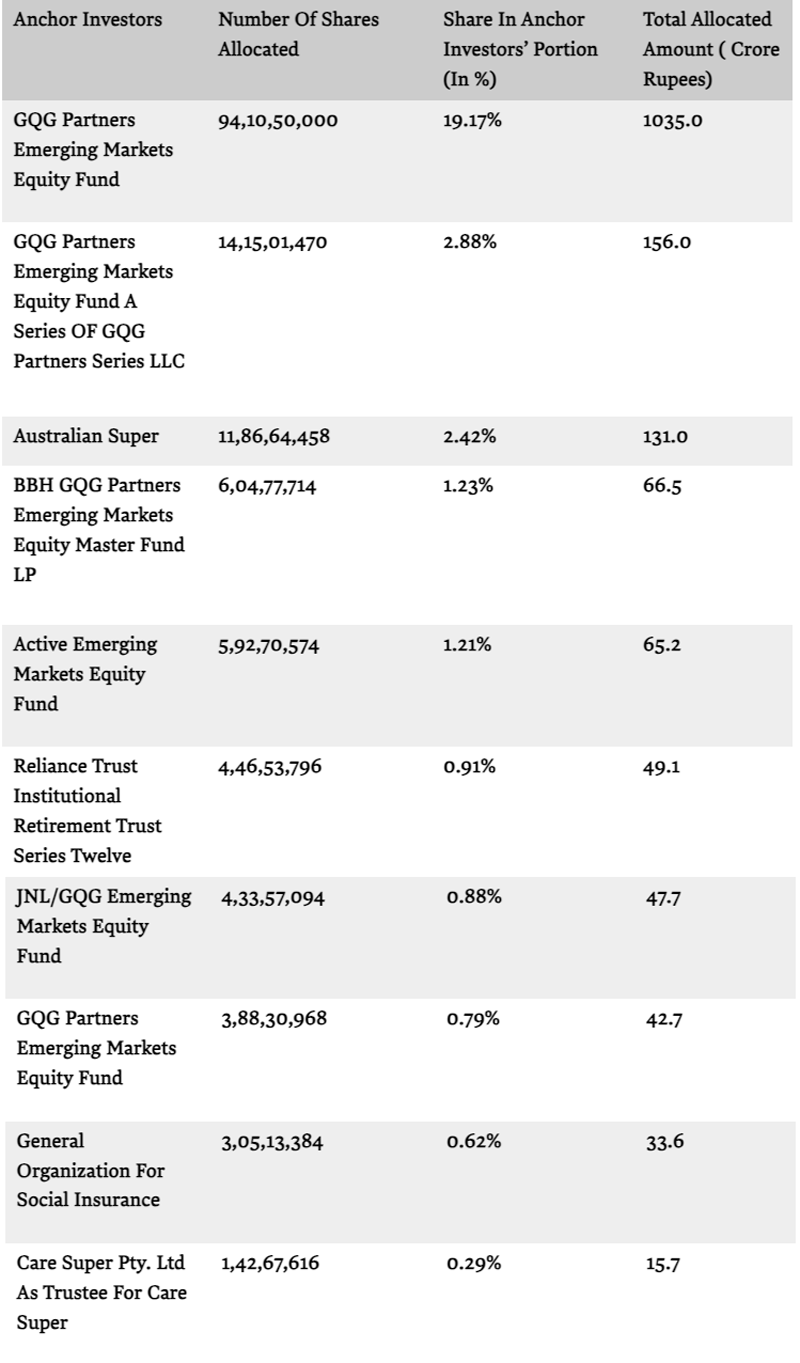

Vi has allotted 490.9 crore shares at Rs 11 apiece to 74 anchor investors.

Leading ten Vi anchor investors

Exchange Filing

Raise funds. Vi is planning to raise Rs 45,000 crore through a mix of equity and debt; Rs 18,000 crore through the FPO (Rs 5,400 crore has been raised from anchor investors ahead of the FPO) and Rs 25,000 crore through debt. The company has already approved raising Rs 2,075 crore from a promoter entity through a preferential share issue. It will engage with a consortium of lenders more seriously once the funding is in from the Rs 18,000-crore FPO.

Utilisation of funds. Funding is primarily for growth CapEx. Vi plans to commence 5G rollout in the coming 6-9 months and reach 40% of revenue coverage in 24-30 months. It will utilise Rs 5,720 crore for 5G CapEx, ₹12,750 crore toward purchase of equipment for the expansion of its network infrastructure, payment of certain deferred payments for spectrum to the DoT and the GST thereon amounting to ₹2,175 crore and balance amount for general corporate purposes.

FPO proceeds will not be utilised to pay any promoter or promoter group entity.

FPO proceeds will not be utilised to clear vendor dues. They will be cleared gradually using internal accruals over time. The telco has negotiated extended credit periods with some vendors to fulfill its contractual obligations partially. It has been actively engaged in ongoing discussions with them to develop mutually agreeable payment plans to address outstanding dues.

Satcom services are not a priority area for Vi. It could explore the segment through the partnership route.

The proceeds of the FPO are likely to enhance the company’s Average Revenue Per User (ARPU), reduce the differential between the company and its peers and of course pave the way for a rally in the stock, at least in the near term. If the stock price moves up as anticipated, it could be included in the MSCI index in the August-November review, leading to passive flows of about Rs 1275 crore.

CT Bureau

You must be logged in to post a comment Login